Author: @long_solitude

TechFlow by: TechFlow

The entrepreneurialization of cryptocurrencies has been going on since 2016-2017. With each cycle, cryptocurrencies gain more visibility, more people enter the space, and the potential rewards diminish. By now, everyone has heard of cryptocurrencies.

Like any emerging industry, the most promising ideas do not require huge amounts of capital. But after the initial excitement and amazing returns, the availability of capital increases and the barriers to investment in ideas decrease. As long as capital flows, everyone can become a founder.

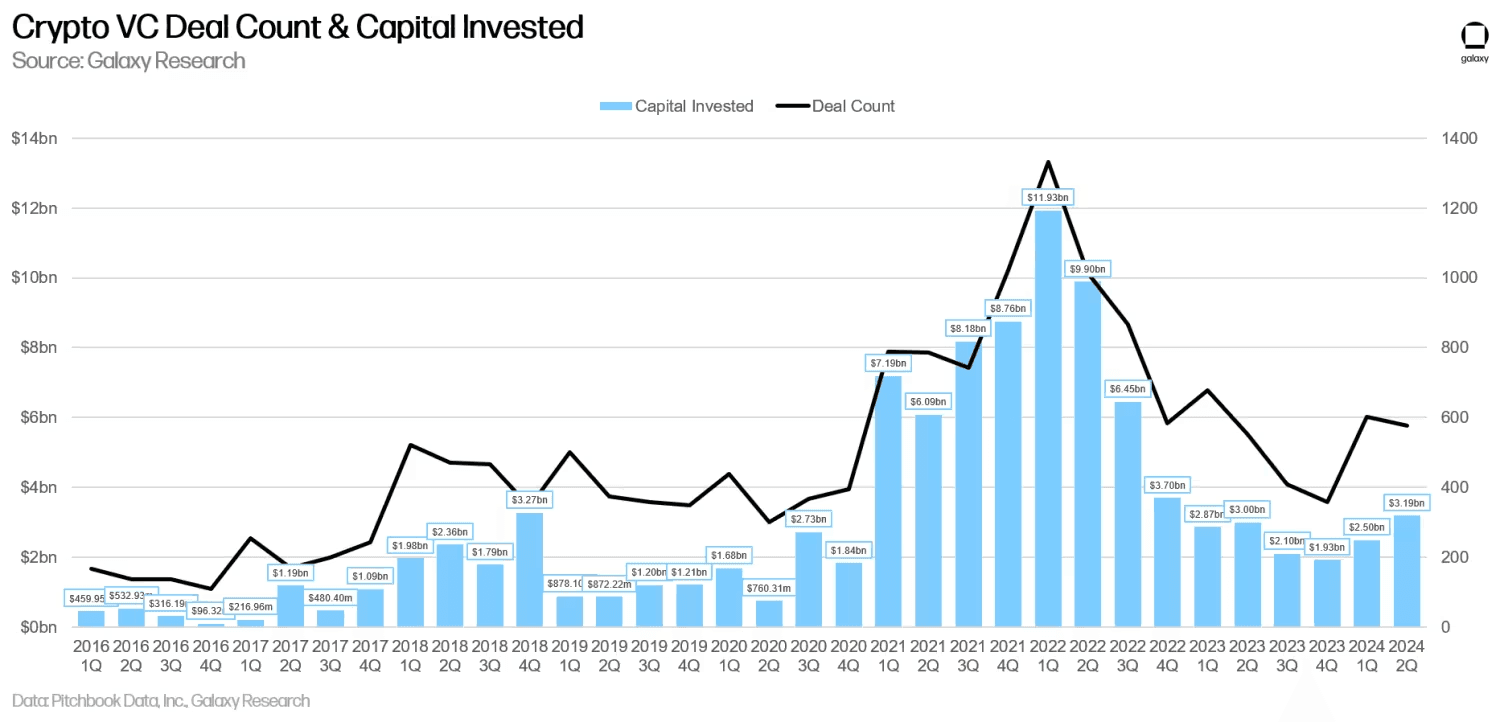

With $100 billion of venture capital pumped into private crypto markets since 2016, founders have used tokens to enter nearly every industry possible. As Abraham Maslow said, “If your only tool is a hammer, you tend to see every problem as a nail.” That torch has now been passed to AI.

