Author: CryptoVizArt, UkuriaOC, Glassnode; Translated by: Wuzhu, Jinse Finance

summary

After the Fed’s 0.50% rate cut, Bitcoin has reclaimed its short-term holders’ cost basis ($61,900) and 200DMA ($63,900).

After a period of net capital outflows, the pressure on short-term holders has eased slightly as prices have risen above their cost basis.

New investors showed a degree of resilience, with actual losses relatively small, suggesting they were confident in the overall upward trend.

The perpetual futures market showed a cautious recovery in sentiment, with demand gradually increasing, but still below levels seen during the strong bull market.

Shift in market gradient

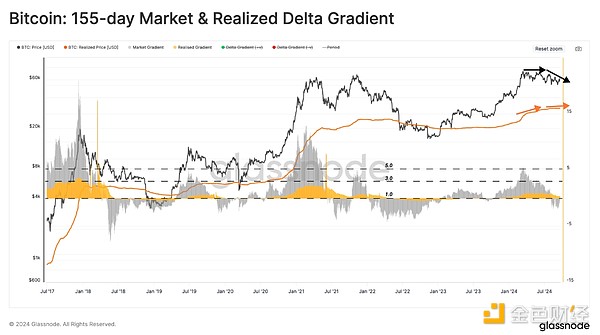

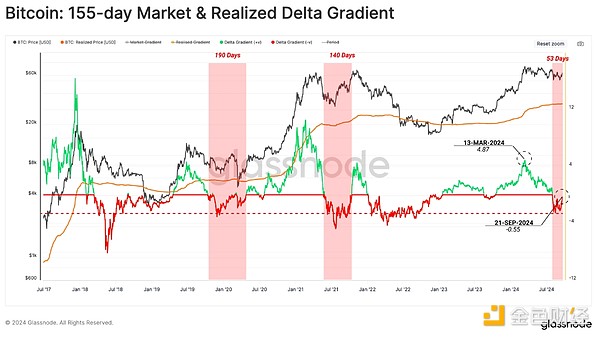

After the market reached its March ATH, capital inflows into the Bitcoin network slowed, causing price momentum to weaken. This can be confirmed by comparing the smoothed 155-day gradient of price (black) to the gradient of actual price (red).

In recent weeks, the market gradient has fallen to negative values, while the actual price gradient is positive but trending lower. This suggests that the decline in spot prices has been more severe than the intensity of capital outflows.

The graph below measures the z-scores of these two gradients. Negative values can be interpreted as periods of relatively weak demand, leading to a sustained contraction in prices.

Using this indicator, we can see that the current structure is very similar to the 2019-20 period, where the market experienced a long period of consolidation after a strong rebound in the second quarter of 2019.

New capital flows

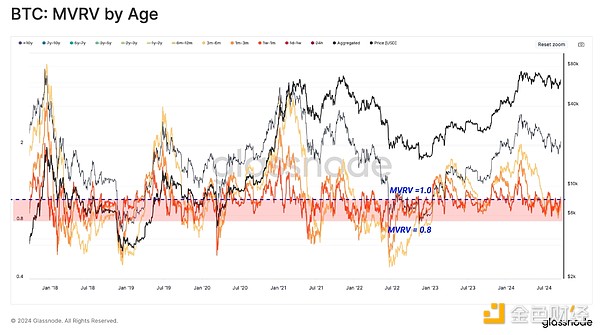

The current consolidation phase has pushed spot prices below cost basis (MVRV ratio <1) for several subgroups of short-term holders since late June 2024. This highlights how investors have been under financial pressure in the near term, suffering increasing unrealized losses.

However, while many new investors' holdings are in negative territory, the magnitude of their unrealized losses is significantly lower than during the mid-2021 sell-off and the March 2020 COVID crash.

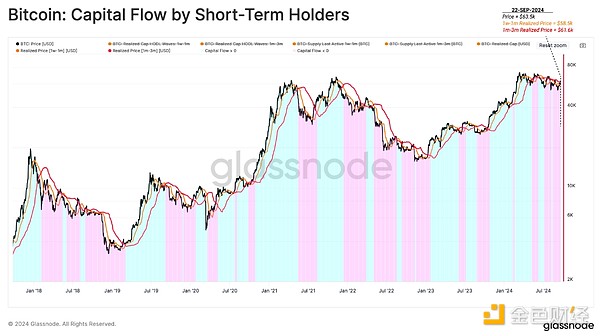

When the market enters a long-term contraction, diminishing returns prompt investors to cash out at lower prices to reduce losses. As a result, the cost basis of relatively young supply will be below the spot price. The repricing of short-term holder supply to lower prices can be described as a net capital outflow from the Bitcoin ecosystem.

To measure the direction and intensity of capital flows from the perspective of new investors, we constructed an indicator comparing the cost base of two subgroups (1w-1m as the fast trajectory and 1m-3m as the slow trajectory).

Capital Outflows (Blue) During a market downtrend, the cost basis of the youngest tokens (1w-1m in red) declines faster than the older coin age groups (1m-3m in red). This structure suggests that the overall direction of capital flows is negative, and the strength of this outflow is proportional to the deviation between these trajectories.

Capital Inflows (Blue) During a market uptrend, the cost basis of younger coins expands faster than the cost basis of older coin age groups. This suggests that the speed of capital inflows is proportional to the divergence between these trajectories.

