Author: Matt Hougan, Chief Investment Officer of Bitwise; Translated by: 0xjs@ Jinse Finance

At a conference last week, a $10 billion financial advisor asked me a simple question: Bitcoin or gold?

He was concerned about the long-term prospects for the dollar and wanted to take steps to hedge. But what steps?

That’s a good question, and one that many are asking right now, amid aggressive rate cuts from the Federal Reserve and economic stimulus from China.

I thought I should address this issue head on.

Bitcoin vs. Gold

Bitcoin and gold are similar in many important ways. In principle, both are forms of money that are free from government interference. Jerome Powell can print all the dollars he wants, but he can’t create more gold or change the 21 million supply cap on Bitcoin.

But there are key differences between the two assets. Bitcoin is less mature and more volatile than gold, but it is also easier to send, store and divide.

When you think about the role each asset can play in a portfolio, you see the same dynamic: Bitcoin and gold are similar yet very different. Both are liquid alternative assets that have historically had low correlations with stocks and bonds. Moreover, as the data below shows, adding both assets to a traditional portfolio has improved risk-adjusted returns over the past decade. (Of course, past performance is no guarantee of future results.)

However, the differences between the two are just as significant, and perhaps even more important. Understanding those differences is key to deciding which one to choose for your portfolio.

What do you want: more returns or less risk?

The best way to understand how Bitcoin and gold differ in an investment portfolio is to watch what happens when you add more and more assets to your portfolio.

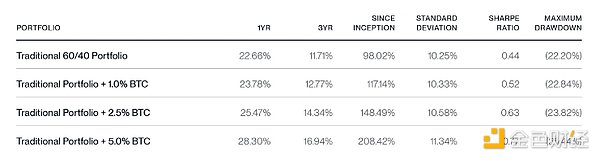

The table below shows the impact of adding 1.0%, 2.5%, and 5.0% Bitcoin to a traditional 60/40 stock/bond portfolio. To generate this table, I used the Bitwise Portfolio Simulator, which is available to financial professionals on our Expert Portal (https://experts.bitwiseinvestments.com/tools/portfolio-simulator). The simulation took into account all available data, starting from January 1, 2014 and running until September 26, 2024 (last Thursday).

Source: Bitwise Asset Management, data from IEX Cloud. Data range is from January 1, 2014 to September 26, 2024.

Note: Traditional portfolio is composed of 60% stocks (represented by SPDR® S&P 500® ETF Trust (SPY)) and 40% bonds (represented by SPDR® Portfolio Aggregate Bond ETF (AGG)). Bitcoin is represented by the BTC spot price. The performance of individual crypto assets may differ significantly from that of Bitcoin. Taxes and transaction costs are not considered.

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no guarantee that actual results will match assumptions or that actual returns will match any expected returns. The historical performance of the sample portfolio is the result of hindsight analysis and maximized results. Returns do not represent actual account returns and do not include fees and expenses associated with buying, selling and holding funds or crypto assets. Performance information is for informational purposes only.

Check out the "Since Inception" column. Historically, as you add more and more Bitcoin, the total return on the portfolio goes up dramatically. The same is true for the past one and three years of returns.

Now look at the standard deviation column: it barely moved! According to the simulation, a 2.5% allocation to Bitcoin would increase the portfolio’s return by 50 percentage points, from 98% to 148%, while the standard deviation would only increase by 33 basis points.

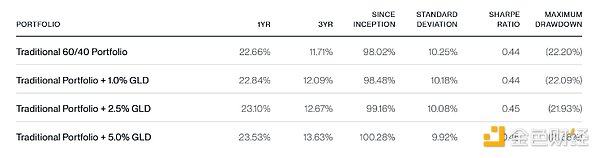

This is in stark contrast to what happens when replacing Bitcoin with gold. As shown in the chart below, there is virtually no impact on returns: over the entire 10+ years studied, a 2.5% allocation to gold would have only increased portfolio returns by 1%! However, where gold does have an impact is in terms of volatility (again, check the standard deviation column), which decreases as you add more and more gold to the portfolio.

Source: Bitwise Asset Management, data from IEX Cloud. Data range is from January 1, 2014 to September 26, 2024.

Note: Traditional portfolio consists of 60% stocks (represented by SPDR® S&P 500® ETF Trust (SPY)) and 40% bonds (represented by SPDR® Portfolio Aggregate Bond ETF (AGG)). Gold is represented by SPDR® Gold Shares (GLD). Taxes and transaction costs are not considered.

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no guarantee that actual results will match assumptions or that actual returns will match any expected returns. The historical performance of the sample portfolio is the result of hindsight analysis and maximized results. Returns do not represent actual account returns and do not include fees and expenses associated with buying, selling and holding funds or crypto assets. Performance information is for informational purposes only.

Every asset tells a story of trade-offs. If the risk is roughly the same, but the reward is higher? Look at Bitcoin. If the risk is less, but the reward is roughly the same? Look at gold.

Both are great results, but very different. Which one you choose depends on your personal situation.

What happens if you buy Bitcoin and gold at the same time?

Faced with these results, a natural question is: Why not invest in both? Can you have the best of both worlds?

Unfortunately, no. There is no such thing as a free lunch.

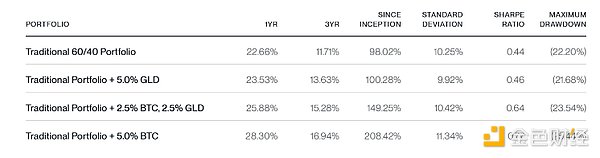

The table below compares three possibilities: a portfolio of 5% gold, 5% Bitcoin, and 5% of both (2.5% gold, 2.5% Bitcoin). The two-for-one portfolio is pretty much what you’d expect: in terms of risk/reward metrics, it essentially splits the difference between a 5% gold and 5% BTC portfolio.

Perhaps the most telling point about this table is that Bitcoin has a much greater impact than gold for an equal allocation. Look at the Sharpe ratio (note: a measure of the performance of an investment relative to a risk-free asset after adjusting for risk) fluctuations between a 5% gold and 5% BTC portfolio - gold has almost no impact, while Bitcoin has risen sharply.

Source: Bitwise Asset Management, data from IEX Cloud. Data range is from January 1, 2014 to September 26, 2024.

Note: Traditional portfolio consists of 60% stocks (represented by SPDR® S&P 500® ETF Trust (SPY)) and 40% bonds (represented by SPDR® Portfolio Aggregate Bond ETF (AGG)). Gold is represented by SPDR® Gold Shares (GLD). Bitcoin is represented by the BTC spot price. The performance of individual crypto assets may differ significantly from that of Bitcoin. Taxes and transaction costs are not considered.

Past performance does not predict or guarantee future results. Nothing contained herein is intended to predict the performance of any investment. There can be no guarantee that actual results will match assumptions or that actual returns will match any expected returns. The historical performance of the sample portfolio is the result of hindsight analysis and maximized results. Returns do not represent actual account returns and do not include fees and expenses associated with buying, selling and holding funds or crypto assets. Performance information is for informational purposes only.

in conclusion

With all of this in mind, what’s the answer to the advisor’s “Bitcoin or gold” question?

One answer might be, “It depends on your risk tolerance and whether you prefer similar returns with lower volatility or higher returns with similar volatility.” This answer is accurate and backed by the data.

But if I were speaking for myself and looking at the Sharpe ratio, I would give a different, simpler answer: “Bitcoin.”