From Bitcoin going from bearish to neutral to Kraken Delisting XMR across the entire European Economic Area, here are some of the top stories in the crypto space.

Bitcoin (BTC) no longer looks bearish based on several key indicators, says a prominent blockchain analyst.

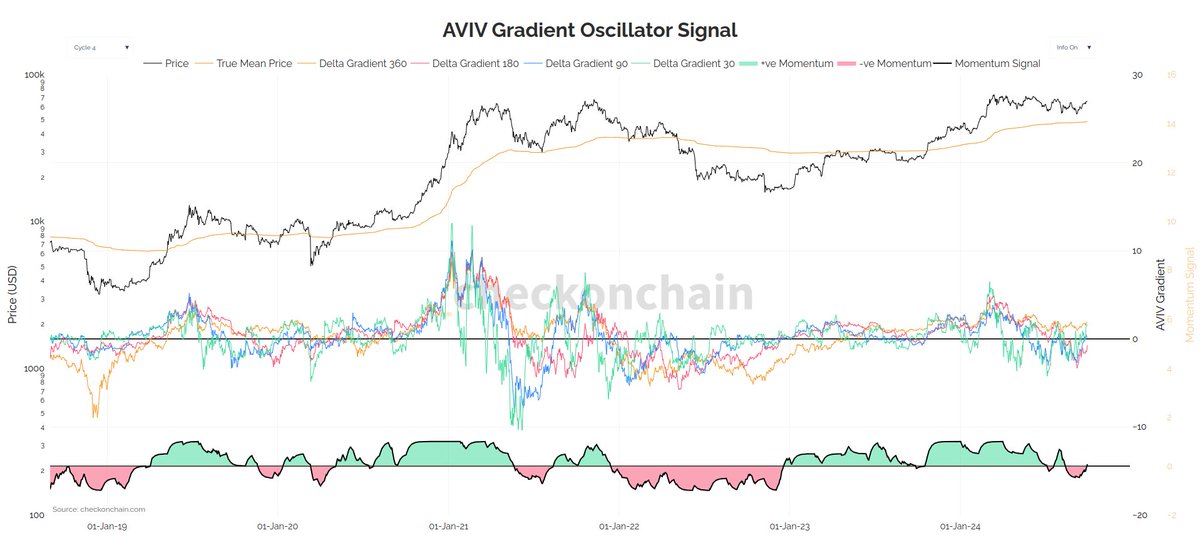

Checkmate told his 98,300 Watcher on media platform X that Bitcoin’s Active Value to Investor Value (AVIV) ratio has shifted from bearish to neutral.

AVIV is the ratio between the active Capital , which excludes lost or inactive Token , and the actual capitalization of investors, the price at which BTC was purchased. This indicator helps assess whether Bitcoin is in an overbought or oversold condition.

“Bitcoin market momentum has returned to neutral. Not completely bullish, but no longer bearish.”

