Airdrop have been a popular method of Token distribution, especially since 2017, but by 2024 the trend has become saturated, with mixed results. While some projects generate initial excitement, many struggle to maintain long-term user retention and quickly lose value after launch. Let’s XEM at the Airdrop landscape in 2024, evaluating the performance of 62 projects across six different blockchains to determine what separates the successful projects from the underperformers.

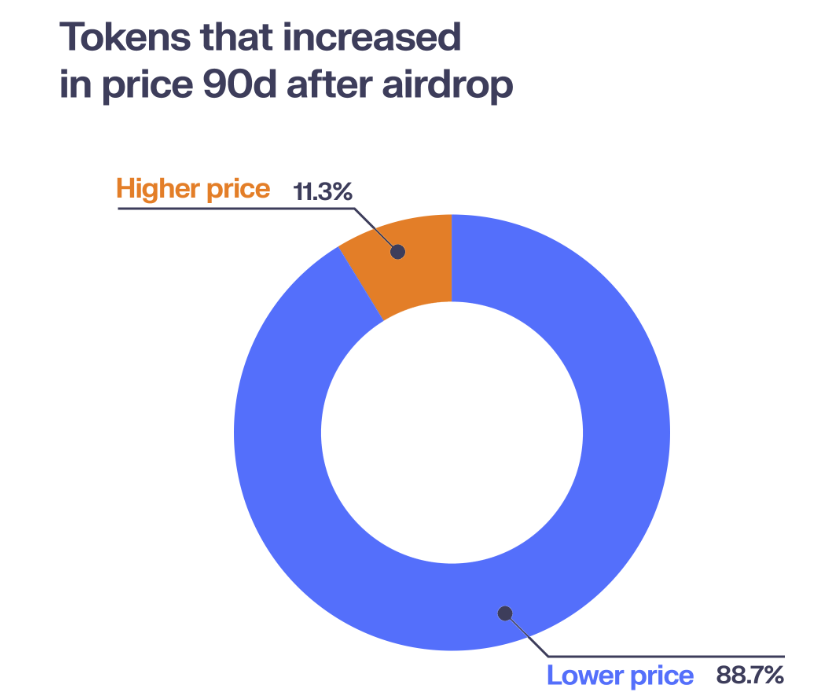

The general trend shows that most Airdrop experience significant selling pressure immediately after distribution. Users often participate in Airdrop only to make short-term profits, which contributes to the rapid decline in Token value. Data shows that many projects fail to maintain interest after the initial reward period, with community participation dropping significantly within the first two weeks.

