Table of Contents

ToggleMarket Analysis – The Black Swan of the Iraq War reappeared, US stocks and cryptocurrencies plummeted

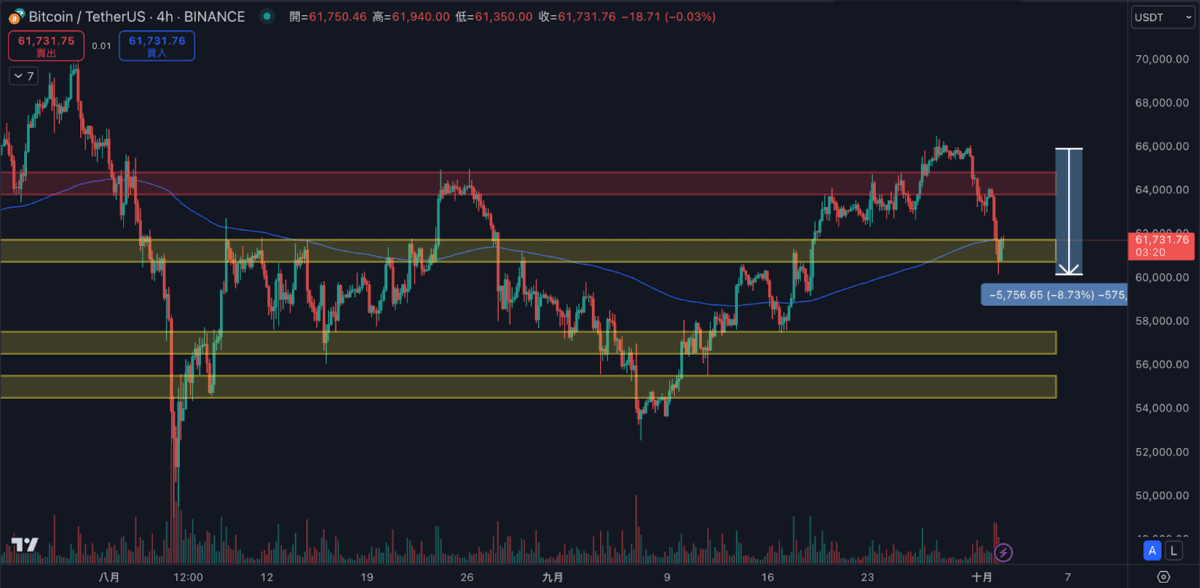

Affected by Iran's launch of hundreds of missiles in retaliation against Israel yesterday evening, Taiwan stocks, U.S. stocks and cryptocurrencies simultaneously fell sharply. BTC also fell by 3.98% yesterday, with the largest drop from the high of $66,000 at the end of September to about 8.7%. , the largest decline in the past month, and other Altcoin also experienced declines of more than 5%. This wave of black swans has undoubtedly caused great harm to the market.

After this wave of decline, the famous fear and greed indicator immediately changed from greed to fear, which shows that the market is worried about the market outlook. Especially after the US Federal Reserve decided to cut interest rates by two points in September and Japan announced to maintain interest rates, the market can be said to be open. Celebrating the market, whether it is BTC, ETH spot ETFs or stablecoin issuance, they are moving in an optimistic direction. However, this wave of war between Israel and Iraq has made the market worry about whether the scale of the subsequent war will continue to expand. When yesterday's incident occurred, we judged that Some positions will also be liquidated urgently to prevent excessive losses caused by uncontrollable subsequent events. The entry will be re-evaluated after the follow-up of the event is more certain.

Regarding the price trend of BTC, the short-term decline stopped in the yellow support range of US$60,000 to US$62,000. This position is more critical. The main reason is that from the perspective of the overall structure, it has risen since the bottom in September. Breaking through this range can be defined as the second wave of rise. , at present, as long as the price can stabilize above this range, the bullish structure has not been destroyed, and it will continue to be bullish in the future, but as long as the price falls below this range, it is likely to mean that this wave of interest rate cuts is over. At present, the short-term is an opportunity to buy low. BTC has oversold. Many Altcoin have also been aggressive in this wave, and their prices have fallen to support positions. For example, CRV, IOTA, and TIA have all received support in the short-term, which you can refer to.

China is letting off steam, and A-share prices are rising sharply, attracting capital outflows from the crypto.