From finance and payments to identity, social networking, media and entertainment, gaming, cloud computing, artificial intelligence, healthcare and science, supply chain, storage, gambling, art, all types of physical infrastructure networks, and even satellites in space — cryptocurrencies have spread across every sector. No sector has been neglected.

Today, the circulating market capitalization of Altcoin other than Bitcoin (BTC) and Ethereum (ETH) is $700 billion, and Coinbase’s stock market capitalization is $40 billion. For simplicity, assume that investors own 30% of the network and ignore any unvested tokens; in the case of Coinbase, investors own about 50% of the shares at the time of its direct listing.

This means there is about $230 billion in liquid value available to venture capital (VC) investors. Of course, this is not completely accurate because we do not take into account all public companies, companies that have not yet issued tokens, or investors selling at different points in different cycles.

But the reality is that most of the $230 billion (for $100 billion in investment) was driven by a few outliers like Solana and Coinbase, ICOs, and meme tokens that VCs didn’t have exclusive allocations to. Do the math yourself and see that outliers in crypto are just as important, if not more so, than they are elsewhere.

Unique properties of cryptocurrencies

It should be clear by now that cryptocurrencies are not a panacea for all global problems. Distributed systems, as we call them, have some very unique properties that have remained largely unchanged since the invention of Ethereum.

The foundation of blockchain is a strong financial element to ensure network security, so it should come as no surprise that sustainable use cases must also move in this direction. This is why certain categories of projects produce lasting winners while others do not.

From 2017 to 2018, billions of dollars flowed into crypto products, including financial and consumer products, and the only products that survived were financial in nature.

The main trend now has returned to the consumer and social fields, but the surviving products are still limited to the financial category.

The less appealing truth, lost in the nothingness of CT

What are these unique properties? While this list is not exhaustive, we think the main ones are:

Permissionless capital formation and, by extension, token distribution;

Global consensus on a distributed ledger of financial assets.

Permissionless capital formation is the most important and universally applicable product market fit ( PMF ) for crypto. It’s why ICOs are generally successful. It’s why pump.fun brought a bull run to the entire Solana ecosystem and made more money in 8 months than 99% of all crypto projects combined. It’s why crypto capital is funding cyber states and longevity experiments. The creative space is unlimited and all assets that receive funding will be stored on-chain, ensuring provenance to their owners.

Global consensus and distributed ledgers make open and permissionless finance possible. Founders have built all the financial components in decentralized finance (DeFi) - lending, savings, trading, payments/stablecoins, and debit cards for spending. From Blackstone, major banks to VISA and Mastercard, they are all paying attention to the characteristics of cryptocurrencies and DeFi and looking for ways to integrate them into their own businesses. Maybe one day, bureaucracy can be outsourced to global consensus on a large scale.

So when we see founders complaining about the Ethereum Foundation’s adversarial stance toward decentralized finance (DeFi), we can’t help but question whether it’s ready to give up on the second-best product-market fit (PMF) crypto has found to date, second only to Bitcoin’s store of value.

If the only thing that has supported your chain for the past five years is DeFi, and the best you can do is barely tolerate it, then you are anti-DeFi. I'm sorry, but the default position should be to absolutely support and encourage it.

