Global markets are reacting to rising geopolitical tensions in the Middle East, which has delayed Bitcoin (BTC)’s anticipated October bull run. Before the Iranian missile attack, Bitcoin was trading above $64,000.

Following the incident, the coin’s price fell to $63,500 as investors responded to the macroeconomic factors by selling. This analysis explores the impact of the conflict on Bitcoin price movements, the changes in market sentiment, and the future outlook for BTC.

Iran's Attack on Israel Threatens Bitcoin

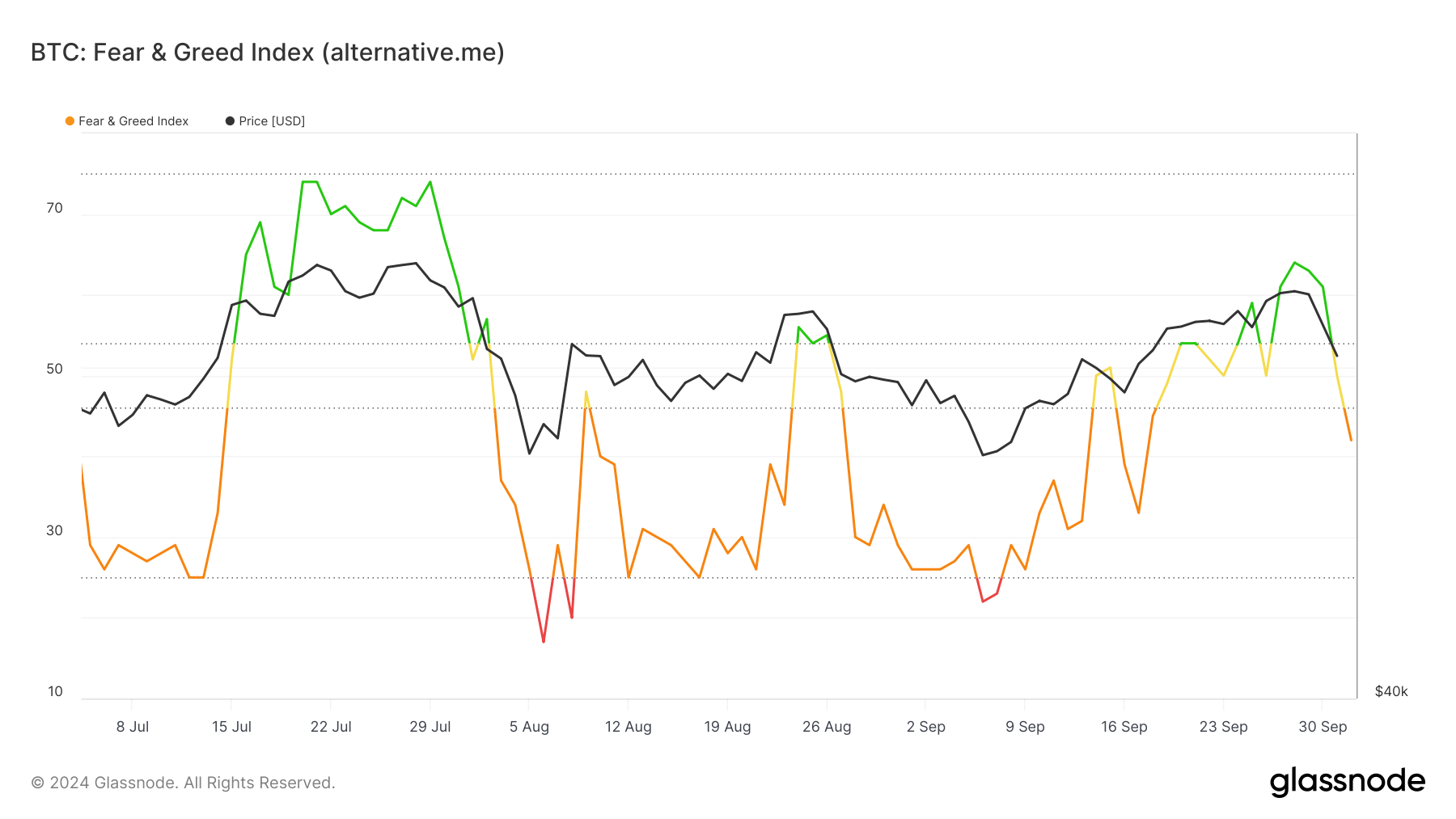

According to data from Glassnode, a cryptocurrency on-chain data analytics platform, the Bitcoin Fear and Greed Index stood at 61 early yesterday, reflecting positive investor sentiment. The index measures market sentiment on a scale of 0 to 100, with values closer to 0 indicating extreme fear, while values closer to 100 indicate greed and optimism.

Before the Iranian missile attack, the index showed strong investor confidence that Bitcoin would surpass $64,000. However, the index has since fallen to 39, indicating growing market fears and a possible pause in Bitcoin’s bull market.

