Translation | Wu Blockchain about blockchain

Original link:

https://x.com/dgt10011/status/1837278352823972147

On September 21, the U.S. SEC approved BlackRock's spot Bitcoin ETF's options trading proposal, which was the first time that a spot Bitcoin ETF was approved for options trading. Jeff Park, head of strategy at Bitwise Alpha, wrote this article, saying that "we are about to witness the most extraordinary rise in volatility in financial history." The following is the Chinese translation of the full article:

With the SEC’s approval today for the listing and trading of Bitcoin ETF options, I shared a view that we are about to witness the most extraordinary volatility surge in financial history. I feel this deserves a more detailed explanation, so I want to highlight some of the characteristics of Bitcoin, the nature of regulated options markets, and the powerful effect of the combination of the two. It is no exaggeration to say that this marks the most important development in the crypto market.

This is the first time that Bitcoin notional value has been “partially banked” through ETF options. What does this mean? While Bitcoin’s non-custodial, capped supply is its greatest strength, it has also become a drag, limiting its ability to create synthetic leverage. Despite Deribit’s efforts, it has never been able to fully address the counterparty and capital efficiency matrix for widespread adoption, while CME futures options require too much active management. Now, for the first time, Bitcoin has a regulated market, with the OCC protecting clearing members from counterparty risk. This means that synthetic notional exposure to Bitcoin can grow exponentially without the Just-in-Time Delivery (JTD) risk that scares investors. In a liquidity-driven world, unlocking synthetic money flows with leverage represents the biggest opportunity for Bitcoin ETFs, greatly enhancing its financial utility compared to the spot market.

Additionally, Bitcoin can now include duration as part of the leverage calculation for the first time. Retail traders have embraced perpetual contracts for leverage, but these instruments are not perfect and are more like a series of daily near-month options that must be constantly rolled. With Bitcoin options, investors can now combine investments based on duration, especially for long-term investments. There is a high probability that buying a long OTM call option as a premium expenditure is more valuable than the risk of a fully collateralized position that could drop 80% over the same period. People often compare Bitcoin to call options because of its premium decay and occasional explosive rises. Now, you can bet on volatility increases for the same or less premium while capturing more delta on a longer time frame, which is undoubtedly an attractive opportunity.

Bitcoin also has unique volatility characteristics, the most important of which is the “volatility smile”. Most stocks or indices exhibit a “volatility skew”, where upside volatility is cheaper than downside volatility (i.e. protection is more expensive than speculation). Bitcoin is unique in that its price rises and falls equally often, so the market demands a risk premium on both sides. The practical meaning of this is reflected in the second-order Greek letter vanna. Historically, for all options, as the spot rises, implied volatility tends to fall. So while the delta of an option increases (becomes more in-the-money), the rate at which it grows slows — this is positive vanna (dA/dvol), which creates a drag effect. However, Bitcoin options have negative vanna: as the spot price rises, so does volatility, which means delta grows faster. When traders who are short gamma hedge this situation (gamma squeeze), the situation in Bitcoin becomes explosively recursive. More upside leads to more upside as traders are forced to keep buying at higher prices. A negative vanna gamma squeeze is like a refueling rocket.

