Hot topics of Master Chat:

Trump and Musk have teamed up to build momentum for the 2024 U.S. presidential election. On October 5, Trump returned to Butler County, Pennsylvania, where he was nearly shot, to give a speech. Musk expressed his support on the spot, praised Trump's perseverance, and mocked the current President Biden.

Musk called on the public to vote actively and changed his Twitter profile picture to an element of the US election. According to Polymarket's forecast, Trump's chances of winning the election have risen to 51%, exceeding Harris's 48%. This move may be good for the crypto market, and it is expected to see an increase by the end of the year.

However, Bitcoin failed to continue yesterday’s upward trend and is currently stagnant. Bitcoin was affected by the risk aversion caused by the rise in US Treasury bond interest rates.

There is still uncertainty in the crypto asset market, and the market direction is expected to be affected by a variety of factors. It is recommended that everyone pay attention to the release of the US September CPI and geopolitical risks.

The current Fear & Greed Index remains neutral, with market participants preferring to buy on dips in prices.

Master looks at the trend:

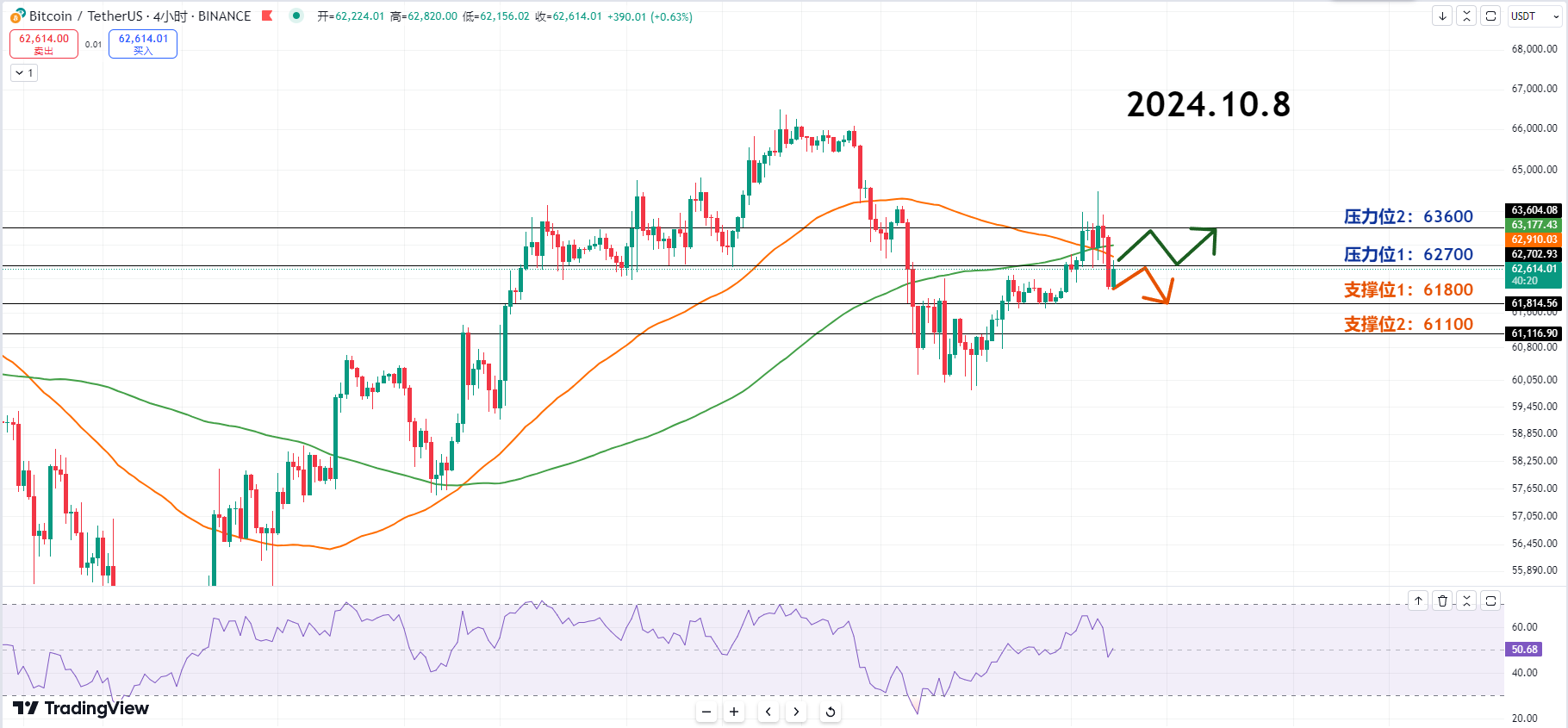

Resistance level reference:

First resistance level: 62700

Second resistance level: 63600

The current price of the currency must first break through the first resistance level to maintain the bullish trend, and 63K has become a new resistance. The second resistance is the short-term high point range, which is an important resistance that must be broken to achieve an increase.

Since it is uncertain whether the first resistance level can be broken in the short term, it is recommended to pay attention to the red arrow trend after the breakthrough. If there is no trading volume during the rebound, it may move towards the short-term adjustment trend of the blue arrow.

Support level reference:

First support level: 61800

Second support level: 61100

If it falls below 62K and touches the first support level, I do not recommend entering the market immediately at the low point, but waiting for an entry opportunity in the middle of 61K.

If the psychological support level of 62K is lost, there may be disappointment selling, which will create opportunities for lower prices. It is recommended to wait for the opportunity to act.

Today's trading suggestions:

In today’s trading, as Bitcoin gives back the previous day’s gains, further declines can be expected and long positions can be entered opportunistically.

I personally think that if Bitcoin falls, it will be a good time to enter the market in the short term. It is recommended to buy in batches and increase positions in batches within a certain falling range to reduce the cost of holding positions.

10.8 Master's short-term pre-buried order:

Long entry reference: 60800-61100 range, long in batches, 500 points of defense, 61800-62700

Reference for short entry: 63600-63900 range short in short 500 points defense target 62700-61800

The content of this article is exclusively planned and released by Master Chen (public account: Master Chen, the God of Coins). If you need to know more about real-time investment strategies, unwinding, spot contract trading methods, operating skills, and K-line knowledge, you can add Master Chen to learn and communicate. I hope it can help you find what you want in the crypto. Focusing on BTC, ETH and Altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates of macro analysis articles, technical indicator analysis of mainstream coins and Altcoin, and spot mid- and long-term review price forecast videos.

Warm reminder: Only the column public account (pictured above) in this article is written by Master Chen. The other advertisements at the end of the article and in the comment area have nothing to do with the author himself! ! Please carefully distinguish the true from the false. Thank you for reading.