Source: Checkmate

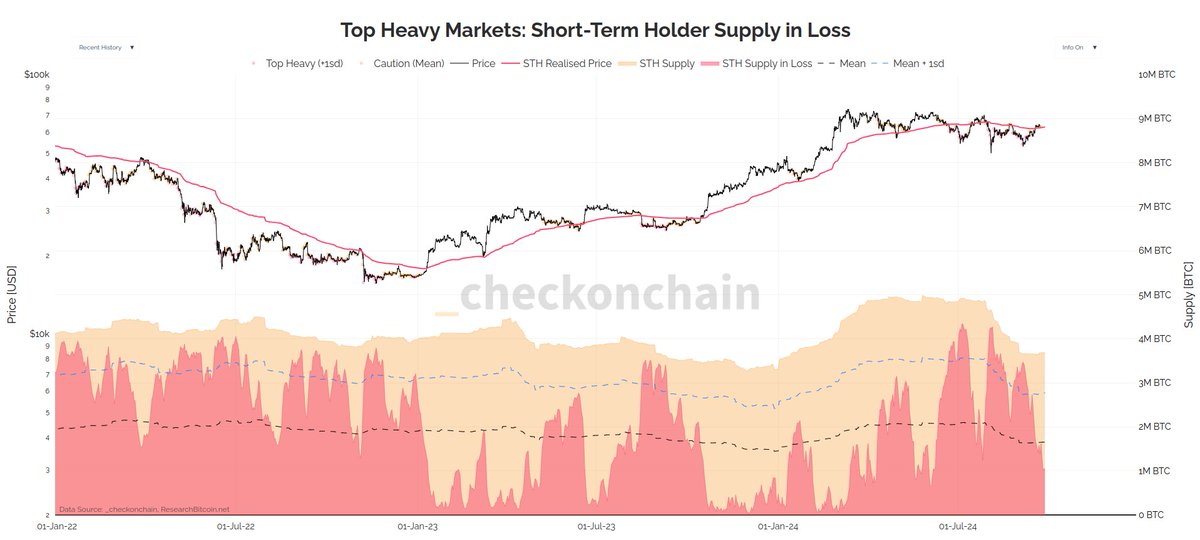

Next, the analyst said the short-term Bitcoin (STH) holder supply metric, which tracks the number of assets held for less than 155 days, is starting to turn bullish.

“Based on short-term holdings, the Bitcoin market is no longer ‘volatile’. This means that the majority of recent buyers have returned, which is likely to improve sentiment.”

Source: Checkmate

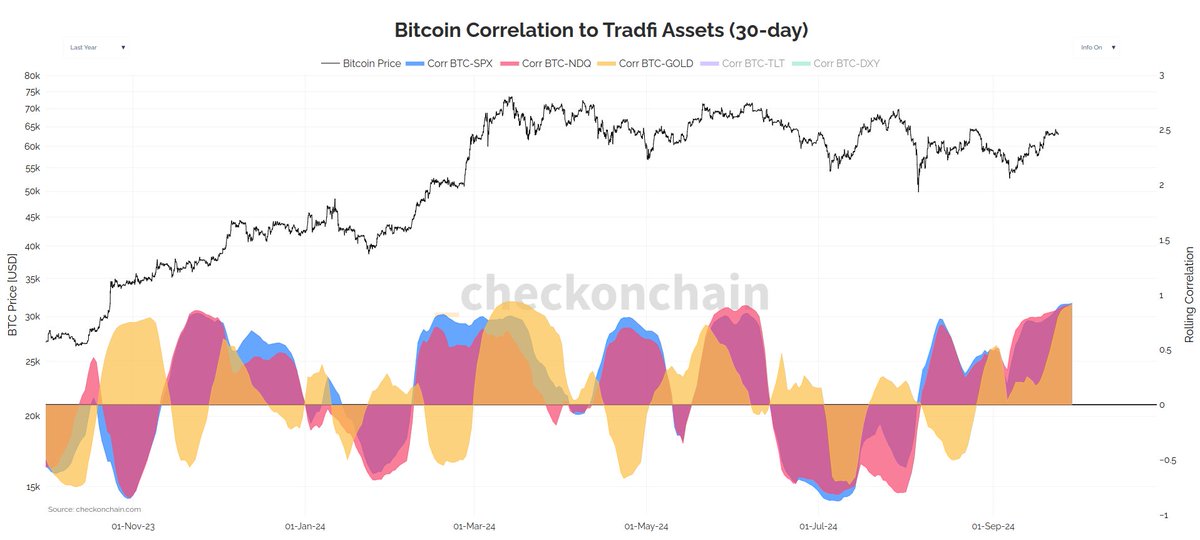

Ultimately, the analyst said Bitcoin appears to be moving in tandem with gold and stocks, which are in an uptrend.

“Bitcoin is now correlated with Gold and stocks over the past 30 days. That’s pretty good, as all of these assets are hitting new ATHs.”

Source: Checkmate

Ripple has been ramping up its stablecoin testing efforts and minting large volumes of RLUSD over the past few weeks.

The company minted 99% of the stablecoin's total supply (800,000) in a 24-hour period from September 28 to 29.

Ripple’s RLUSD stablecoin has a total supply of 812,034 across two blockchains – Ethereum and XRP Ledger.

Meanwhile, data from Coinalyze shows that XRP ’s open interest (OI) rose to a high of $1 billion on Sunday and then adjusted down to $846 million on Wednesday.

XRP OI in the Futures Market | Source: Coinglass

While Ripple stablecoin trials are underway, the payments remittance company is working with regulators to obtain relevant licenses to drive adoption of its financial services infrastructure.

