Author:MiX

TL;DR

1. The era of synchronized rise of crypto assets is over;

2. The super cycle of Memecoin has begun, and it is now;

3. Any crypto asset that does not distribute cash flow to your wallet and cannot be used as a means of storing value is a Memecoin;

4. The cryptocurrency industry is not a technology-first industry, but an asset-first industry;

5. Memecoin is not a vampire attack on crypto technology, but a counterattack against traditional Crpyto Tokens;

I really started to think about Memecoin in April 2015, because at that time Casey @rodarmor , the father of Runes, gave a definition for Runes: Runes were built for degens and memecoins. Runes were born for Memecoins.

Later, I gave a presentation in Hong Kong titled "Runes|Bringing Memes Back to Bitcoin": On the one hand, I believe that the Runes protocol will become the first standard for the issuance of Memecoins in the entire Crypto world; on the other hand, I found that the connotation of Meme is expanding, growing and evolving, from "speculation" to a "Growth strategy" and becoming a carrier of a "social movement."

In the future, Memecoin may take the lead in attracting the public to make financial pricing for consensus, and after the survival of the fittest consolidates the community, interesting and valuable things can be done, which in turn can empower Memecoins. Doesn’t this prove the saying that "Memecoin is the business card of an ecosystem", and the subtext is that without Memecoin, it is highly likely that this ecosystem will not even have enough basic community consensus.

Vitalik has also extended and thought about the value of Memecoin⬇️ , and his vision is very high.

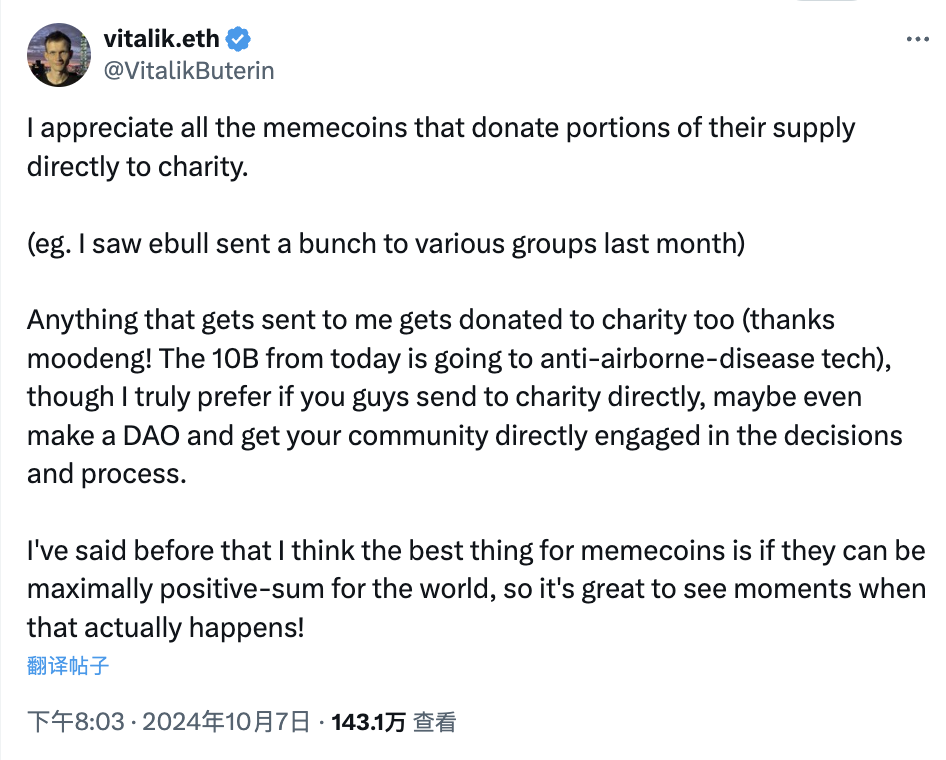

Vitalik was still talking yesterday, hoping that Memecoins could bring positive utility to the world .

Today’s article “The Memecoin Supersycle” is Murad’s speech at the recent Singapore TOKEN 2049 Conference⬇️

Since the video was released, it has been played on YouTube 26,000 times in 10 days, and post X has been exposed more than 1.2 million times. With such momentum, Memecoin really has the opportunity to become an important practice in exploring new economic models and promoting social progress.