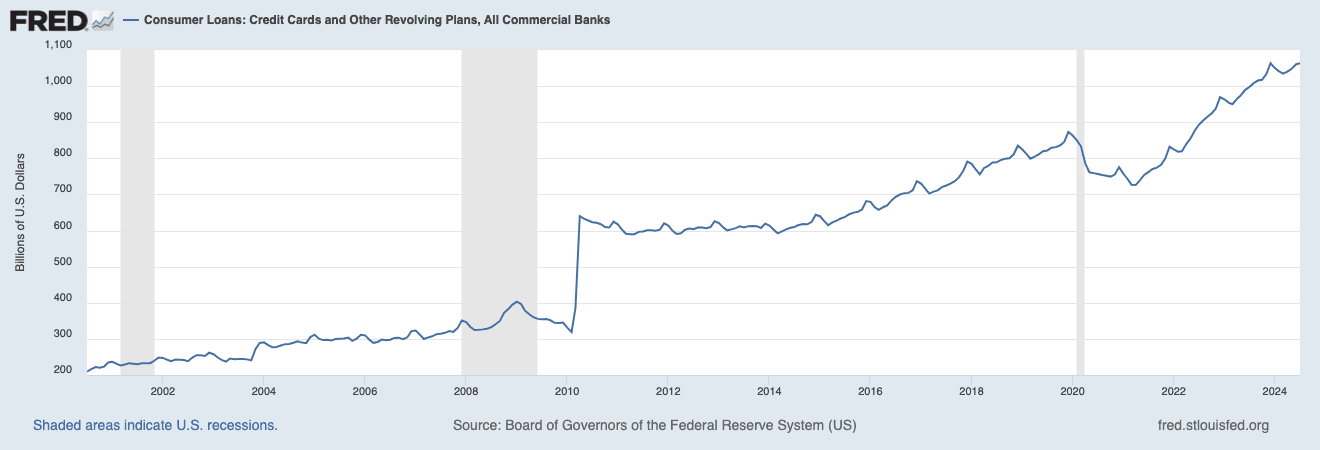

While Vitalik would argue that Decentralized Finance (DeFi) is Ouroboros , a snake figure that eats its own tail, we believe the opposite is true. DeFi may be the only positive-sum crypto category! It creates new capital markets and enables people to get credit and spend. Credit expansion is the fundamental force that creates consumption and investment. It’s why the US went off the gold standard and the US market didn’t collapse, but instead surged for decades. The key to an economy is to keep it circular so that growth can occur. Why can’t DeFi be circular?

Which projects have most successfully exploited the unique properties of cryptocurrencies since the market bottom in November 2022? Unsurprisingly, they all focus on decentralized finance (DeFi) or capital formation:

Solana ’s price has increased 15x, and it has always prioritized DeFi. In fact, it was envisioned as the “decentralized Nasdaq” from the beginning.

Pump.fun has earned over $100 million in fees for itself and generated nearly $1 billion in revenue for the ecosystem as it enables barrier-free capital formation for speculative assets;

Ethena expands basic transaction size to billions of dollars;

Polymarket provides people with a new speculative market;

Additionally, we have many centralized finance (CeFi) businesses, such as Tether and Coinbase , that provide financial services and have significantly increased their market share.

One of the most notable narratives this year has been the shift toward consumer-facing cryptocurrencies. We can roughly divide this into ultra-speculative plays (like Bonding Curve, Casino, Memes) and digital ownership-oriented products (like Farcaster, Zora, etc.).

We first wrote about the need for consumer applications in The Fappening at the end of 2022, when we felt the market had become too focused on infrastructure. Now, it seems like all the attention is on building consumer applications for cryptocurrencies, but often without questioning the unique capabilities that the application can enable.

Are mini-games on TON more enabling and enduring than boring borderless crypto payments? Probably not. It’s not that mini-games don’t have a role, but they don’t take full advantage of the unique properties of cryptocurrencies, as high integrity of financial data isn’t necessary for these games. The distribution of tokens, the fundamental principle of crypto capital formation, is what makes them interesting in the first place.

Cryptocurrency creates new markets

Now that we’ve established that cryptocurrencies excel at capital formation and facilitating financial transactions, where does this take us? New markets.

Although Florence had no access to the sea compared to Genoa and Venice, it became a trading superpower in medieval Europe, largely due to its innovations in banking and financial instruments. The gold florin minted in Florence quickly became the dominant trade currency in the Western world.

The superpower of cryptocurrencies has always been to find prices for assets that would otherwise be unpriced. In other words, to create markets where there were none; or, at least, to significantly improve the trading experience by providing abundant liquidity where liquidity is lacking. Cryptocurrencies are a coordination tool that enables transactions in opaque and emerging areas that require a high degree of specialization and are plagued by bureaucracy and multiple layers of intermediaries.