Source: Keyrock

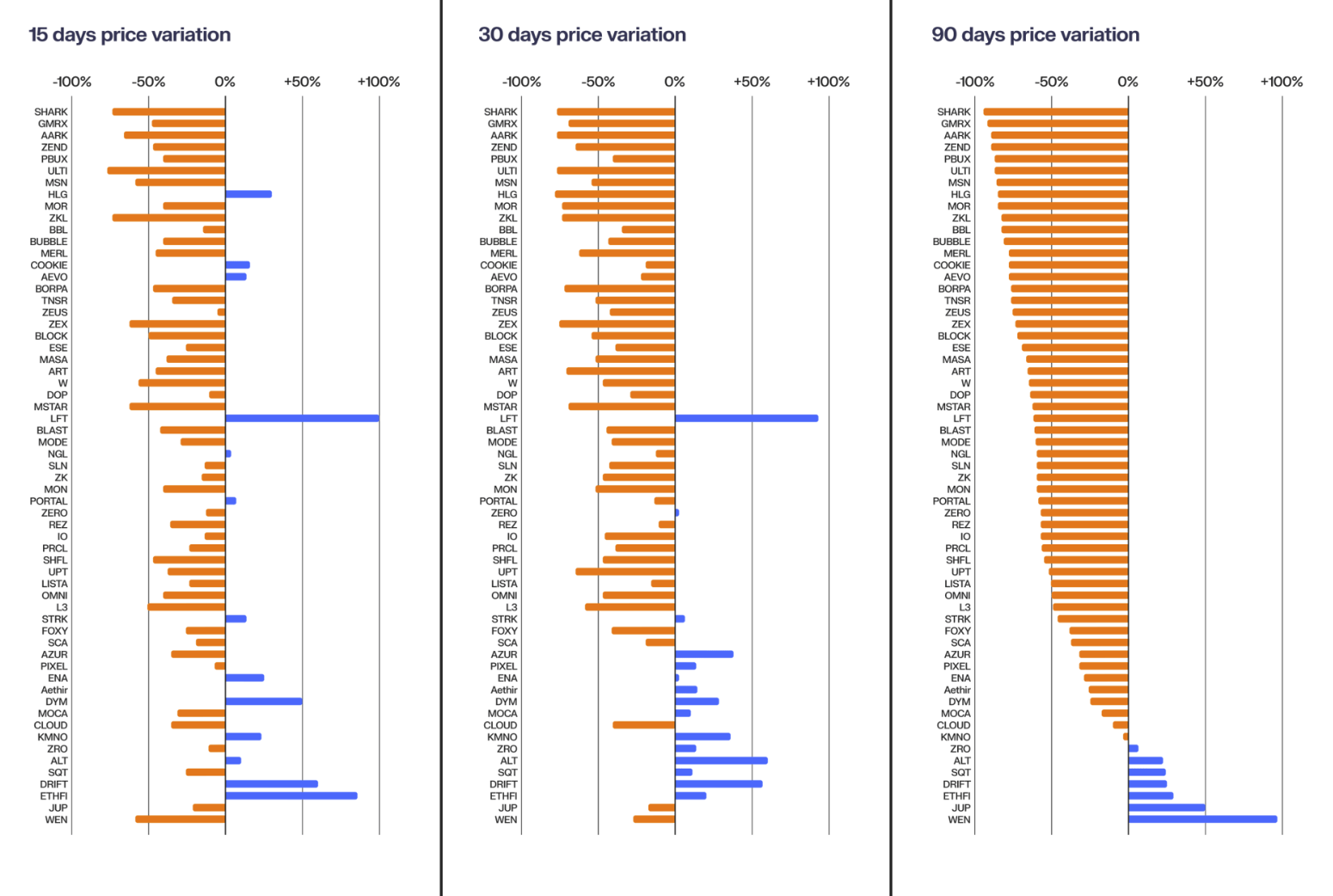

Research shows that most Airdrop Token lose value within 15 to 90 days, reflecting a lack of long-term viability. While the overall cryptocurrency market did not perform well during this period, Airdrop were particularly vulnerable.

