Ripple (XRP) is looking to finish September strong with a 6% gain today. However, as October 2024 approaches, ongoing regulatory developments, institutional inflows, and other factors will determine whether XRP has an interesting month ahead.

Investors are eagerly looking for clues about XRP’s price potential. This analysis examines key technical indicators, whale movements, and market sentiment to provide insight into what to expect from the token in the coming months.

Factors Ripple is Watching as Market Interest Grows

Starting at $0.55 at the beginning of the month, the price of XRP has increased by 10% on a monthly basis. At the time of writing, the altcoin is worth $0.62. This positive gain could be related to the overall recovery in the market, especially with Grayscale launching the XRP Trust two weeks ago.

For some investors, this trust is seen as a first step towards an XRP ETF despite the current regulatory challenges. Some believe this development will have a positive impact on XRP’s price in October.

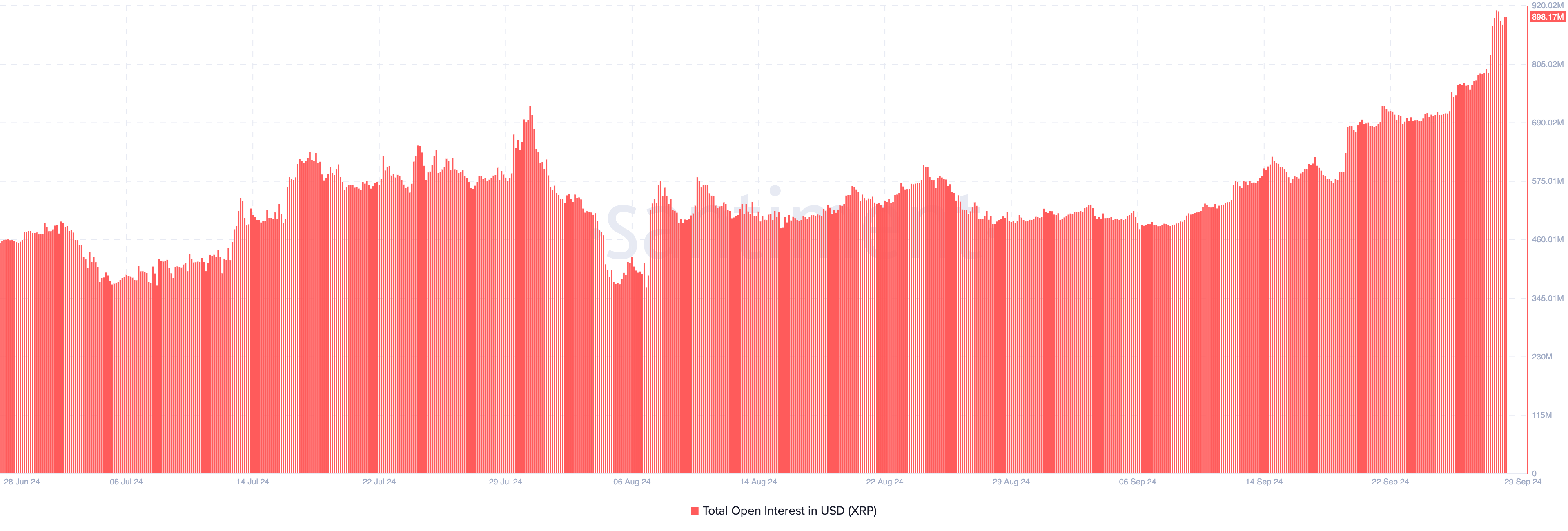

Additionally, the surge in the token’s open interest (OI) appears to be in line with this sentiment. At the time of writing, XRP’s open interest stands at nearly $900 million, indicating a notable increase in speculative activity around the token.

In terms of price, the increase in open interest means more money is flowing into the derivatives market. When this happens during an uptrend, it gives more strength to the trend. Therefore, the price of XRP could continue to rise in the coming months.

Read more: XRP ETF Explained: What It Is and How It Works

However, Juan Pellicer, senior researcher at cryptocurrency on-chain data platform IntoTheBlock, disagrees with the potential XRP ETF effect. According to him, the launch of Ripple’s stablecoin and its integration with decentralized finance (DeFi) will have a bigger impact after October 2024.

“While the launch of the XRP Trust and its potential transition into an XRP ETF are important developments to watch, the main catalyst for XRP in Q4 2023 is expected to be the launch of the RLUSD stablecoin and its integration into the DeFi ecosystem,” Pellicer told BeInCrypto in an exclusive interview.