The following is the full text of the speech, Enjoy~

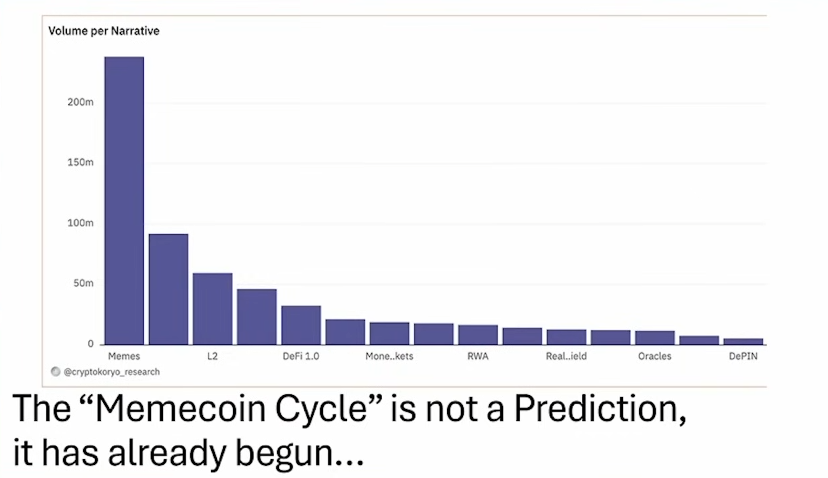

Meme coins have created a frenzy in the cryptocurrency market, so the meme coin super cycle is not just a prediction of the future, but has actually happened.

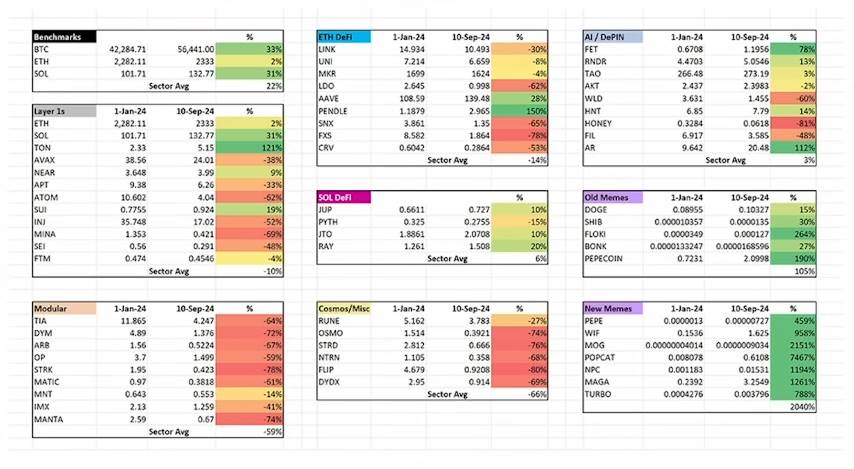

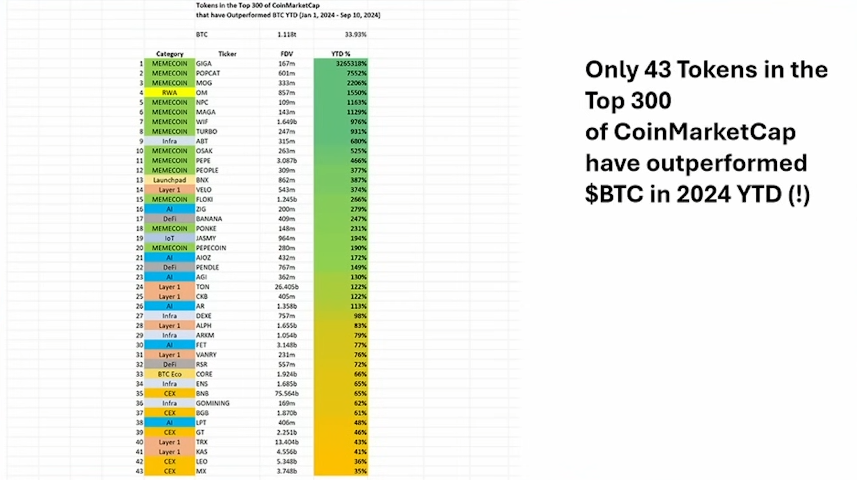

When we look at the performance of all major cryptocurrency categories so far this year, you’ll find that they’re mixed, with a lot of disappointing coins, but as the chart above shows: memecoins are a standout.