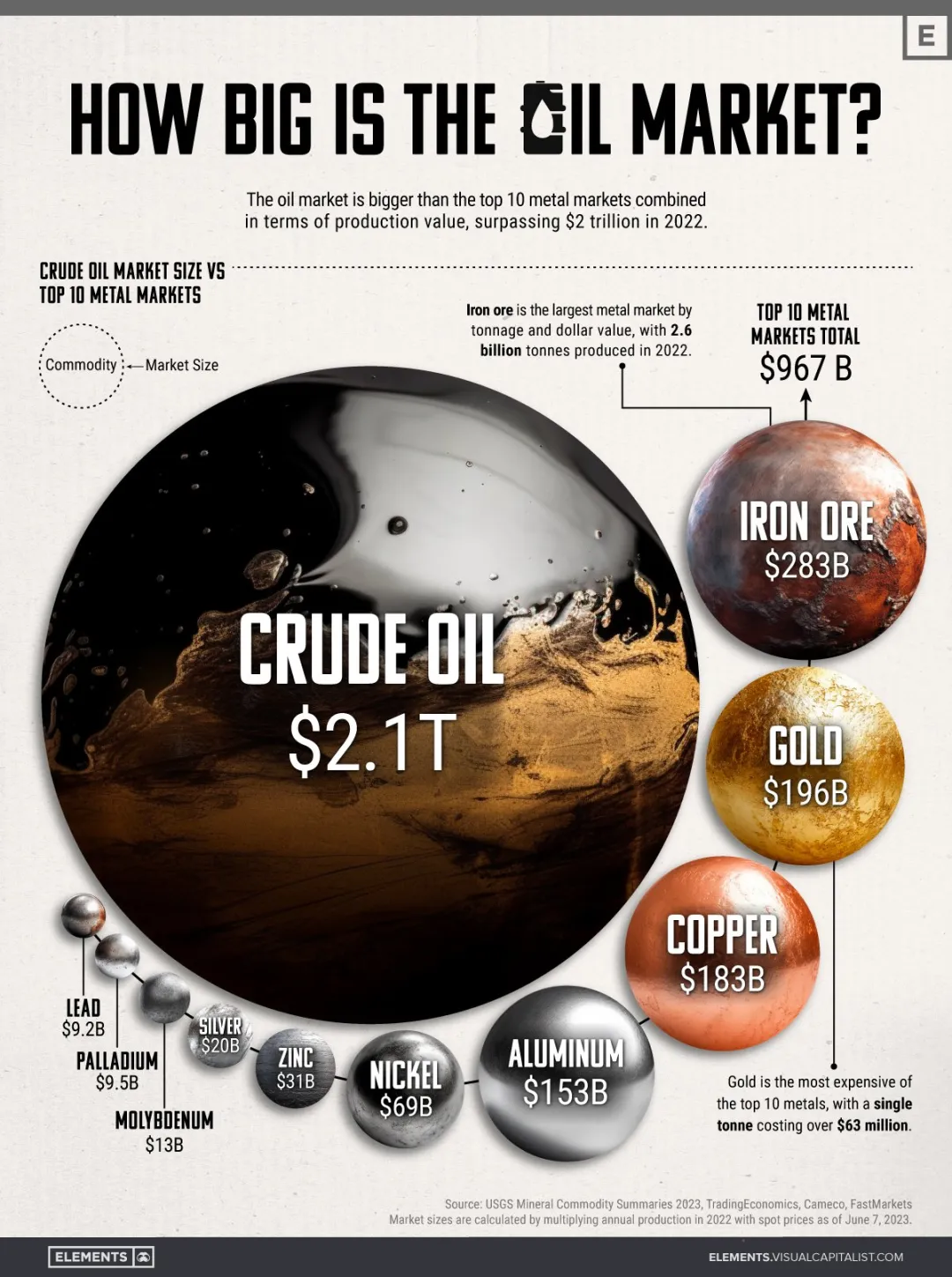

The most critical factor that ties this all together is this: Bitcoin itself cannot be diluted to accommodate this newfound leverage. In contrast, a stock like GME or AMC, where management can issue new shares to take advantage of pricing anomalies, thereby limiting the stock's upside. Bitcoin can never do this. You might ask, "Jeff, what about commodities like oil or gas? Aren't they similar? If so, why is Bitcoin different?" The key difference is that most physical commodities have expiration dates, which means they tend to be traded with futures markets rather than spot markets. Futures markets are different from spot markets in that they vary total and notional exposure based on expiration dates and net interest in physical vs. paper, so they do not allow for concentrated participation in a single direction (i.e., people trading long and short on the curve, physical vs. paper hedging). In addition, these markets are subject to supply manipulation by organizations like OPEC.

In summary, the Bitcoin ETF options market is the first time the financial world has seen an opportunity to achieve regulated leverage on a truly supply-constrained perpetual commodity. In this scenario, things could get really wild and regulated markets may not be able to absorb them easily.

But what’s remarkable about Bitcoin is that there will always be a parallel decentralized market that cannot be shut down, unlike the CME — which conceivably would add more fuel to the fire.

It will be an incredible spectacle.