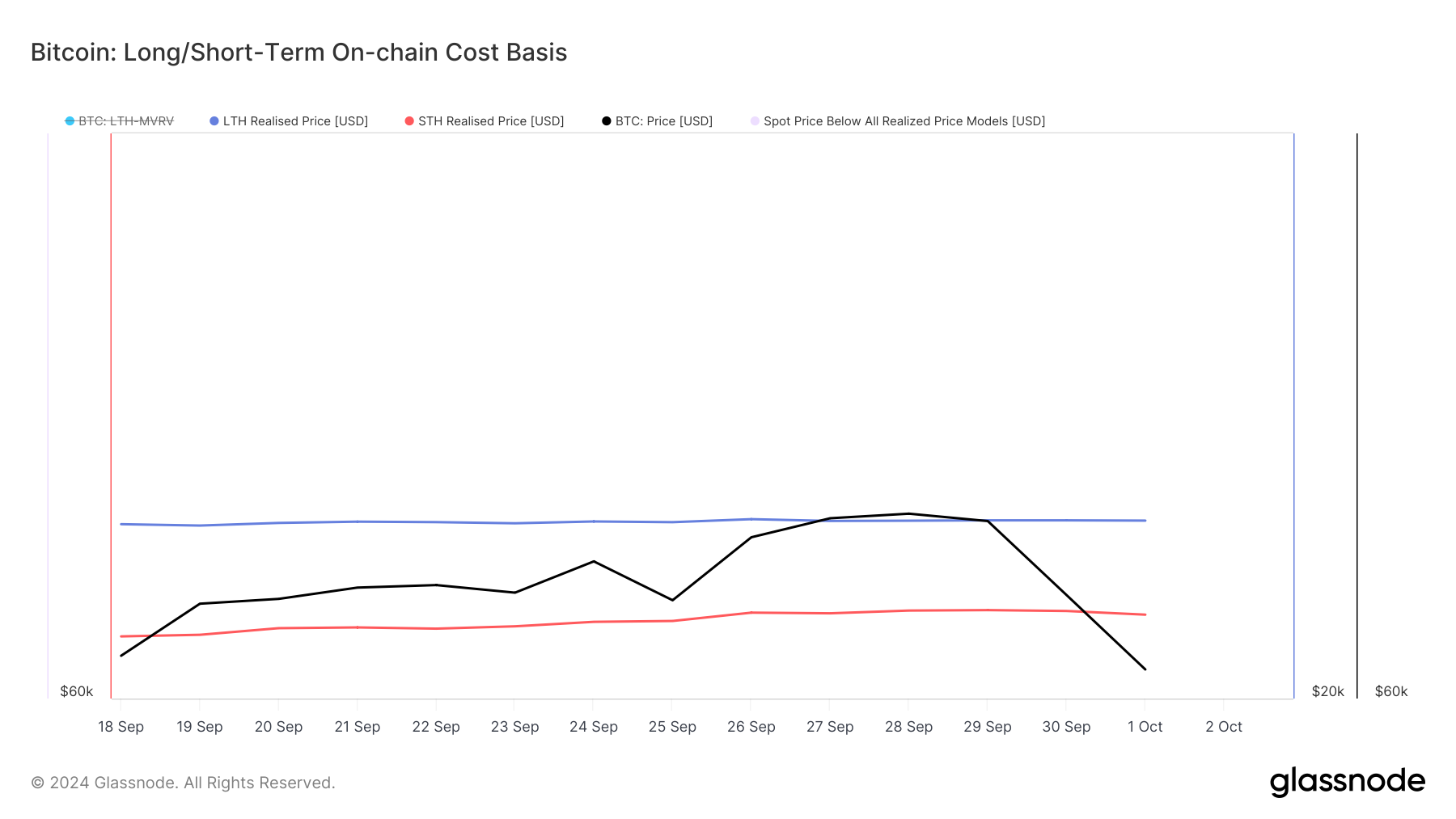

Amid the gloomy sentiment, the price of Bitcoin fell below the Short-Term Holder (SHT) Realization Price, which is the average on-chain acquisition cost over the past 155 days.

If the coin price exceeds this, the trend is bullish and the price can reach higher levels. The current Bitcoin STH realized price is $62,617. This indicates a high level and suggests that Bitcoin is unlikely to approach $80,000 in the short term.

