The Federal Reserve’s rate cut has been good for Bitcoin and the overall economy. Major banks such as Goldman Sachs, Morgan Stanley, and Bank of America have adjusted their forecasts for the impact of the cut.

This new forecast varies greatly depending on the banks' analysis. bp

US Treasury Secretary Yellen: “Positive Signs for the Economy”

The Federal Reserve has decided to cut interest rates by 50bp , and various sectors of the crypto economy are responding. Bitcoin has surged from $57,400 to $64,000. Bullish sentiment is spreading across the financial and regulatory ecosystem.

For example, US Treasury Secretary Janet Yellen, previously critical of cryptocurrencies, has warmly welcomed these terms:

“The cut is a very positive signal about the current state of the U.S. economy. It reflects the Fed’s confidence that inflation has come down significantly and is returning to its 2 percent objective,” Yellen said .

It is a minor miracle that these cuts were approved when Treasury bonds were rising. The general view is that these cuts are beneficial to everyone, but especially to Bitcoin and the cryptocurrency market.

Read more: Exploring the Key Elements of Traditional Finance: TradFi Explained

The major U.S. investment banks are taking different approaches to the future, but Bank of America has the most aggressive forecast and is the only major firm that has actually raised the possibility of a rate cut.

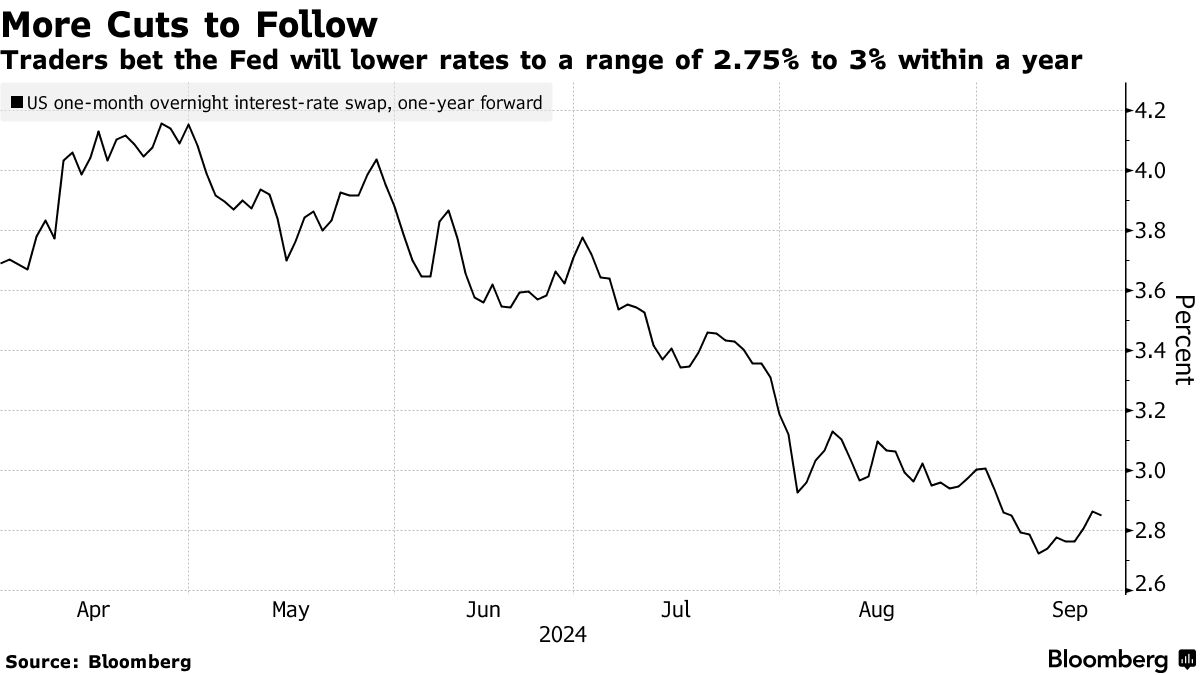

This attitude is consistent with their pro-crypto stance . The company expects another 75bp cut in Q4 and a whopping 125bp cut in 2025. This would bring rates down from the current 4.75%-5% range to below 3%.

“The first rate cut was larger than the company had expected, and we are skeptical that the Fed intends to deliver a hawkish surprise,” the spokesperson said.

Read more: The 2023 US Banking Crisis Explained: Causes, Impacts, and Solutions

Goldman Sachs is somewhat more dovish. Before recent events, it had forecast a 25bp cut in Q4 2024, and now expects that cut to be extended. The firm argues that the 25bp cut will occur gradually between November 2024 and June 2025, with an overall target of 3.25% to 3.50%.

Citigroup was the most aggressive in its downward revision, downgrading its forecast from a 125bp cut in Q4 2024 to a 25bp cut. Morgan Stanley’s analyst team was the most traditional, expecting a gradual, small cut in the coming months.

In an exclusive interview with BeInCrypto, Horizon Labs CEO Rob Viglione said that in the long term, “lower interest rates will continue to favor riskier assets like Bitcoin for investors seeking higher yields outside of traditional investments,” which could further support the Bitcoin rally.