In addition to Jeff Park, Joshua Lim, co-founder of Arbelos Markets, also expressed his views on this matter. Original link:

https://x.com/joshua_j_lim/status/1838291733261566284

First, we have to remember that the crypto space already has a very well-known and extremely liquid (by crypto standards) options trading venue — Deribit. Bitcoin options trade about $40 billion in notional volume per month, while CME trades about $3 billion. Deribit is an “offshore” and “crypto-native” exchange, and yes, that’s where some retail crypto traders who know a thing or two about derivatives go to trade. But a lot of traditional financial firms also make markets there.

Do you think firms like IMC, Optiver, Citadel, Jane Street, SIG, etc. would not go where there is retail trading volume with healthy margins (relative to other traditional financial macro markets)? I know these firms have had their interest in crypto in fits and starts, but I guarantee that at least some of them are now active on Deribit, and if not directly involved, their former employees have gone on to form countless small (and sometimes large) crypto proprietary trading firms that trade on Deribit.

In addition, there are also a large number of institutional users active on Deribit. We have seen directional traders use the December call spread or 1x2 structure to reduce the cost of upside risk, and there are also volatility arbitrageurs buying high-strike options as the relative value of ATM straddles. And the vega of these large trades exceeds $100,000 in a single transaction. It is hard to say that traditional finance or retail traders are first exposed to Bitcoin options. At the same time, I admit that the 0-dte (zero expiration date option) market of r/wsb (Reddit/WallStreetBets) traders is a force that cannot be ignored.

The memory of GME and AMC is etched in the mind of any options liquidity provider. GME’s peak market cap was about $33 billion, which is only 1/36 of Bitcoin’s $1.25 trillion market cap.

It’s hard to squeeze an asset class with a market cap of over $1 trillion. Can it happen? Of course, crazier things have happened in history. The Hunt brothers squeezed silver in 1980, and a simple search shows that the global silver supply at the time was about $30 billion, which is equivalent to $114 billion today in 1980 dollars, so it’s obviously much harder to push a $1 trillion asset. But Bitcoin is essentially a digital native asset that is easier to financialize and flow quickly in transaction settlements than other commodities. IBIT and other ETFs have increased its liquidity, allowing Bitcoin that was originally used for cold storage to participate in liquid transactions.

There are two more questions worth pondering:

First, why didn’t CME options (based on cash-settled futures, launched in January 2020) or BITO options (ETF based on CME rolling futures strategy, launched in October 2021) lead to a noticeable or large short squeeze in Bitcoin? If you look closely at the BTC/USD chart, you’ll see that both launches were close to local highs for Bitcoin — of course, this is partly due to external factors like the COVID-19 pandemic and the Fed’s rate hike cycle. But it also shows that Bitcoin’s macro flows have a much greater impact on price than options’ gamma squeeze potential.

Second question, if we are going to screen for commodities with short squeeze potential, why not focus on energy, agricultural or metal markets that have smaller supplies and lower annual production? Even in the precious metals space, the total supply of platinum and palladium is less than $1 trillion each.

I’ve read a lot of macro analysis articles lately speculating on the potential for exponential gains in gold and silver (“Is Silver the Next NVIDIA?”), but this is more based on the hard currency properties of these precious metals. Will Bitcoin once again experience a parabolic rise due to its unique properties as a non-sovereign store of value? Of course it could — but this has less to do with a gamma squeeze in the retail options market and more to do with macro capital allocation inflows.

“So, is buying IBIT gamma a good trade?” Maybe! If you believe in Bitcoin’s fundamental thesis! In a way, Bitcoin is the ultimate reflexive asset (i.e., it goes up because it is more likely to become a globally accepted store of value, and that likelihood increases as it goes up).

But waiting for a trade to work is also hard unless you have an extremely keen sense of the market pulse of r/wsb. Look at the chart of GME and imagine what it feels like to hold options on it - 95% of the time, it just fluctuates or slowly goes down.

“Are you completely against IBIT options?” No, the introduction of IBIT options will bring some important positive effects:

First, it will greatly increase the trading volume of the entire derivatives market. Just as the launch of CME options brought more trading volume to Deribit (increased cross-platform arbitrage opportunities), ETF options will have a similar impact.

This impact would be even stronger as prime brokers/FCMs would allow for some sort of risk netting between ETFs and CME products, something that existing crypto OTC and Deribit markets are not yet able to participate in.

