The Federal Reserve announced a one-digit interest rate cut in September on the 19th, officially starting the era of major interest rate cuts. It once led Bitcoin to break through 63,000 US dollars, and also caused a slight rebound in the U.S. stock market. However, now it has caused concerns among Wall Street people. Some People think that this is just a short-term market rebound of expectations and does not mean that the future economic situation will be very good.

According to the latest dot plot, there is still room for two interest rate cuts this year, but JPMorgan Chase analysis said that if the employment data is not ideal, the Federal Reserve may directly announce another two rate cuts in November, rather than in November. , and cut interest rates by one yard each in December, which means that the economy may show signs of recession, and it is bound to accelerate the rate of interest rate cuts to prevent economic collapse.

The latest report from the Wall Street Journal pointed out that the current economic situation is very close to the eve of the Lehman Brothers collapse in 2008, and believes that this may be just the beginning.

A repeat of Lehman Brothers?

What landmines lie behind the Fed’s decisions? Wall Street Journal reporter Spencer Jakab wrote a special article for this article, analyzing how the current situation is different from the past. It is worth noting that the entire article uses 2007 and 2008, before the outbreak of Lehman Brothers, as examples, and believes that interest rates are now starting to be cut. The situation is very similar to that of that time.

Jakab mentioned that when a major interest rate cut cycle begins, there is likely to be an economic illusion, that is, the outlook is bright, but the reality is turbulent . For example, in the interest rate cut cycle since 2007, the Dow Jones Industrial Average saw a huge increase after the initial interest rate cut. The stock market also expected that interest rate cuts would bring huge financing energy. The Dow Jones Industrial Index soared, setting its best record in four years. Lehman Brothers soared by 10%, which can be called the best cycle in history. But who knew that this was just the beginning of the disaster. .

The ups and downs of the interest rate cut cycle

How optimistic was the market at that time about the interest rate cut? Jakab mentioned that David Malpass, chief economist of Bear Stearns, who was on the wave at the time, also published "Don't Panic about the Credit Market" in the Wall Street Journal in August 2007, and expressed public confidence that there would be no economic collapse. Because the liquidity of the financial system has improved significantly:

Many now see this as different from the freeze in credit markets in 1998, with global liquidity reserves now overflowing rather than empty as they were then.

Although this seems like hindsight, we all know how serious the financial crisis was at that time, but the public at the time was obviously living in a dream, and they had no idea that the future they were facing would be so severe.

Three weeks after the peak of the bull market, the bubble burst in January 2008. The huge real recession prevented Lehman Brothers from deleveraging in a short period of time. Lehman Brothers quickly went bankrupt within a year, becoming the largest bankruptcy case in U.S. history. After that, the Federal Reserve cut interest rates 6 times in a row, finally cutting interest rates to 2%. Finally, two months after the bankruptcy of Lehman Brothers, the Federal Reserve also cut interest rates to 0% (0~0.25%).

During the period of zero interest rates, the S&P 500 and Dow Jones rebounded sharply, only to fall right back down within a week, plummeting by nearly a quarter before hitting bottom in March 2009.

Current economic risks

In the article, Jakab also warned of many current hidden risks, such as over-leveraging of credit and real estate, China's surprising economic weakness, and the over-reliance of the United States and the world economy on the theme of artificial intelligence (AI), and government debt around the world. The situation has not improved significantly due to Covid-19, and government debt has never been so high before an economic collapse, which will make it more difficult to deal with a recession in the event of a global collapse.

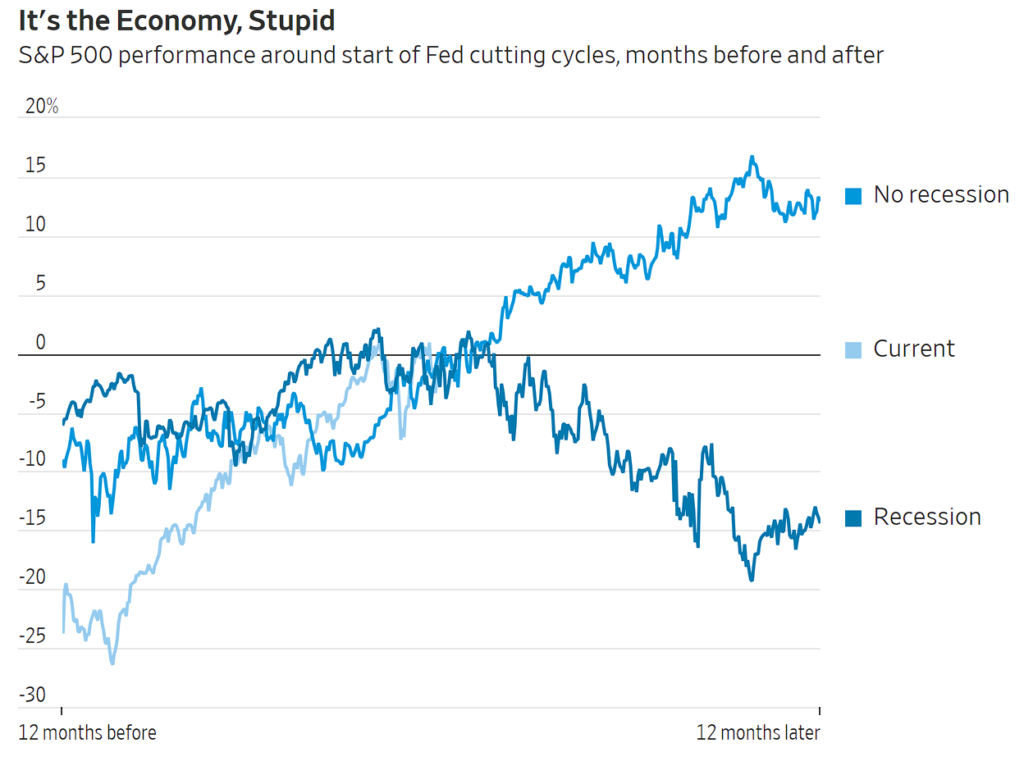

He also cited research by Goldman Sachs strategist David Kostin and pointed out that if the economy experiences a real recession before cutting interest rates, then regardless of the fluctuations in the interim, the final median path of the Standard 500 Index will adjust downward by 14%; otherwise there will be no If there is a recession, it will be adjusted upward by 14%.

Fluctuations in interest rates are very important to bond investors. On the other hand, low interest rates mean that for companies and consumers, it will take a very long time for an interest rate cut to reflect the economic effects of its "low opportunity cost."

This may explain why the current Fed seems dovish, but actually leaves a lot of room for reservation, because no one can know whether a recession has occurred until more economic data comes out.