China released a series of measures to stimulate the market last week, causing the Chinese stock market to experience its largest single-day rise in 16 years on September 30. A-shares have accumulated an increase of about 20% so far. As the market turns to a bull market, Chinese stock market investors are laughing and a large number of investors are rushing to invest in A-shares.

On the other hand, the crypto is relatively bleak. In the past few days, there should even be a lot of talk about the return of A- crypto in major crypto . From the figure below, the negative premium of RMB to USDT over the counter can also be seen. USDT The demand is gradually decreasing and has now reached a long-term relative low. Chinese investors have always played an important role in the crypto. If A-shares continue to rise, it will undoubtedly have a blood-sucking effect on the crypto.

Key U.S. data

The Institute for Supply Management (ISM) released the September manufacturing PMI on October 1, maintaining August's 47.2, shrinking for six consecutive months and lower than market expectations of 47.5, indicating that demand continues to be weak, output declines, and the manufacturing industry continues to be weak. , adding some variables to the prospect of a soft landing.

In addition, the United States will also release services PMI (October 3) and September labor market data (October 4) this week. In terms of the labor market, analysts predict that non-farm payrolls will increase by 144,000, slightly higher than August's 142,000, while the unemployment rate is expected to remain unchanged at 4.2%.

Labor market data is a key reference data for the Federal Reserve to measure economic conditions. Deutsche Bank economists pointed out in the latest research report: "While the overall data is important, the upcoming employment data will provide greater confidence for the Fed to We believe the weak trend is stabilizing." Although Federal Reserve Chairman Powell has declared this week that large interest rate cuts will not be the norm, and has predicted that there is a high probability of a 1-cent rate cut in each of the next two months, according to FedWatch data, the market still does not seem to rule out a 2-cent rate cut in November. possibility.

Labor market data will play a key role in this regard. If the data is not as good as expected, it will intensify the market's concerns about an economic recession and force the Federal Reserve to further cut interest rates.

Changes in crypto market structure

Excluding macroeconomic and geopolitical risk factors, the current situation in the cryptocurrency market is very different from that in the past.

In the current market environment, targets with rising momentum or that can attract investors to buy mostly revolve around "head projects with sound ecosystems" and "meme coins that grasp topic trends." There may be more than 80% of Altcoin in the entire market that are not in these two categories. These Altcoin lack narrative and profitability and can only follow the market trend.

Therefore, investors must be more cautious than before when selecting targets and avoid stagnating capital for a long time on Altcoin that lack momentum. If you do not have the ability to judge the potential of the project, it is better to abandon Altcoin and concentrate capital on leading projects such as BTC, ETH, SOL, and SUI, or simply withdraw money and invest in the Chinese stock market and wait for the market to find its narrative direction again.

