With the RSI crossing above the trendline, a bullish breakout in Dogecoin price is imminent, with a huge potential for a potential rebound towards the $0.11 resistance level driven by whale accumulation.

Dogecoin (DOGE) is showing signs of a potential bullish breakout as the popular meme-based cryptocurrency gains momentum. While a key technical condition has been met, most investors are keeping a close eye on key price action that could drive Dogecoin sharply higher. Meanwhile, Dogecoin price has been bullish after support was established at the intraday low of $0.1042. At press time, Dogecoin is trading at $0.107, up 4.20% from its intraday low.

Bullish On-Chain Indicators for DOGE

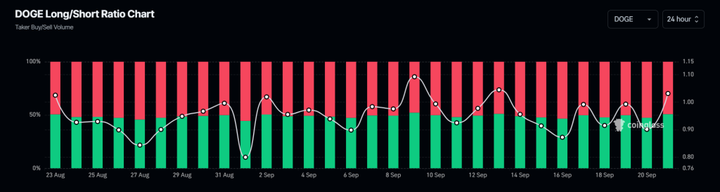

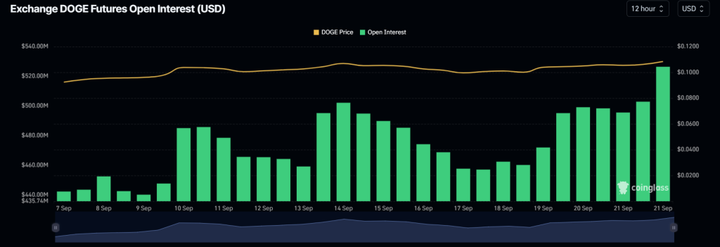

Amid this market reversal, DOGE’s on-chain indicators such as the long/short ratio, future open interest, and OI-weighted funding rate all signal potential buying opportunities and hint that a massive rally is imminent. According to on-chain analytics firm Coinglass, DOGE’s long/short ratio is currently at 1.042, indicating that traders are bullish on the market sentiment. Additionally, its future open interest has increased by 8.9% in the past 24 hours and 4.8% in the past 4 hours. The increase in future open interest suggests that bulls are buying frantically and traders may open more long positions.

Traders and investors often use the combination of increasing open interest and a long-to-short ratio above 1 to establish long positions. Currently, 51.20% of the top DOGE holders hold long positions, while 48.80% hold short positions. The Dogecoin derivatives market presents a mixed picture, with falling volumes and rising open interest. Rising open interest indicates new capital entering the market and an increase in speculative positions.

Whale activity and aggregation patterns

Recent data shows an increase in activity from large Dogecoin investors, commonly referred to as whales. We have observed a clear increase in large Dogecoin transactions, which is often a precursor to large price movements. Whales accumulating DOGE near key support levels, especially around $0.10, is seen as a positive sign. Historically, whale buying patterns have been associated with subsequent price increases, and the current buying behavior suggests that strong support levels could spark a rally. As large investors continue to accumulate DOGE, the likelihood of a breakout above key resistance points is increasing, which could further validate the bullish outlook.

Dogecoin Technical Analysis and Upcoming Levels

According to expert technical analysis, DOGE is about to break through the strong resistance level of $0.112. If it breaks through this resistance level and closes above $0.113, there is a high possibility that the DOGE price will surge by 20% in the coming days to reach the $0.134 level.

As of now, DOGE is trading below its 200 exponential moving average (EMA) on a daily chart, indicating a downtrend. The 200 EMA is a technical indicator used by traders and investors to assess whether an asset is in an uptrend or a downtrend. And the relative strength index (RSI) has broken above its downtrend line on the daily chart. This technical indicator is often used to assess the momentum of an asset, indicating that buying pressure is increasing. A breakout of the RSI trendline usually signals a rise in prices, which adds to traders’ optimism.

But it is worth noting that for the bullish momentum to gain sufficient traction, Dogecoin needs to break through the $0.11 resistance level. This price point has been a significant obstacle in recent trading days, and a successful breakthrough of this price point will pave the way for further gains.

In addition, DOGE options trading volume increased significantly, up 370.09% to $53.64 million, while options open interest also increased significantly, up 224.82% to $783,900. This growth indicates increasing participation in options trading, indicating increased expectations for DOGE price volatility in the short term.

In simple terms

Dogecoin RSI breakout indicates rising buying pressure; traders eye $0.11 resistance for further gains. Currently, as large investors accumulate DOGE near the $0.10 support level, whale activity surges, suggesting that prices may surge. At the same time, DOGE option trading volume rose 370.09%, highlighting the growing market interest and expectations of increased price volatility. In the short term, market sentiment and technical indicators support DOGE's bullish outlook, but the current high market volatility is expected to affect its upward trend. In the long run, a big market trend is taking shape as interest rate cuts are set, and the bulls are back soon!