Last week, Yang Jinlong, the president of the central bank , launched the most severe housing crackdown in history. Not only did small builders and home buyers complain, but construction stocks have been falling continuously in recent days. Investors are also worried that this wave of golden dragon tsunami will cause the housing market to collapse. Taiwan Real estate may follow Japan's 30-year loss.

Will Taiwan copy Japan’s housing market collapse?

From this point of view, the following article will quickly sort out the bursting of the economic bubble that occurred in Japan in the early 1990s, and analyze together whether it will really face the same tragic situation?

Background of Japan’s housing market collapse:

- The formation of the bubble economy in the 1980s : Japan's economy was in a stage of rapid growth in the 1980s. The Bank of Japan adopted an easy monetary policy at the time, keeping bank interest rates low and stimulating investment and lending. In this environment, companies and individuals began to borrow heavily and invest in the stock market and real estate, further pushing up asset prices.

- Skyrocketing land and housing prices : Especially in the real estate market, because people at the time generally believed that land prices would always rise, investors purchased large amounts of land, pushing up land prices across the country. Land prices in Tokyo even reached incredibly high levels.

Reasons for the bubble burst:

- Government Austerity : In 1989, the Bank of Japan began raising interest rates under pressure from the United States. As borrowing costs rose, investors gradually exited the stock and real estate markets, and asset prices began to fall rapidly.

- Credit tightening : Banks began to face large amounts of non-performing debt, making it more difficult to borrow money, leading to a liquidity crunch. This exacerbated the decline in property prices.

- Chain reaction : As asset prices plummeted, investor confidence collapsed rapidly, companies and individuals were unable to repay borrowed money, and banks' bad debts surged, eventually leading to the bankruptcy of many banks and companies.

Effects of bubble bursting:

- Economic Recession : After the bubble burst, Japan entered the "lost decade", sometimes called the "lost 20 or even 30 years," with stagnant economic growth and years of sluggish real estate prices and stock markets. During this period, corporate funds were tight, consumer confidence was low, and investment was reduced.

- Failure of financial institutions : Many banks collapsed due to excessive burdens of bad debt, and even required government bailouts. Instability in the financial system makes the economy even weaker.

- Social impact : Due to falling housing prices, many people cannot afford to buy houses, and even have family bankruptcy caused by mortgage pressure, which has brought huge financial and psychological pressure to Japanese society.

Overall, the bursting of the bubble changed the structure of Japan's economy from high growth to a long-term slump. Even today, this history is still viewed as an important lesson by economists and policymakers.

Will Taiwan copy Japan's tragic situation?

Let us return to the situation in Taiwan. First, Taiwan’s central bank held its third-quarter Board of Governors meeting last week and decided to keep interest rates frozen for two consecutive years. Coupled with the fact that the United States has started a cycle of interest rate cuts, unless Taiwan's inflation increases on a large scale, there should be no overly aggressive interest rate raising strategy.

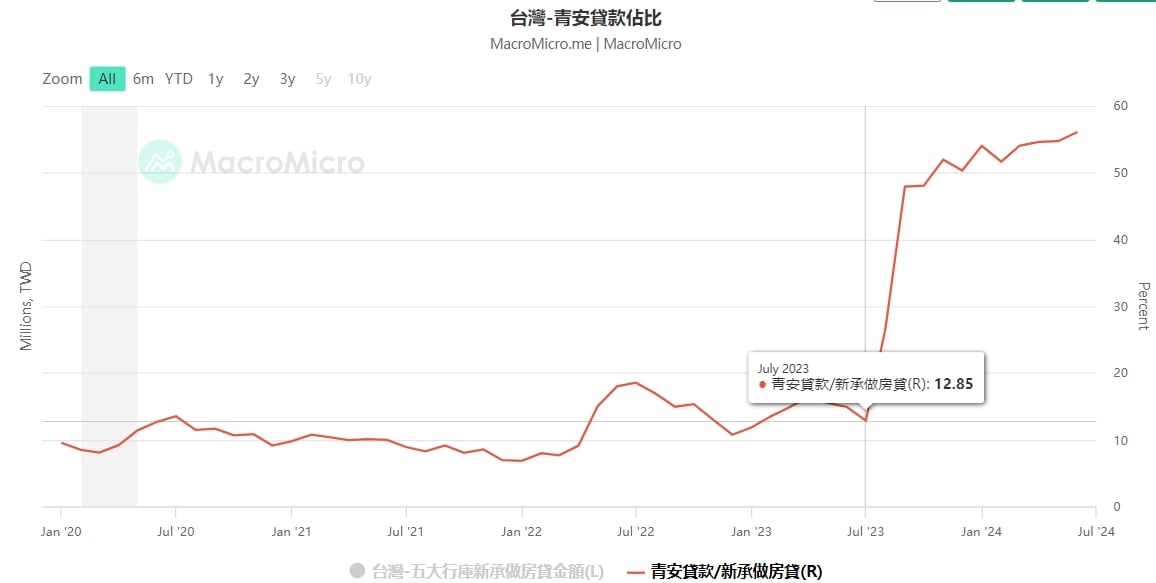

On the other hand, the rapid growth of housing prices in a short period of time is inseparable from the new Qing'an policy launched last year, which reduced the cost of borrowing and financing and further encouraged speculation. After the central bank further tightened loan conditions, experts believe that the market expectation that it will be more expensive if you don't buy may return to rationality. The super-hot buying momentum will cool down in the first half of the year, and the overall housing market is expected to turn into a trend of stable prices and slow volume.

However, the continued rise in the stock market and real estate market has indeed deepened the possibility of a bubble. If the U.S. economy fails to successfully achieve a soft landing, it may affect the global venture capital market, and Taiwan will not be able to escape the consequences. Investors are advised to prepare in advance to face possible risks.

Taiwan's three major ethnic groups are most affected

Under the most stringent prevention measures in history, experts point out that there are three types of people who suffer the most:

1. For those who want to change houses, the difficulty is much higher.

2. Heirs, who inherit the inheritance of their elders and only hold part of the shares, belong to a household in their name. They are labeled as non-first-time buyers by the central bank and there is no grace period.

3. First-time buyers. Most of them are drifters from the north. This kind of people is the worst off. They own a house in their hometown but rent a house in Taipei. If they want to buy a house to live in the north, they cannot apply for Xinqing'an and there are no loans. Grace period.