Each bull cycle in the cryptocurrency market presents different challenges and opportunities. The 2024 bull cycle is significantly different from the 2017 and 2021 cycles.

This is because liquidity was concentrated in a small number of altcoins in previous cycles, simplifying investment choices for retail investors. However, the cryptocurrency market has evolved significantly, with liquidity increasingly being distributed across a wider range of altcoins.

Liquidity dispersion due to memecoin

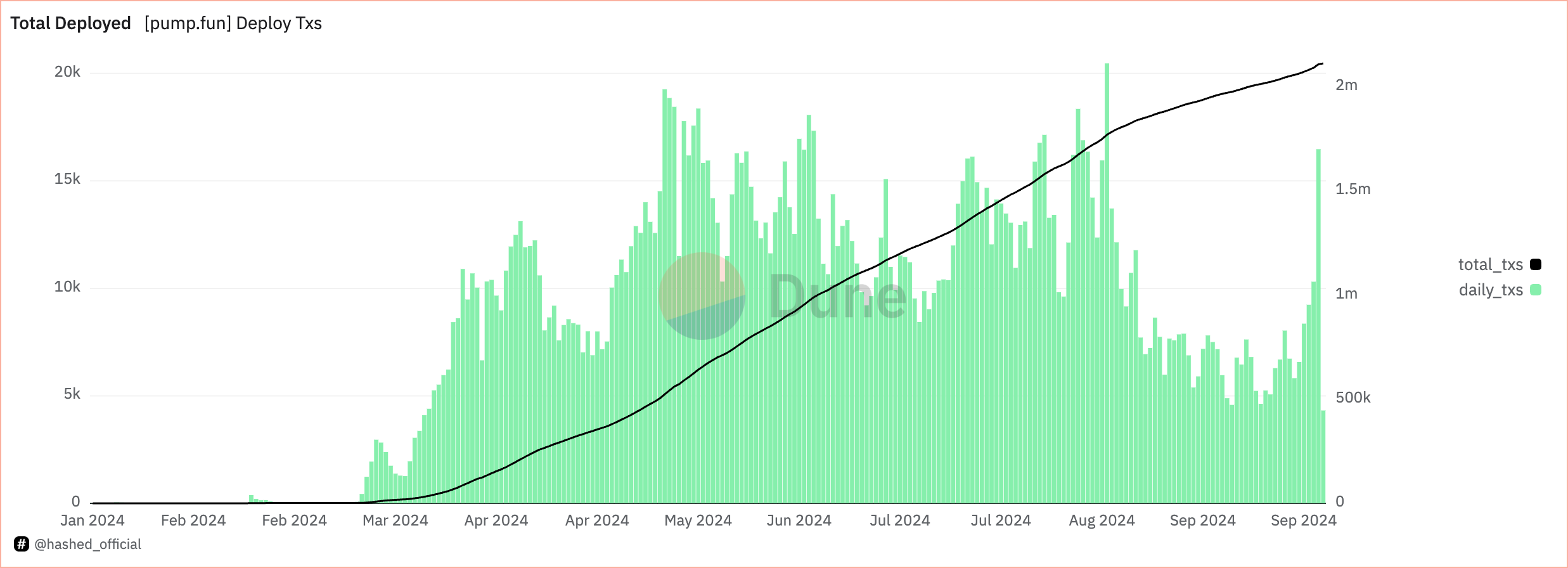

The expansion of the cryptocurrency market has been particularly notable with the surge in altcoins and meme coins facilitated by platforms such as Pump.fun . Launched in January 2024, the platform has been instrumental in the creation of over 2 million meme coins, collecting over $138 million in fees.

Read more: 7 Hot Meme Coins and Altcoins That Will Be Trending in 2024

This surge in tokens has led to what Alex Odaziu, Investment Director at Binance Labs, calls “liquidity dispersion.” In an interview with BeInCrypto, Odaziu emphasized the duality of this trend.

“The surge in memecoins has certainly created some noise, but it seems to be part of the natural evolution of the Web3 space. While it may cause a short-term liquidity variance, over time the market is likely to regroup around projects with real value propositions,” he explained.

Despite its speculative nature , MemeCoin has played a pivotal role in attracting new users and fostering community engagement. Furthermore, Odajiu believes that as the market matures, investor interest will shift to utility-focused projects that provide sustainable value and practical use cases.

Altcoin Investment Strategy

Since September 6 , the price of Bitcoin has risen by almost 25% . It is currently trading above $65,000, indicating a return to bullish momentum .

However, as the number of tokens increases, the attention and excitement that certain projects previously enjoyed has been diluted. In response, Odajiu presented a strategy for long-term investors to effectively navigate the crowded market.

