Author: Revelo Intel Source: substack Translation: Shan Ouba, Jinse Finance

Last week we discussed the Fed’s decision to cut interest rates by 50 basis points. However, we also spent considerable time discussing easing measures around the world, especially in China, the world’s second-largest economy. We noted that China has not yet taken “hard” measures, such as cutting interest rates, but has begun to opt for more subtle modest easing measures, such as potentially allowing mortgage refinancing.

This continued to play out as trading opened in mainland China and Hong Kong on Monday, with the People’s Bank of China making several important announcements that drew attention from international investors in both the cryptocurrency and traditional finance sectors. These announcements and moves were not as clear-cut as a simple 50 basis point rate cut, but rather were deliberate attempts to direct liquidity directly to the areas of the Chinese economy that needed it most, particularly the real estate and stock markets that have been in trouble in recent years.

With a series of recent policy changes, we are bringing forward this week’s macro updates. In today’s edition, we will dive deeper into these measures and explore the global impact of China that could impact cryptocurrencies in the coming months and years.

The People's Bank of China breaks its silence

The fact that the People's Bank of China held a press conference was itself seen as an improvement. US investors hoped to get some forward-looking information.

With this in mind, we can surmise that this was an important message from the PBOC, worthy of a press conference. This press conference was the PBOC’s first since January. It reflects the Chinese authorities’ recognition of the delicate situation at hand – we all know that markets typically overreact to Fed comments, often pricing in months in advance. Given the current state of Chinese asset prices, it seems reasonable that the PBOC would want to fully explain its thinking and avoid any misunderstandings.

Announcement of the People's Bank of China

Let’s take a look at what the People’s Bank of China announced on Monday:

Cut 7-day repo rate: The People's Bank of China cut the 7-day repo rate by 20 basis points, lowering banks' borrowing costs. The move is intended to encourage businesses and consumers to lend, thereby stimulating consumption and economic activity.

Lowering the reserve requirement ratio: The central bank announced a 50 basis point cut in the reserve requirement ratio for major banks, from 10.0% to 9.5%. The adjustment is expected to free up more capital for banks to lend, helping to offset the impact of weak credit activity.

Supporting the real estate market: The People's Bank of China plans to increase support for the mortgage market by reducing interest rates on outstanding mortgages and lowering the minimum down payment for second home purchases from 25% to 15%. In addition, the proportion of funding support for unsold homes will be increased from 60% to 100%.

Changes to the monetary policy framework: The People's Bank of China will formulate new monetary policy rules aimed at stabilizing and developing the stock market and ensuring better access to liquidity for companies. The measure establishes a RMB 500 billion swap line with the People's Bank of China specifically for stock brokerage firms and mutual funds. This will allow stock exchanges to obtain funds directly from the People's Bank of China. If this swap line proves effective, another RMB 500 billion swap line will be established.

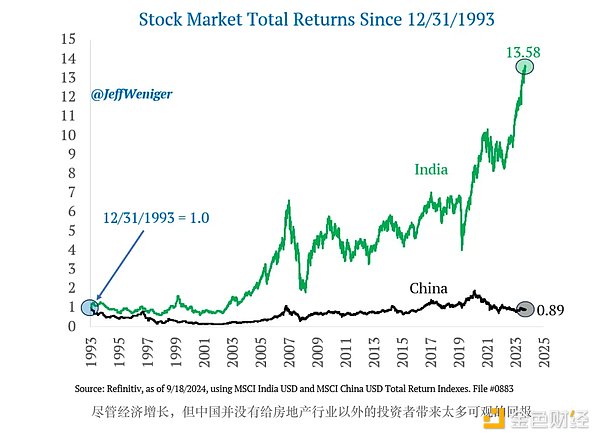

This last point made a lot of headlines in English. Ultimately, the value of this policy implementation was only about $70 billion per swap line, which is a drop in the bucket compared to the total market value of stocks eligible for this funding, which totals about $10 trillion plus. Only 10% of the Chinese population owns stocks, so the stock market doesn’t get a lot of attention, as our historical stock market return chart above shows. This is probably why this specific measure has attracted attention despite its relatively small impact.

