The Chinese government has announced vigorous economic stimulus measures since last week. In addition to injecting capital into the stock market, it is also trying to save the housing market. The People's Bank of China first lowered the reserve requirement ratio by 2 cents, released about 1 trillion yuan of liquidity into the financial market, and lowered the 7-day reverse repurchase operation. The interest rate was 0.2%, and then the existing mortgage interest rates were lowered. Shanghai and Shenzhen also announced the relaxation of some housing purchase restrictions, and Guangzhou completely canceled purchase restrictions.

China’s policies determine the future direction of the global market

Driven by China's large-scale economic stimulus measures, China's stock market has continued to rise sharply in recent days, which has also boosted some stocks in overseas markets such as New York. The Wall Street Journal reported that some investors believe that the situation in China in the next few months may be a decisive factor in global economic growth. key to market direction.

The Shanghai Composite Index soared 8% on Monday, the last trading day before the National Day holiday, the largest one-day rise since 2008. It rose 17% in September, the largest monthly gain since the Chinese stock market bubble in 2015.

September's gains have all but erased months of losses for the Shanghai Composite Index. China's weak economy has weighed on the stock market in recent years, triggering capital flight and prompting retail investors to flee to safer assets.

Investors welcomed China's pledge to increase economic support. Solita Marcelli, chief investment officer of UBS Global Wealth Management (UBS) Americas, said policy changes could be a factor in changing the trend of China's risk assets. As interest rates have fallen, U.S. stock indexes are close to history. At high levels, some believe a rebound in China could fuel the next leg of the rally.

However, according to report analysis, many people are still worried that China’s economic stimulus measures are not enough to alleviate the pressure on the world’s second largest economy. As a global manufacturing center and the world’s largest consumer of commodities, China’s problems tend to affecting other places.

Speculative traders may switch from Bitcoin to A-shares

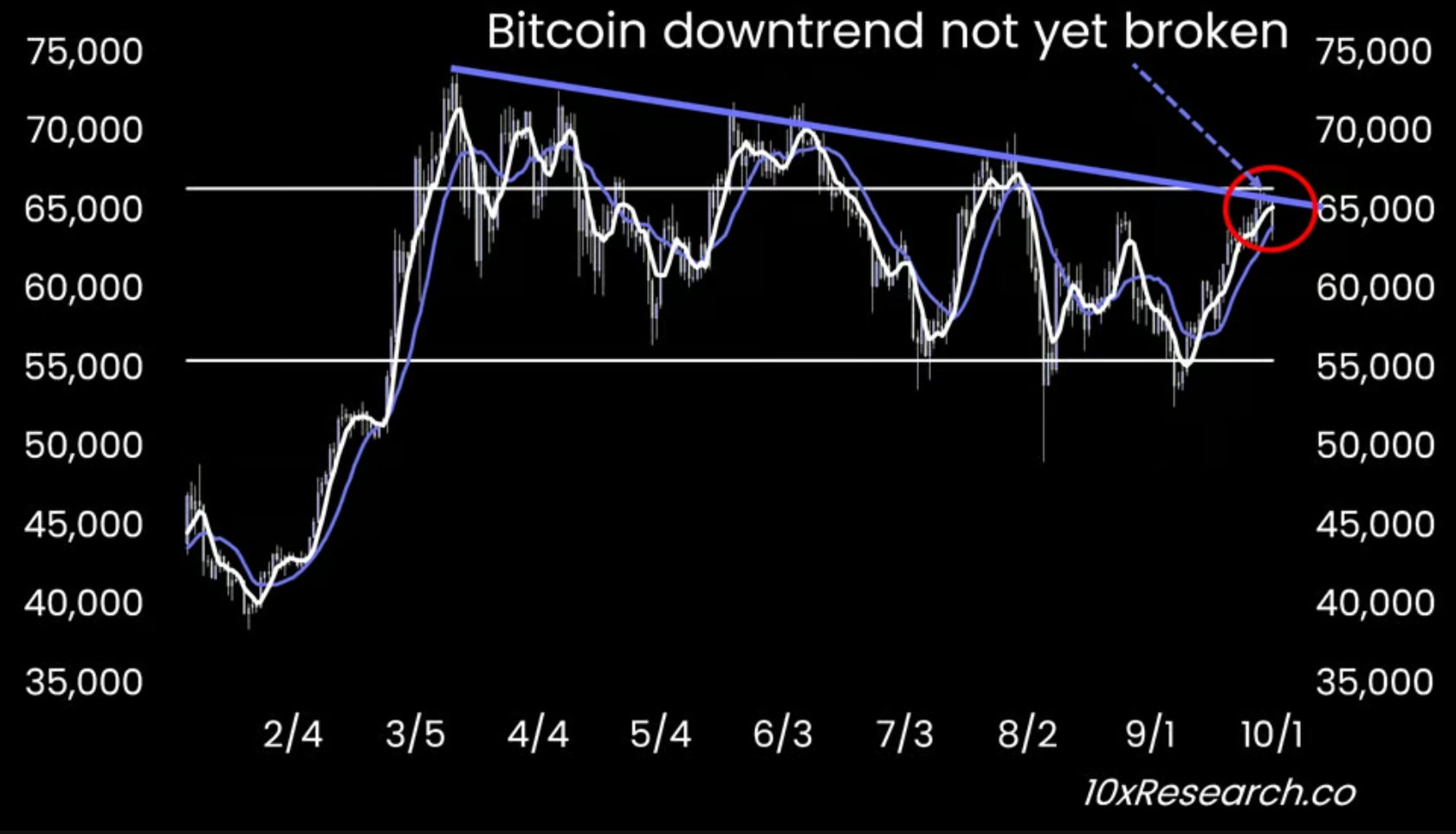

It is worth noting that China’s economic stimulus measures are also affecting Bitcoin trends. 10x Research stated in the latest report that the cryptocurrency market is undergoing some major changes. Although short-term doubts are obvious, larger trends may soon overshadow These worries.

10x Research said that the agency accurately predicted the correction in the past six months and held a bullish stance in the past three weeks. Bitcoin also began to rebound from $54,000. At present, Bitcoin has not broken out of the downward trend and has begun to fall, but it believes that the breakthrough is only a matter of time. .

Against the background of the U.S. interest rate cuts and China's major fiscal and monetary stimulus measures, Bitcoin successfully broke the "September Curse" that almost guaranteed a fall in September this year, and once broke through $66,000. However, it tried again yesterday. The price failed at US$66,000 and continued to fall, reaching as deep as US$62,850 at around 7:30 this morning.

Against the background of the U.S. interest rate cuts and China's major fiscal and monetary stimulus measures, Bitcoin successfully broke the "September Curse" that almost guaranteed a fall in September this year, and once broke through $66,000. However, it tried again yesterday. The price failed at US$66,000 and continued to fall, reaching as deep as US$62,850 at around 7:30 this morning.

In response to Bitcoin starting to fall, 10x Research believes that the reason may be related to the weak economic data from China, which shows that China needs additional stimulus measures. Therefore, speculative traders may have switched from Bitcoin to Chinese stocks to obtain higher prices. High volatility exposure, while short-term technical indicators for Bitcoin currently appear to be overbought, pointing to a possible move lower.

Data released by the National Bureau of Statistics of China last night showed that the manufacturing purchasing managers index (PMI) rose from 49.1 to 49.8 in September, shrinking for the fifth consecutive month. The non-manufacturing PMI fell from 50.3 to 50.0 in September, a record of 21 The new low since last month indicates that construction and service industry activities have lost momentum and are on the verge of shrinking.