Ripple’s native token XRP looks bearish and expected to fall in price as whales have moved millions of tokens to centralized exchanges. According to on-chain analytics firm CryptoQuant, XRP has been in consolidation mode for nearly three weeks, during which time whales moved 23.5 million tokens worth $13.63 million to exchanges.

Meanwhile, new insights have emerged in the wake of the ongoing legal battle between the United States Securities and Exchange Commission (SEC) and Ripple, highlighting the SEC’s rather surprising stance.

Speculation

According to a document shared by asset researcher Anderson in his XRP tweet, the SEC acknowledged that speculation is key to increasing XRP's utility and price. The document Anderson released comes from Ripple's lawsuit and includes an email from Ripple CEO Brad Garlinghouse. Garlinghouse sent it to board members on April 9, 2017. In the email, Garlinghouse noted that the surge in XRP market activity and price is a significant development for the company. The SEC took this into account, acknowledging that speculative trading brings liquidity to the XRP ecosystem, which is critical to Ripple's products. This shows that the SEC recognizes that buying and trading XRP is not just for trading purposes, but also for potential gains. While speculation is generally considered risky, it plays a key role in building the liquidity that Ripple needs to operate its payment solutions, such as its On-Demand Liquidity (ODL) product.

Community Response

Anderson's tweet sparked discussion in the XRP community. Some were surprised that the SEC would use this as an argument. Others saw it as a validation of XRP's future. Speculative trading is critical to XRP's liquidity. This could mean that the token's value is more resilient than previously thought. However, some members remain concerned about Ripple's upcoming RLUSD stablecoin. People wonder if it will eventually replace XRP in Ripple's payment system. But Ripple clarified this, saying that XRP still plays an important role in its cross-border payment system. The SEC emphasized that Garlinghouse's comments indicate that as long as speculation drives XRP prices to fluctuate significantly, the token will remain at the core of the Ripple ecosystem.

XRP Exchange Reserves Surge

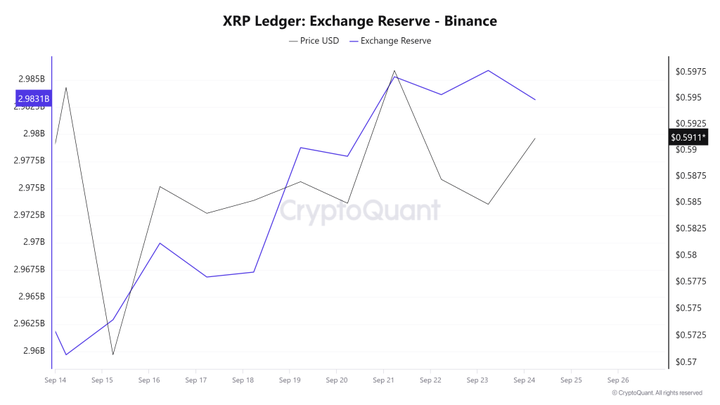

It appears that whales’ interest in XRP is fading, which could have a negative impact on its price. According to CryptoQuant, during XRP’s consolidation, reserves on exchanges have been increasing, which is a negative sign. When cryptocurrency giants or institutions move their holdings to exchanges, it is often considered a sign of potential selling.

At press time, XRP is trading near $0.585, with prices down more than 1% over the past 24 hours. During the same period, its trading volume has grown by 3%, indicating increased trader participation amid ongoing consolidation.

XRP Technical Analysis and Upcoming Levels

According to technical analysis from CoinPedia, XRP is in an uptrend as it is trading above the 200 exponential moving average (EMA) on the daily timeframe. The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or a downtrend.

Furthermore, XRP is in a consolidation zone between $0.56 and $0.598. A breakout of this zone from either side will give a clearer picture of whether it will rise or crash. Based on historical price momentum, if XRP breaks out of this zone and closes the daily chart above $0.60, there is a high chance of a 20% surge to $0.72. On the other hand, if it breaks out of this zone and closes the daily chart below $0.545, the price could plunge by more than 14%. Currently, XRP’s open interest remains stable with no significant changes in the past 24 hours, which suggests that traders are waiting for a breakout from the consolidation.

In simple terms

XRP whale transferred 23.5 million tokens worth $13.63 million to exchanges. At the same time, open interest remained stable and no major changes were observed, indicating that traders are waiting for a consolidation breakout. But it is worth noting that XRP exchange reserves have been rising continuously, which is a negative sign.