Original author: Sleeping in the rain, crypto KOL

As mentioned in the previous introduction, this October Outlook will be very concise. I will only talk in detail about the 3-5 tokens that I personally want to participate in. I hope everyone will like this format (it was too scattered before and the information efficiency was not high).

TLDR: $UNI $SOL Berachain |_20241111120232_| $WELL $ENA

Market hype is generally divided into two modes. One is artificial narrative, which generally pushes a leading token to an independent trend, such as $SUI. The other is the brewing, emergence and outbreak of innovation. This innovation may be a fun Ponzi, or it may be a narrative that largely meets market demand, such as $AXS (this round of memecoin is an atypical case).

Generally speaking, the first wave of narratives will give ordinary people more opportunities. This kind of big innovation is often born in the context of macro liquidity spillovers - funds have a higher demand for money-making effects and capital efficiency, and demand drives innovation.

A big problem in this round is that "there is no narrative that can guide the inflow and transfer of liquidity like in the previous round", and liquidity is the key to asset pricing. If the narrative cannot guide liquidity, it will be difficult to hype assets. Everyone is hyping memes and paying attention to memes. As long as there is some movement, related memes will quickly appear. But meme narratives are also the easiest to make investors tired, and ultimately a mess.

So is there still a chance in the crypto?

I think yes, at least there are several main narratives in the crypto that are developing in parallel.

Intention Abstraction & Chain Abstraction

The ultimate goal of this narrative is to "allow users and liquidity to enter and participate in Crypto in a low-threshold and non-sensing way", which seems to have a bright future. But this is not Ponzi, and there is a high probability that there will be no large-scale wealth opportunities.

Essentially, these hypes are based on the idea that "crypto users think this narrative can bring them new buyers." But whether it can eventually bring a large number of real users and liquidity to the crypto remains a question.

The core catalyst of this narrative lies in the launch of $UNI v4.

The launch of Uniswap v4 is a catalyst that draws market attention to this narrative. In the future, as this narrative develops, the front-end may become the most popular hype target, followed by "infrastructure layer targets" like Uniswap v4 and "liquidity interaction layer targets". But at the beginning, $UNI should still have the biggest opportunity. At the same time, $COW $1INCH with similar concepts should also have corresponding opportunities.

Layer 1 Competition

In the current market, Layer 1 competition is the most mainstream narrative, no doubt about it.

During this cycle, the main line of market hype is Solana, and from time to time other Layer 1s will pop up to compete with Solana.

For example, in the previous $AVAX, Avalanche promoted the growth of token prices through "hype memes" and "official announcements and PR with top companies". The same is true for the current $SUI. They use "OTC transactions to make English CTs shill(doubtful, uncertain) to create a new narrative", "memecoin hype (there are also some good wealth effects on Sui now)" and "using $SUI tokens to incentivize liquidity (similar to Arbitrum)" to attract market attention and increase liquidity stickiness. It is worth mentioning that the DeFi yield on Sui is still good.

Now many Layer 1s have begun to try to use memecoin to attract market attention and liquidity, but in the end the results were minimal (such as BSC).

Therefore, I think the Layer 1's "you sing and I come on stage" is most likely a short-term event. If you participate in these Layer 1 activities in the short term, you will definitely make a profit - because your behavior matches the needs of the project party.

Another Layer 1 gameplay is Fantom's Rebrand - creating a better-performing chain for brand upgrade. If no one plays the blockchain at the beginning, then use the expectation of future airdrops as incentives. In essence, it is similar to the previous Layer 2 gameplay, not very innovative, but effective before the airdrop.

Speaking of Layer 1s that I’m optimistic about, my list here is: Solana $SOL and Berachain.

The reason for being optimistic about Solana is simple. Just look at which company has more large-cap memecoins on Binance. Memecoin is a trump card of Layer 1.

Berachain's PoL is the only major innovation in the Layer 1 consensus mechanism in this cycle, which introduces a dynamic game between users, nodes and project parties. At the same time, they are also actively supporting ecological projects in a transparent, decentralized and fair way. I am deeply involved in the Berachain ecosystem, so I will give my support, DYOR.

In addition to the basic Layer 1 competition, I also like the modular narrative, which is a new narrative that is being discussed a lot in this cycle. In fact, just look at the picture below.

However, modular projects are a bit hard to describe. I originally wanted to give $EIGEN a try, but I didn’t expect $EIGEN to have a hacker incident, which caused a great response from the community. In short, I am still optimistic about $EIGEN, and I think $EIGEN may suck blood from other modular projects, and there will be a wave of price performance in Q4 (it will take the next cycle to really hype up on a large scale).

AI

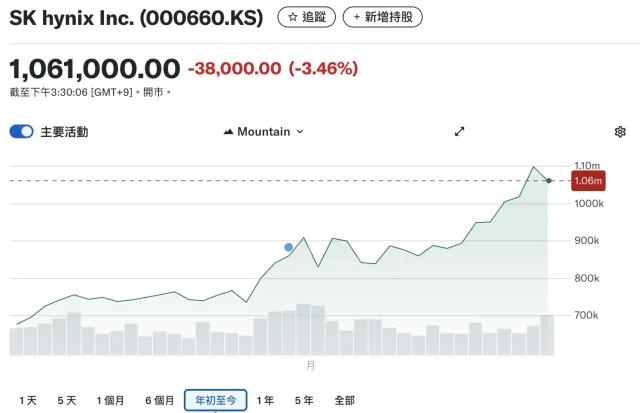

There is no need to talk about the AI narrative, just look at OpenAI's recent operations. Also, AI tokens used to follow Nvidia stocks. Recently, the best performing token in the Crypto AI track is $TAO. If you want to choose a target, choose the strongest one. The hype of AI tokens has nothing to do with fundamentals. We should still focus on the changes in the AI industry. (China TAO $NMT can also be paid attention to, but its hype is $TAO later) The key words are "price performance during the market correction" and "appropriate time node".

This kind of hype will continue until the AI bubble bursts. Before it bursts, all we can do is enjoy the bubble.

Stablecoin Competition and DeFi

The competition in the current stablecoin market is becoming increasingly fierce. For example, with the entry of Paypal, Binance has turned to support FDUSD, BlackRock is also actively developing the stablecoin market, and Coinbase has USDC and euro stablecoins on Base.

Under such fierce competition, the three tokens that we can hype at present are mainly Sky (formerly MakerDAO), $LQTY and $ENA.

Sky is the oldest decentralized stablecoin project, and is currently promoting the transformation of its governance token and native stablecoin. It is clear that Sky hopes to reduce the impact of interest rate cuts on project products, and transform from the model of "using RWA income to incentivize adoption" to the model of "using tokens to incentivize adoption". Later, Sky will open a new plate by issuing SubDAO to maintain the scale of adoption of the project's stablecoin. There will definitely be wealth opportunities, but the community is not buying into Sky's recent operations. I have also seen some negative comments from the community.

In addition, as Mr. Shenyu said, the interest rate cut will definitely increase the competitiveness of DeFi. DeFi tracks, including Ethereum and Solana's DeFi, have opportunities. In short, the higher the activity on the Layer 1 chain and the higher the TVL, the more popular the DeFi project tokens on that chain will be. Later, the demand for high returns may also give rise to new plates. But that's a matter of the big bull market, so let's take it one step at a time.

Here I would like to mention Ethereum Layer 2 Basechain separately. Base has performed very well recently, and TVL has increased a lot in September. The growth of fundamentals will bring new wealth opportunities. Here we need to clarify Coinbase's needs for Basechain: Base can expand Coinbase's influence in the crypto industry and bring sorter income to Coinbasse. If Base is good, Coinbase will benefit, and then Coinbase will have every motivation to promote the continued growth of the Base ecosystem (the same is true for the previous pull $AERO).

What is Coinbase promoting now?

cbBTC.

Moonwell and Aerodrome will be the main places for cbBTC to grow. Currently, Moonwell has launched cbBTC liquidity mining subsidies. Pulling the price$WELL can promote more cbBTC adoption (personal opinion).

$LQTY has v2 expected (November), and is also a decentralized stablecoin recognized by the community. Sky's transformation itself is good for $LQTY, which is one of the reasons why it has risen so fiercely in the past period of time (my personal opinion). The impact of industry changes and the upcoming fulfillment of expectations may affect the future price performance of $LQTY.

The competitiveness of $ENA lies in: "New stablecoins coming out of this cycle" and "cooperating with BlackRock to launch new UStb stablecoins". The influence of this form of cooperation is much greater than those projects participating in BlackRock's Buidl Fund. In-depth cooperation is the best catalyst. The recent airdrop and unlocking of $ENA should give us an opportunity to enter the market.

Other promising tokens are $PENDLE and $BANANA. $PENDLE has been discussed many times before. Recently, it is promoting BTCFi and v3 is expected. For $BANANA, you can refer to this article by @BensonTWN (very well written): https://x.com/BensonTWN/status/1839664439093813397

For games, I will consider $PIXEL $PRIME $PIRATE. I personally think that we cannot look at these projects from the perspective of the game sector, but need to look at the catalysts corresponding to these projects separately.

The BTC ecosystem needs further observation (the core demand is still there, for details, please see my metagame article). We are still at a stage where the market believes that miners need on-chain activity to increase their income, and we look forward to new plates emerging in the BTC ecosystem. But the problem is that the surge in on-chain fees is likely to be a short-term phenomenon. Miners may like it, but the market cannot continue to pay for it.

Regarding the memecoin narrative, I personally think that the mainstream memecoins will see a huge surge after the return of liquidity, and $WIF $PEPE has the greatest chance. Memecoins cannot be predicted, so we can only follow the trend. Overall, I am still optimistic about the memecoin track, and I think that this track will have at least two memecoins with a market value of 10 B+, just like the last round of $DOGE $SHIB.

Finally, let's take a look at what's going to happen in October:

$JEWEL Colosseum PvP on Metis: I don’t know what kind of sparks these two projects can create, but $METIS is indeed going well;

$XRP ETF and SEC: I think there is a chance for a nice rally;

$STX Nakamoto Upgrade: It is positive for $STX, and there is a high probability that there will be good wealth opportunities on Stacks;

$DUSK Mainnet Launch: We are not paying much attention to this track at the moment;

$AVAX Summit ( 16-18 Oct)$WLD "New World" with Sam Altman: also related to the AI industry;

$RENDER Migration Rewards End$TIA Unlock of $ 1.05 BJPY Interest Rate Decision

For details, please refer to this article: https://x.com/breadnbutter247/status/1840435197893857689