Right now, the old memecoins are doing well, and the new memecoins are doing exceptionally well. The days of all crypto assets rising in sync are over, the “we’ll get there” narrative is out, and this is a natural step in the evolution of the space.

As you can see in the chart above, you’ll notice that only 43 tokens have outperformed Bitcoin so far this year, and 13 of the top 20 tokens are memecoins.

# Why do memecoin cycles occur?

There are two driving factors behind the cycle of memecoin, one is from the internal reasons of the crypto field, and the other is external reasons. First, let’s look at the internal factors of the crypto field.

1. Overproduction of tokens : In 2024, by April alone, 600,000 new tokens had been launched on the market, with more than 5,500 new tokens added every day. This overproduction has flooded the market with a large number of new tokens, causing the value of many projects to be severely diluted.

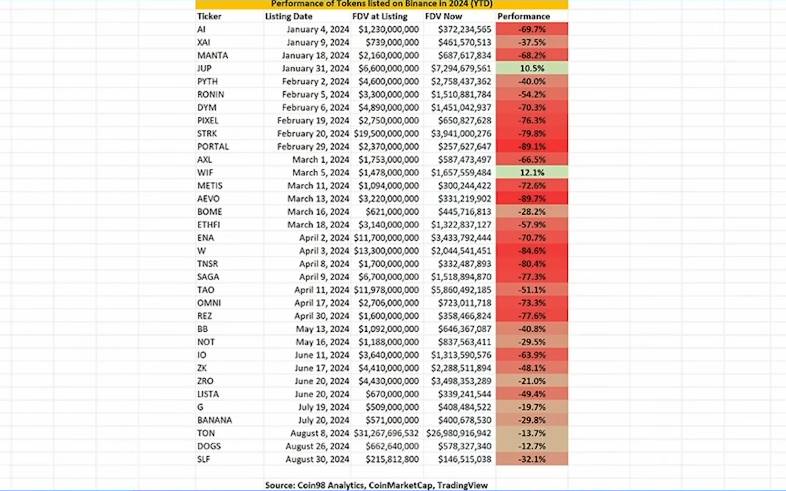

2. Altcoin valuations are seriously inflated : When these tokens are listed on centralized exchanges, the valuations are artificially inflated. Founders get tokens at almost zero cost, venture capitalists and angel investors buy a large proportion of tokens at extremely low prices, and then centralized exchanges, market makers, Twitter KOL, Telegram group callers, YouTubers, etc., all promote the project by obtaining tokens or money. In the end, retail investors become the source of liquidity when these projects exit. When you launch a project with a valuation of up to $10 billion, retail investors are the ones who are sold off.

3. Price increase during the private placement phase : The vast majority of Altcoin price increases occur during the private placement phase. By the time the token is actually launched, the valuation has often reached $500 million, $1 billion, or even $1.5 billion, and retail investors have almost no chance of profiting from it. They are simply attracted to the bubble at the high point of the token price.

I firmly believe that these tokens were deliberately marketed at extremely high initial valuations at the time of listing, so that even if the token price inevitably plummeted by 90% in the early stages, seed investors would still receive hundreds of times the returns, while retail investors were misled into thinking that these tokens were being sold at a “discount”.

Of all the new tokens launched on Binance in 2024, with two exceptions, every project has fallen. One exception is Whiff, which has barely grown since listing, and the other is Jupiter, which is closely tied to the memecoin trading infrastructure. These facts send a strong signal that most newly launched Altcoin projects are not performing well.

