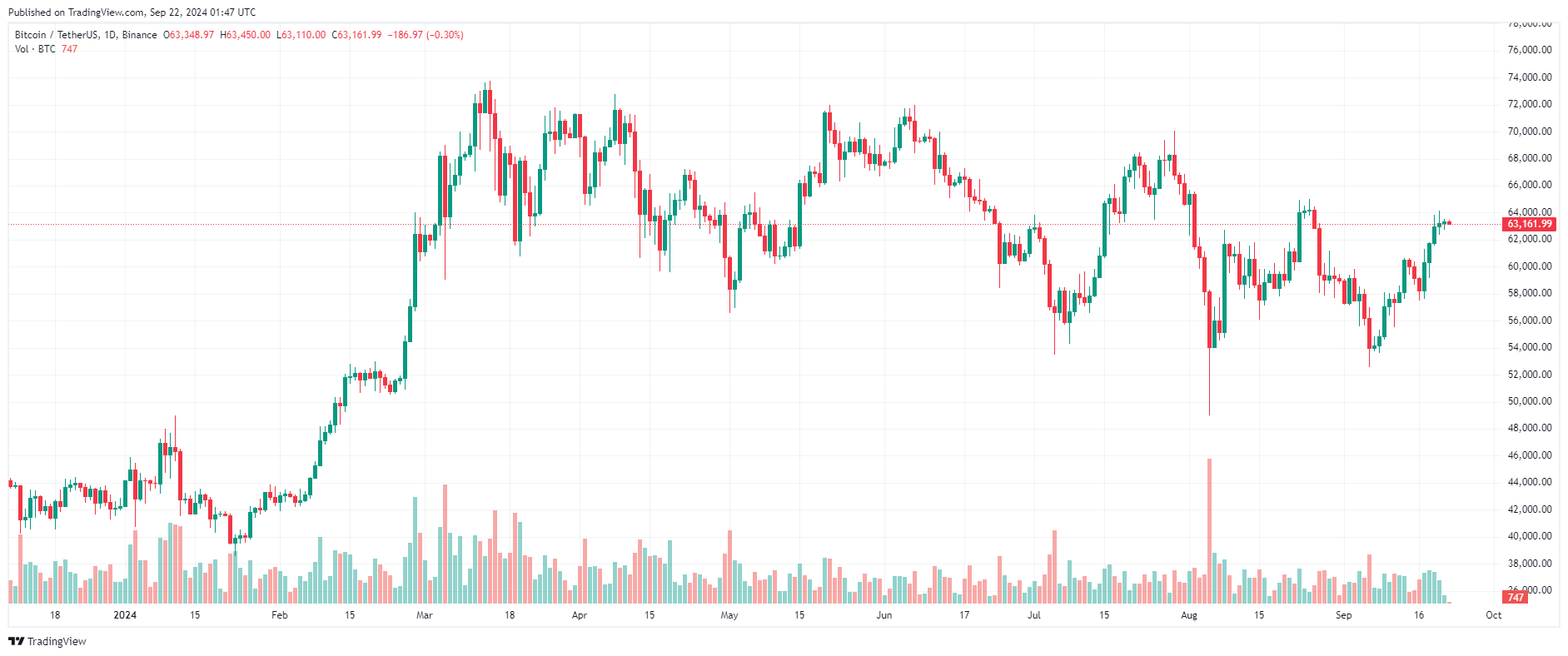

Bitcoin is poised for a second consecutive weekly rally. Starting the week around $59,000, BTC pushed above the psychological $60,000 mark on Tuesday, then went on to set a local September high of $64,133.

The rally came after the Fed announced its decision to cut interest rates by 0.5 percentage points and the Bank of Japan (BoJ) decided to keep interest rates unchanged at 0.25%.

The top asset is currently trading around the $63,000 mark.

BTC Price Chart – 1 Day | Source: TradingView

Let's join Bitcoin Magazine to review the outstanding news of the week starting from September 16 to September 22, 2024.

The US Federal Reserve (Fed) cut its benchmark interest rate by 50 basis points to a range of 4.75%-5% at 1am this morning (September 19), marking the first rate cut in four years after the central bank's most aggressive rate hike cycle.