Here are a few examples: Kettle is building a marketplace for tokenized watches, and the Kettle team is busy in NYC’s Diamond District, handling the authentication, safekeeping, and logistics of watches. Baxus solves a similar problem for collectible wine, and their team handles authentication and operates a central vault that controls humidity, temperature, etc. Eventually, they will all have the potential to replace Sotheby’s. There is a lot of highly specialized work going on in the physical world, and the crypto element (coordination of payments) makes it possible to solve the cold start problem earlier. We will see the physical world and the crypto space feed off each other’s progress.

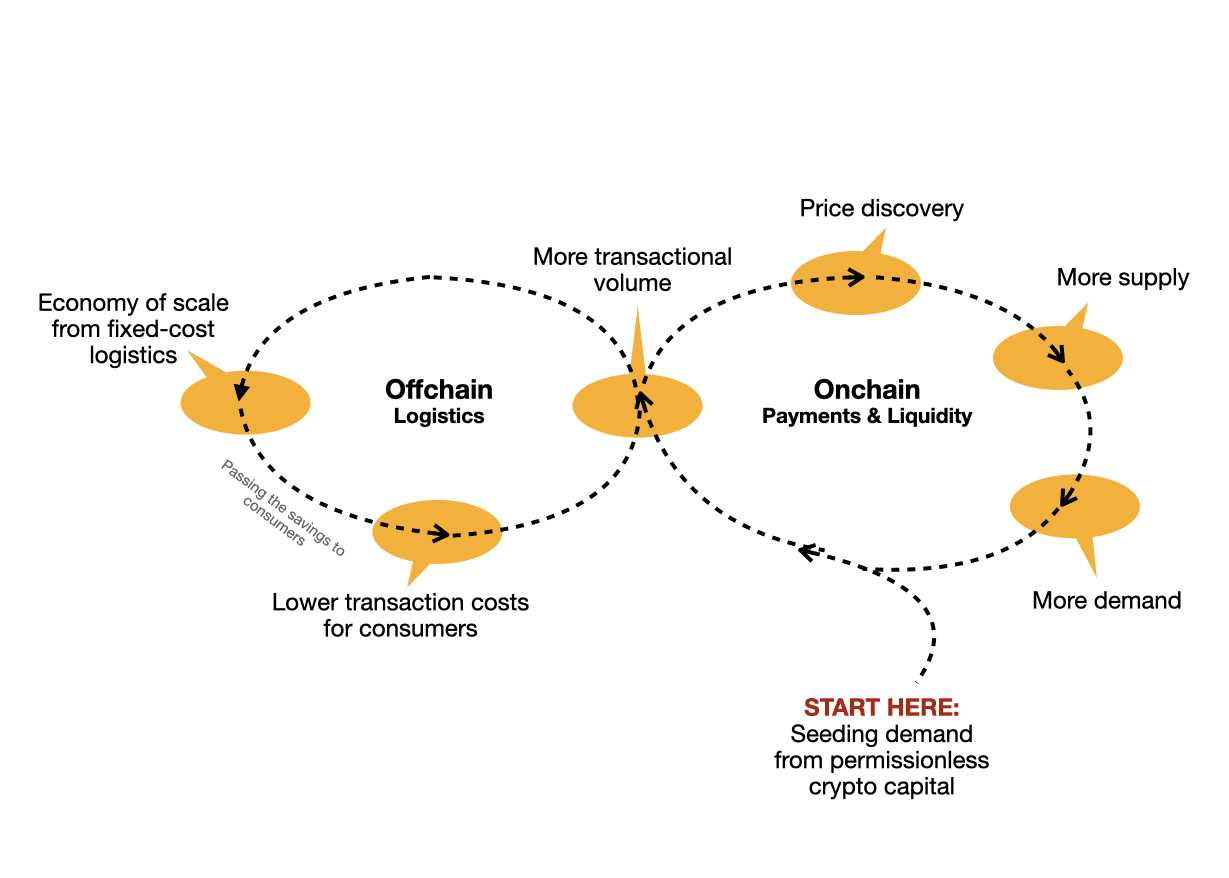

The on-chain and off-chain components complement each other as they both benefit from higher transaction volumes.

