Written by: flowie, ChainCatcher

After four months in prison, CZ is expected to return in a few hours. This Chinese entrepreneur has officially passed the first inevitable "calamity" in the process of leading Binance to become a global great enterprise.

Looking back at November 22 last year, a day that went down in history, the crypto market was plunged into turmoil after CZ pleaded guilty, resigned as CEO of Binance, and accepted a sky-high fine of over 4 billion.

But with CZ and Binance admitting their penalties, the era of cryptocurrencies as a hooligan has officially ended. Soon after, the US Bitcoin spot ETF and Ethereum ETF were approved one after another. Cryptocurrency upstarts used their money power to compete for the right to speak in the US election, and cryptocurrencies are no longer a niche.

The nearly one year since CZ retired was also a critical period for Binance and the entire crypto market to move from grassroots to strong compliance, and from niche to mainstream.

Under the leadership of He Yi and new CEO Richard Teng, Binance's business has developed steadily. In September, Binance's historical trading volume exceeded the 100 trillion US dollar mark for the first time.

But everything did not go smoothly as expected. Faced with the ever-changing crypto market, Binance was inevitably confused in its strategy and was embroiled in huge controversy over its coin listing strategy.

The fate of Binance is a microcosm of the crypto industry. As the old and new crypto cycles alternate, hope and confusion are intertwined.

Although the massive capital injection from Wall Street has allowed Bitcoin to break through $70,000, crypto innovation seems to have failed to keep up with the pace, and all participants, including project owners, VCs, and retail investors, have not been able to enjoy the wealth they enjoyed in the previous bull market cycle. This round of crypto bull market has therefore been criticized as a fake bull market.

At the beginning of the Federal Reserve's interest rate cut cycle, can the return of crypto totem CZ once again inject confidence and innovative vitality into the confused crypto market?

Binance is no longer a grassroots organization, and cryptocurrencies have entered an era of strong compliance

After CZ resigned, the regulatory hammer on Binance has not stopped. Earlier this year, Nigeria announced that Binance was suspected of conducting illegal financial transactions on its platform and detained Binance executives Tigran Gambaryan and Nadeem Anjarwalla to date, accusing Binance of contributing to the collapse of the country's fiat currency.

However, under the pressure of successive regulations, Binance was forced to move from grassroots to full compliance.

In addition to the CEO being replaced by Richard Teng, who has 30 years of experience in financial services and regulation, Binance also saw changes in many senior positions including chief marketing officer, chief strategy officer, head of product, vice president of custody business, and vice president of compliance business.

Binance has invested unprecedented human and financial resources in compliance.

According to a Bloomberg report at the end of August, many of the 1,000 employees Binance plans to recruit this year will be concentrated in the compliance field, and Binance's annual compliance expenditure has exceeded US$200 million.

Richard Teng also said that it plans to expand the compliance team to 700 people by the end of 2024, while the company continues to work towards establishing a global headquarters.

It is not just Binance. Under stronger regulatory pressure, other exchanges or leading projects regard compliance as the most important development strategy. Hong Kong and other regions are also actively promoting the establishment of compliant licensed exchanges.

The other side of US regulation on Binance is that crypto is beginning to enter the mainstream.

On the one hand, Bitcoin spot ETF and Ethereum ETF were approved in early and mid-2024, respectively, and Wall Street forces have joined in. Wall Street financial giants, led by BlackRock, are not only investing in assets such as Bitcoin and Ethereum, but are also trying out crypto innovations such as RWA.

On the other hand, under the heavy pressure of regulation, crypto upstarts are no longer sitting idly by. They have influenced American politicians' attitudes towards crypto assets by providing campaign funds to support cryptocurrency-friendly candidates.

The amount of crypto donations in the 2024 US election far exceeded that of the previous election cycle, which to a certain extent created many famous scenes in which candidates such as Trump, Biden, and Harris played the crypto card. The 2024 Bitcoin Conference also transformed from a technical forum into a political stage.

However, with the end of the wild and grassroots era, as more and more professional players from the traditional primary and secondary markets have joined the gold-digging team, the way crypto is played is also changing. Binance and even the crypto market have inevitably fallen into a period of pain.

Binance’s controversy, crypto confusion

Compared to the sky-high fine of over $4 billion, the crypto community was more concerned about the impact of CZ's departure on the future development of Binance. But it turns out that Binance still maintains a strong position under the leadership of He Yi, another co-founder and CZ's wife, and new CEO Richard Teng.

It still holds the top spot in terms of trading volume and user scale. According to CoinGecko data, Binance's 24-hour trading volume exceeds US$17 billion and its monthly visits exceed 53 million. CoinGecko's second quarter report shows that Binance's market share in Q2 is about 44%, which is slightly lower than the same period last year, but still ranks first.

He Yi's attribute of "Binance's best customer service" was also fully demonstrated during CZ's departure. Compared with the CZ period, Binance directly provided answers to almost every key point of market doubts, and contributed many inspiring crypto essays to the crypto market.