There is also the issue that stocks are the most accessible market for U.S. investors and their main way to take advantage of China’s economic growth. Other known ways to invest in China include mining stocks and European luxury goods stocks, which benefit from rising Chinese consumption.

Other measures

In addition to the major announcements, there are other signs that the Chinese authorities are leaning towards further easing. Take, for example, the recent Kanye West concert on China's Hainan Island. The actual economic impact of the event was not large, contributing an estimated $60 million in consumption.

But the event and other celebratory tours involving American personalities show some willingness to encourage foreign economic interaction with China in order to increase consumption and boost GDP growth. This comes against the backdrop of the Chinese government banning several American celebrities from performing in the country over the past decade. While such a move may seem small, it shows that Chinese authorities want to make Hainan Island a tourism and consumption hub, similar to a tropical special economic zone (SEZ). Speaking of special economic zones and special administrative regions, let's talk about Hong Kong.

Today, Hong Kong officials announced plans to reduce taxes on spirits. The move may seem small, but it could be a sign of a larger trend in the city. As China develops, more and more investment can be made directly in mainland China, without the need for Hong Kong as an intermediary. This calls into question Hong Kong's added value - a possible alternative is to turn into a consumption center, attracting tourists from China and overseas for purposes closer to leisure rather than pure business. It is also an idea being mentioned as many believe China is emphasizing the role of consumption in GDP growth and becoming less dependent on investment and exports.

We mentioned earlier that China is not the best place for foreign direct investment (FDI). The authorities may want to mend fences with overseas investors in certain areas, with the recent move to allow foreigners to fully own private hospitals and medical facilities. These are additional examples pointing to a larger picture of further easing of policies in the Chinese economy.

Real easing or KPI?

What is important to note is the timing of these recent announcements. Not only did they come right after the Fed and ECB decided to cut rates, but we are heading into the fourth quarter of 2024. This is important because it is the last chance for Chinese authorities to meet their annual KPI targets.

This may be a slightly unfamiliar concept to those who follow the U.S. market. The U.S. does not regularly set economic growth targets. The Chinese government has set a 5% GDP growth target for 2024.

The consensus seems to be that US GDP growth will be between 2-3% this year. And the projected growth for the Eurozone is thought to be even lower, below 1%, with an improvement expected in 2025. But the Eurozone, the US and China are very different economies, the former two are extremely mature, while China is still growing rapidly. Therefore, a 5% growth rate could be twice that of the US, or even five times that of the Eurozone. Even though the US economy is larger than China, a smaller growth rate is still feasible.

The point is that 5% may seem high, but it is low compared to the 8% and 9%+ growth rates that China has achieved in recent years. Therefore, the recent announcement may be an attempt to meet this annual quota rather than a basis for medium- to long-term growth. Speculators must watch for any further moves by the People's Bank of China or other Chinese entities that suggest they are more forward-looking.

On the other hand, these announcements came just days after the Federal Reserve quickly began cutting interest rates. This timing may indicate the importance the People's Bank of China places on the medium- to long-term outlook, intending to follow the Fed and provide more momentum to its economy without having to worry too much about the depreciation of the RMB against the US dollar.

The impact of China's easing measures

The biggest impact of China's recently announced easing policy was immediately felt in Chinese stock indices, which reversed many of their losses and left the indices close to flat year-to-date. The Shanghai Stock Exchange Composite Index is now down about 2% year-to-date. Other mainland indices are still in deeper declines. Hong Kong's Hang Seng Index is up more than 13% year-to-date, making it the first choice for many people to assess the health of Chinese stocks.