“In a market overflowing with new tokens, it is important for investors to focus on fundamentals rather than chasing excitement. Long-term investors should take a systematic approach to distinguishing short-term trends from long-term value. Projects with real-world use cases, strong teams, solid roadmaps, and sustainable business models are more likely to survive through multiple market cycles,” Odajiu emphasized.

Read more: 11 cryptocurrencies to add to your portfolio before altcoin season

He also said there is still significant potential within specific areas such as decentralized finance (DeFi) , infrastructure, tokenization of real assets , and applications aimed at mass adoption.

“Projects that prioritize strong technological innovation, demonstrate meaningful product-market fit, and have sustainable revenue models will continue to attract attention even in crowded markets,” Odajiu said.

Odajiu recommends a balanced approach to building a robust crypto portfolio . He believes that a robust crypto portfolio should be diversified across different asset classes and sectors.

“While Bitcoin remains the underlying asset due to its stability and market dominance, altcoins that drive real technological innovation and have strong community support can offer significant growth opportunities. Diversification across sectors such as DeFi, infrastructure, and gaming can help mitigate risk and capture opportunities in emerging trends,” he elaborated.

Bitcoin Remains Most Preferred Cryptocurrency for Institutions

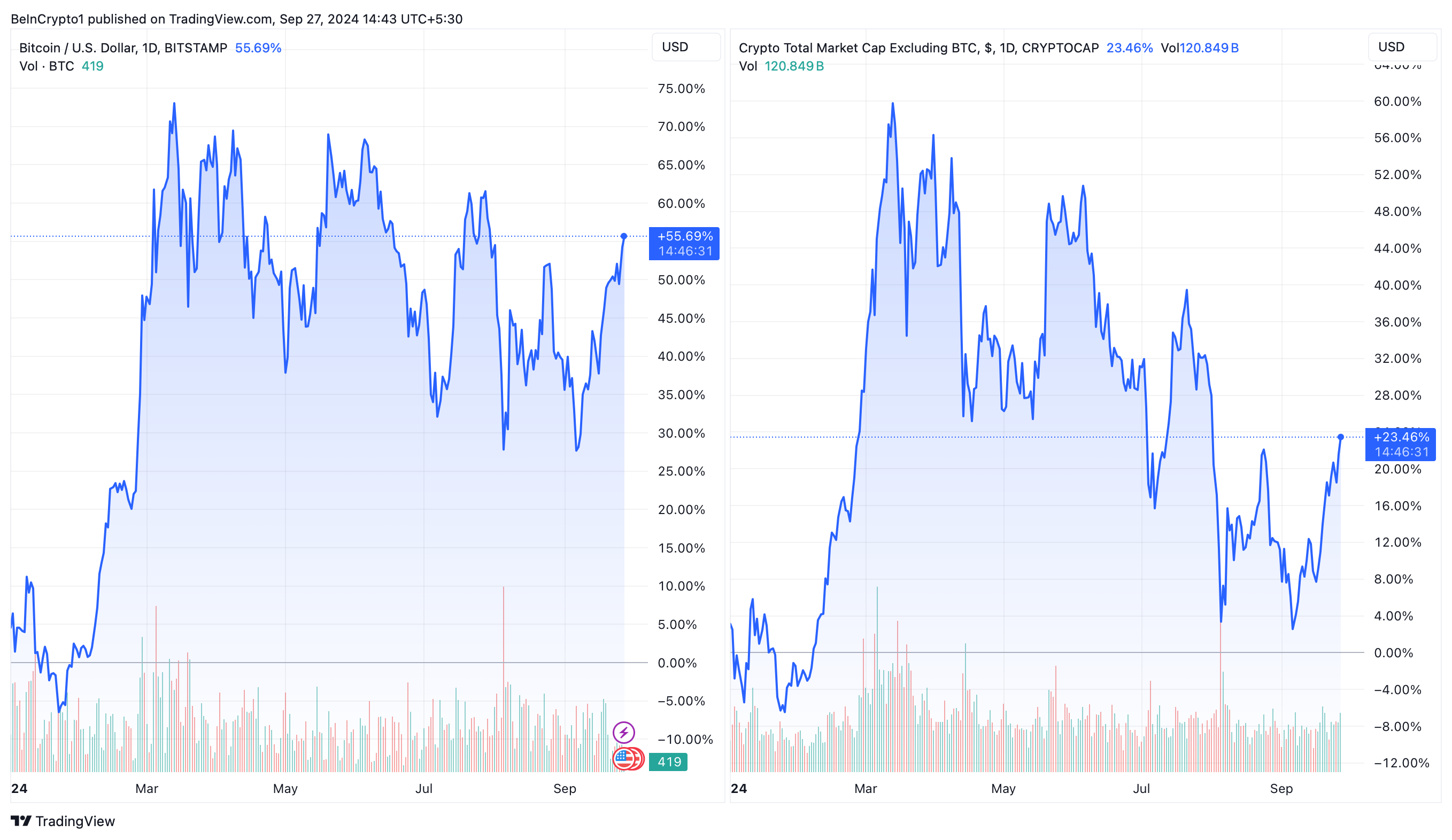

Given Bitcoin’s dominant market position, institutional attention is largely focused on Bitcoin, often neglecting other promising altcoins. Since the beginning of the year, Bitcoin’s price has risen by more than 55%, while the overall cryptocurrency market cap, excluding Bitcoin, has only risen by 23%.

Read more: Who will own the most Bitcoin in 2024?