Binance Copying Analysis

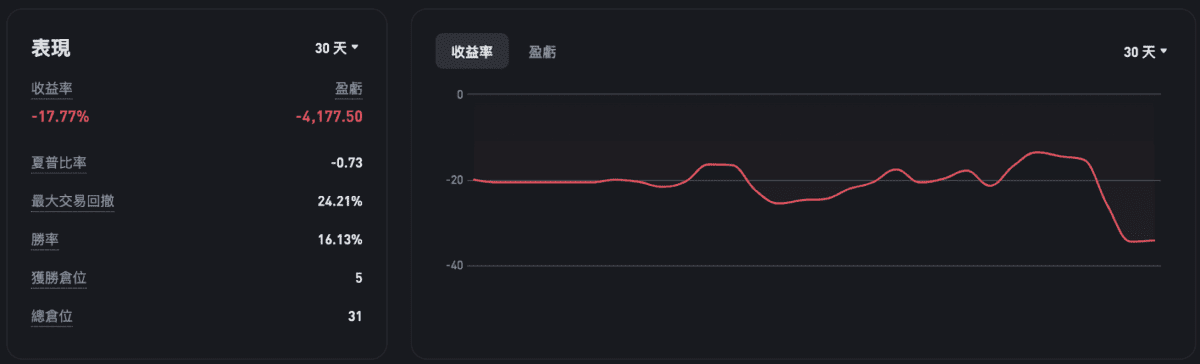

GTRadar – BULL

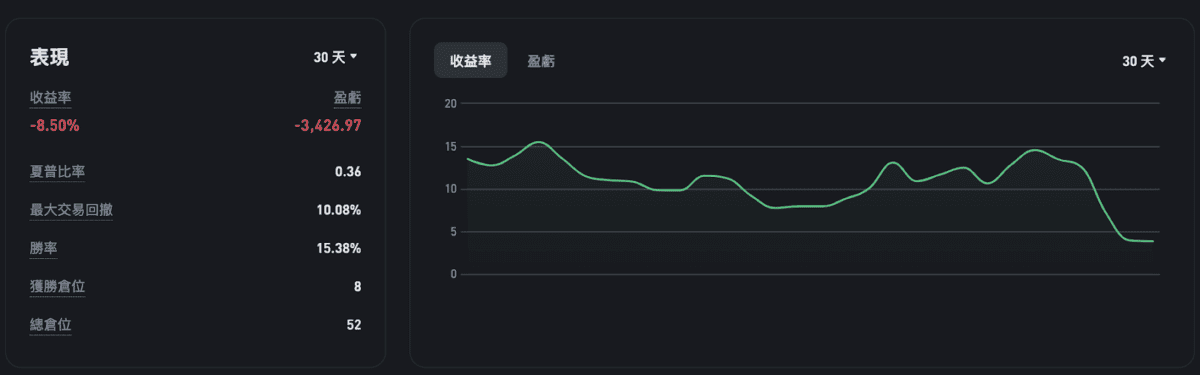

GTRadar – Balanced

GTRadar – Potential public chain OKX

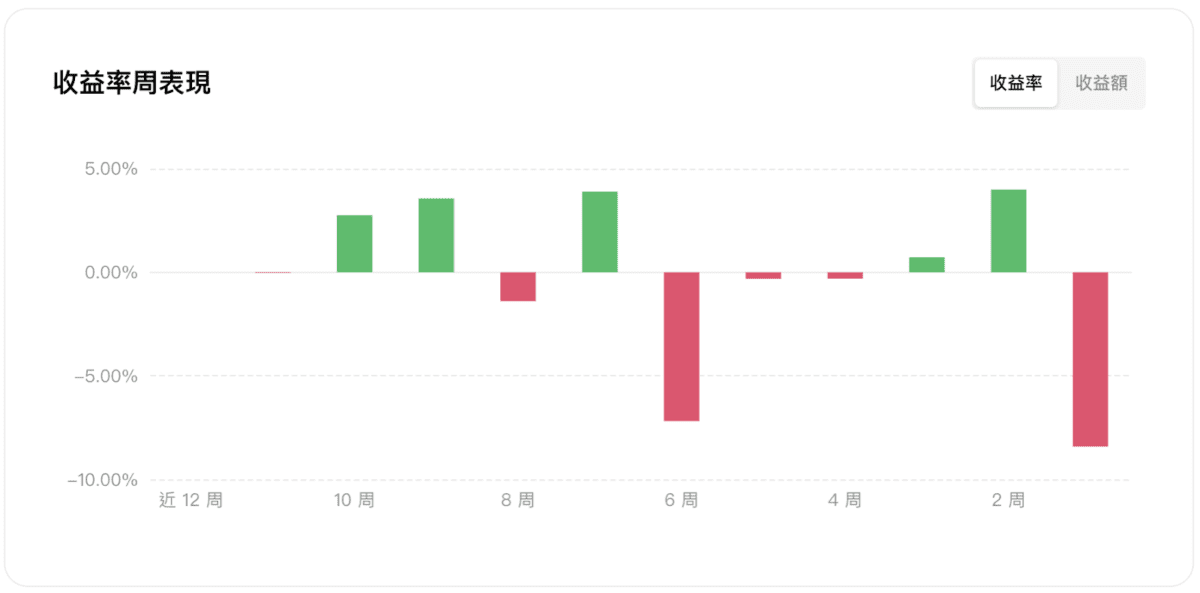

- The yields of "GTRadar - BULL", "GTRadar - Balance" and "GTRadar - Potential Public Chain OKX" in the past 7 days are -20.97%, -7.96% and -8.42% respectively, and the yields in the past 30 days are - 17.75%, -8.51% and -4%.

- Iran launched an attack on Israel in the early morning of 10/1, causing all risky assets to plummet. Because this wave of investment groups were in the early stages of the bull market, the overall proportion of positions was relatively large. Although some positions were urgently sold out at the moment of the plunge, the sudden plunge still resulted in the loss of positions. Substantial losses.