Ripple announced on Tuesday that the company has received a license from the Dubai Financial Services Authority (FSA).

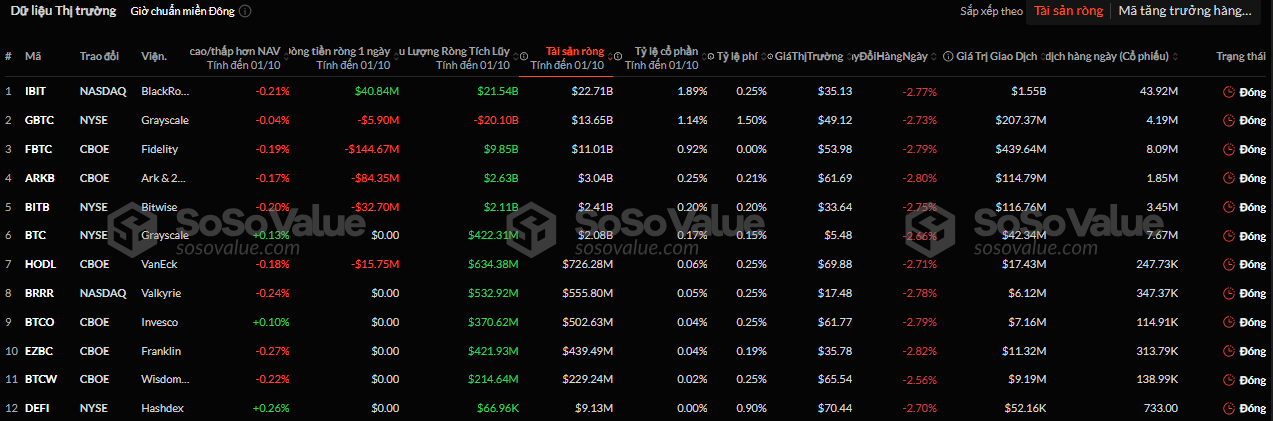

On October 1, total net outflows from spot Bitcoin ETFs were $243 million, marking the first net outflow in the past eight days.

Fidelity FBTC had an outflow of $144 million, ARKB had an outflow of $84.35 million while BlackRock ETF IBIT recorded an Capital of $40.835 million.

Source: SoSoValue

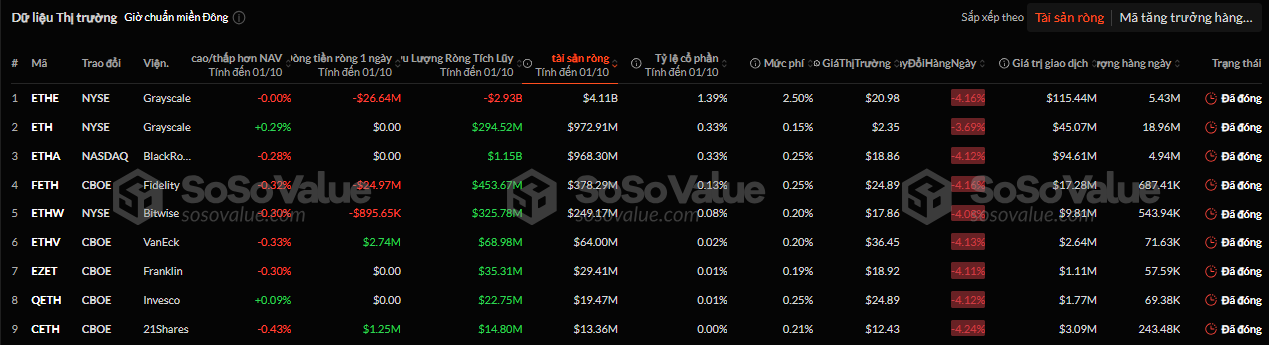

Also on October 1, total net outflows from Ethereum spot ETFs were $48.519 million, with ETHE and FETH outflows of $26.64 million and $24.97 million, respectively.

Source: SoSoValue

According to a press release on October 1, BitGo, a leading digital asset custodian, will provide custody services for USDA, a Cardano based stablecoin.

The partnership includes BitGo Trust, the USDA’s Anzens issuer, and EMURGO, the technology provider behind the Anzens platform.

