Written by: 1912212.eth, Foresight News

This month, as the Fed meeting approaches, market sentiment has quietly warmed up, like a spring breeze, sweeping away the previous haze. On September 17, BTC was like a wild horse that had broken free from its reins, advancing for two consecutive days from below $58,000, and unstoppably broke through the $61,000 mark. When the heavy news that the Fed announced a substantial interest rate cut landed, the cryptocurrency market seemed to have ushered in a long drought and all worries and uncertainties disappeared in an instant. BTC was even more full of firepower, performing an extremely rare feat of six consecutive positive daily lines, with an impressive weekly increase of 7.52%, and the price approaching $65,000, demonstrating a strong recovery momentum.

The surge in the price of the coin is like a shot in the arm, effectively responding to all doubts and challenges. ETH is not far behind, rising straight from the low of $2,150 to a new high of $2,600, and the FUD sentiment has finally been effectively alleviated. It is particularly worth mentioning that since the ETH/BTC exchange rate hit a three-year bottom, it has shown amazing resilience, strongly regaining lost ground and returning to above 0.04, heralding a full return of market confidence. As a leader, AAVE broke through the $180 mark in one fell swoop, setting a new high since May 2022, and many Altcoin followed closely behind, adding considerable vitality to the market.

Good news continues to come. US presidential candidate Harris has also publicly stated that if she is successfully elected president, she will help increase investment in AI and cryptocurrency. The total market value of the crypto market has once again rebounded to above $2.2 trillion. Recently, the total daily trading volume of the crypto spot market has exceeded $80 billion, more than double the lowest point of $40 billion in June.

In terms of on-chain data, the total market value of stablecoins exceeded US$172.2 billion, a new high since May 2022, with a weekly increase of more than 0.5%. Ki Young Ju, CEO of CryptoQuant, posted on social media that "institutions are no longer short Bitcoin aggressively. Net positions in CME futures have fallen by 75% in the past five months."

The market panic has finally broken free and returned to a normal neutral level. The market continues to rebound. In addition to Bitcoin and Ethereum, which sectors have performed well?

Sui

Sui has performed extremely strongly recently. After falling below $0.5 in early August this year, it quickly rebounded to around $1. After fluctuating for several weeks, it soared again from around $0.8 to a high of nearly $1.8, an increase of more than 100%.

Since this month, Sui has received a lot of good news. Mysten Labs launched a game console pre-order in early September, priced at $600 each, which was quickly sold out, bringing it a lot of popularity. A week later, Grayscale Trust announced that it had opened up to qualified investors seeking to invest in SUI, opening up a large capital entry. On the same day, Binance launched a perpetual contract based on SUI currency, with a maximum leverage of 20 times, which continued the rise in its currency price.

On September 17, Sui Lianchuang announced that USDC would soon be extended to the Sui network. The next day, the Sui network TVL exceeded $1 billion, setting a new record high.

Its ecological sectors also saw significant growth subsequently, including SUIP, CETUS, NAVX, etc. Even the Meme coin BLUB continued to rise during this period, with its market value rising to 45 million US dollars.

Noteworthy projects

Scallop

Scallop is a Sui lending protocol. Benefiting from the increase in SUI, the Swap V2 update and the reward activities, its TVL data has soared to 154 million US dollars. Its coin price has also risen from around US$0.15 in early September to above US$0.4, with a historical high of US$1.44.

CZ Concept

On September 17, He Yi published a long article specifically responding to rumors that the crypto was anxious about listing coins, which shows that the market was extremely dull. However, a week later, when the market picked up again, CZ's release from prison became a major event in the crypto. According to data from the U.S. Federal Bureau of Prisons, CZ will be officially released from prison on September 29, and the news event even rushed to the hot search list recently.

The community has been discussing CZ's actions after his release from prison and the tokens of Binance's new projects. Binance's territory and its new projects have seen a wave of growth.

On September 23, IO in Launchpool rose by 8.8%, ALT soared by 17.48%, AI soared by 15.89%, NTRN soared by 11.75%, and ARKM soared by 22.16%. SEI rose from the recent high of $0.26 to $0.47.

Noteworthy projects

ENA

As a stablecoin project in Launchpool, its second quarter airdrop was collected just the day after CZ was released from prison. By hedging the considerable selling pressure under the positive trend of the overall market. In addition, Ethena also launched sENA, a liquidity receipt token that locks ENA, which is beneficial to the combination and function of its tokens in other projects, and has a certain boosting effect on the coin price. The current coin price is around $0.33, and the highest point is $1.5.

EDU

Open Campus is a decentralized education platform supported by Binance that aims to solve key challenges facing the education industry today. The current price of the coin is $0.69, and the historical high is $1.34. As we all know, after CZ resigned as CEO of Binance, he announced that he would focus on education. It is not known whether CZ will post tweets about his education career after he is released from prison, but market hot spots may bring in funds.

HOOK

Hooked Protocol is a product infrastructure that provides enterprises and users with the ability to learn and earn at the same time. Its track is also education-related. Its historical high is $4.1 and its current price is $0.49. However, the current token liquidity is not high.

