Source: WOO X Research

On September 19, 2024, the Federal Reserve cut interest rates by 50 basis points (bps), bringing the federal funds rate to between 4.75% and 5%. Interest rate cuts are an important tool used by the Federal Reserve to stimulate the economy during economic slowdowns or recessions. Let's follow WOO X Research to see what impact the interest rate cut will have on cryptocurrencies in the next stage.

The Fed's rate cut means a reduction in the benchmark interest rate, which usually has a series of important effects on the economy. For example, lower borrowing costs can encourage businesses and consumers to increase loans, thereby stimulating investment and consumption; or rate cuts can help promote economic growth because easier access to credit will promote market demand. Rate cuts may affect inflation, driving up prices due to increased demand. At the same time, rate cuts usually lead to higher asset prices such as stocks and real estate, as investors seek higher returns. In addition, rate cuts may also lead to a depreciation of the local currency as investors turn to other currency assets with higher returns. Overall, the Fed's current 50 basis point (bps) cut reflects the Fed's concerns about the state of the US economy, and there may already be signs of an economic recession. For the cryptocurrency market, rate cuts are one of the most concerned good news in the market since the Bitcoin halving. With interest rate cuts, investors may be more willing to participate in other asset investments.

Background (trends before and after historical interest rate cuts)

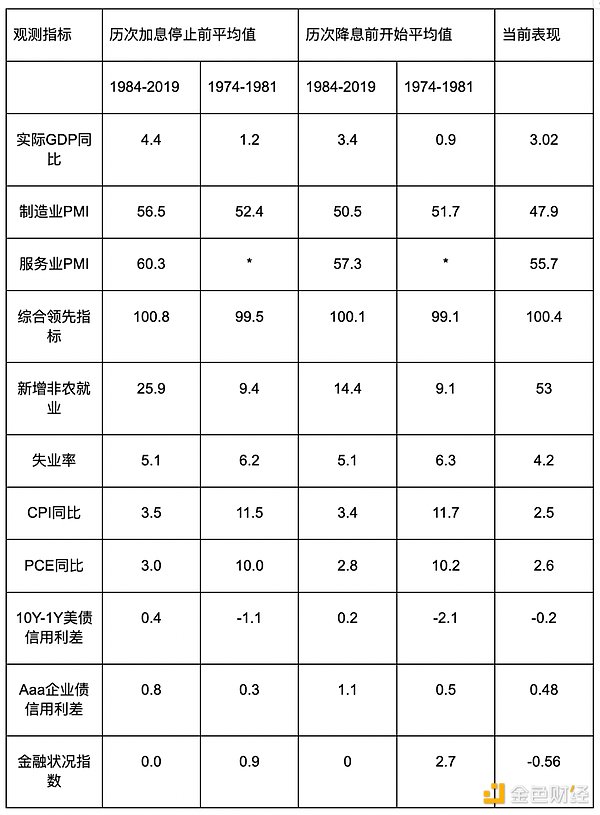

Judging from various economic indicators, the current economic situation shows a lot of downside risks, and interest rate cuts are needed to stimulate growth. The current value of the manufacturing PMI is 47.9, which is in the contraction range, indicating weak manufacturing activities; although the service PMI is 55.7, it is lower than the historical average. In addition, the current value of the unemployment rate is 4.2, and the year-on-year CPI and PCE are 2.5 and 2.6 respectively, which are lower than the historical average, indicating weak demand. More noteworthy is that the 10-year and 1-year US Treasury credit spreads are -0.2, which is usually a sign of economic recession, while the financial conditions index is -0.56, indicating that financial conditions are tightening, which may further suppress economic activities. Against this data background, the Federal Reserve announced a 50 basis points (bps) interest rate cut. Lower interest rates encourage investors to invest their funds in investment activities with higher returns, which has a boosting effect on the investment market; but a large amount of funds flowing into the market will have to face the risk of inflation and the possibility of instability in the economic system.

