TAO’s price has increased significantly over the past month, driven by growing interest in artificial intelligence coins. With a recent increase of over 60%, many indicators and statistics provide insight into the coin’s future performance potential.

While the current EMA configuration shows strong bullish momentum, distribution pressure on TAO remains an issue that could affect the ability to sustain the uptrend.

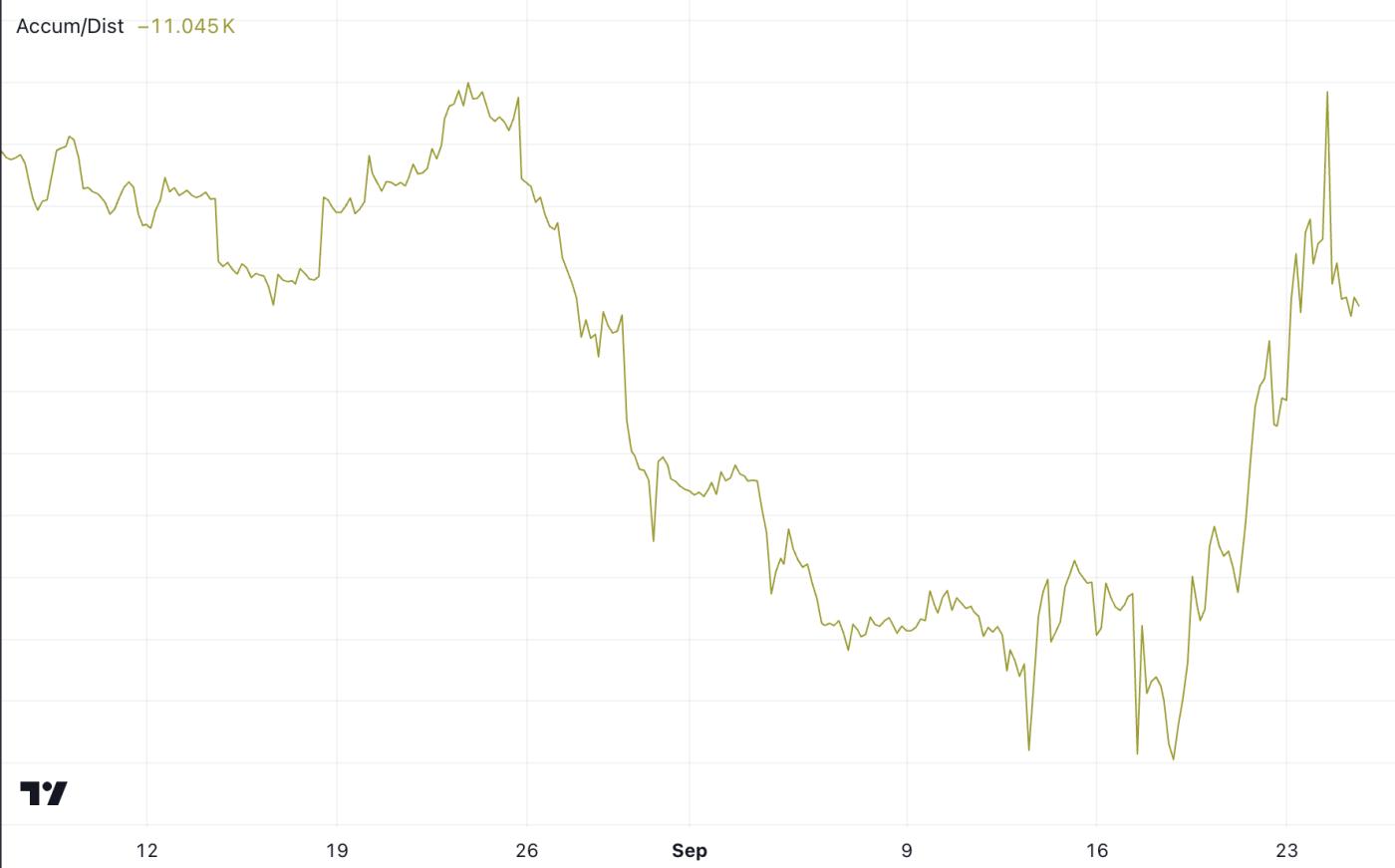

TAO's Accumulation/Distribution value is currently negative, but not too bad

The Accumulation/Distribution (A/D) value for Bittensor (TAO) is around -11.045, indicating heavy selling pressure recently. This negative value suggests that more traders have been selling TAO than accumulating it. This could lead to a bearish outlook for TAO price in the short term.