Bitcoin Surpasses $61K After Fed Cuts Rates by 50 Basis Points

The Bank of Japan (BoJ) decided to keep its interest rate unchanged at 0.25% on Friday, after official data showed core consumer prices rose 2.8% year-on-year in August.

The decision was widely expected amid concerns that rising prices could hurt consumer spending. The BoJ has been cautious about adjusting interest rates, as raising them could dampen economic activity and hamper demand-driven inflation, which it is trying to boost.

Stock and currency markets have seen increased volatility since the July rate hike to 0.25%. The central bank said it would XEM the impact of the previous hike before making further adjustments, to avoid further market volatility.

Japan's BoJ keeps interest rates unchanged

Fantom (FTM) Price Spikes 40% in One Month – What’s Driving the Price Rise?

FET Price Up 75% in One Month, What's Driving It?

Whales are paying attention to these 2 altcoins

BNB Chain, a community-driven blockchain ecosystem, has just announced an update that aims to improve the stablecoin’s infrastructure by making transactions Gas Price.

The initiative, announced on September 18, aims to make stablecoin payments more accessible, fast and cost-effective, in line with the goal of simplifying everyday cryptocurrency transactions.

Gala Wen, Director of Ecosystem Growth at BNB Chain, Chia that the company is collaborating with centralized exchanges (CEX), wallet providers, and bridges, to create a “zero-fee trading experience.”

BNB Chain Introduces Gas Stablecoin Payment Initiative

Solana Reveals Details of Its Second Crypto Phone ‘Seeker’

Donald Trump Confirms Launch of DeFi Project Governance Token World Liberty Financial

Ripple, Hedera, Aptos Team Up for MiCA Compliance in the EU

Silvergate Bank's parent company files for Chapter 11 bankruptcy

WalletConnect is about to launch its native Token with an Airdrop of 185 million WCT

Sky Completes Rebranding with Launch of New dApp and Token

Google Cloud Launches Ethereum-Compatible Blockchain RPC Service

Bitget and Foresight Ventures invest $30 million in TON blockchain

TON Blockchain to See Explosive Growth of 3,435% Daily Active Addresses by 2024

Hemi Labs Raises $15M to Launch Blockchain Module in Round Led by Binance Labs

Shiba Inu Optimizes Puppynet With Major Upgrades to Enhance User Experience

Catizen gamers angry over sudden change in CATI Token Airdrop

The U.S. Securities and Exchange Commission (SEC) recently filed an amended complaint in its ongoing lawsuit against cryptocurrency exchange Binance , seeking to remedy issues raised by a federal judge earlier this year.

The lawsuit , which started in June 2023, accuses Binance of operating as an unlicensed broker, clearinghouse, and trading platform, and offering unregistered securities through its native BNB Token , BUSD stablecoin, and Staking services.

Moonbix, Binance's latest tap-to-earn game on Telegram, has just been leaked and is attracting a lot of attention in the crypto community. Due to many problems arising, Binance had to officially speak out.

In a recent announcement, Binance confirmed that Moonbix is their game project, operating on the Telegram mini app.

Binance also warned the community that there are currently many scam projects impersonating the name Moonbix, so be careful.

In just 1 day of leak, the game had more than 1 million players hoping to earn Airdrop Token from the world's largest exchange.

Binance Confirms Moonbix as New Gaming Project on Telegram, Warns Users of Fake Projects

The US Securities and Exchange Commission (SEC) has officially approved Nasdaq to list and trade BlackRock's Bitcoin ETF spot share options.

In a September 20 announcement, the SEC approved options trading for the iShares Bitcoin Trust, ticker symbol IBIT, on Nasdaq. According to Nasdaq, the exchange will apply the same options trading rules for the Bitcoin ETF as it does for other ETFs.

“IBIT options will be settled in kind in the U.S. style,” the SEC said in a statement. The exchange said IBIT options must comply with its initial and ongoing listing standards, which include a basic requirement that the underlying security “have a significant number of shares outstanding, be widely held, and be actively traded.”

SEC Announces Approval of BlackRock’s Bitcoin ETF Spot Options

Hong Kong Could Approve Ethereum Staking for Spot ETFs This Year

The stablecoin wars are heating up, with the latest entry from BitGo, the leading US digital asset custodian, through the launch of a new coin pegged to the US dollar on Wednesday.

