Written by: NingNing

In the crypto world, we often hear the saying “history doesn’t repeat itself, but it rhymes.” Although many people think that DeFi is outdated, in fact, this field is only in the “early stage of maturity” of the Gartner curve—iteration and innovation are still happening.

With the rise of new narratives such as PayFi (such as Huma) and CeDeFi (such as the Trump family's World Liberty Financal), and primitives such as chain abstraction and Intent Centric gradually entering the productization stage, DeFi's product architecture and UX layer may undergo qualitative changes in the near future (within 6 to 12 months).

Against this backdrop, Pyth Network’s recently launched Oracle Integrity Staking (OIS) and anti-MEV Solver network Express Relay have attracted market attention.

As a key part of DeFi infrastructure, the importance of oracles is self-evident. Pyth is redefining the security, reliability, and efficiency of oracles through these innovations, which may become one of the important factors driving the next round of DeFi prosperity.

Let's take a look at some key data of Pyth:

Number of data providers: 114+ (up 2.70% month-on-month)

Trading volume: $794 billion+ (up 9.88% month-on-month)

Number of price sources: 507+ (up 1.00% month-on-month)

Number of integration partners: 410+ (month-on-month growth of 7.18%)

TVL (Total Value Locked): $8.1 billion+ (down 7.27% month-on-month)

These data show the important position of Pyth in the DeFi ecosystem. It is particularly noteworthy that although the total locked value has declined (which may reflect the overall market trend), other key indicators such as transaction volume and the number of integrated partners have been steadily increasing.

In addition to Solana's base, Pyth is continuously expanding its penetration in DeFi applications and its monopoly in the new L1/L2 oracle market.

Recently, it has established partnerships with Morpho and Gauntlet to improve the lending experience on Ethereum and Base; and with Starknet to become the default integrated oracle along with Chainlink.

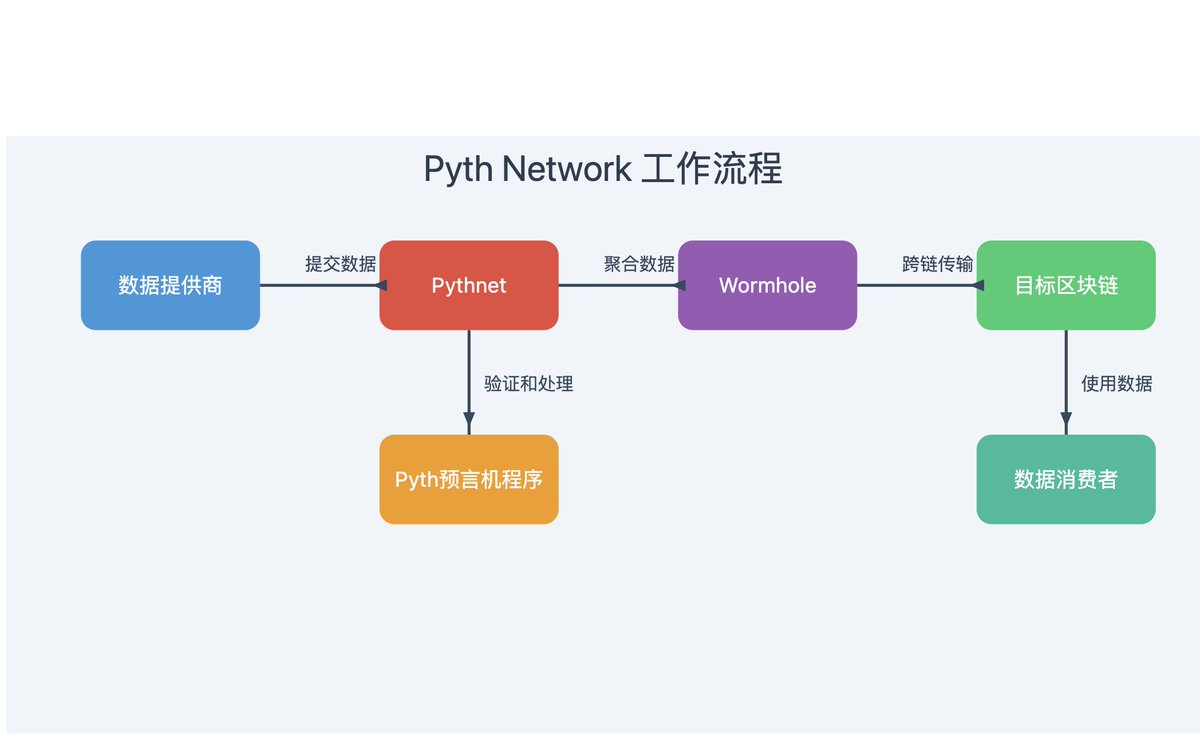

Before we talk about the new features recently introduced by Pyth, let's take a quick look at the basic architecture of Pyth:

Data source model: Use a network of first-party data providers to obtain data directly from primary sources (such as exchanges, market makers).

