After the recent stagnation of Dogecoin, the activity of large holders has increased significantly, with net flows soaring from negative 2.23 million DOGE to 20.66 million DOGE, an increase of 1000%. This change shows that whale holders are actively increasing their holdings of DOGE, while the balances on cryptocurrency exchanges have dropped significantly. This trend may mean that large holders are preparing for a potential bull market. Although the price of DOGE has risen slightly, it has not yet broken through the key resistance level of $0.11, which may drive more holdings and change future price trends.

Welcome to join the exchange group →→ VX: ZLH1156

After a few weeks of stagnation and unattractive price action, Dogecoin holders are working tirelessly to change the crypto landscape. Notably, on-chain data suggests that large holders of Dogecoin are working to extend the price gains that were expected last week. Data insights from IntoTheBlock (ITB) show a significant increase in both large holder net flows and exchange net flows, indicating an increase in activity and accumulation levels among Dogecoin whales.

Dogecoin whale activity increases

"Large Holder Net Flow," one of IntoTheBlock's best metrics for whale activity, recently rose from negative to positive. Large Holder Net Flow tracks the difference between the number of DOGE tokens entering addresses and the number of DOGE tokens leaving addresses that are at least 0.1% of the circulating supply. The higher the inflow compared to the outflow, the higher the net flow.

Such a trend is often interpreted as positive for the associated cryptocurrency as it means that whales are employing an accumulation strategy. However, a period of negative readings indicates that outflows are outstripping inflows into whale addresses, which could have implications for the price outlook.

Data from ITB shows that net flows have risen dramatically, surging from a negative -2.23 million DOGE to a staggering 20.66 million DOGE in the last 24 hours. This 1,000% increase suggests that whales have significantly increased their activity during this time. While this level of net flows may seem insignificant compared to the massive DOGE volumes seen during previous market surges, it represents an important first step for the popular meme token after a long period of slump.

Interestingly, the increase in DOGE whale activity coincided with a significant drop in balances across cryptocurrency exchanges. Specifically, total exchange net flows plummeted from 28.25 million DOGE to negative 43 million DOGE in the same 24-hour period.

DOGE Price Outlook

The dual trends of increasing whale accumulation and decreasing exchange balances suggest that large holders are moving their assets off exchanges, perhaps in anticipation of a bull market rally.

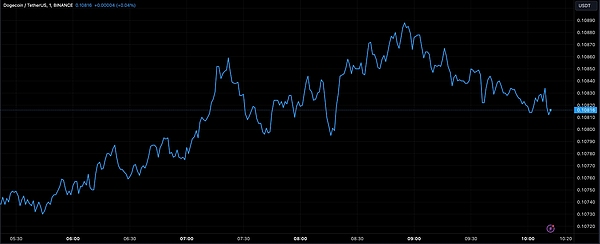

As of this writing, DOGE is trading at $0.1086, up 1.96% in the past 24 hours and 7.78% in the past 7 days. Despite the price increase, DOGE has yet to break above $0.11, a price point it has struggled to break through since early September.

Technical analysis of Dogecoin’s price shows that $0.11 is a key price point for a bullish rebound outlook. The only thing left now is for Dogecoin to break through $0.11. If it can break through the $0.11 mark, it could trigger more accumulation by large holders and could significantly change its price trajectory for the rest of the year.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156