Also, according to cryptocurrency analyst Murad Mahmudov, only 42 of the top 300 coins on CoinMarketCap have outperformed Bitcoin so far in 2024. Odaziu explains why Bitcoin will remain the dominant cryptocurrency in the bull market in 2024.

“Bitcoin’s dominant position in the market is deeply rooted in its status as the first cryptocurrency, and institutional investors often view it as a simpler, more familiar, and less risky asset than Ethereum or altcoins. Bitcoin’s narrative as a store of value, often referred to as ‘digital gold,’ aligns with traditional investment strategies, making it a natural entry point for new institutions in the crypto space,” Odaziu explained.

However, as institutional investors become more familiar with the cryptocurrency ecosystem, Odajiu expects interest in Ethereum (ETH) and other altcoins to increase.

“Accordingly, we (Binance Labs) expect to see interest in Ethereum and other altcoins grow as institutions continue to build trust in the Web3 ecosystem and see utility beyond Bitcoin,” he added.

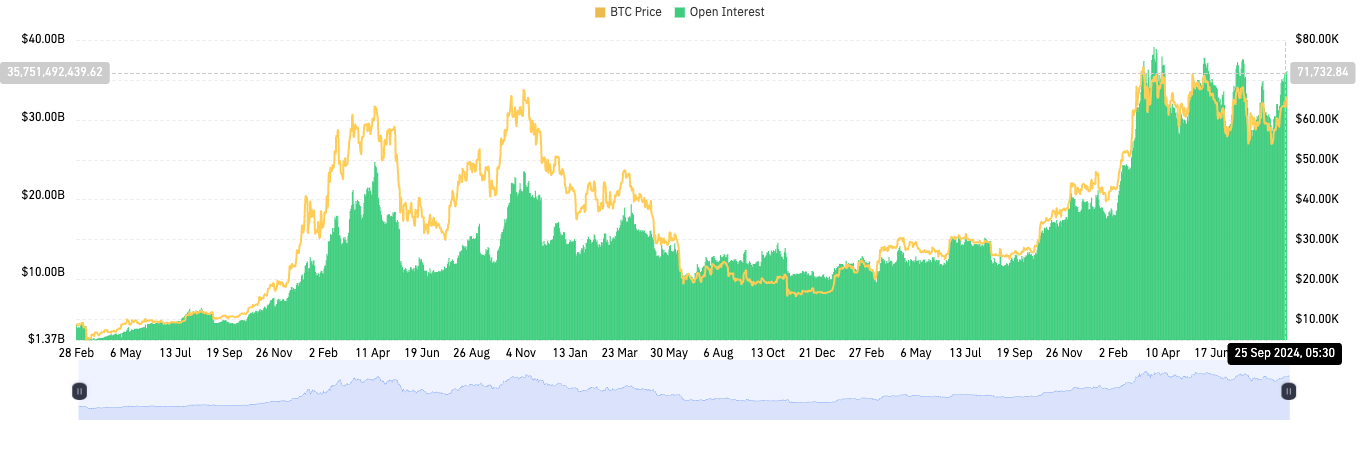

The current market cycle also highlights the rise of leveraged trading among crypto traders. According to data from cryptocurrency derivatives data platform Coinglass, open interest is at $359.3 billion, nearing its highest level in four years.

Open interest refers to the total number of unsettled derivatives contracts, such as futures and options. It is used as an indicator of market sentiment.

Read more: How to Trade Cryptocurrency on Binance Futures: Everything You Need to Know

However, Odajiu warned against the temptation of high-risk leverage. He said leverage can magnify both profits and losses, so investors should use it responsibly, especially in volatile markets.

“Ultimately, long-term success in cryptocurrencies comes from sound investment principles, not from pursuing short-term profits with high-risk leverage,” he concluded.

Indeed, the cryptocurrency market demands that investors prioritize sustainable investment strategies so they can navigate the challenges of the 2024 bull market with informed confidence.