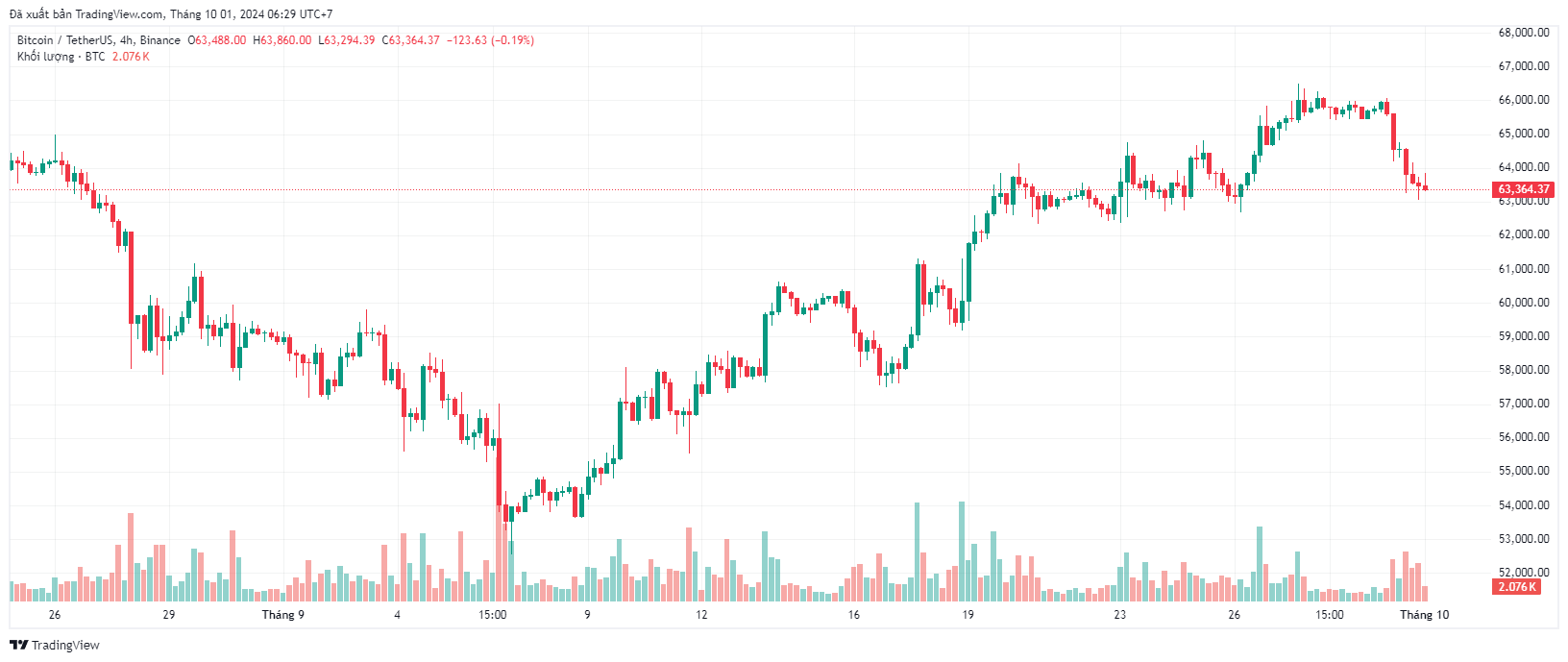

Bitcoin started the week with a sharp sell-off, sending prices down to $63,000, despite Federal Reserve Chairman Jerome Powell’s statement that further rate cuts are still on the cards. Despite the correction, Bitcoin still closed the third quarter in the green.

Bitcoin fell from $65,634 on September 30, losing about 4% to hit an intraday low of $63,049, according to data from TradingView. At the time of writing, Bitcoin is trading at $63,364, down 3.6% over the past 24 hours.

BTC/USD hourly chart | Source: TradingView

In a speech at the National Association for Business Economics in Nashville, Powell said the upcoming rate cuts would not be as dramatic as the recent 50 basis point cut. He explained that if the economy continues to perform as expected, markets could expect two more rate cuts of 0.25% each in 2024.

“We do not feel the need to rush into a rapid rate cut.”

“Going forward, if the economy evolves as expected, policy will move toward a more neutral stance. But we are not on a fixed path. Risks exist on both sides, and we will continue to make decisions at each meeting,” Powell added.

Powell's comments come less than two weeks after the Federal Open Market Committee (FOMC) cut interest rates by 50 basis points, the first time since March 2020.

