Written by: Mu Mu

The Federal Reserve has finally completed its first interest rate cut since March 2020, and monetary policy has shifted from a tightening cycle to an easing cycle.

On September 18, local time, the U.S. Federal Reserve announced that it would lower the target range of the federal funds rate by 50 basis points to a level between 4.75% and 5.00%. Federal Reserve Chairman Powell said that the 50 basis point rate cut was a "powerful action."

The crypto market seemed to be welcoming the dawn. On September 19, Bitcoin's volatility increased, rising from $59,000 to over $63,000, a daily increase of 6%. On September 23, it further broke through to around $64,600; Ethereum also rose from $2,200 to $2,400, and stood at the $2,600 mark on September 23. The overall market value of the crypto asset market also rose by 6% five days after the rate cut, reaching $2.3 trillion.

After the first rate cut, the market generally expected that the rate cuts would continue in the fourth quarter. Except for the emergency rate cuts during the crisis, it is rare for the Fed to cut interest rates by 50 basis points at a time. The last major rate cut occurred in 2020. In the face of the impact of the new crown epidemic, the Federal Reserve implemented an aggressive rate cut policy, reducing interest rates to near zero. At that time, the price of Bitcoin did not soar immediately, but broke through the $30,000 mark at the end of the year.

From a historical perspective, interest rate cuts usually drive up Bitcoin prices. After this rate cut, will the crypto asset market repeat history?

The interest rate cut has landed

Since the second half of this year, Bitcoin has been on a roller coaster ride with the crypto asset market. After entering August, it continued to fluctuate at a low level, and the U.S. federal funds rate has become the focus of attention in the crypto market.

The so-called interest rate cut refers to the Federal Reserve lowering the federal funds rate, which is the benchmark interest rate for interbank lending in the United States. Lowering interest rates means lower borrowing costs, making it easier for businesses and individuals to obtain loans, thereby stimulating economic activity, increasing employment and controlling inflation. Lowering interest rates reduces the cost of funds, stimulates economic activity and investment, and makes investors more inclined to high-risk, high-return assets, such as stocks, as well as other crypto assets such as Bitcoin.

From 2008 to 2022, the U.S. federal funds rate remained in an extremely low range of 0-0.25%. Since 2016, there has been a wave of moderate increases, but the maximum has not exceeded 2.25%.

During the more than two years of anti-inflation in the United States, the Federal Reserve has continuously raised the federal funds rate. In the 2022 interest rate hike cycle from March to the end of the year, there were a total of 7 interest rate hikes, with a cumulative increase of 425 basis points; by December 2022, the Federal Reserve raised the federal funds rate target range to 4.25%-4.50%, the highest level since the 2008 international financial crisis.

As of September 8, 2024, the Federal Reserve's federal funds rate target range is 5.25%-5.50%. From the chart, the current US federal funds rate is at its highest level in more than a decade.

The pace of interest rate hikes finally stopped in September. On September 18, local time, the Federal Reserve announced that it would lower the target range of the federal funds rate by 50 basis points to a level between 4.75% and 5.00%. Federal Reserve Chairman Powell said that the 50 basis point rate cut was a "powerful action". He emphasized that the sharp rate cut did not mean that the US economic recession was imminent. The rate cut was more of a preventive action aimed at maintaining the current sound status of the economy and the labor market.

