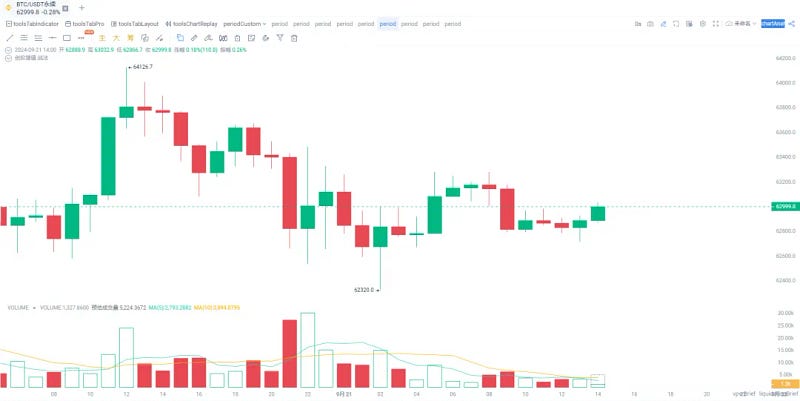

Bitcoin continued to fluctuate in a narrow range around $63,000 yesterday (20th), until the Bank of Japan announced at around 11 a.m. that it would maintain the current interest rate level. Within two hours, the price briefly broke through $64,000.

But then selling pressure emerged, and the price of Bitcoin fell back to around $63,000, retesting the $62,964 support level. At the time of writing, it was reported at $62,999, down 1% in the past 24 hours.

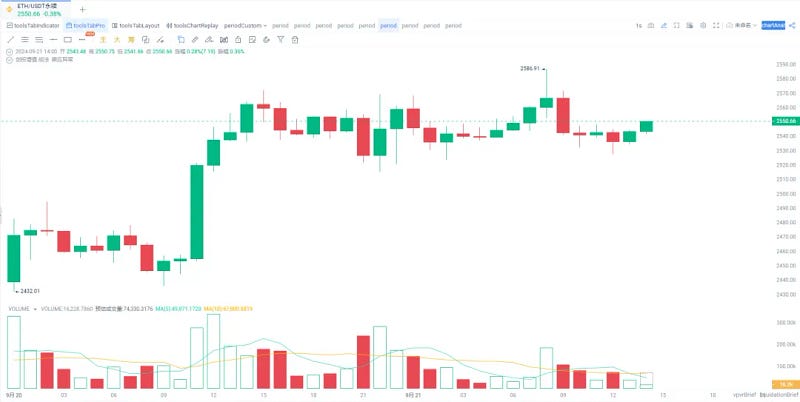

Ethereum's trend is stronger than Bitcoin. After the Bank of Japan announced that it would maintain interest rates, Ethereum broke through $2,500 and started a new wave of gains earlier, reaching a high of $2,587.4, with the momentum to challenge $2,600.

At the time of writing, it was trading at $2,550, up 0.4% in the past 24 hours.

Some people say that this wave of rise is a "short trap", while others say it is a "bull market rebound".

My view has been that since 2023, 2024 will be the fourth bull market in the crypto.

Although the market has been falling from April to August, and the value of cottage industry has been cut in half, this is just a superficial phenomenon, and the core bull-bear law will not change.

This half-year-long shock has frightened all retail investors, whether they are bullish or bearish.

From the sharp drop in the crypto on August 5 to the 50 basis point rate cut by the Federal Reserve on September 19, the long-short battle in the crypto is coming to an end.

There is only one reason why the market was washed out for half a year: to digest the skyrocketing bubble after the Bitcoin ETF was approved.

The approval of ETF brought the price of Bitcoin to 73,000 USD ahead of schedule. However, the institution that was the biggest promoter of ETF application failed to buy the appropriate low-priced chips.

Therefore, there were subsequent public "dumping" such as Mentougou's compensation, the German government's sale, and Grayscale's sale, and then a secret attack took place.

"buy the dips institutions" and "panic retail investors"!

Although the market has looked shaky in the past few months, and the voices of "bull market is over" have been heard everywhere, the 13F documents disclosed by the SEC for the second quarter of 2024 show that as the price of Bitcoin fell, US institutions have been increasing their holdings of Bitcoin ETFs against the market trend:

According to Bitwise Chief Investment Officer Matt, the number of institutions holding Bitcoin ETFs increased from 965 to 1,100 in the second quarter. More than 130 institutions purchased Bitcoin ETFs for the first time in the second quarter, and the proportion of Bitcoin ETFs held by these institutions also increased from 18.74% to 21.15%.

Therefore, despite the sharp market fluctuations and even when the trend is not clear, these institutions are not scared away, but continue to increase their positions. It is conceivable that if it is a bull market, the number of institutions entering the Bitcoin ETF and the amount of purchases will be even more considerable.

Judging from the trend chart of the number of bitcoins held since the issuance of the Bitcoin ETF, this data has generally maintained a continuous upward trend over the past 9 months. Even during the period of drastic fluctuations in the crypto market, the number of bitcoins held by the entire Bitcoin ETF has not changed much.

Therefore, despite market fluctuations, Bitcoin's fear and greed index once entered the extreme panic range, and large US institutional investors continued to test the waters and buy.

If you have been chasing ups and downs, often being trapped, and have no latest news in the crypto and no direction, please scan the QR code below. I will try my best to answer any questions you have recently. If you are confused about the future, I will share the strategy layout with the small circle! You are welcome to join us to grasp the next hot spot and maximize the return on investment together!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!