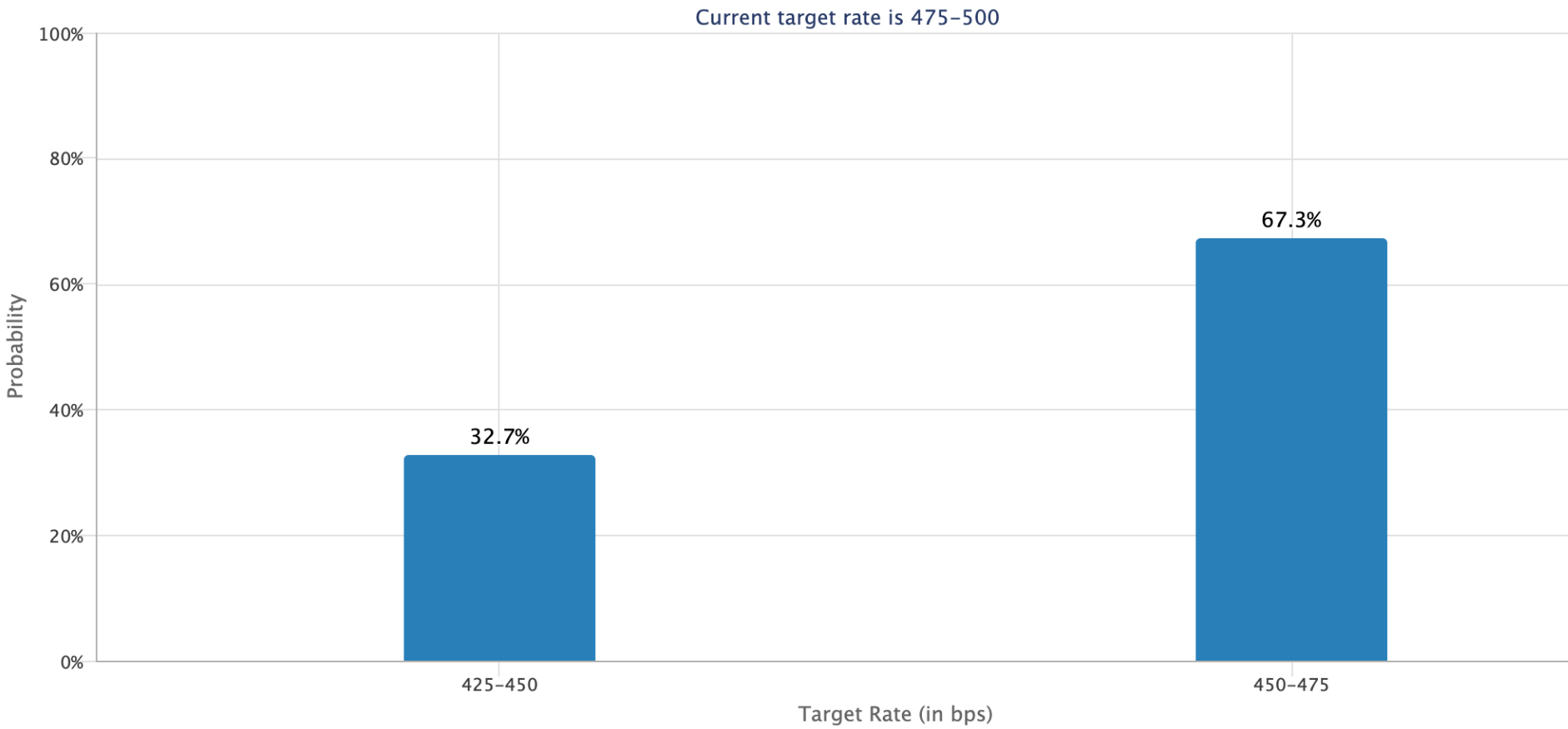

Futures markets are predicting the Fed will likely be cautious at its November meeting and could approve a quarter-point cut. However, traders see a more aggressive move in December. Data from the CME Group’s FedWatch tool shows a 48% chance of a 50 basis point rate cut at the FOMC meeting on December 18.

Probable target interest rate for November 7 FOMC meeting | Source: CME Group

Prior to these statements, the market expected the FOMC to cut interest rates by another 0.5% at its upcoming meeting.

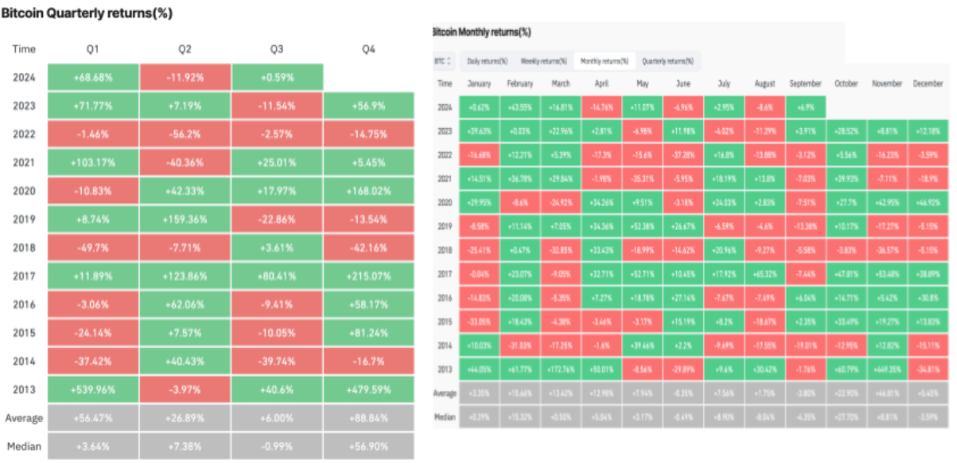

Powell’s comments come as the broader cryptocurrency market has enjoyed three straight weeks of gains. Bitcoin struggled in September, a month that has historically been its worst month, falling 11% from the 1st to the 6th. However, prices recovered after the Fed cut interest rates by 50 basis points at the FOMC meeting on September 18.

Data from CoinGlass shows that Bitcoin is likely to end Q3 with a gain of 0.6% and gain 7% in September.

Bitcoin price movements on a quarterly and monthly basis | Source: CoinGlass

“In 100% of election years, October, November and December saw growth,” wrote Quinten François, co-founder of WeRate, in a September 30 post.

“100% of years with a green September have seen green October, November and December. Q4 starts tomorrow.”

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Mr. Teacher

According to Cointelegraph