AI Section

The AI sector was also silent for a long time, but with OpenAI's recent actions, the AI trend has once again hit the crypto. OpenAI is not only negotiating to raise $7 billion, but also launched an artificial intelligence model o1 with reasoning capabilities, internally codenamed "Strawberry". OpenAI o1 can reason about complex tasks and solve problems that are more difficult than previous scientific, coding, and mathematical models. In the test, OpenAI o1 performed similarly to a doctoral student on challenging benchmark tasks such as physics, chemistry, and biology, and performed well in mathematics and coding.

The AI track sector has a high valuation ceiling and is in line with hot spots, so it often performs well in the market rally. ARKM soared from around $1 to over $1.5. NEAR rose for three consecutive days, from $4.5 to $5.46. TAO rarely saw eight consecutive daily increases, from around $280 to a high of over $599.

Projects worth noting

WLD

Due to the large monthly selling pressure, the price of WLD has not improved significantly. In July this year, according to the Worldcoin Foundation, the WLD tokens allocated to Worldcoin contributor Tools for Humanity were originally scheduled to be unlocked daily in a linear manner starting from July 24, 2024. However, TFH will extend the unlocking schedule of 80% of WLD held by team members and investors from 3 years to 5 years. In addition, in April this year, Worldcoin announced that it will launch World Chain later this year. It is now close to Q4 and is not far from major positive news.

From the past history, from October last year to the first half of this year, WLD was greatly influenced by Ultraman and OpenAI. The actions of its CEO or the company have caused WLD to fluctuate greatly. Strictly speaking, although WLD is an identity ID track, its AI attributes are now very large and it has become a hot spot for OpenAI in the crypto. The current price is $1.88 and the historical high is $11.97.

TIA leads the way in modularization

After TIA was listed on the exchange, it soared from $2 to over $20, a more than 10-fold increase. Soon after, it fell to around $3.7 due to the sluggish market.

Chris Burniske, a firm long placeholder investor of TIA, has recently boldly shill for buying TIA below $5. It is worth mentioning that he also boldly called for long when SOL was below $10 in the last bear market. Chris said that those who are short TIA do not understand the following points:

CelestiaOrg as an ecosystem is running at full steam, with a diverse group of passionate developers actively experimenting.

The “evil VCs” who were given liquidity are less likely to sell in October as expected because they see the progress of the ecosystem and the vision of the team.

Many of TIA's biggest supporters are not as short-term focused as they are portrayed to be.

Buyers who have been sitting on the sidelines due to concerns about unlocking pressure will be encouraged to take action by positive price action and reduced uncertainty.

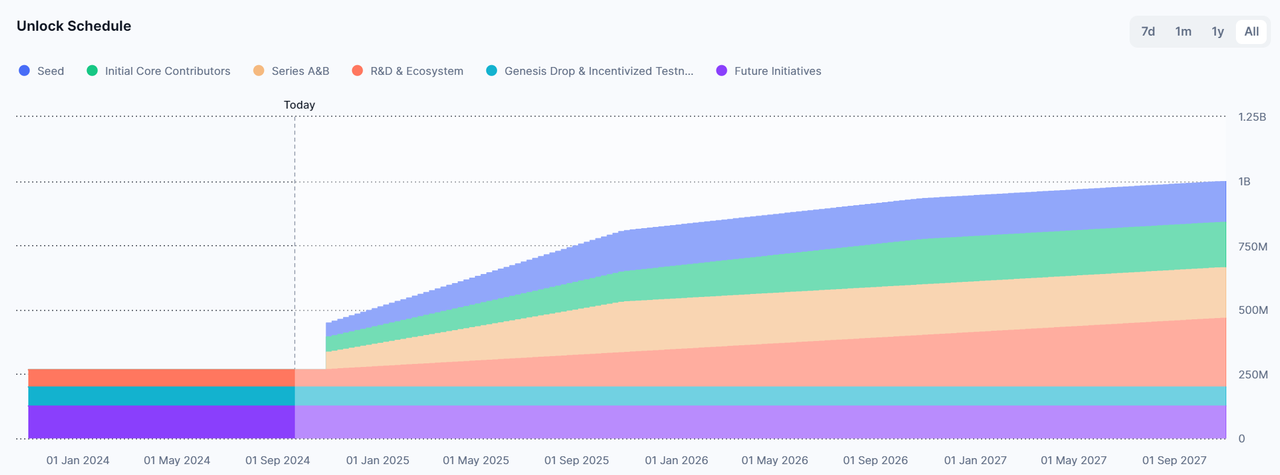

TIA will unlock about 175.74 million tokens on October 31st. Many investors are worried about such a huge unlocking. However, as of now, there is still a month left and the market sentiment is still optimistic. Today, the Celestia Foundation also completed a $100 million financing round, led by Bain Capital Crypto, with participation from Syncracy Capital, 1kx, Robot Ventures, Placeholder, etc., bringing the total financing amount of the project to $155 million.