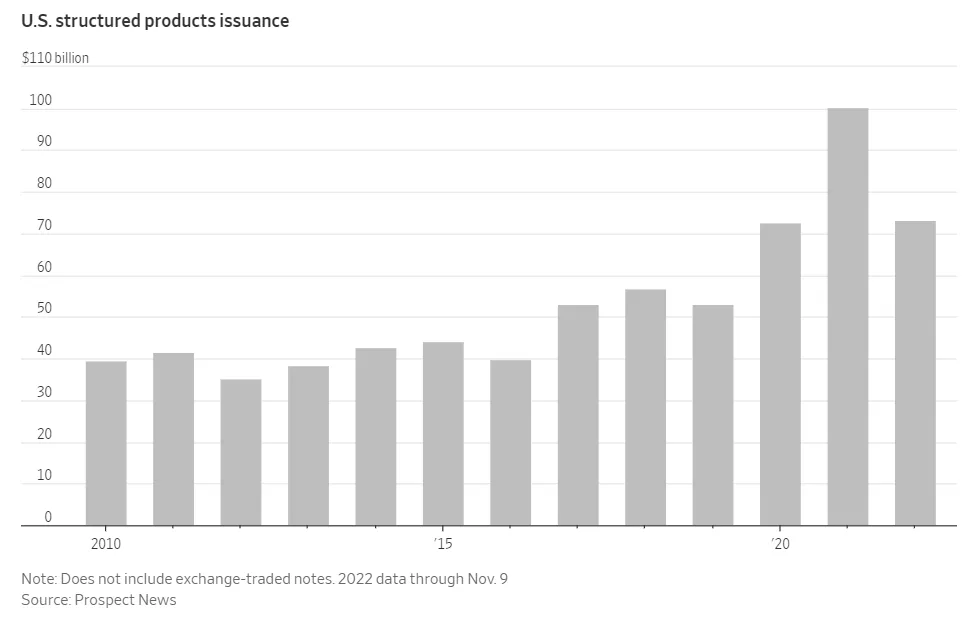

Second, new traditional financial options markets generally suppress volatility as the supply of structured products increases. The U.S. structured note market is about $100 billion a year, mostly volatility sellers who sell options to earn income. If some RIAs (registered investment advisors) or private banks' funds flow into IBIT-linked notes, even if there is only $5 billion in issuance, it would be equivalent to a quarter of Deribit's current open interest of about $20 billion.

Third, with the return of crypto lending, a wave of Altcoin could be triggered. At the end of 2021, one of the largest loan books in the crypto space reached $12.5 billion. The space has not fully recovered since the last cycle. If prime brokers provide USD margin loans using Bitcoin as collateral, this will significantly increase the supply of USD cash in the crypto space. This will prompt funds to circulate from Bitcoin ETFs to higher-risk areas such as memecoins, NFTs, alternative L1s, and speculative VC investments.

An IBIT options market (and market makers’ willingness to take on risk) will make it easier to price risk in margin lending against IBIT and increase the likelihood that prime brokers will be willing to accept crypto assets as collateral for lending, thereby driving a boom in the Altcoin market.

Fourth, the basis spread will narrow. The premium of BTC futures over spot mainly comes from the need for longs to maintain exposure through perpetual contracts or futures. With the easier access to USD funds mentioned above, USD funding rates across the entire crypto ecosystem will decline, thereby compressing the basis spread.

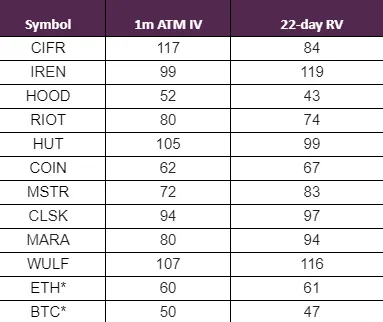

Finally, single stock options for cryptocurrency exposure (e.g., MSTR, COIN, Miners, etc.) currently have higher volatility, typically in the 70–100 volatility range. Bitcoin options typically have a volatility of 40–50. As market makers become more willing to take on the risk of hedging transactions between single stocks and the volatility of the underlying commodity, the volatility of these single stocks may compress and become closer to the volatility of Bitcoin.