Their joint efforts will focus on creating a secure stablecoin solution for the Cardano blockchain, which will also strengthen the security and functionality of the USDA by integrating it into advanced financial infrastructure.

BitGo’s involvement will help strengthen the USDA’s security and efficiency, in line with Anzens’ goal of bridging the traditional and crypto financial ecosystems, according to the announcement. The partnership will streamline and ensure compliance for minting, burning, and custody services.

Solana DEX Volume Surpasses Ethereum for the First Time in 43 Days.

SOL recorded a volume of $91.12 billion over the past week, surpassing ETH’s $90.94 billion.

Telegram founder Pavel Durov has clarified that, since 2018, the platform has been disclosing criminals' IP addresses and phone numbers upon legal request.

The recent privacy policy update simply unifies existing rules, with Telegram continuing to protect user privacy while complying with regulations from legal authorities.

Binance announced that its mobile and web apps are now “fully available” to users in Argentina after registering as an official cryptocurrency service provider in the country.

The exchange highlighted that it has been included in Argentina’s Virtual Asset Service Provider (VASP) register under the National Securities Commission (CNV). This is its 20th attempt with regulators around the world.

After registering in Kazakhstan, India, and Indonesia, Binance subsidiary Tokocrypto received an official license from the Indonesian Commodity Futures Trading Authority on September 9.

Binance also announced that it will delist and cease trading on the following spot trading pairs: ACE/FDUSD, FIL/ BNB, OP/ BNB , and TRB/FDUSD at 10:00 on October 4 (UTC).

The exchange removed the above spot trading pairs due to various factors such as low liquidation and volume.

South Korea's largest exchange, Upbit, announced that it has launched KRW, BTC , and USDT trading pairs for Wormhole (W) at 17:00 on October 2 (UTC).

Wormhole is the chain bridge protocol of the Solana ecosystem. In response to this news, the price of W surged by more than 20% and is currently trading around $0.372.

Source: TradingView

Coinbase announced that it will add ionet (IO) and Degen (DEGEN) to its listing roadmap.

ionet is a distributed GPU AI project on Solana. The project's IO Token has dropped 14% in the past 24 hours; meanwhile, Degen is a memecoin issued on the Base chain and Farcaster ecosystem, whose price has increased by 83% in the short term.

Kraken has announced the Delisting of Monero (XMR) across the entire European Economic Area (EEA) due to regulatory changes.

Effective October 31, 2024 at 22:00, trading and deposits for all XMR markets will be halted and any open orders will be automatically closed.

Customers will have until December 31, 2024 to withdraw their XMR holdings. After this date, any remaining XMR balances will be converted to Bitcoin (BTC) at market rates, with the converted BTC redistributed to customers by January 6, 2025.

