Chicago Fed Chairman Goolsby recently emphasized that in order to achieve a "soft landing" for the U.S. economy, the Fed needs to further cut interest rates in the next year and gradually return to neutral interest rates.

(Preliminary summary: Yellen: The U.S. economy is strong and has achieved a soft landing without flashing red lights, and may step down as Treasury Secretary with Biden )

(Background supplement: The U.S. economy will not have a hard landing. Federal Reserve officials support Powell’s gradual interest rate cuts, and there is hope for a ceasefire with Kazakhstan )

Although U.S. inflation has dropped significantly and the labor market is showing signs of weakness, interest rates remain at their highest level in nearly 20 years after the Federal Reserve lowered interest rates by 50 basis points last week. In this regard, Chicago Federal Reserve Chairman Goosby recently stated that in order to achieve a "soft landing" for the economy, interest rates still need to be lowered further.

Chicago Fed Chairman delivers market comments

Goolsby told the annual meeting of the American Association of State Treasurers in Chicago on Monday that inflation has slowed significantly over the past two years without triggering a recession, which is rare globally. He further added:

The unemployment rate has gradually increased to 4.2%. This number is considered by many to be a stable and full employment level, which is also the state we want to maintain.

However, he also stressed that if the Fed does not cut interest rates "significantly" in the next few months, it will not be able to maintain a favorable level of employment and inflation. He said:

If restrictive measures are maintained for too long, the best of both worlds will not be maintained for long.

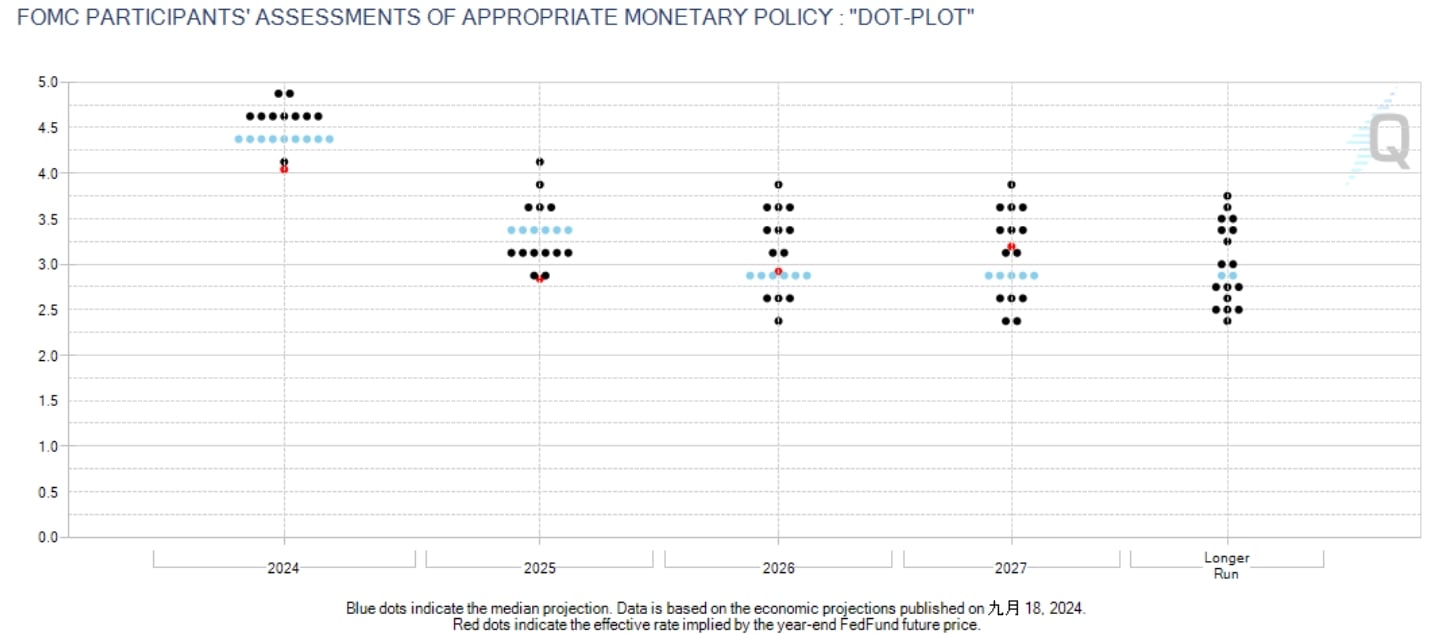

Goolsby also mentioned last week's FOMC decision, saying, "The current interest rates are still at a 20-year high, far exceeding the so-called neutral level. Is this appropriate?" He expects U.S. interest rates to fall to 4.5% by the end of this year, to 3.5% by the end of 2025, and to a neutral level of 3.0% in June 2026.

Fed interest rate dot plot

According to the FOMC's economic forecast in September, interest rates are expected to be cut by 100 basis points this year and another 100 basis points next year, eventually adjusting interest rates to a range of 3.25% to 3.5%.

Fed officials have raised their forecasts for long-term interest rates for three consecutive quarters, and the current forecast is just below 3%, which is seen as the consensus for a neutral rate.

In addition, according to Fitch's forecast, the Federal Reserve may cut interest rates by 25 basis points at each of its November and December meetings. The rate cuts in this easing cycle are expected to remain moderate.