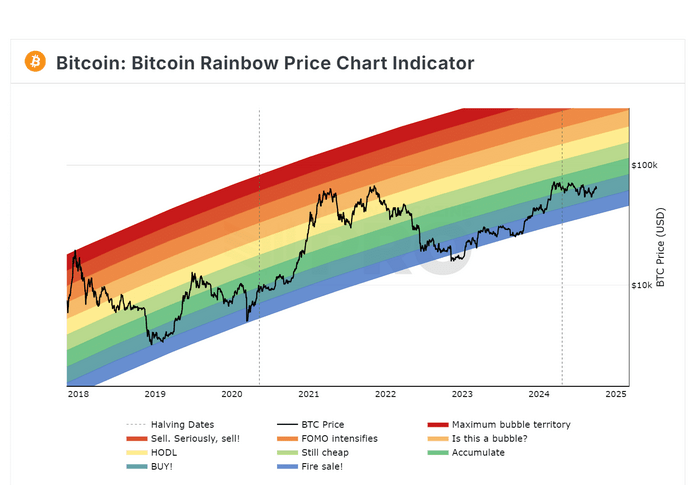

Since reaching its peak in March and experiencing a subsequent decline, BTC has remained in the “accumulation” and “buy” zones according to the rainbow chart.

Over the past seven months, Bitcoin (BTC) has been stable, fluctuating between $60K and $70K. Although the price hasn’t seen major volatility, BTC’s current value is still considered an attractive buying opportunity, especially ahead of Q4, which typically shows strong upward trends.

According to the Bitcoin Rainbow Chart, BTC remains in the “buy” zone. Since its rise in March and the following correction, BTC has consistently stayed within the “accumulation” and “buy” zones.

The Rainbow Chart uses historical BTC price data, where lower color bands indicate that the price is undervalued, while higher bands suggest the market might be overheating.

Other indicators also show that BTC is currently priced quite low.

The Pi Cycle Top indicator suggests that BTC is still far from reaching the top of its current cycle. The large gap between the 111-day MA and the 350-day MA multiplied by 2 indicates that BTC’s bull cycle is still ongoing.

The Puell Multiple, which measures BTC miners’ profitability, also indicates that the current price is in the “discount” zone. At 0.73, this index shows that BTC is undervalued, making it an appealing buying opportunity.

Many forecasts suggest BTC will see a strong increase by the end of 2024 and into 2025.

Standard Chartered Bank predicts that BTC could reach $250K by 2025. Meanwhile, CK Zheng, the founder of ZX Squared Capital, believes that BTC will reach a new peak in Q4 2024, regardless of the outcome of the U.S. elections.

He emphasized that high national debt and the U.S. fiscal deficit will make BTC an attractive option when the Federal Reserve cuts interest rates.

If these predictions hold true, BTC’s price could break away from its current level, making this a significant buying opportunity.