The Ethereum Foundation continues to face criticism for increasing selling pressure on the digital asset by regularly selling ETH.

Over the past two days, the Foundation has sold 300 ETH, worth approximately $763,000. This sale is part of a month-long trend of the Foundation selling off ETH.

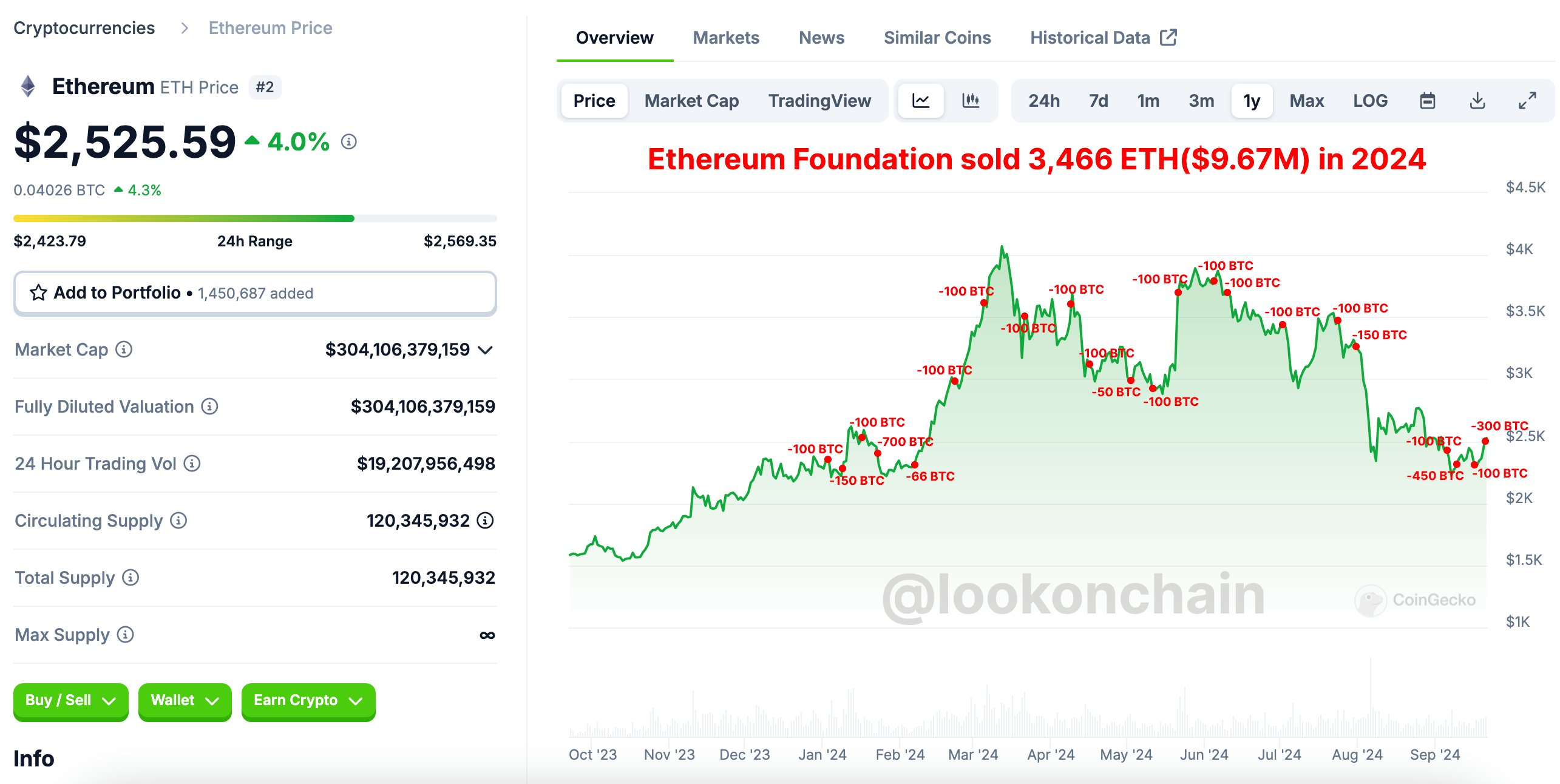

Ethereum Foundation Sales in 2024 Approaching 3500ETH

Blockchain analytics firm Spotonchain highlighted that since the beginning of this month, the Ethereum Foundation has sold 950 ETH, worth approximately $2.27 million, with sales occurring every four to seven days.

Another platform, LookOnChain, revealed a larger pattern. Since the beginning of the year, the Ethereum Foundation has sold 3,466 ETH, which is equivalent to about $9.67 million. LookOnChain explains that the Ethereum Foundation has sold about $421,000 worth of ETH every 11 days. This figure does not include the 35,000 ETH transferred to Kraken exchange in August, worth about $100 million.

Read more: How to invest in Ethereum ETFs?

These frequent sales have raised concerns among some community members, with independent Bitcoin journalist Joe Nakamoto noting that Ethereum supporters will take issue with the foundation’s continued sales.

But not everyone shares this view. Justin Drake, a researcher at the Ethereum Foundation, believes that these sales are beneficial to the network. In an interview with Colin Wu, Drake explained that reducing the foundation’s ETH holdings promotes long-term decentralization of the blockchain network.

“In the long run, the reduction in ETH held by the Ethereum Foundation is a good thing; the EF currently controls 0.23% of the ETH supply, and as this percentage approaches 0% over the next few decades, it will help drive decentralization in the Ethereum ecosystem,” Drake said .

Despite these sales, the Foundation still holds a significant amount of ETH. According to data from Arkham Intelligence, one of the Foundation’s wallets holds 271,652 ETH, worth $683.83 million.

This activity comes amid improving market sentiment for Ethereum . After several weeks of poor performance, ETH has recovered the $2,500 level and is trading at $2,551 at the time of writing.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

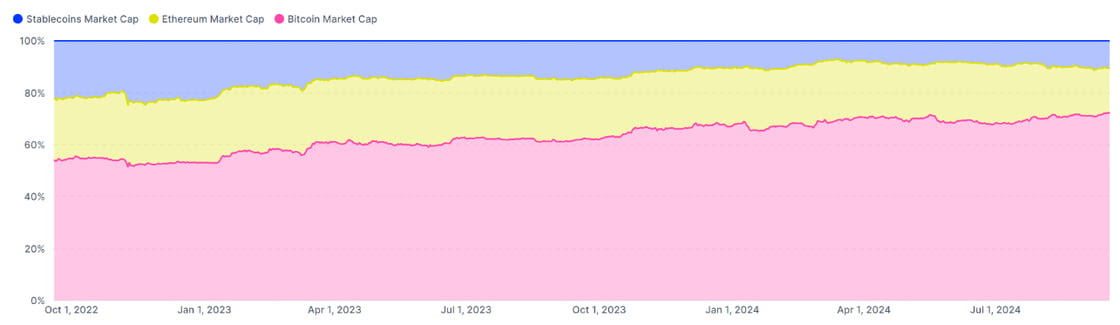

However, ETH is at its lowest level in 40 months versus BTC , which blockchain platform IntoTheBlock attributed to ETF inflows being mainly positive for Bitcoin . According to the firm, this trend suggests that institutional investors prefer the relative stability of Bitcoin over the higher risk of Ethereum.

“ETF inflows into BTC have been largely positive, while ETH has experienced primarily outflows. This trend suggests that institutional investors prefer the relative stability of Bitcoin over the higher risk, higher reward profile of ETH,” IntoTheBlock said .