Source: Keyrock

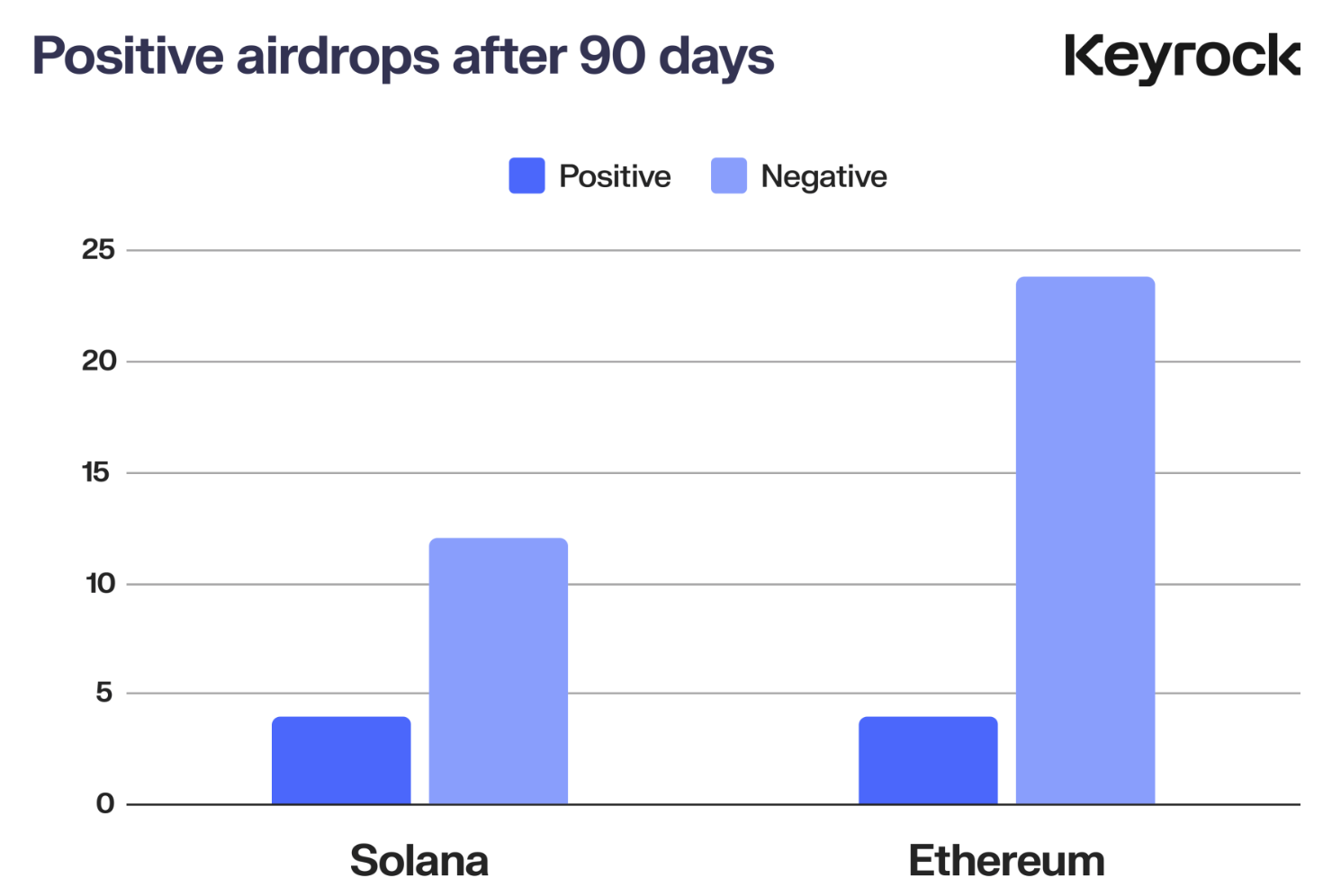

Of the 62 Airdrop analyzed, only eight generated positive returns after 90 days, with Ethereum and Solana being the best performing blockchains. Solana Airdrop had a 25% success rate, while Ethereum had a 14.8% success rate. Layer 2 solutions such as BNB, Starknet, Arbitrum, Merlin, Blast, Mode, and ZkSync did not have positive returns after 90 days.