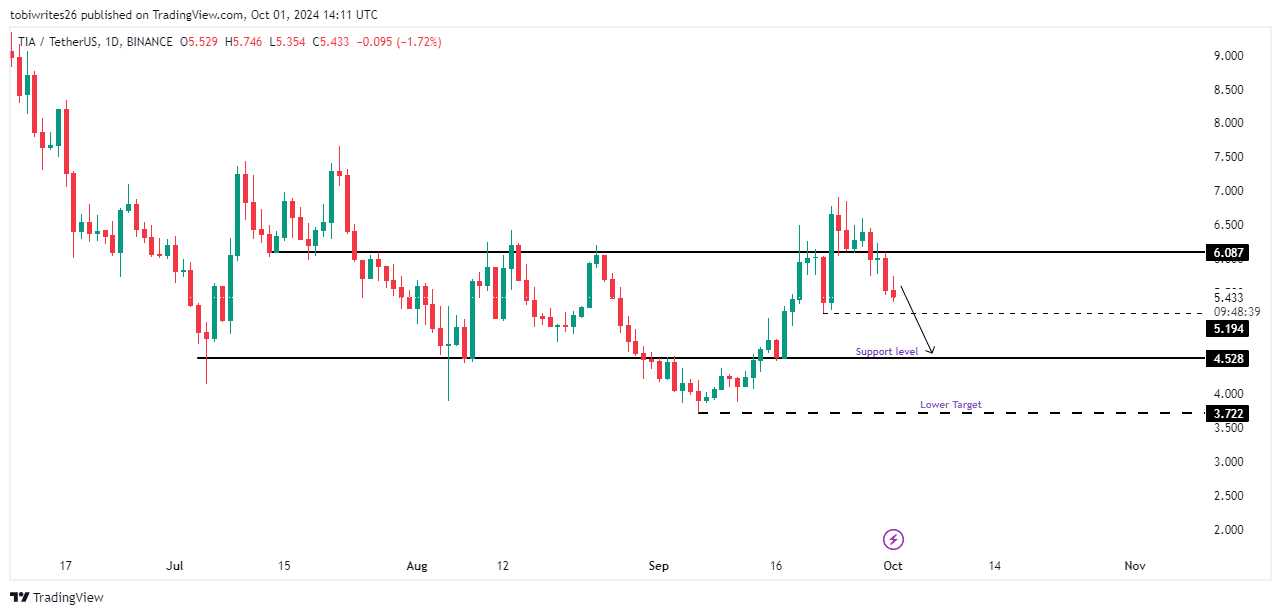

Celestia (TIA) has recorded a drop of nearly 9% today, as market sentiment continues to turn negative.

TIA has been fluctuating within this range since entering a consolidation channel in early July. Currently, the price is reacting to the resistance line, where TIA is facing strong selling pressure.

This resistance level became a focus for market participants to potentially push prices lower, as witnessed by a daily drop of nearly 9%.

Source: TradingView

If this selling pressure continues, TIA is expected to drop to the $4,528 support level, where it could find temporary stability. However, with continued downward momentum, TIA is likely to hit its September low at $3,722 or even fall further.

Mysten Labs, the developer of the L1 Sui (Sui) blockchain, has introduced Warlus, an innovative decentralized storage network for blockchain applications and autonomous agents.

Leveraging advances in erasure coding, Walrus enables fast and robust encoding of unstructured data Block into smaller pieces, distributed and stored across a network of storage nodes.

Developers can now access the binary client operated from the command line interface, JSON API, and HTTP API.

Sui is currently priced at $1.86 with a market Capital of $5.14 billion and a fully diluted market Capital (FDV) of $18.6 billion.

Three Arrows Capital's newly launched memecoin 3AC is now down 50%.

Previously, the infamous founders of Three Arrows Capital, Zhu Su and Kyle Davies, launched the memecoin Three Arrowz Capitel (3AC), last week.

After attracting the attention of a segment of investors in the market, helping 3AC's Capital increase from 0 to 170 million USD just a few hours after its launch, the price of memecoin has continuously decreased in recent days.

The reason is because of the constant insider trading allegations that have been brought up and aimed at this memecoin, claiming that the team behind 3AC has intentionally controlled the supply to manipulate the price.

Three Arrowz Capital also allocates up to 50% of the total supply of memecoin to an internal wallet, as well as levying a 1% tax on every purchase and sale to collect an additional 7% of the total supply as of now.

3AC is currently down 15% over the past 24 hours, with a market Capital of just $43 million, down more than half from four days ago. Three Arrows Capital’s Memecoin has been listed and supported for trading on several CEX exchanges such as MEXC and Gate.io

MHC Digital Group and Circle have announced plans to collaborate to increase the distribution of Circle ’s USDC to institutional investors in Australia and the Asia-Pacific region.

MHC Digital will seek to provide “efficient and cost-effective access to USDC ” to wholesale clients.

As part of this initiative, MHC Digital is launching an OTC trading service targeting high net worth individuals, hedge funds and crypto businesses in the region.

AutoLayer (LAY3R) will be initially listed on Kucoin, Gate and MEXC on October 3, 15:00 (UTC).

Recently, AutoLayer was launched on Kucoin GemPool with a total reward of 230,000 LAY3R, lasting until October 10.

Previously, LAY3R conducted IDO on Magic Launchpad, Poolz, ChainGPT, and Ape Terminal. The IDO price was $0.65, with a valuation of $19.5 million and an initial market Capital of $890,000.

AutoLayer is a multi-chain hub for LRTfi, providing one-click Staking and liquidation Staking along with other DeFi strategies and incentives.

The company raised $2.5 million in a Capital round backed by Morningstar Ventures, Poolz Ventures, Kucoin Labs, Staked.vс, BlackEdge Capital, Spark Digital Capital, and Dewhales.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine