If you haven’t heard of $TAO by now , you’re missing out.

It dominated the AI discussion last year, then cooled, and is now heating up again.

Is this a fleeting moment, or is $TAO evolving into something bigger?

Here's what you need to know

$TAO has surged 10x since the subnet launch in October 2023 .

The index peaked in March 2024, but plunged 74% as the market turned to risk aversion.

After three retests, the support level stabilized around $220.

Now, with the increase in liquidity, $TAO could hit new highs.

What is Bittensor?

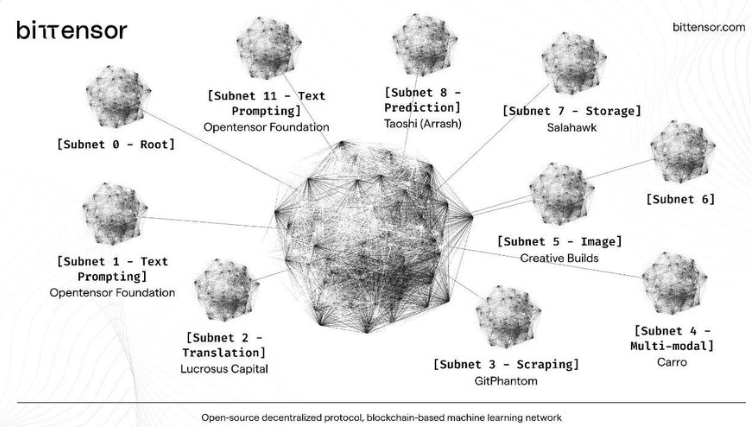

Bittensor is a decentralized marketplace for “incentivized intelligence”.

Its inspiring network attracts top talent and innovators.

Crypto-based rewards drive its growth in the subnet.

Professional skills market:

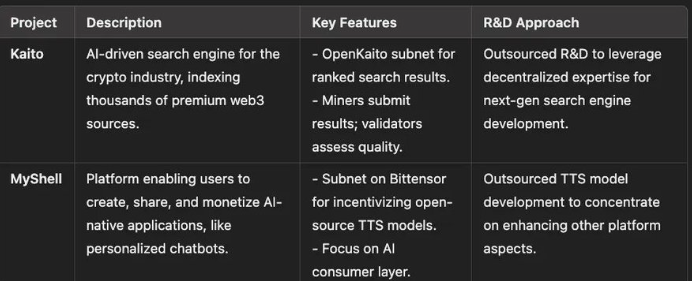

The crypto team uses Bittensor to outsource intelligence.

Its network of experts makes it easier to attract contributors.

Contributors will receive instant rewards in $TAO for their efforts .

Well-known projects such as KaitoAI and MyShell use Bittensor.

Vision:

As AI projects take off, incentivizing resources is critical.

Bittensor is a competitive incentive layer.

Subnet uses $TAO to leverage nodes and contributors.

This is similar to how dApps benefit from the security of Ethereum.

Ecosystem Overview:

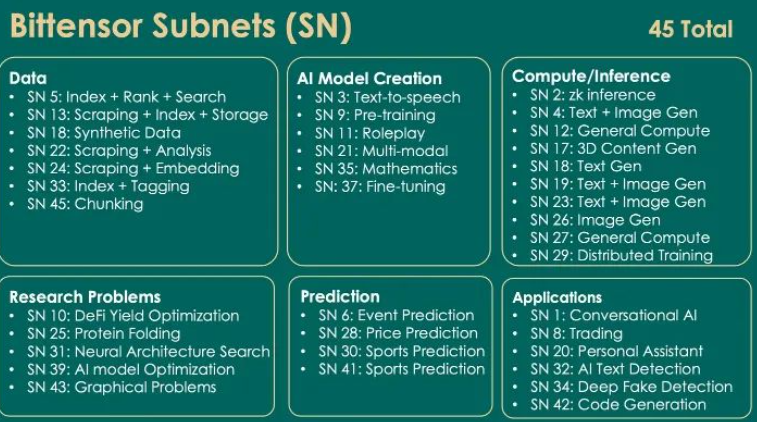

Bittensor hosts more than 45 subnets. Two key highlights include:

> ReadyAI outperforms both MTurk and GPT-4o by a wide margin.

> SocialTensor generates over 21 million images every day using AI.

Token Economics Overview:

$TAO was launched in 2021 with a token supply of 21 million.

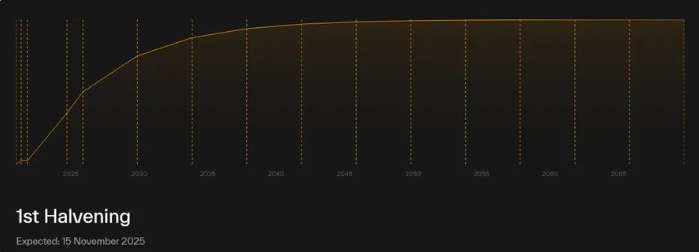

Like Bitcoin, it undergoes a halving cycle every four years.

The first halving is expected to occur in November 2025.

$TAO incentives, management and payment services.

Supply and demand dynamics:

Demand for $TAO is driven by both utility and speculation.

Each block creates 1 $TAO , which is shared by miners and validators.

More subnets = greater $TAO requirements.

Speculative interest still plays a major role in its price.

Competition Overview:

$TAO is the market leader in Web3 AI and by extension, Web2 as well.

It competes with projects such as Together AI in the Web2 space.

Unlike most Web3 AI projects, $TAO coordinates the entire stack.

Its integrated framework covers everything from data to models.

Key risks:

Bittensor’s daily inflation rate is approximately $3.2M USD or $1.2B per year.

This inflation adds significant selling pressure to the value of the token.

The subnet continues to grow, but faces challenges from horizontal competition.

Major trust assumptions must also be made about the verifier's knowledge.

Final Thoughts:

$TAO is the undisputed leader in the Web3 AI movement.

However, its current token flywheel has several key limitations.

Upcoming dTAO upgrades could better align incentives and foster growth.

(Not Financial Advice) The Crypto, Distilled team does not own $TAO or have any affiliation with Bittensor.