Author: Matthew Kimmell, CoinDesk; Translated by: Wuzhu, Jinse Finance

Over the years, Ethereum’s ability to host a wide range of applications and assets has become apparent, but the investment case for its native token, ETH, has become increasingly complex. With key protocol changes, especially the hard forks that activated EIP-1559 and EIP-4844, investors are beginning to wonder how Ethereum’s adoption will translate into the long-term value of ETH.

While the platform has scaled, the relationship between its growth and the supply and demand for ETH (and therefore its price) is no longer as simple as it once was.

The EIP-1559 Revolution: Linking Utility to Token Value

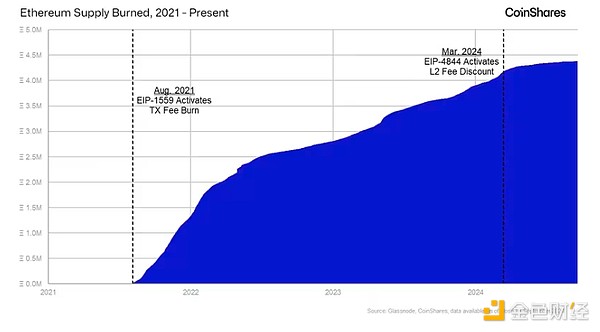

When Ethereum implemented EIP-1559 in 2021, it introduced a burn mechanism where the vast majority of transaction fees (base fees) would be permanently removed from circulation. This created a direct relationship between Ethereum usage and the supply of ETH. As users pay transaction fees on the Ethereum network, burns will act as a deflationary force, reducing the supply of ETH and putting upward pressure on its price.

In 2023, our valuation model at CoinShares shows that under the right conditions, with Ethereum generating $10 billion in L1 transaction fees per year, which is the peak it reaches in 2021, ETH’s value could reach nearly $8,000 by 2028.

However, since then, optimism has faded due to the Dencun hard fork and the rise of Layer-2 (L2), which upended fee burning and altered ETH’s value potential.

The rise of Layer 2: a double-edged sword

L2 platforms are designed to scale Ethereum by moving transactions from the main chain (L1) to a faster, cheaper network. Initially, L2 was a complement to L1, helping the network process more transactions without clogging up the base chain — like a pressure release valve to keep it balanced during times of high usage.

But with the introduction of “blob space” in 2024, L2 can now settle transactions on L1 at a much lower cost, reducing the requirement to pay expensive L1 fees. As more activity migrates to L2, the supply consumption that EIP-1559 was designed to instill begins to decline, weakening the downward pressure on ETH supply.

The reality of Ethereum generating high L1 fees to support the value of ETH now looks bleak. L1 transaction fees have been steadily declining, raising questions about how the services provided by each layer differ and what will drive the L1 fee landscape moving forward.

The way forward: Resume destruction or adapt to a new reality

Despite these challenges, there are potential pathways to reviving demand for L1 transactions, and by extension, ETH valuation.

One option is to develop high-value use cases that rely on the security and reliability of L1, but given current trends, this seems unlikely in the near future. Another possibility is that L2 adoption grows so rapidly that the sheer volume of transactions can make up for the discounted fees - but this would require extraordinary L2 growth beyond near-term expectations.

The most likely, and perhaps most controversial, solution is to reprice blob space to increase L2 settlement fees. While this would recover some of the L1 supply burn, it could disrupt the economics of L2, which is key to Ethereum’s recent success and enhances its ability as an ecosystem to compete with other platforms such as Solana, Binance Chain, etc.

ETH’s uncertain future

While L2s have expanded Ethereum, they have also disrupted the mechanisms that tie ETH’s value to its utility. For investors, this means that ETH’s future depends on how Ethereum balances innovation with maintaining healthy economic policies.

Currently, the investment case for ETH is unsettling, and the risks remain high as the Ethereum community decides its path forward.