Cryptocurrency has the power to draw attention to things they didn’t know existed before. Uniswap drew attention to ERC20 tokens, and Opensea drew attention to NFTs.

One new use case we like is SkyTrade , which allows landowners to sell or lease airspace rights above their property. These airspace rights are tokenized as NFTs and then auctioned off to real estate developers and drone delivery companies like Walmart, Amazon, or other specialized air delivery companies in the future. Most real estate owners have no idea that a) they own airspace, and b) that airspace has value to someone. Crypto, as the hottest form of money, could soon prove this.

DePIN Market

Another market area with strong transactional characteristics is DePIN, or decentralized physical infrastructure. The supply side often leverages latent or idle physical hardware, so this is the easier part of the two-sided market to start. The existence of the demand side is unproven - we can only speculate its existence based on the demand for similar centralized services.

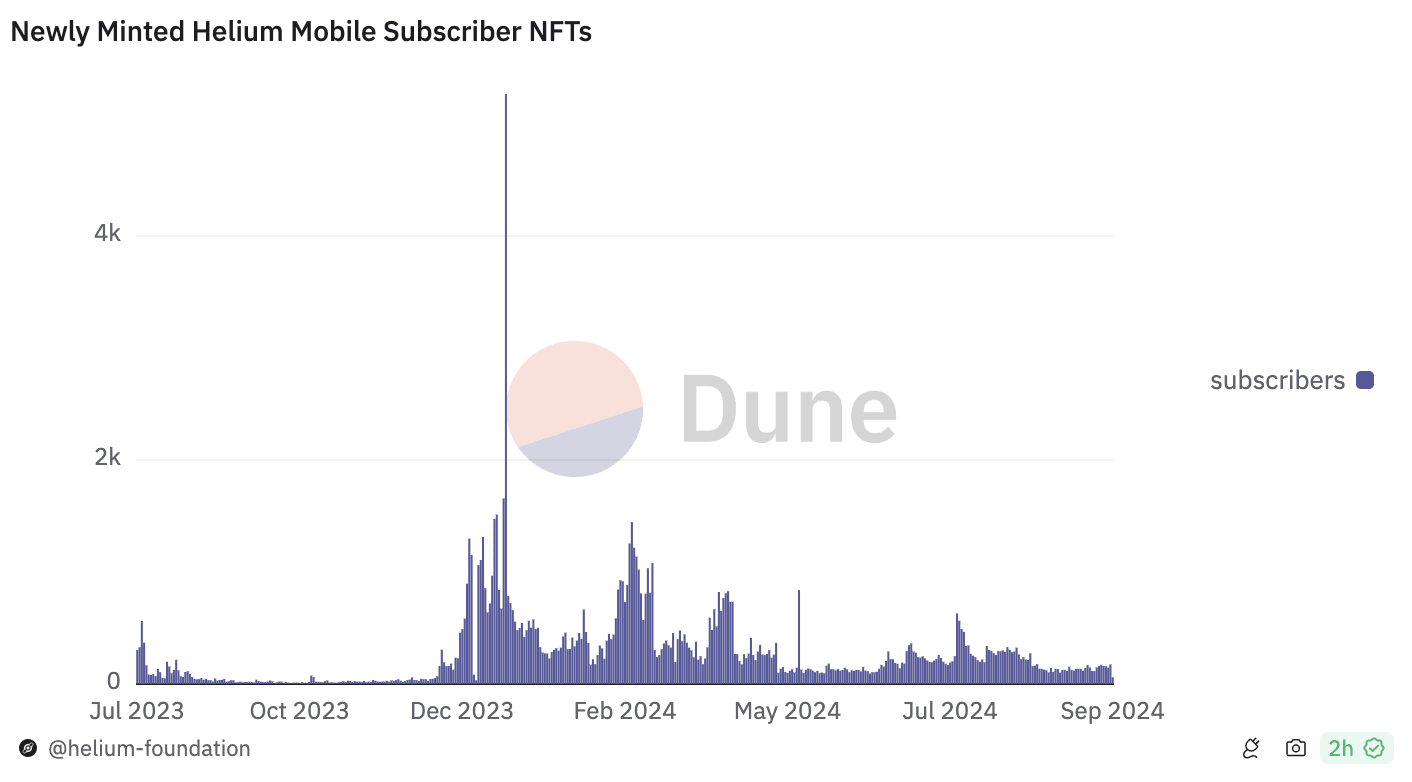

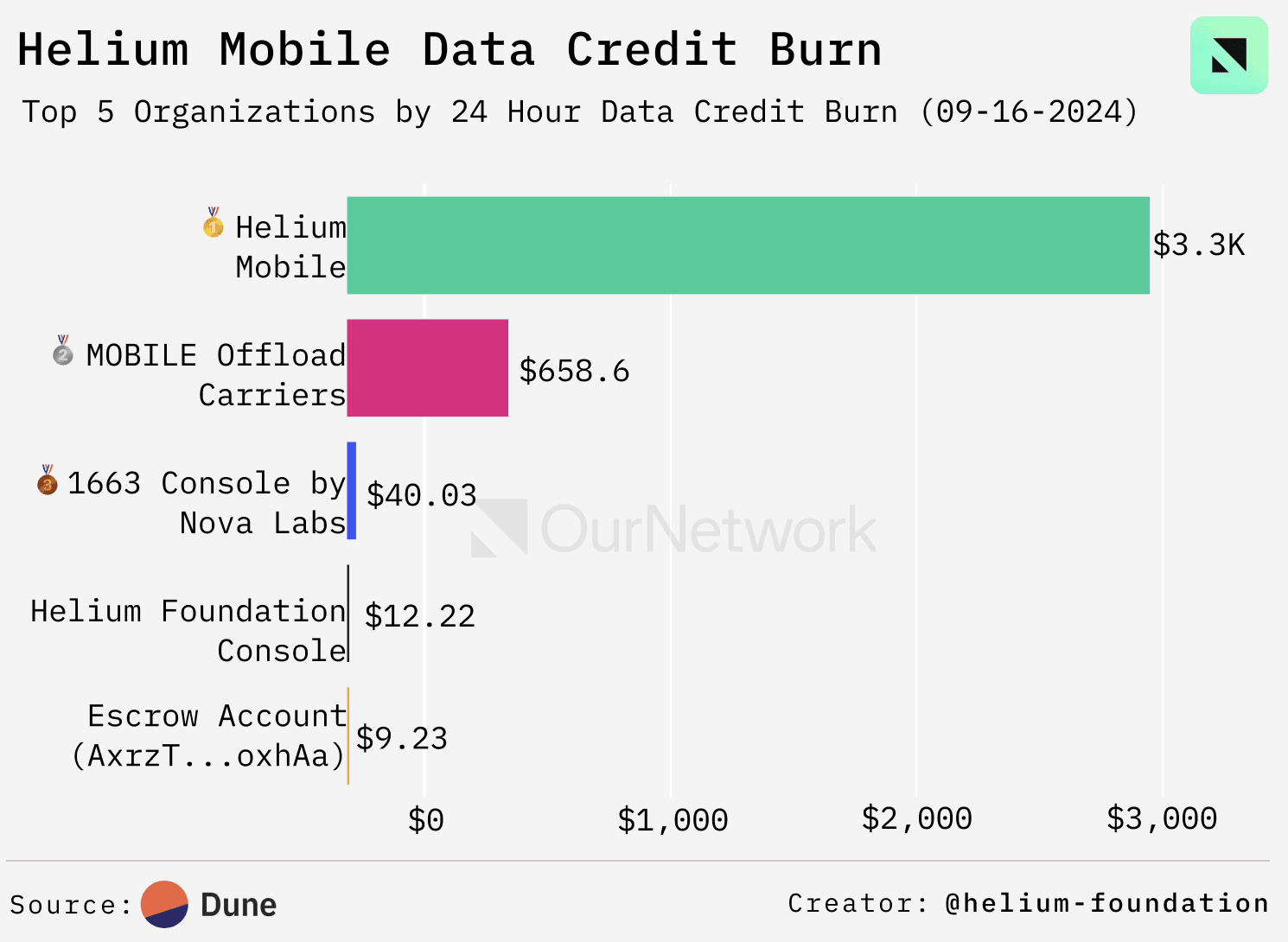

Essentially, DePIN is a marketplace for trading services. Unfortunately, we don’t have enough demand and transaction value to prove that it has found product-market fit (PMF).