Source: Keyrock

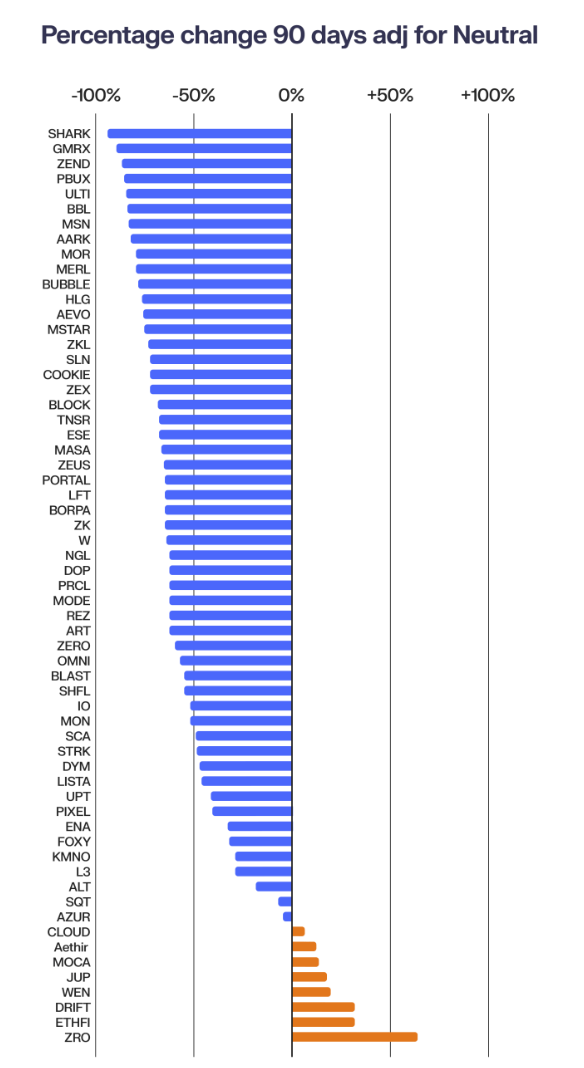

When Airdrop results are normalized against the performance of the ecosystem Token (e.g. comparing an Airdrop on Polygon to the price of Matic), a similar negative trend persists. Despite the overall market decline, Airdrop show a deeper decline than chain Token .