But in the past year, Binance has never stopped being controversial. In terms of business strategy, at the end of last year, the popularity of Bitcoin Ecosystem Inscriptions caused a number of CEXs to be involved in the battle for traffic and Web3 wallets.

In the face of fast-changing new things, He Yi revealed in the AMA that it is difficult for Binance to judge the future popularity, resulting in insufficient investment. Binance has also been questioned for not entering the market faster and the Web3 wallet user experience not meeting expectations.

In addition to business strategy, the biggest controversy Binance faced in the year since CZ left was more about coin listing.

From girlfriend coins, VC coins to meme coins, Binance has been caught in the whirlpool of public opinion many times. He Yi responded to the coin listing debate at least 5 times through short essays or AMM.

Girlfriend Coin can be said to be a legacy of the CZ era. But this year, Binance was questioned by VC coins and meme coins, exposing the collective confusion of Binance and even the crypto market.

Money is not so easy to make anymore, and the crypto narrative is starting to deflate.

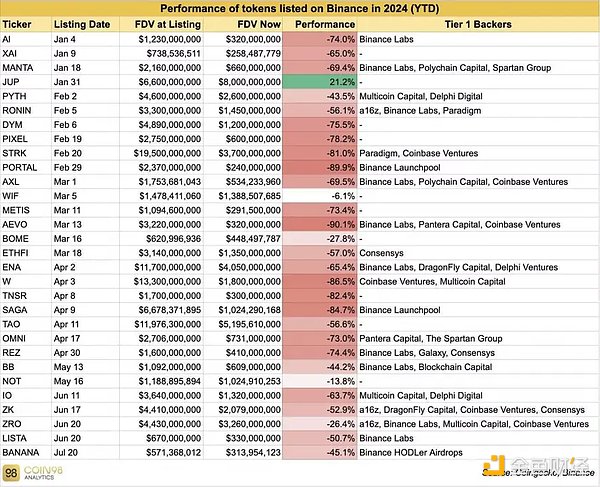

VC coins have driven the popularity of high FDV, low circulation tokens this year. These tokens generally have weak prices after TGE. According to the statistics of crypto KOL @Ryanqyz_hodl, most of the tokens listed on Binance in 2024 have all fallen sharply after TGE.

Data source: @Ryanqyz_hodl

Whether it is VC coins, mini-games on TON, or memes, project development has gone to an extreme, and everything is for the purpose of being listed on Binance.

However, since users could not make money, they could not avoid criticizing Binance. Binance then took the lead in adjusting its coin listing strategy, which also caused collective reflection in the crypto market. The crypto community generally realized that the crypto industry was caught in a vicious cycle of creating unreal stories and just wanting to sell coins.

Therefore, although the public opinion on high FDV tokens has subsided, Binance has recently launched meme tokens in succession to compete for traffic, which has caused controversy again. Although memes are good, they cannot be just memes. When can the crypto market move from the PVP (mutual cutting) model to the PPP (mutual assistance) model?

Everyone misses the CZ era, but history moves forward

When Binance and the entire crypto market were caught in controversy and confusion, the Federal Reserve announced a rate cut, and CZ's return may inject new confidence and vitality into the crypto market. The activity of the BNB chain and the CZ release concept meme coin before CZ was released from prison can be seen.

Although CZ is still prohibited from participating in the operation or management of Binance's day-to-day business, the founder who has dominated Binance's 7-year glorious history is still Binance's largest shareholder and retains influence on Binance's future.

CZ's influence is not limited to Binance. In addition to the new impact of Binance itself on cryptocurrencies after CZ's return, CZ himself, as one of the crypto totems, may also bring highlights to the new crypto cycle with his global vision and experience of going through cycles.

However, Binance and the crypto market are also facing many challenges after CZ's return. The crypto cycle has changed, and the logic and gameplay are also changing.

When CZ led Binance from a workshop to the world's largest crypto exchage, it was also the period of the fastest growth in crypto. Perhaps everyone misses the myth of wealth of 100x and 1,000x coins brought by innovative IEO models in the CZ era. But as He Yi lamented in his new article "If We Have Different Opinions, You May Be Right", this is more of a double blessing of the early niche market and the macro economy.

In the year that CZ retired, the crypto industry came to a new critical juncture.

He has always said that the global economy has entered a new cycle, consumption has been downgraded around the world, and more traditional players have joined the gold rush. After the transaction scale of traditional financial products related to cryptocurrencies has been steadily expanding, although the big ones are indeed coming, the way they come is different from the way everyone imagines that capital will take over without thinking.

In addition, crypto innovation still faces a balance or even compromise under the compliance trend. Binance and the entire crypto market have to endure a more complex environment on the road to stability, innovation and growth. The 100-fold and 1,000-fold growth of the CZ era may be more difficult to replicate.

But the other side of the coin is that after the bubble of only telling stories and selling coins is punctured, encryption may not only be about technology, but return to the essence of business and value-driven. Blockchain technology may gradually be based on serving the real needs of most people and enter the homes of ordinary people.

With the return of CZ, we look forward to Binance’s continued stability and change, and we also look forward to the development of cryptocurrencies.