Source: Dune and Helium Foundation

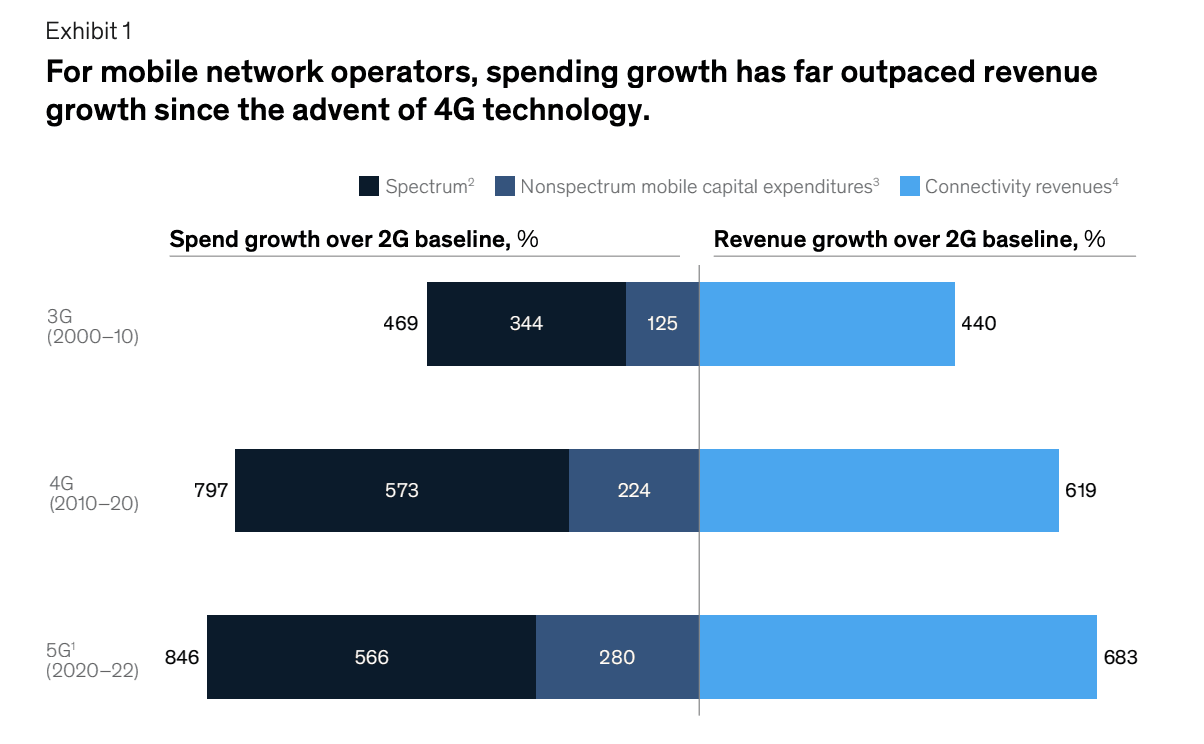

One of DePIN’s main value propositions is to move infrastructure investment and maintenance to decentralized networks. The cost of doing this for centralized entities is rising, with capital expenditures (capex) growing faster than revenues. Higher expenditures mean consumers have to pay more for services. And the better the network coverage, the more expenditure is required, because in rural areas, the cost of the last mile increases exponentially. Without price discrimination, someone will end up subsidizing the service.

