One of the best indicators of cryptocurrency demand shows that some Chinese investors are switching from digital assets to the country's soaring stock market, according to Bloomberg.

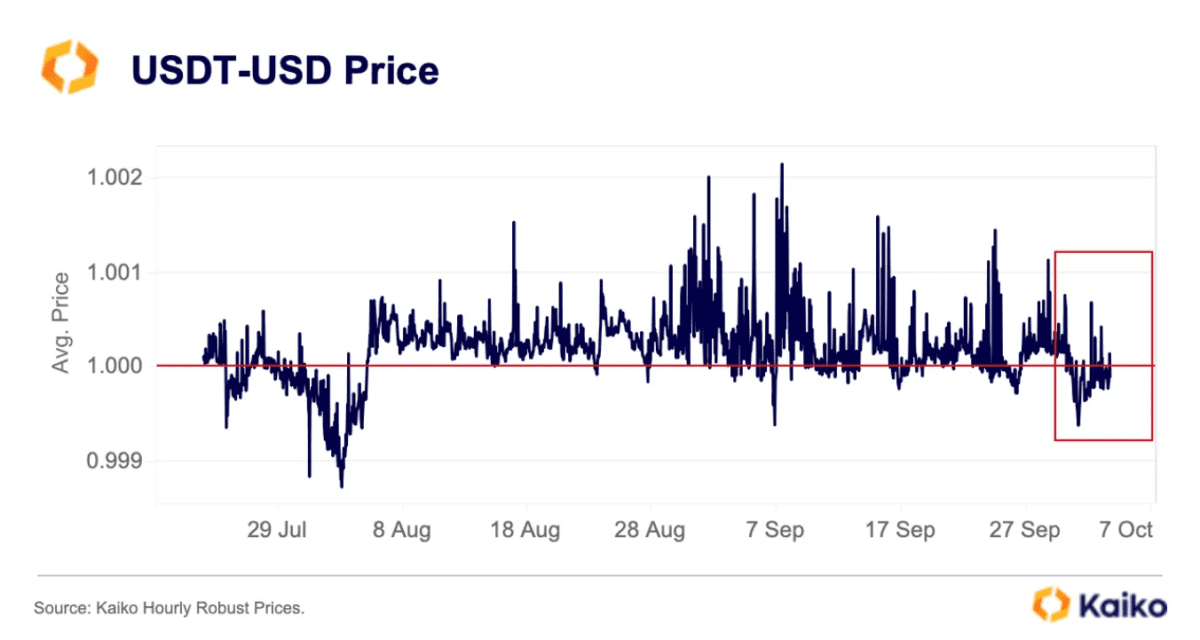

Dessislava Aubert, a senior research analyst at blockchain data company Kaiko, said that since the end of September, USDT, the U.S. dollar stable currency issued by Tether, has often traded at a discount relative to the U.S. dollar. The emergence of this discount is in line with the Chinese central bank’s efforts to curb the deterioration of the economic outlook. A series of easing policies were introduced simultaneously, and these measures drove the stock price to soar.

Livio Weng, CEO of Hong Kong cryptocurrency exchange Hashkey, said: "If traders are rushing to exchange back to fiat currency, it can be inferred that they are panic buying Chinese stocks."

Although China banned cryptocurrency trading in 2021, many mainland residents continue to use overseas accounts and exchanges to buy and sell digital currencies, in part to avoid capital controls and move assets overseas. Kaiko’s Aubert said that due to the ban, there are no USDT/CNY trading pairs on cryptocurrency exchanges, which makes the US dollar the de facto indicator of activity, and this small discount shows increased demand for US dollars and the sale of USDT.

While it’s difficult to measure how much of USDT’s selling pressure comes from Chinese investors on exchanges, some platforms present a clearer picture. Binance’s peer-to-peer trading market shows that RMB merchants quoted prices per USDT in over-the-counter (OTC) transactions ranging from RMB 6.78 to RMB 6.98, while the trading price of offshore RMB against the U.S. dollar in traditional currency markets is RMB 6.78 to RMB 6.98. $7.07.

Annabelle Huang, managing partner of Singapore-based digital asset investment firm Amber Group, said we "can see a correlation with domestic A-share trading demand," with some brokers even opening their doors during China's recent Golden Week holiday to "attract new investors." client". "This may be the first time that people want the National Day holiday to be shorter, which is quite an incredible change," Huang said.

According to Laura Vidiella del Blanco, head of business development and strategy at cryptocurrency hedge fund MNNC Group, demand is not only driven by retail investors, but some of the company’s institutional investors are also shifting capital allocations to Chinese stocks. "These are mostly Asian investors who are familiar with the market and have multiple strategies besides digital assets," Vidiella del Blanco said.

China's Shanghai Composite Index rose 21% from September 23 to September 30.

Related reports:

" Coinbase Report: Bitcoin set for strong fourth quarter, driven by U.S. interest rate cuts and Chinese stimulus policies "

" Chinese cryptocurrency OTC brokers have seen capital inflows exceed $20 billion in the past three quarters "