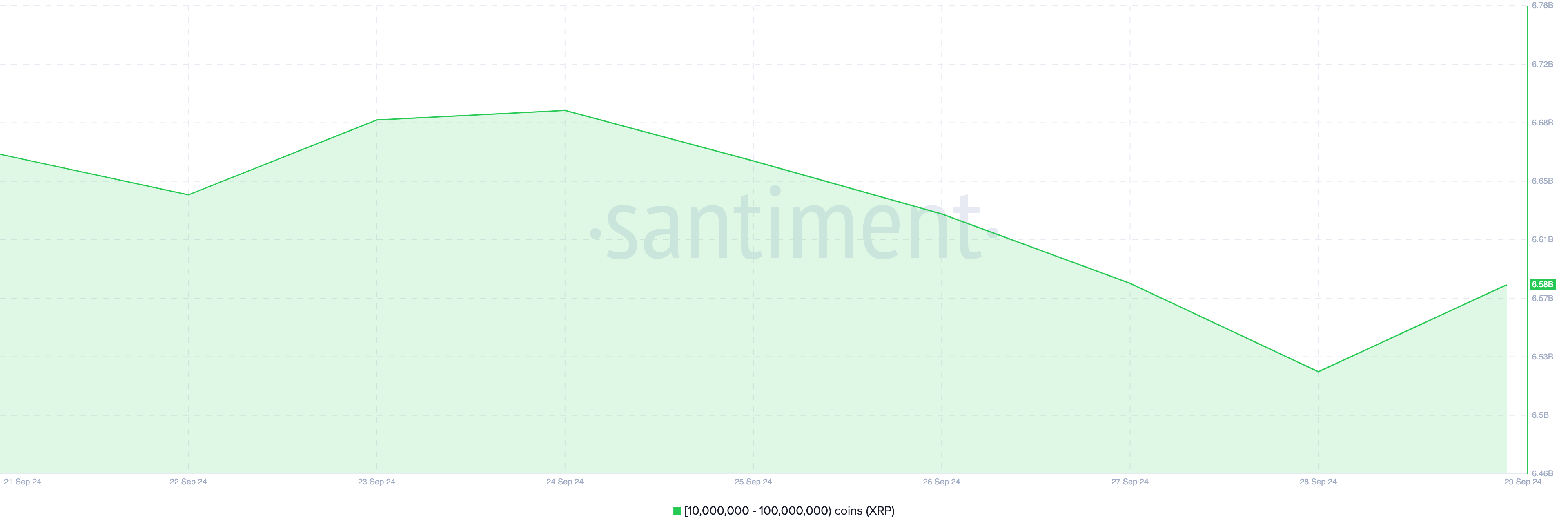

Regardless of the major catalyst, data from Santiment shows that crypto whales are again buying XRP . As you can see below, these whales bought 60 million tokens between yesterday and today, worth $37.2 million. Based on this behavior, it seems that whales are preparing for a surge in XRP prices as Q4 approaches.

XRP Price Prediction: Ready for Breakout

From a technical perspective, the lack of volatility around the token has prevented XRP’s price from reaching $0.70 previously. However, looking at the daily chart, it now appears more likely to reach that value.

For example, if you look at the Ichimoku cloud, which usually tracks support and resistance, this indicator is located below the price. When the Ichimoku cloud is located below the price, it indicates support, meaning that the cryptocurrency may have a solid base to push higher. Conversely, when the cloud is above the price, it acts as resistance, suggesting that the value may fall.

For XRP, the cloud below the price means strong support, which could push the value higher than $0.62. With support at $0.59, the price of XRP could break through the resistance at $0.63.

Read more: How to buy XRP and all the information you need

After that, the next level that the altcoin can reach could be around $0.69, and it could go up to $0.72 before the end of October. However, if XRP experiences a significant decline in whale activity in the coming months, this prediction may not come true. Instead, the price of XRP could decline to $0.57 .

However, Pellicer said that when it comes to the price of the cryptocurrency, it could see increased volatility, which could push it out of its current tight trading range.

“As this situation unfolds, we expect XRP volatility to increase. The success of the RLUSD stablecoin and its DeFi integration could propel XRP to new yearly highs, depending on market conditions and regulatory outcomes,” the analyst said.