Source: "DePIN's Imperfect Current Situation and Bright Future: In-depth Analysis of Compound "

Another factor is the resilience of the network, with the U.S. electric grid being a good example. Consider that even the electric grid is not a single, monolithic network, with no single company responsible for its maintenance. Instead, it is made up of many different utilities (both privately and municipally owned) and overseen by federal and state regulators. The grid is already fragmented, precisely for reasons of resilience. And it can be further fragmented, as long as it achieves affordability and resilience goals while earning the required cost of capital for the companies that invest in and operate this infrastructure.

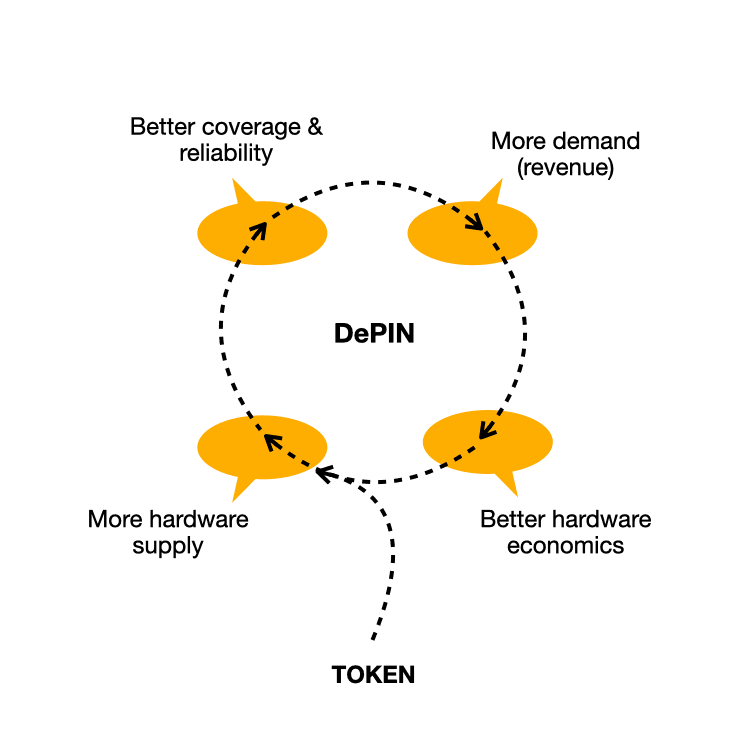

Why is DePIN effective in overcoming the upfront investment costs of hardware? Because capital formation enables projects to quickly deploy and distribute tokens to hardware operators.

Granted, a token alone is not enough. But it should be enough to get 100 users on the supply side who actually care about it to see if the demand side and revenue exists. If it does, as demand and network coverage increase, unit economics will improve and reliance on token incentives will decrease. Ultimately, all sustainable crypto markets will compete on a) price, and b) reliability and/or customer service, with revenue being the single most important metric.

Once again, the role of cryptocurrency is to help the market, and by extension DePIN, reach the critical mass of rapid development as early as possible, through the coordination of resources and payments.

Create markets where people want to trade

After multiple cycles of crypto investing, we have come to realize that ideation in the crypto space is limited by the unique properties that crypto has to offer, which we discussed above.

The permissionless nature of crypto capital is both a blessing and a curse. The design space for crypto startups seems limitless until you realize that those ideas must contain a strong and explicit financial element.

We think the answer is pretty clear - find assets and markets that people want to trade before they know it. These ideas always sound controversial - whether it was Helium last cycle (and Uniswap before that), or SkyTrade today. But that's the sign you know you're exploring something worth paying attention to.

Sadly, not all asset types will be traded. We have seen time and again that users do not value their data, privacy, or in-game swords. Markets associated with “ownership” and equal compensation schemes for content creators have not panned out. In crypto, enough time has passed where some sectors have proven ineffective while great businesses have been built in others. In each cycle, the explicit financial elements have proven to be stronger than ever.

Crypto does not solve economically irrational ideas; instead, it further reinforces the characteristics of capitalism as we already know it. More money, more transactions, higher returns, and faster speeds. Crypto is pushing us down a path we have known and traveled since capitalism began to take shape in the late Middle Ages.

Create new markets, find new assets, and your applications will thrive on blockchain networks with guaranteed economic security. This is the most optimistic future for crypto.