Data Trends

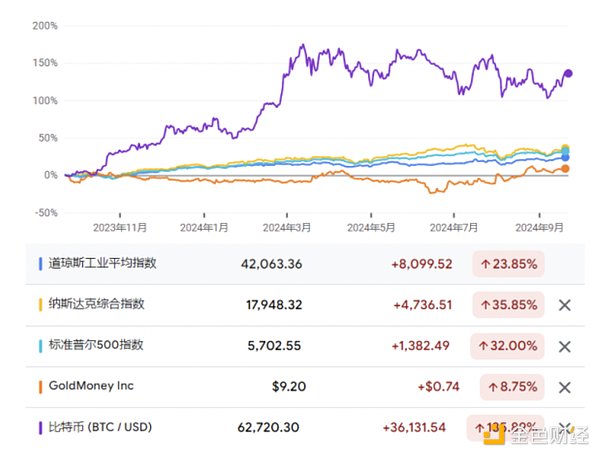

In the context of interest rate cuts, fighting against the inflation that may be caused by interest rate cuts is an issue that people need to seriously consider. In the past, people often chose gold as a hard currency to fight inflation. But as the cryptocurrency market enters the field of vision of more and more investors, BTC, known as "digital gold", is attracting more and more attention, especially after the approval of the BTC spot ETF, which provides investors with a more secure investment method.

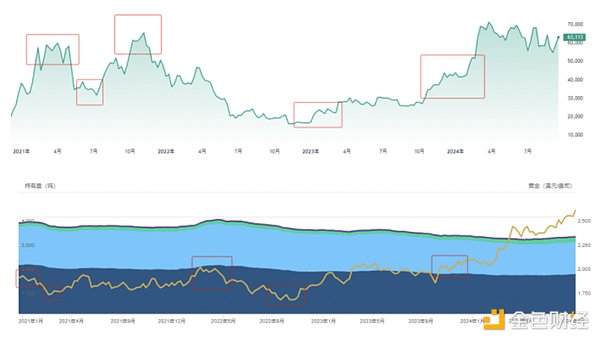

Comparing the price trends of BTC (digital gold) and gold (traditional safe-haven assets), we can find that the two trends are strongly correlated, and the changes in BTC prices have a certain lag in time relative to the changes in gold prices, usually 2-5 months later than the changing trend of gold prices.

Gold and major stock indices (General & Poor's Index, Nasdaq 100 Index) are mainly negatively correlated. When the economic market is turbulent, gold can serve as a hedge and preserve value.

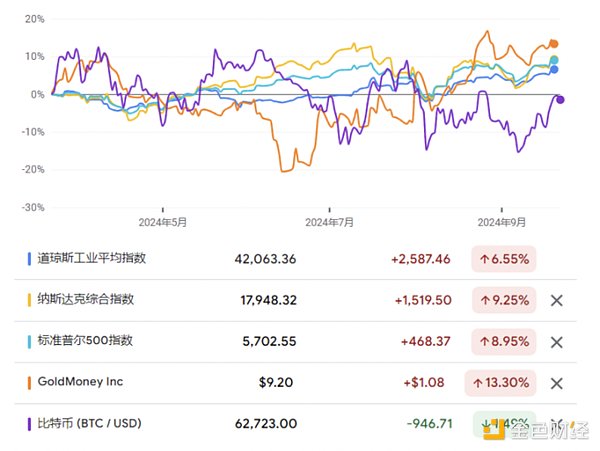

In the past six months, Bitcoin has been showing a risk-averse trend similar to that of gold, that is, it is weakly correlated and inversely correlated with mainstream stock market indicators. And in the case of having the same risk-averse properties, Bitcoin can achieve higher returns for risk-averse investors.

Possible future trends?

The United States is the world's largest and most developed economy, and the Fed's decision to cut interest rates is not only the United States' economic policy, but also a reference for other countries. The Fed's 50 basis points (bps) interest rate cut also expresses that the current economic situation cannot be too optimistic. From the previous data, we can see that before the interest rate cut, gold fluctuated and rose by a large margin. After the announcement of this interest rate cut, BTC and other cryptocurrencies may usher in a correction, but there are not enough positive factors in the later period. Due to concerns about economic recession, the market may easily fall into a state of turmoil.