Source: Keyrock

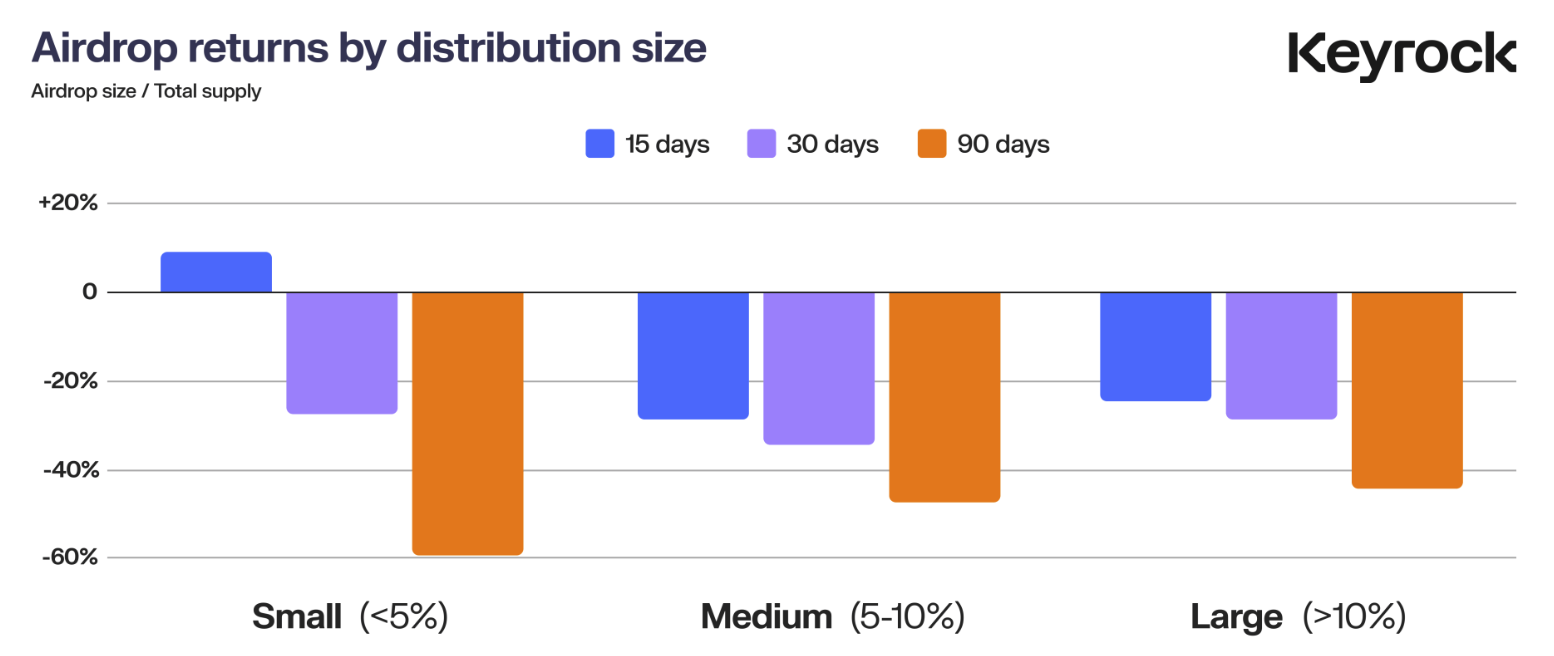

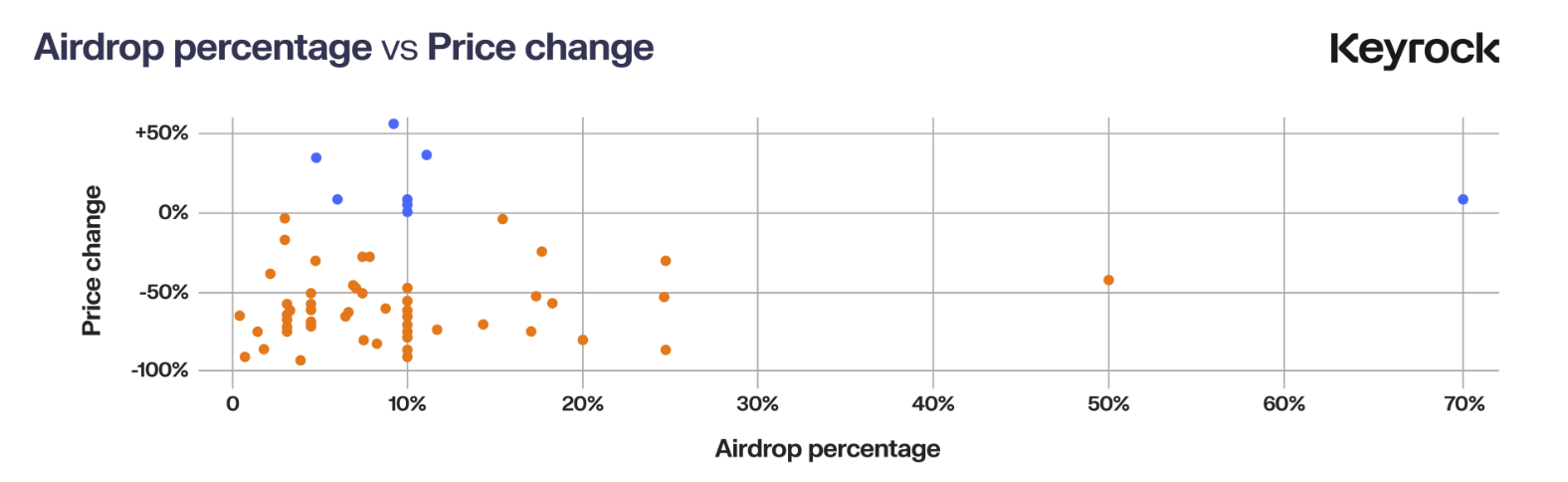

Another important factor that affects the performance of an Airdrop is the distribution of the total Token supply. The amount of Token a protocol decides to distribute can significantly affect its price performance. Does empowering users with more Token lead to better price action, or does it create risk by giving away too much too quickly?

There are 3 groups of Airdrop sizes and their impact on Token price as follows:

Source: Keyrock

More generous Airdrop generate higher investment from users, leading to better price stability and sustainability over time. Meanwhile, smaller Airdrop may provide short-term gains but fail to retain users. Projects with active communities on platforms like Discord and innovative features tend to maintain momentum better.