The cost basis of newer tokens is currently lower than that of older tokens, indicating that the market is experiencing a net outflow mechanism. Using this indicator, a sustainable market reversal may be in the early stages of building positive momentum.

New investor confidence

As new investors hold more unrealized losses during market corrections, their tendency to capitulate at a loss also increases. Statistics show that short-term holders are more sensitive to volatility, making their behavior useful for tracking market turning points.

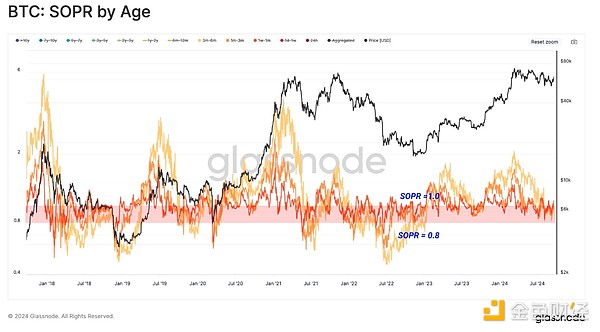

The SOPR metric by coin age shows nearly identical behavior when examined alongside MVRV by coin age. This confirms that new investors are both holding assets at a loss and experiencing enough stress to materialize those losses.

We can also assess how strongly short-term holders react to changes in market sentiment.

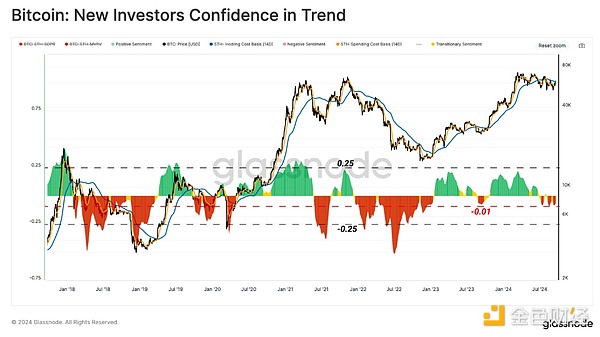

The difference between the cost basis of new investors who are spending (red) and the cost basis of all new investors (blue) reflects their overall confidence. When normalized by the spot price, this deviation allows us to highlight periods when new investors overreact to extremely high unrealized profits or losses.

In recent months, new investors who bought tokens in the past 155 days have shown higher market confidence than the previous "bearish trend". The losses locked in by this group are still relatively low compared to the cost basis of their holdings.

Long Perpetual Contract Premium

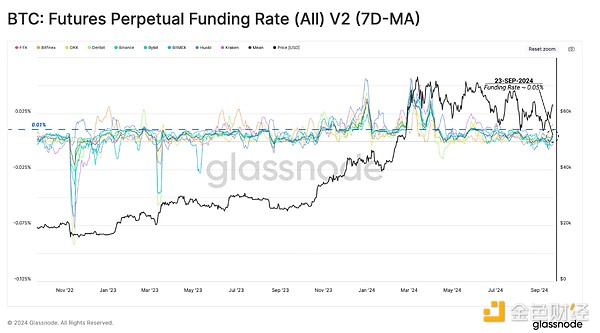

We can use the perpetual futures market to add another dimension to our investigation of new capital confidence in an uptrend. First, we use the futures perpetual funding rate (7D-MA) to show that speculators are willing to pay higher rates to take on leverage on long positions.

Considering that the funding rate value of 0.01% is the equilibrium value for many exchanges, we consider deviations above this level as a threshold for bullish sentiment. The recent price rebound has been accompanied by a relative increase in long-biased leverage in the perpetual contract market. This has pushed the weekly average funding rate up to 0.05%.

While this is above equilibrium levels, it does not yet indicate strong or excessive demand for long bias in the perpetual contract market.

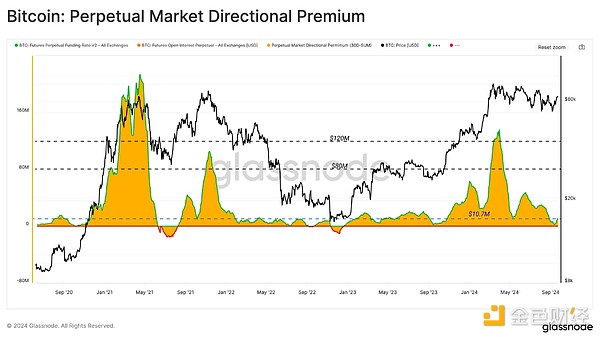

If we calculate the cumulative monthly premium paid by long contracts to shorts over the past 30 days, we can see that the total cost of leverage near the March ATH was approximately $120 million per month.

By mid-September, the metric had plummeted to $1.7 million per month and has only risen slightly to $10.8 million per month today. As a result, demand for long leverage has increased over the past two weeks, but remains well below levels seen in January 2023. This suggests that the market has cooled significantly during this correction.

Summarize

The Bitcoin market has been in a prolonged consolidation phase that is reminiscent of the period between late 2019 and early 2020. Since hitting an all-time high in March, capital inflows to the Bitcoin network have slowed, challenging profitability for short-term holders.

However, despite a period of partial net capital outflows, confidence in the market from new investors remains very strong. The long bias in the perpetual futures market has also seen a very modest uptick in recent weeks.

Overall, this paints a picture of a market cooling down from the excessive volatility of March, while not breaking the mood of many new Bitcoin investors.