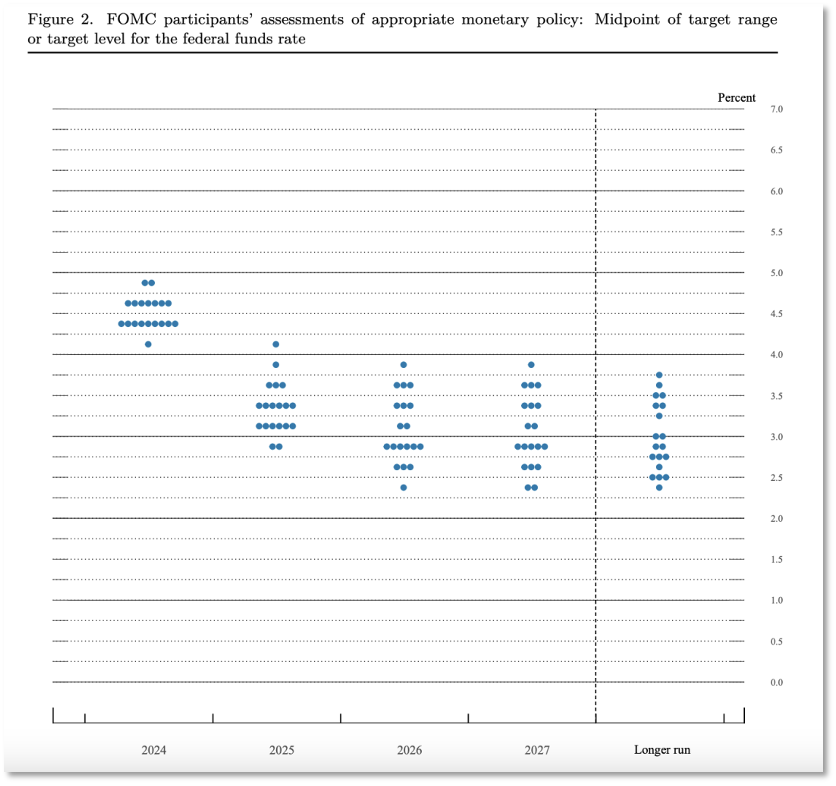

US Federal Funds Rate Dot Chart

The interest rate dot plot shows that the median expectation of 19 policymakers for the Fed's interest rate at the end of 2024 is between 4.25% and 4.5%. This means that they generally believe that by the end of the year, the interest rate will be cut by another 50 basis points on the current basis.

ETH rebounds better than BTC

After the Fed cut interest rates, the three major U.S. stock indexes closed down collectively on the 18th local time. The rate cut did not achieve the expected boost to U.S. stocks. In contrast, the performance of the crypto asset sector is more optimistic, especially Bitcoin and Ethereum, which rank first and second in market value. These two assets also entered the U.S. stock ETF asset target sequence last year and this year respectively.

As soon as the news of the interest rate cut came out on September 19, Bitcoin (BTC) rose in response, from $59,000 to above $63,000, with a daily increase of 6%. Ethereum (ETH) also rose from $2,200 to above $2,400, and broke through $2,600 on September 22.

However, Ethereum’s overall performance is better than Bitcoin, with a 7-day increase of 16.3%, far higher than Bitcoin’s 7-day increase of 9.7%.

In addition, SOL also achieved an increase of more than 20% on the day of the interest rate cut news, Meme coin DOGE increased by 3%, and the inscription tokens ORDI and SATS of the Bitcoin ecosystem achieved an increase of nearly 10%.

As the prices of crypto assets rose collectively, the Bitcoin spot ETF also ended its eight consecutive days of net outflows. Since September 12, the Bitcoin spot ETF has achieved four consecutive days of net inflows, and the confidence of OTC funds is gradually recovering.

Many market professionals are optimistic about the Fed's rate cuts, believing that this will boost the Bitcoin and crypto markets. Anthony Scaramucci, founder of hedge fund Sky Bridge, believes that this is good for asset prices in the United States and around the world. Driven by a series of rate cuts by the Federal Reserve and clearer regulation of crypto assets in the United States, Bitcoin will hit a record high of $100,000 by the end of the year.

From a theoretical and historical perspective, the interest rate cut does indeed translate into an increase in Bitcoin prices.

In 2019, the Fed cut interest rates in July, September, and October, lowering the target range of the federal funds rate to 1.5%-1.75%. Before the rate cut, the price of Bitcoin had risen from about $4,000 at the beginning of the year to $8,000. After the rate cut was announced, the price of Bitcoin reached a high of $10,000 in July, but then fell back.

In 2020, in the face of the impact of the COVID-19 pandemic, the Federal Reserve implemented a more aggressive rate cut policy, lowering interest rates to near zero. Despite this, the price of Bitcoin did not immediately soar, but instead broke through the $30,000 mark at the end of the year.

However, although the interest rate cut has brought about the effect of "loosening money", it has also cast a shadow of economic recession. Some Fed officials are worried that cutting interest rates too quickly may lead to a rebound in demand and keep inflation high. Republican presidential candidate Trump believes that this shows that the US economy is in a bad state. "Assuming they are not playing politics, such a large drop shows that the economic situation is very bad."

Peter Cardillo, chief market economist at Spartan Capital Securities, said the Fed's move was clearly dovish, mainly because it was worried about the overly weak labor market. Although the U.S. stock market reacted positively to the news of the rate cut, market sentiment may change in the next few days and investors may begin to worry about the economic outlook.

Compared with traditional financial markets such as stocks, CryptoSea founder Crypto Rover is more optimistic about the future development of Bitcoin. He said: "The last time this happened, the bull market for Bitcoin began." Wealth Mastery founder Lark Davis is also more optimistic about the long-term trend of Bitcoin. He emphasized: "If history repeats itself, the next 6-12 months will be crazy."

In any case, the interest rate cut cycle has begun. Among the 19 officials within the Federal Reserve, 7 officials believe that the interest rate should be cut by another 25 basis points in 2024, 9 officials believe that the interest rate should be cut by another 50 basis points in 2024, 7 officials believe that the interest rate should be cut by another 75 basis points in 2024, and only 2 officials believe that there should be no further interest rate cuts in the remaining meetings in 2024.

Employment market data will shape the pace and end point of future interest rate cuts. As time goes by and interest rate cuts continue, market liquidity will become more active, and some funds will likely flow out of bonds and banks and into stocks, crypto assets and other markets.