Ethereum is struggling to stabilize around $3,000, while altcoins are being held back by weak institutional inflows and declining investor confidence.

However, October is expected to bring about a major shift in sentiment and price action if institutions cooperate.

Ethereum may not rise above $3,000

The bullish outlook for Ethereum is heavily institutional, and weak inflows into spot ETH ETFs are a major concern for altcoins. However, this is expected to change in the coming months.

In an interview with BeInCrypto, Matt Mena, cryptocurrency research strategist at 21.co, discussed the reasons for the poor inflows.

“The recent lack of institutional demand for Ethereum can be traced back to the unfortunate timing of the ETH ETF launch. The ETF faced several unfavorable factors during the summer, which was a period of low activity in both traditional and crypto markets. This was further exacerbated by the launch just two weeks before a significant macroeconomic event, the Japanese Yen Unwind Trade, which created a significant headwind for risky assets, including crypto,” Mena told BeInCrypto.

However, Ethereum’s $3,000 milestone also depends on many external factors. Alvin Kan, COO of Bitget Wallet, discussed these factors with BeInCrypto:

“What could cause ETH to go back to $3,000? First, technological innovation – AI, payments and re-staking projects could be deployed on Ethereum, attracting new users and utilities. Second, improved macro liquidity – after the Fed rate cut, we are seeing more dovish signals. If the Fed lowers rates closer to Ethereum’s staking yield (around 3.5%), ETH could regain its appeal as a yield-generating asset, attracting more capital,” Kan told BeInCrypto.

Read more: How to invest in Ethereum ETFs?

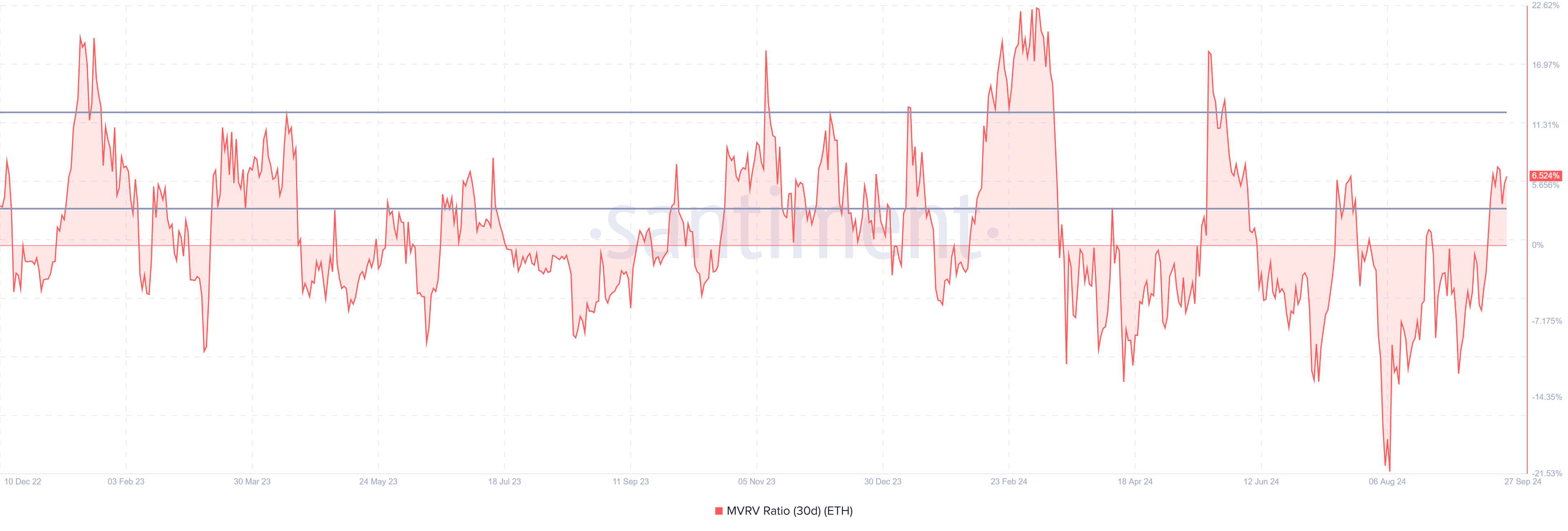

Meanwhile, bearish signals from investors are also gradually appearing. Ethereum’s 30-day MVRV ratio is currently at 6.5%, which is in the danger zone. The MVRV ratio is a key indicator of profit and loss, and when it is between 3% and 12%, investors tend to sell their holdings to realize profits.

This action could increase the risk of a sell-induced correction, putting pressure on the price of Ethereum.

The high MVRV ratio suggests that Ethereum investors may start cashing out their profits as market sentiment remains fragile. This selling pressure could prevent Ethereum from making a solid move above $3,000 unless bullish momentum picks up.

ETH Price Prediction: Wait and Watch

Ethereum is currently trading at $2642 and could be breaking out of the downward channel pattern that has been forming for the past two months. This pattern would lead to a 23% rally, with a target of $3258, which is a highly anticipated level among investors.

However, this uptrend is largely dependent on improved institutional inflows. Even if Ethereum fails to achieve the 23% gain, continued investor bullishness and favorable macroeconomic conditions could allow ETH to break above the $2930 resistance and break above $3000.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Meanwhile, if the breakout fails, Ethereum could be stuck within the channel, which could potentially lead to a test of the lower trendline around the $2170 support level. This could invalidate the bullish outlook and delay any significant upside moves in the altcoin.