Called USDS, the new stablecoin will focus on “fairness, transparency, and market neutrality.” USDS is expected to launch in January 2025, with rewards promised to users.

The launch comes as BitGo attempts to compete with Coinbase, the largest cryptocurrency exchange in the United States, in developing new digital asset products.

BitGo Competes With Coinbase and Tether by Launching Stablecoin USDS

Stablecoins Hit Record Circulating Supply, Have Become Systemically Important: Bernstein

Fintech giant Revolut is set to launch its own stablecoin

TON Foundation Partners with Curve Finance to Incubate Stablecoin Swap Project

Tether (USDT) Market Share Increases 20% to 75% in Two Years

Circle Partners with Sony Block Solutions Labs to Expand USDC

BlackRock, Microsoft, Global Infrastructure Partners (GIP), and MGX have joined forces to form the Global AI Infrastructure Investment Partnership (GAIIP), an initiative to mobilize $30 billion in private Capital to expand data centers and enhance energy infrastructure for artificial intelligence (AI) technology.

Larry Fink, Chairman and CEO of BlackRock, emphasized that investing in AI infrastructure such as data centers and energy sources is a huge and sustainable opportunity, predicting that it will create a trillion-dollar market.

“Data centers are the foundation of the digital economy; these investments will drive economic growth, job creation, and AI technology innovation.”

BlackRock, Microsoft Back $30 Billion AI Infrastructure Project

OpenSea Hit With Class Action Lawsuit Over Alleged Securities Sale

AI poses serious risks if it does not integrate blockchain technology: 0G Labs CEO

CEO Jack Lu: Magic Eden had its 'best year ever' despite Non-Fungible Token market downturn

Infinex Non-Fungible Token Sales Hit $40 Million in First Four Days Despite Bear Market

Hung Dinh, a famous businessman with many technology products known to the community, is becoming the center of attention on social networks due to fraud allegations related to the GM.AI project.

On the afternoon of September 14, account X with the username @HungDinhScammer shocked the crypto community when it accused Hung Dinh, a famous Vietnamese CEO and businessman, of being behind a $30 million crypto scam through the GM.AI project.

The $30 million fraud allegations involving the GM.AI project have sent shockwaves through the crypto community, drawing strong reactions from both investors and industry influencers.

After a long period of silence, Hung Dinh, under the account @dexter_cap, suddenly posted a new tweet on September 16, 2024 to apologize and commit to compensate investors of the GM.AI project. This is a response to public pressure and serious fraud allegations that he is facing.

Hung Dinh and the fraud allegations in the $30 million GM.AI project

Supreme Court of India’s YouTube Channel Hijacked to Promote XRP

Hackers Demand $6 Million in Bitcoin Ransom After Attack on Seattle-Tacoma International Airport

BingX exchange hacked, losses up to 20 million USD

German authorities shut down 47 cryptocurrency trading platforms in cybercrime crackdown

MetaHub Finance shows signs of violating Vietnamese law, likely a Ponzi

PRIME Price Drops Over 4% After DeltaPrime Exploited for $6 Million

SEC Charges 3 Individuals and 5 Companies for Operating “Pig Butchering” Scams

Ethena website hacked, Ethena Labs advises users not to interact

The Hong Kong government is expected to issue new policies for the financial industry regarding the use of artificial intelligence (AI) by the end of October.

The policies aim to boost the use of AI in traditional trading, investment banking, and cryptocurrency sectors in Hong Kong. The Financial Services and Treasury Bureau (FSTB) will develop a framework to ensure the ethical use of AI in financial markets. Officials are currently finalizing the policy document and seeking industry input, according to a Bloomberg report citing unnamed sources.

The AI guidelines will be released during the Hong Kong FinTech Week event, which runs from October 28 to November 1.

Hong Kong prepares to issue AI guidelines for financial industry

SEC XEM Proposal for New Custodian for Bitcoin and Ethereum ETFs

You can XEM coin prices here.

The "Weekly News" section will be updated at 9:30 every Sunday with general market news. We invite you to follow along.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine