Written by: OSL

Is blockchain a disruptor of the traditional financial system, or a catalyst that helps TradFi achieve its transformation?

The answer to the question may not be either this or that. On the one hand, the emergence of blockchain technology has indeed brought a huge impact on the traditional financial system. It is not only expected to remove the cumbersome intermediary links in traditional finance and reduce transaction costs, but the smart contract function can also improve transaction efficiency and reduce the risk of human errors and fraud, making it have the potential to subvert the traditional financial system to a certain extent.

But at the same time, blockchain can also support traditional finance to achieve more efficient and secure solutions. For example, in the fields of cross-border payments, securities trading, supply chain finance, etc., it can help traditional finance achieve digital transformation, improve service quality and competitiveness, and thus become a driving force for traditional finance to achieve a leap forward.

However, this requires a blockchain infrastructure layer that is strong enough to nurture killer applications. At the Solana Breakpoint conference, the Solana validator client Firedancer developed by Jump Crypto also officially announced the launch of the mainnet (non-voting mode). During internal testing, it can reach 1 million TPS, far exceeding Solana's current theoretical limit of tens of thousands of TPS. This breakthrough seems to be enough to meet the needs of all high-frequency trading applications and provides stronger technical support for the application of blockchain in the traditional financial field.

A strong wind starts with a small ripple. In the long run, Solana, as a representative of high-performance public chains, is expected to solve the "last mile" of the integration of traditional finance and blockchain, bringing new imagination space to TradFi.

Web3: A new trend in traditional finance

Before that, we can ask a question: Which is the most successful crypto financial product in the world in the past five years?

The answer is not difficult to guess. It is neither the on-chain financial innovations such as Uniswap that ignited the DeFi Summer, nor the digital artworks such as CryptoPunks that set off the NFT craze. Instead, it is the stablecoins that everyone has long been accustomed to.

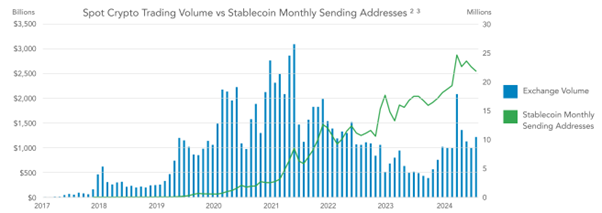

That’s right, in addition to games such as DeFi and NFT that have their own big-player attributes, stablecoins for ordinary users have become one of the use cases widely accepted by crypto/non-crypto users - the number of on-chain accounts of the TRC20 version alone exceeds 40 million, truly making blockchain and crypto economy no longer a carnival for a few people, and greatly broadening and deepening the user base of the crypto economy.

According to the report " Stablecoins: The Emerging Market Story ", the adoption of stablecoins has gone beyond serving only cryptocurrency users and trading scenarios. In the first half of 2024, approximately US$2.62 trillion was settled through stablecoins, with an annualized scale of US$5.28 trillion, covering a wider range of financial scenario needs such as currency exchange, commodity payment, remittances and wage payment .

The reason is simple. Stablecoins provide an excellent entry point for users who have demand for cross-border transactions and payments in the traditional financial system. Blockchain-based payments greatly reduce transaction costs and improve the overall efficiency of cross-border transactions. It not only reduces delays, but also solves the complexity and high cost issues associated with the traditional financial system, making it easier for businesses and individuals to make cross-border payments and improve their reliability.

To put it bluntly, global payment services based on cryptocurrencies such as USDT have even become a must-have option that "you don't notice the benefits, but you will find it difficult to survive if you lose them", which is also a true reflection of the current integration of the traditional financial system and Web3:

Although the traditional financial system has established a relatively complete structure and norms in the long process of development, it has gradually revealed some limitations in the face of the rapid development of globalization and the impact of emerging technologies. For example, the high fees in cross-border transactions, the long settlement cycle and the complex regulatory requirements have hindered the efficient circulation of the economy to a certain extent .

The decentralized, efficient and convenient technical concepts represented by Web3 provide new ideas and directions for the transformation of the traditional financial system.

Solana is accelerating its penetration into TradFi

As a high-performance blockchain platform, Solana's high throughput, low latency and scalability give it huge advantages in processing financial transactions, and it can meet the needs of traditional financial institutions for efficient, secure and reliable transaction processing systems.

Judging from the data, Solana's first wave of growth actually came from the promotion of the Solana Foundation's Breakpoint annual meeting in 2023. Before October 2023, the number of daily paying users, which measured the activity of the Solana ecosystem, had been hovering between 80,000 and 100,000.

The Breakpoint conference stimulated the first phase of growth from the end of October to November 2023, and the subsequent JTO airdrop and Coinbase's launch of BONK further promoted the growth of this data, causing it to soar by more than 5 times to reach the level of 500,000.

Since entering 2024, Solana has accelerated its penetration into TradFi with its unique advantages in today's rapidly developing financial technology field, bringing new changes and opportunities to the financial industry.

PayFi’s Solana underlying logic

PayFi is a typical example. As the name suggests, it creates diversified application scenarios and functional services (Fi) around the behavior of "monetary payment" (Pay).

Lily Liu, president of the Solana Foundation, also gave an intuitive explanation: " PayFi is motivated by the original vision of Bitcoin payments. PayFi is not DeFi, but rather creates new financial primitives around the time value of money, etc. "

At present, PayFi on Solana has not been fully developed and is still in a blue ocean. Lily Liu also gave the community many examples of usage scenarios that it can cover, such as:

- Buy Now Pay Never : In contrast to the common installment payment model, it is done by depositing the purchase amount into DeFi products for lending and interest, using the interest to pay for the purchase, a process that sacrifices cash flow. For example, a user buys a $1,000 TV and then deposits $10,000 into a DeFi lending product. Over time, the interest generated by this deposit gradually increases. When the interest reaches $1,000, the system automatically uses the interest to pay for the TV and unlocks the remaining deposit and returns it to the user;

- Creator Monetization : Suppose a painter creates a painting and expects to sell for $5,000, but needs to wait two months to receive the payment. At this time, the painter can use PayFi to immediately cash out the expected income of the painting at a price of $4,500. In this way, the painter can get funds in advance to purchase painting materials, pay living expenses, etc., so that he can continue to create without having to wait for a long period of time to be paid back;

- Account Receivable : A small business provides a batch of goods to a customer, and the accounts receivable is $20,000. However, the customer's payment cycle is long, which leads to the company's cash flow shortage. The company can mortgage this account receivable to an accounts receivable financing company and obtain $18,000 in cash. In this way, the company can obtain funds in time to pay employee wages, purchase raw materials, etc., to ensure the normal operation of the company, and not be affected by the customer's payment speed;

In addition, you can also imagine what the scenario would be like if we could implement an automatic "daily wage system" or even pay for work by the hour, or pay by the minute or second when watching videos or listening to music?

In general, with the help of the programmability of smart contracts, the high-performance, low-transaction-cost Solana can meet the high-frequency, small-amount stream payment scenarios that traditional financial settlement systems cannot achieve. Previously, due to Ethereum’s high gas fees and performance bottlenecks, previous stream payment attempts have always been short-lived.

Comprehensive optimization of traditional financial transaction system

In addition, in traditional financial markets, large transaction volumes and high speed requirements are common characteristics. Solana's high throughput can easily cope with large-scale transaction needs and transfer transactions to the chain to achieve more efficient and decentralized processing.

The most direct demand is the securities trading market. A large number of transactions of financial products such as stocks and bonds occur every day. Traditional trading systems may be congested during peak periods, resulting in transaction delays. Solana's high performance allows it to process millions or even tens of millions of transactions in a short period of time, ensuring the timely execution of transactions.

In particular, once Firedancer is officially fully rolled out, it means that Solana's peak throughput can reach hundreds of thousands of transactions, far exceeding the processing capacity of traditional financial systems , providing traditional financial institutions with more efficient transaction processing solutions, reducing transaction waiting time, and improving market liquidity.

At the same time, in financial transactions, time is money. Low latency is critical for quick decision-making and transaction execution. Solana’s low latency feature enables transactions to be confirmed within milliseconds, providing traders with a real-time trading experience.