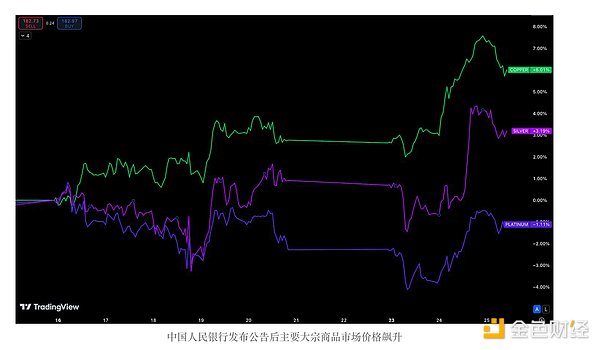

The impact of these announcements also spreads to the commodity market. As a major global exporter, easing measures will undoubtedly stimulate growth in the manufacturing industry and increase demand for commodities. This may also affect the US economy and may affect the Fed's decision. China's current deflationary state has led to some deflation being exported, which may make the Fed consider this factor. Rising commodity prices may affect US inflation.

Last but not least, we have to talk about cryptocurrencies

The link between China and cryptocurrencies, if it exists, is unclear. But that doesn’t stop us and others from speculating. A key impact of the U.S. Federal Reserve’s easing (rather than China’s) is that the estimated $5 trillion in U.S. dollar assets held by Chinese exporters are more likely to start flowing back to China.

As China takes steps to boost confidence in its stock market, the appeal of capital flowing back to China is greater. Cryptocurrencies could also be part of that. Whenever money moves from one place to another, the chances of cryptocurrencies being considered increase. It can be argued that in the case of China, this possibility is particularly strong.

As the market cap and attention for cryptocurrencies grow, the chances of capital moving into cryptocurrencies will only increase, not to mention the U.S. itself becoming more hostile to foreign holdings of the U.S. dollar. We have seen gold prices rise significantly in recent days, which is just the latest manifestation of a larger trend over the past two years.

Over the past few days, and especially over the weekend, some crypto market price action has been observed to occur outside of U.S. trading hours. Overall, while it is difficult to tell how much of this liquidity will flow into cryptocurrencies, increased currency liquidity bodes well for cryptocurrencies, and increased global liquidity is particularly beneficial to this asset class.

We have already seen Hong Kong attempt to gain a foothold in the crypto market, with many investors and builders based in the city. It remains to be seen whether China will announce changes to its mainland crypto stance, or continue to operate through special economic zones and special administrative regions. The Chinese population holds a lot of money, and the government wants them to be able to put it to use. Ideally, this should come in the form of spending, such as eating out at restaurants, buying products, etc., rather than buying cryptocurrencies, at least that's the general idea. It is estimated that Chinese households have savings of more than $18 trillion. If the easing measures include any clear relaxation allowing Chinese individuals to trade cryptocurrencies, this would be huge.

Currently, Bitcoin mining and crypto asset trading are prohibited, but China remains the second largest Bitcoin miner in the world. Owning crypto assets is still legal, but access to centralized and decentralized exchanges is prohibited.

in conclusion

Regardless of the legality of cryptocurrencies in mainland China, the fact that China, the world’s second-largest economy, is providing monetary stimulus and has fiscal stimulus yet to come is a positive sign for cryptocurrencies. The Chinese economy is already the largest in the world by a wide margin in terms of real GDP.

The purpose of measuring with real GDP is to eliminate the bias of strong currencies when assessing the value of the economy, so it is not particularly important when assessing cryptocurrencies and asset flows. Regardless, despite the size of the Chinese economy, especially in the crypto space, it remains poorly reported.

The impact of the global economy on crypto has become hard to ignore in recent years. A lot of this is due to poor communication, which has led to little discussion, especially given the poor performance of Chinese assets in recent years. A recent series of announcements from the People's Bank of China seems to have turned a lot of crypto attention to China, which had not been the case before. Fortunately, this is mostly good news for cryptocurrencies.