Read more: Top 7 Platforms Offering Bitcoin Signup Bonuses in 2024

BTC Price Prediction: $66,000 is the Key

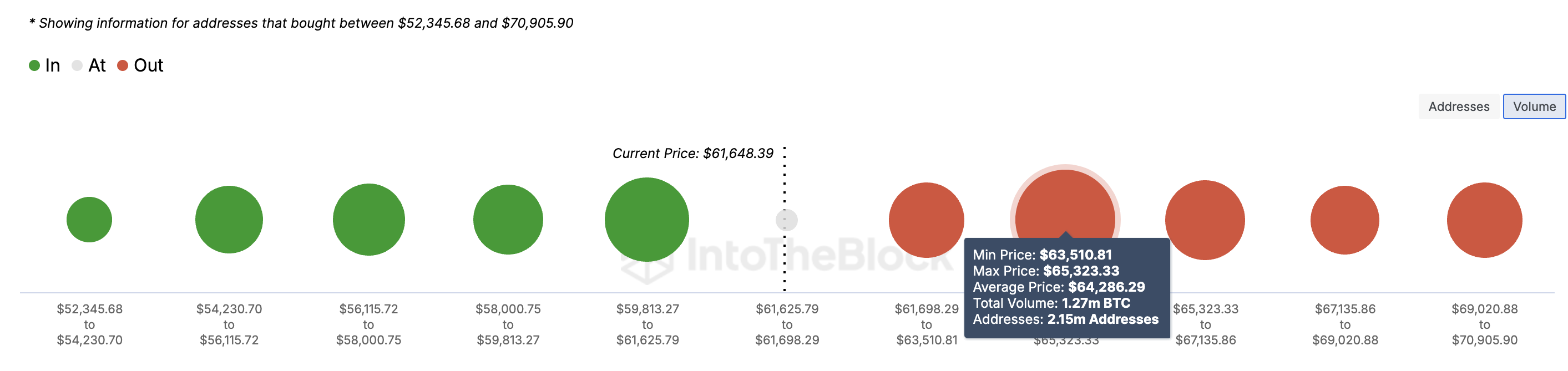

From an on-chain perspective, the inflow/outflow around the price (IOMAP) shows that the area between $63,510 and $65,323 is important for Bitcoin. IOMAP shows the number of addresses accumulating a certain amount at a certain price point.

Generally, the higher the volume, the stronger the support or resistance. As you can see below, in the mentioned area, 2.15 million Bitcoin addresses hold 1.27 million BTC. This volume is higher than the small support of $66,666.

Therefore, it may be difficult for the price of Bitcoin to reach $65,000 in the short term. Instead, it is likely to fall to $59,813.

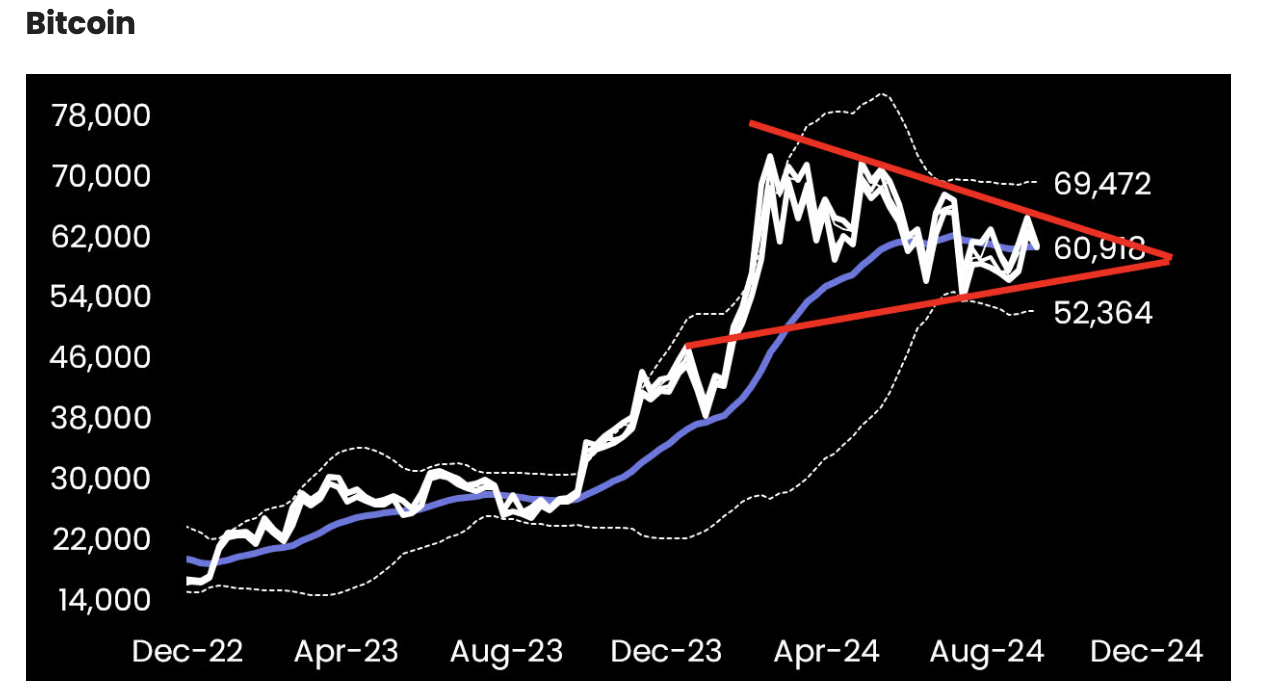

Interestingly, digital asset management firm 10x Research agrees that the $66,000 level is a minor resistance for BTC, stating in a recent report that the price of Bitcoin needs to break above $66,000 to invalidate the current bearish position.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

“The liquidity cycle has not yet fully materialized. Bitcoin’s failure to break above $66,000 coincides with a downside resistance level, which it could have surpassed had the ISM manufacturing data been more favorable,” wrote Marcus Thielen, senior analyst at 10x Research.