Source: Keyrock

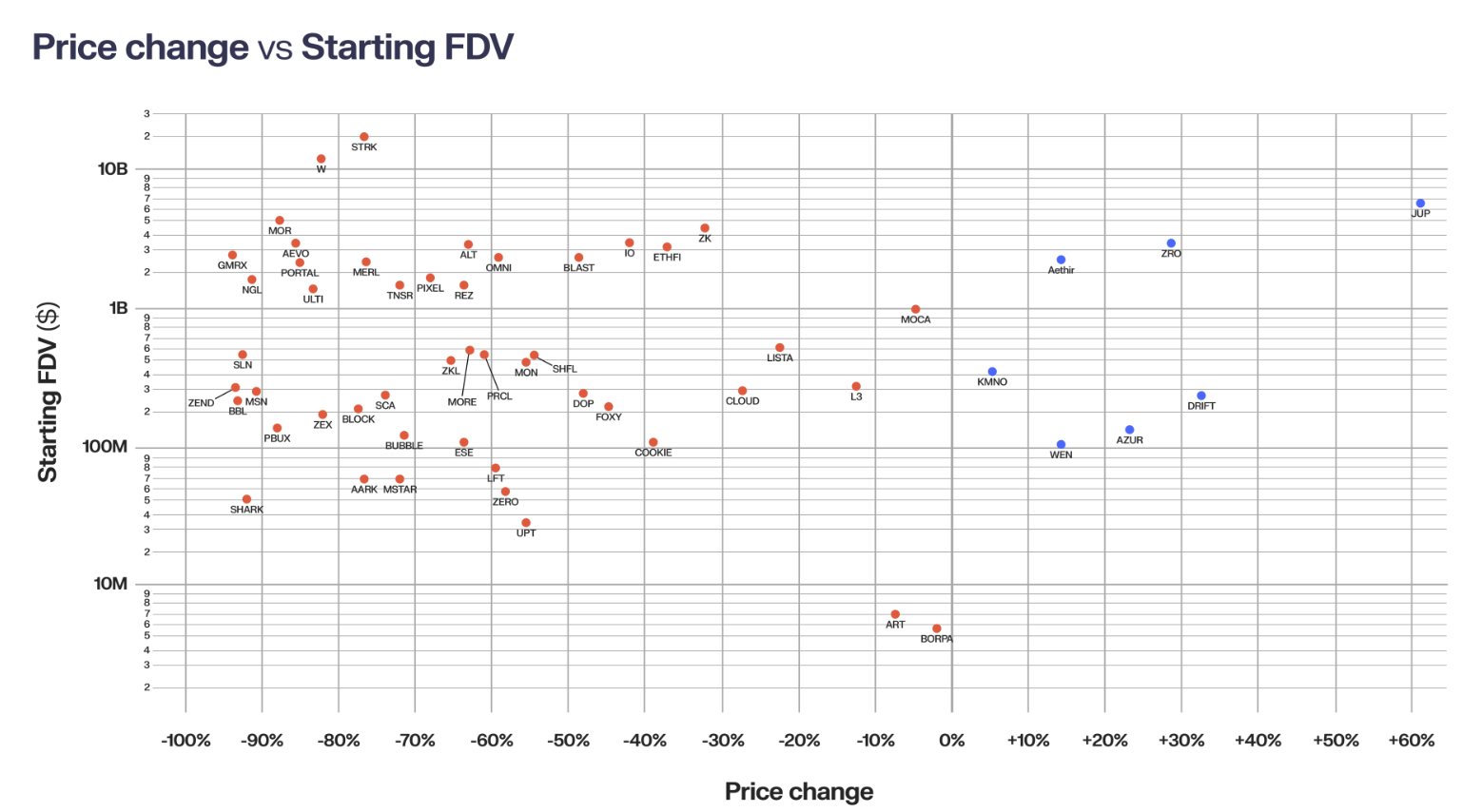

FDV is also an important factor affecting post Airdrop performance. Token with large FDV often have difficulty maintaining their value, as investors tend to favor projects with more growth potential. Projects with high FDV often lack the liquidation needed to maintain their market value, leading to high selling pressure and poor long-term performance. Projects with lower FDV, on the other hand, show less price decline.

Source: Keyrock

Airdrop in 2024 are still a double-edged sword – while they may create initial excitement, most do not create long-term value. However, projects that distribute Token generously, engage the community, and launch with moderate FDV are more likely to be successful in the long run.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to Keyrock