The A/D indicator is important in understanding this market behavior. It combines both price action and volume to provide a clearer picture of whether an asset is accumulating (more buying) or distributing (more selling). With this strong distribution pressure, prices may struggle to establish a sustained uptrend unless there is a change in market sentiment.

TAO Accumulation/Distribution. Source: TradingView .

TAO Accumulation/Distribution. Source: TradingView .If the A/D line begins to stabilize or turn up, it could indicate renewed interest and accumulation, potentially reversing the decline. Since TAO has increased by more than 60% over the past month, this could lead to strong selling pressure in the short term.

However, the Accumulation/Distribution indicator at -11,000 may not be strong enough to initiate a bearish trend for TAO. It is important to keep an eye on this indicator. If it continues to decline, it could change the sentiment on the coin.

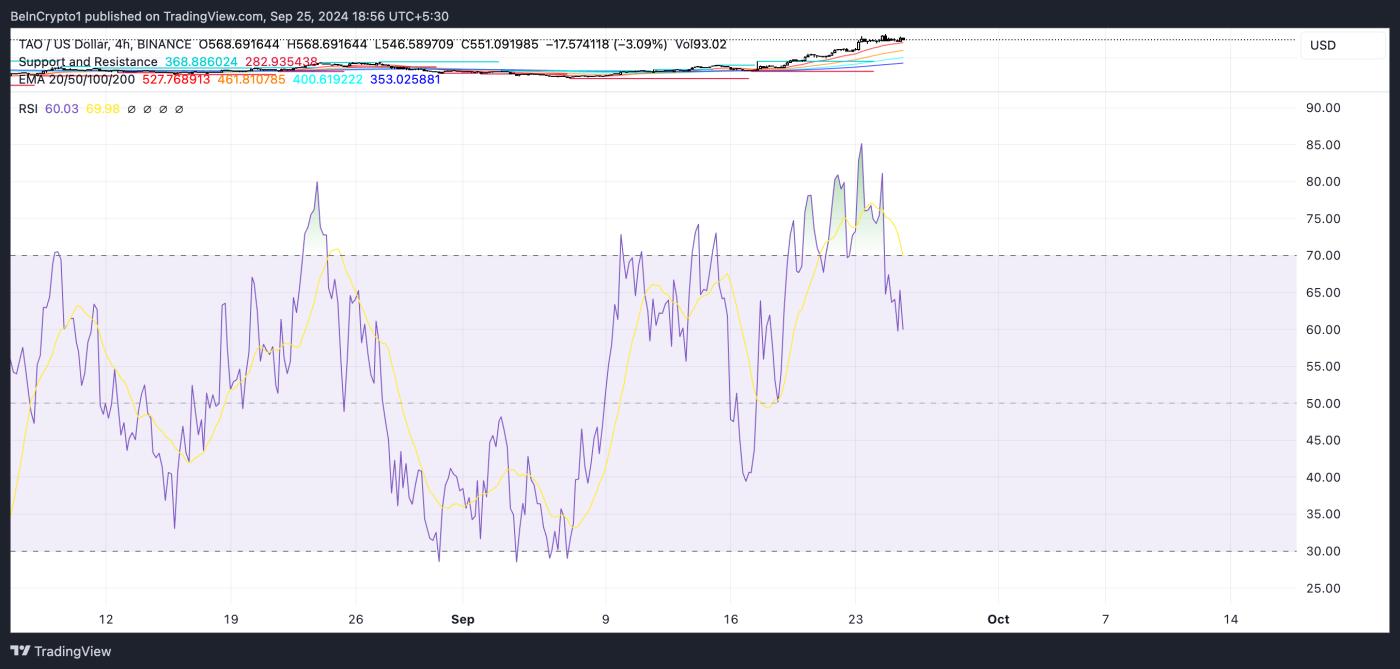

TAO RSI remains stable for further growth

Bittensor’s Relative Strength Index ( RSI ) is currently at 60. This is notable because it reflects a significant shift in momentum since September 16, when the RSI was at 39. This increase suggests that buying interest has increased over this period, suggesting stronger bullish sentiment for TAO. An RSI in this range suggests that the market is strengthening but not yet overbought, making it a potential indicator of near-term upside if momentum continues.

TAO RSI. Source: TradingView .