Taking the foreign exchange trading market as an example, exchange rates fluctuate rapidly, and traders need to obtain market information and make decisions in a timely manner. Solana's low latency can ensure that traders complete transactions in the shortest time possible and avoid missing the best trading opportunities due to delays. At the same time, low latency can also help reduce market risks and improve transaction security.

Scalability meets the growth needs of financial services

As financial markets continue to develop, traditional financial institutions face system pressures brought about by business growth. Solana's scalability enables it to easily cope with growing transaction needs and business scale.

For example, with the rise of the digital currency market, more and more traditional financial institutions are beginning to get involved in this field, and Solana can provide these institutions with a stable and reliable blockchain infrastructure to support the transaction, storage and management of digital currencies. At the same time, Solana can also be integrated with traditional financial systems to achieve cross-chain transactions and asset transfers, providing financial institutions with more business innovation opportunities.

Currently, DeFi projects on Solana such as PYUSD provide new business models and revenue sources for traditional financial institutions, and also provide customers with higher-yield savings products and convenient lending services: Since PYUSD was launched on Solana, it has grown by 271%, of which PYUSD on Solana accounts for 88%.

From this perspective, through integration with Solana DeFi, traditional financial institutions can improve their competitiveness and meet customers' demand for diversified financial services.

Supply Chain Finance and Asset Tokenization

Solana's blockchain technology can provide transparent and traceable transaction records for supply chain finance and reduce credit risk. For example, in international trade, Solana can record the transportation, storage and transaction information of goods to ensure that all parties can understand the status of goods and the flow of funds in a timely manner. This helps to improve the efficiency of the supply chain, reduce financing costs, and provide better financing channels for small and medium-sized enterprises.

In addition, according to BCG's research, the market for asset tokenization will reach 16 trillion US dollars by 2030, equivalent to 10% of the global GDP. Solana can tokenize traditional financial assets such as real estate and artworks, realize the digitization of assets and enhance liquidity, lower the investment threshold, and improve the liquidity and value of assets.

Cross-border transaction settlement

Previously, in the article " Re-examining Cryptocurrency Trading: A New Interpretation of Liquidity Revolution under the Traditional TradFi System ", we summarized several inherent problems in the current traditional cross-border payment system:

- First, since the entire process involves multiple correspondent banks, the process is cumbersome and multi-step, which may extend the settlement time to several days (T+N). At a time when real-time transactions are becoming the norm, this undoubtedly causes a huge waste of efficiency;

- Second, each intermediary bank involved in the transaction charges a fee, which significantly increases the total cost to the remitter. For businesses that rely on timely payments to manage cash flow efficiently and for individuals sending money to family members across borders, these delays and fees are almost unbearable;

- Furthermore, the regulatory environment in different jurisdictions is complex and diverse, so multiple intermediary banks around the world also pose challenges to traditional cross-border payments. During the long transaction period, the unpredictable risk of exchange rate fluctuations further exacerbates these difficulties;

In short, there are many problems with the traditional financial interbank payment process. The market urgently needs innovative solutions that can provide faster, more cost-effective and more reliable cross-border payment options to support the speed and scale of global trade. Blockchain-based cross-border payment settlement solutions already provide a better option.

Solana has an advantage over other blockchain solutions, not only in making inter-bank transfers faster, but its low latency, high throughput and smart contract programmability will completely change the way money circulates , making the transaction forms between individuals and merchants, and between merchants and supply chains and financial institutions more diversified - accurately quantifying everyone's economic behavior in the form of stream payments, realizing instant and automatic payment and settlement, and other financial payment paradigms unique to Web3 .

summary

In short, Solana is accelerating its penetration into the traditional financial sector with its advantages of high throughput, low latency, and scalability, bringing new changes and opportunities to the financial industry. With the continuous development of technology and the continuous promotion of its applications, Solana is expected to become an important driving force for the digital transformation of traditional financial institutions.

Just recently, OSL officially launched Solana (SOL) trading for professional investors, aiming to provide investors with valuable investment opportunities.

As the Web3 industry continues to develop, we will undoubtedly see Solana bring more and better solutions to the traditional financial system and the world as a whole, and hopefully continue to be the main narrative of the next bull market.