- Currently, "GTRadar - BULL" holds a net long position of 20%, mainly in BTC and ETH.

- Currently, "GTRadar - Balanced" holds a net long position of approximately 10%.

- Currently, "GTRadar - Potential Public Chain" holds about 10% of its net long positions, mainly ETH and SOL.

- The long-term returns of a follower who frequently changes his investment portfolio are not as good as those of a follower who continues to follow a single group. Don’t end the follow-up easily just because of a short-term retracement. Judging from the curve, the retracement is a good time to start following. In and out, on the contrary, the yield rate will be significantly reduced.

Hot news

10x Research: Chances of crypto market rebound in Q4 are high

Markus Thielen, founder and head of research at digital asset research agency 10x Research, believes that with Bitcoin regaining its price of $65,000, the possibility of a rebound in the much-anticipated fourth quarter of the cryptocurrency market is very high, and the gains may be will be realized in advance.

Grayscale update TOP20 watch list: optimistic about SUI, TAO, OP, HNT and other six currencies!

According to the fourth quarter 2024 insights report released yesterday by asset management firm Grayscale, the company assessed Ethereum’s year-to-date performance and updated its research department’s top 20 watch list.

Bankrupt cryptocurrency exchange FTX's restructuring team, led by a team of lawyers from Sullivan & Cromwell, will set aside up to $230 million for preferred shareholders from government forfeiture proceedings. The agreement, disclosed in recent filings, caught creditors off guard because they typically receive repayment ahead of shareholders in bankruptcy proceedings, and it came as creditors overwhelmingly approved the plan ahead of an Aug. 16 voting deadline. , was unaware of the existence of this provision.

CZ(CZ), the co-founder of the cryptocurrency exchange Binance, spoke publicly for the first time after being released from prison, promising to continue investing in the blockchain field, as well as artificial intelligence and biotechnology. He called himself a person who focuses on "impact." "non-return" long-term investor.

According to the latest announcement, the Financial Supervisory Commission has approved the opening of multiple entrustment investments in foreign virtual asset ETFs. However, considering the relatively high investment risks of virtual asset ETFs, and referring to the recommendations of the trade association, initially only "professional investors" will be allowed to invest in multiple entrustment methods. Foreign virtual asset ETFs will be observed and reviewed on a rolling basis in the future.

The institutional arm of the U.S. cryptocurrency exchange Coinbase emphasized its optimistic expectations for the cryptocurrency market in a report released last week, believing that driving factors such as U.S. interest rate cut expectations and China's monetary stimulus policy may boost Bitcoin (Bitcoin) in 2024. Season 4 performance. Additionally, the exchange also mentioned that Ethereum’s on-chain activity is growing.

South Korea's private pension fund "National Pension Service" (NPS), with an asset management scale of 1,147 trillion won (approximately NT$30 trillion), invested in the Coinbase exchange and holds a large amount of Bitcoin IT enterprise micro-strategy related to cryptocurrency of stocks. In response, the group emphasized to members of parliament that the move was "not for the purpose of investing in virtual assets" and stated that "cryptocurrencies such as Bitcoin are not investment targets." The company explained that these stocks were included in the portfolio only because they were included in the benchmark index.

Many institutions and KOLs will publicly share their personal favorite currencies and target prices on social platforms. As the smart contract public chain second only to Ethereum, Solana naturally has many supporters and bidders, most of whom share target prices ranging from US$300 to US$1,000. However, KOL Evanss6 analyzed the future release of SOL tokens and found that under such a target price, future daily emissions may reach 35.6 million to 120 million US dollars.

Federal Reserve Chairman Jerome Powell said at a meeting hosted by the National Association for Business Economics on October 1 that although inflation is gradually slowing, the U.S. labor market remains solid. He also hinted that there may not be a significant rate cut this month at the Fed's next two meetings.

According to the latest announcement issued by the Financial Supervisory Commission, the regulatory agency previewed the draft specifications and requirements for the "Money Laundering Prevention Registration Measures for Enterprises or Personnel Providing Virtual Asset Services", as well as the "Prevention of Money Laundering and Combating Financing Terrorism for Virtual Currency Platforms and Trading Business Enterprises". Amendments and implementation details of relevant laws and regulations.

The above content does not constitute any financial investment advice. All data comes from GT Radar official website announcements. Each user may have slight differences due to different entry and exit prices, and past performance does not represent future performance!