TIA has been rising from the lowest of $3.7, and on September 23rd, it soared 24.19% in a single day, approaching $7. SAGA has risen five times in a row from the recent $1.4, breaking through $2.7. DYM has also seen two single-day surges of more than 20% recently, breaking through $2 at one point.

Noteworthy projects

Avail

Avail is a modular public chain project that has raised tens of millions of dollars in financing and has a luxurious venture capital lineup. After the launch of the mainnet, it caused great controversy and negative reviews due to its airdrop details. The current coin price is $0.15, the historical high is $0.246, and the total market value is $288 million. Compared with TIA, SAGA and DYM, AVAIL has not seen a huge increase.

Outlook

At present, the much-questioned fields such as games and social networking are generally confused and have not seen much improvement. New memes have not set off a large hype atmosphere. A considerable amount of funds have been pouring into the aforementioned fields in the article.

At the macro level, after the Fed cut interest rates this month, the market generally predicts that interest rates will continue to be cut in November and December, and it is expected that there will be another 70 basis points of interest rate cuts this year. The published dot plot suggests that there will be another 50 basis points of interest rate cuts this year. The Fed's continuous interest rate cuts will inject liquidity into the crypto market and provide continuous benefits for the rise of the crypto market. In addition, after the results of the US presidential election in early November are announced, some hesitant funds will also choose to be injected into the crypto market.

In the crypto market, October is historically an extremely bullish month. Market conditions tend to pick up significantly at the end of the year and the beginning of the year, but generally perform poorly in the summer.

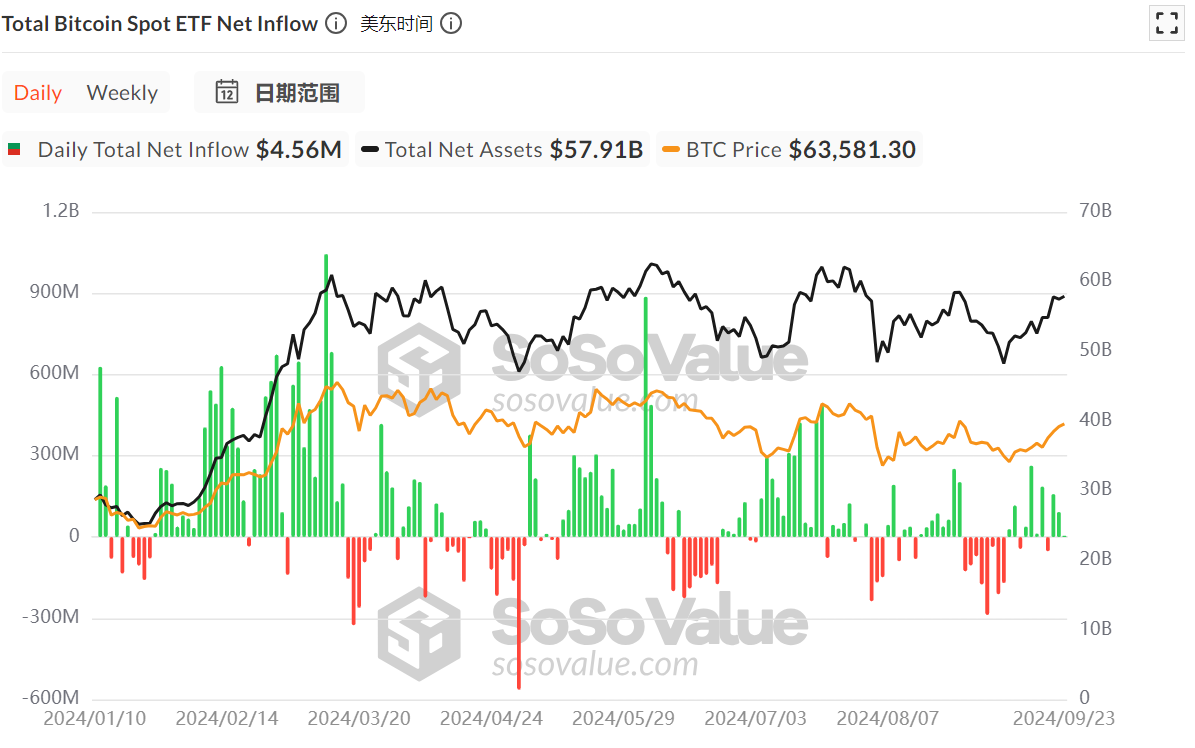

As for Bitcoin spot ETF, the total net inflow has reached 17.7 billion US dollars since its launch. In addition, since September 9, there have been only two days with small outflows, and the rest have been positive inflows, with the largest one-day net inflow reaching 263 million US dollars. The data performance is relatively optimistic, and the confidence of OTC buying funds is firm.

TOKEN 2049 in 2023 is the dawn of the bull market before the end of 2023. It is worth waiting to see whether the just-passed TOEKEN 2049 will once again become the bottom of a new round of bull market cycle.