TAO RSI. Source: TradingView .RSI is a popular momentum oscillator used to measure the speed and change of price movements. It ranges from 0 to 100, with thresholds typically set at 30 and 70. An RSI below 30 suggests that the asset may be oversold, presenting a buying opportunity, while an RSI above 70 suggests that the asset may be overbought, indicating a possible correction or pullback. With TAO’s current RSI at 60, the Token is in a neutral to slightly bullish range. This could indicate that TAO still has room to grow before reaching overbought levels.

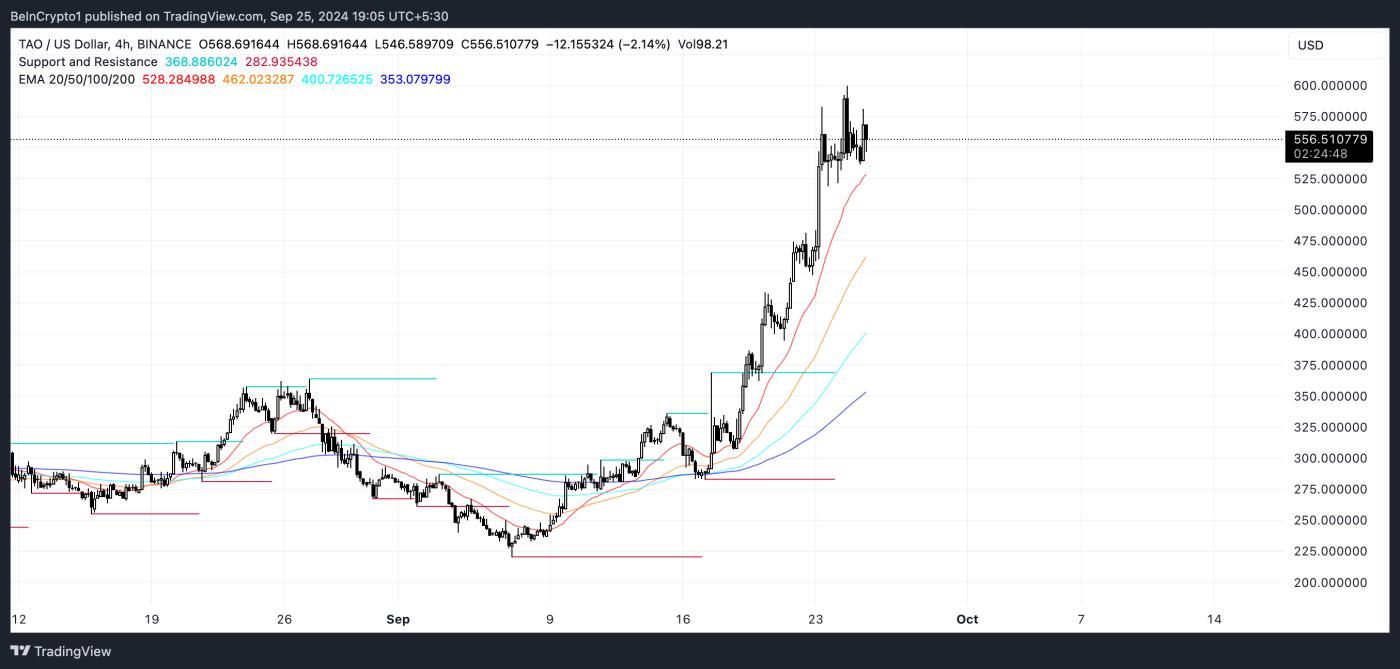

TAO Price Prediction : Can It Hit $700 by October?

TAO is currently showing an extremely bullish configuration, as its Exponential Moving Averages (EMAs) are widening. This gap shows that the short-term EMAs are significantly higher than the long-term EMAs, indicating a strong uptrend. The widening gap between these EMAs reflects a continued price increase and increasing momentum.

EMAs are technical indicators that give more weight to recent prices, making them sensitive to market activity. When prices are above the EMAs, and the short-term EMAs are placed above the long-term EMAs, it confirms a strong uptrend.

TAO EMA and Support/Resistance. Source: TradingView .

TAO EMA and Support/Resistance. Source: TradingView .If TAO can sustain this momentum, supported by growing interest in AI coins, it could potentially surpass $600 for the first time since April 2024. Breaking the key resistance level of $625 could push the price higher, possibly reaching $700 — a 26.81% increase from its current value.