Data update mechanism: Use a push model on Solana, updating every 400 milliseconds; use a pull model on other chains.

Cross-chain strategy: Multi-chain support is achieved through the Pythnet application chain and the Wormhole cross-chain messaging protocol.

Data transparency: Each data point is traceable to the public key of the individual provider.

Scalability: With a pull model and centralized data aggregation, it is easier to scale to new price sources and blockchains.

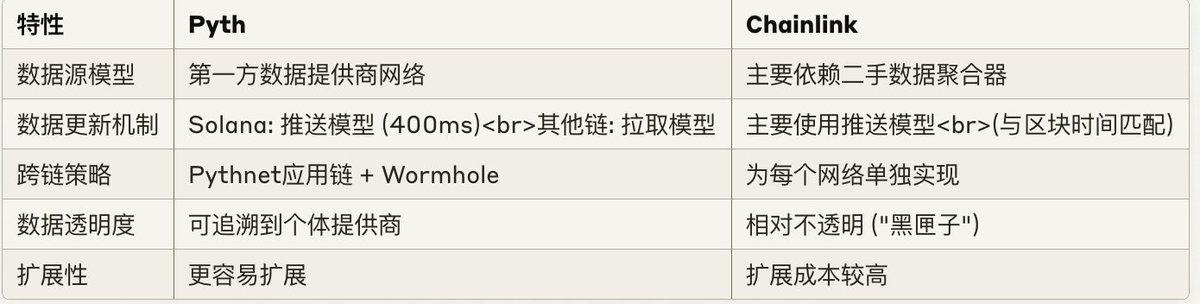

Pyth's architecture gives it unique advantages over Chainlink in terms of data freshness, transparency, and cross-chain scalability.

However, as a rising star, Pyth is weaker than Chainlink in terms of data trustlessness, network role incentive alignment, and product line richness.

Oracle Integrity Staking (OIS) and the anti-MEV Solver network Express Relay are exactly Pyth’s oracle network completion plan.

The core idea of OIS is to ensure the trustlessness of price feed data through a free market game based on Tokenomics to optimize the mechanism that previously relied entirely on reputation and algorithms.

The OIS mechanism is not complicated or difficult to understand. It is a micro-innovation based on the mature token staking mechanism for oracle scenarios. In short:

Data publishers need to stake PYTH tokens to receive rewards, and providing incorrect data will result in tokens being slashed.

PYTH token holders can delegate their tokens to data publishers, increasing potential rewards and strengthening network security.

The PythDAO oversees key parameters, including the maximum reward rate, delegation fees, and Slash amounts. The DAO also plays a role in deciding how Slash tokens are used and can adjust incentives to ensure long-term sustainability.

This mechanism not only improves the reliability of data, but also creates a more fair, transparent and benefit-sharing ecosystem.

Additionally, data publishers can increase their returns by supporting more price sources, including a variety of long-tail assets, providing developers with a wider range of reliable data.

Express Relay connects DeFi protocols directly to the Solver network by building a decentralized order flow auction system. Express Relay optimizes transaction execution, reduces MEV, and improves transaction efficiency.

The Solver network has now almost become the standard middleware in the chain abstraction project stack.

In terms of the choice of ecological expansion strategy, Chainlink is entering the cross-chain interoperability protocol CCIP to compete with LayerZero; Pyth's Express Relay is entering the anti-MEV Solver network to compete with CowSwap.

The core business of Pyth Oracle is to provide high-quality, low-latency price data. Express Relay focuses on optimizing the transaction execution process. The two have natural synergy in data flow:

Improved real-time performance: Express Relay can use Pyth’s high-frequency data updates (once every 400 milliseconds) to achieve more accurate trading timing. This is especially important in high-volatility markets.

Data integrity: Pyth’s OIS (Oracle Integrity Staking) mechanism ensures data reliability and provides a solid foundation for Express Relay’s transaction execution.

Closed-loop feedback: The transaction results executed by Express Relay can be used as an additional market data source to feed back to the Pyth oracle, forming a virtuous circle.

Although the current market sentiment may not be as enthusiastic as the "DeFi Summer" in 2020, innovation in the DeFi field has never stopped. As investors, we should pay close attention to the development of these infrastructures. Because it is these seemingly insignificant innovations that may become the fuse that triggers the next round of DeFi prosperity.