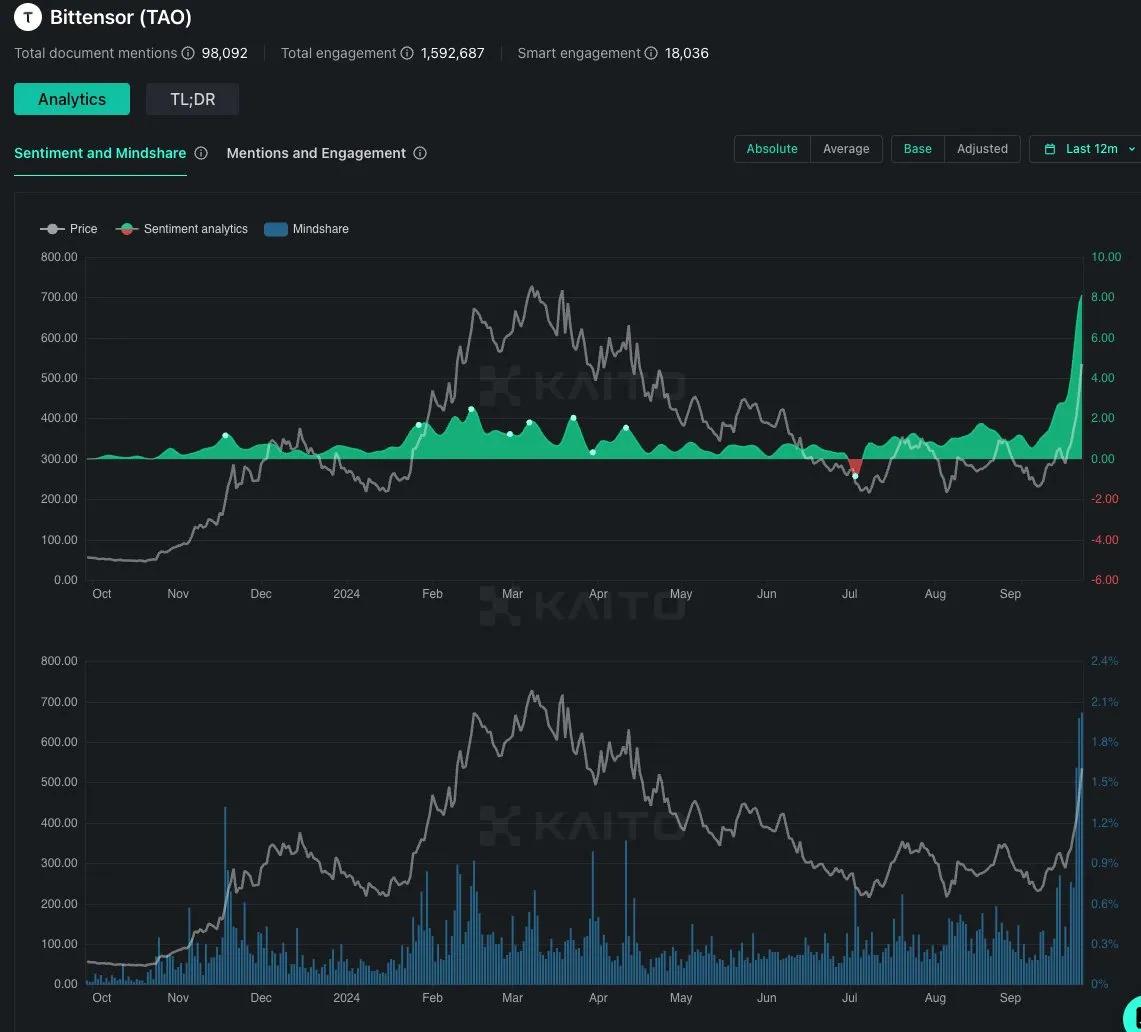

On the other hand, interest and sentiment towards Bittensor recently hit an All-Time-High, which could contribute to a new bull run.

Emotions and concerns towards TAO. Source: Kaito .

Emotions and concerns towards TAO. Source: Kaito .However, if TAO fails to sustain this bullish momentum, there are risks to XEM . If the Accumulation/Distribution value turns increasingly negative, indicating stronger selling pressure, and if the RSI moves into overbought territory (above 70), the price could fall significantly. In that case, TAO could fall as low as $284 in the coming weeks.

Join the BeInCrypto Community on Telegram to learn about technical analysis , discuss cryptocurrencies, and get answers to all your questions from our experts and professional traders.