# Problems in the industry

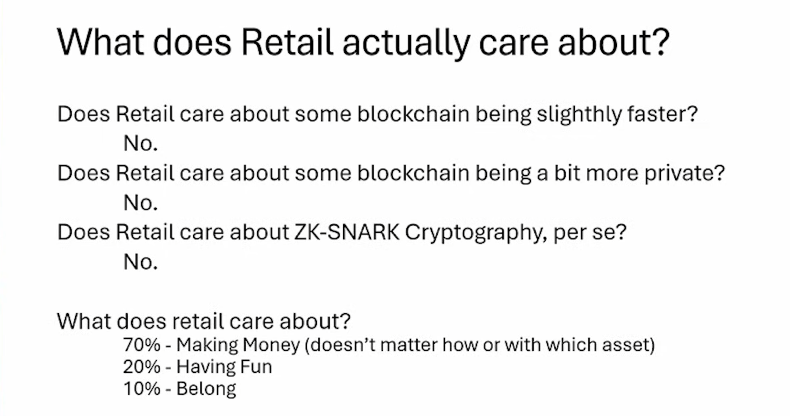

Without the inflow of retail funds, the entire token market cannot be sustained, but the vast majority of retail investors never care about technology.

Even though we have been using smart contract technology for over a decade, there are still very few non-speculative decentralized applications (dApps) that can succeed in this industry. If you look at projects like Uniswap, dYdX, GMX, and Solana, these are probably the projects with the highest product-market fit in the history of crypto, but they rely almost entirely on speculation. 99% of Altcoin are not worth their valuations, and many projects do not pay dividends, often claiming that it is due to regulatory reasons, when in fact, it is not in their interest.

It’s not uncommon to see projects that are only generating $500 a day in fees being valued in the billions, and these infrastructure tokens are clearly not going to be a store of value for money.

The value of these tokens often relies on narratives, imitation effects, and market hype, and the market tends not to value these tokens based on actual revenue.

# Unique advantages of memecoin

In contrast, memecoins have their own unique advantages. Memecoins do not need to rely on complex valuation models or actual revenue to support market capitalization like traditional technology tokens. Their advantage lies in simplicity and directness - the token itself is the product. Memecoins are not an attack on encryption technology, but a counterattack against encryption technology tokens. Memecoins and Altcoin are actually promoting the same thing - the token itself, not the technology behind it.

Memecoins are the spiritual embodiment of the ICO wave of 2017, but they appear in a new and purer form. They represent a more direct community economy that does not rely on complex technical narratives, but instead uses simple and easy-to-understand methods to attract the market.

Many venture-backed technology projects are overvalued and lack real community support. Memecoin uses the community to build a strong brand and loyalty, allowing the project to continue operating. In contrast, venture capital projects rely on private placements and high valuations to drive the market, while memecoin uses the power of the community to allow participants to profit from it and become loyal supporters.

# External environment driving

In addition to internal factors in the industry, the external environment is also driving the development of memecoin. Today's global economy is very different from four years ago. Inflation is rising rapidly, and the prices of daily commodities are also continuing to rise. The rapid development of artificial intelligence has even threatened employment opportunities in traditional STEM disciplines, and wealth inequality has reached an all-time high. Especially in areas outside of developed countries, the situation is even worse.

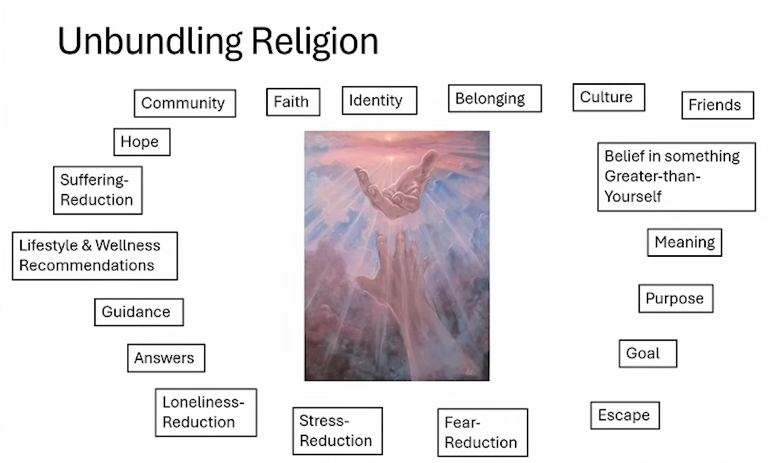

The intensification of loneliness, sexual repression and mental health problems has prompted more and more people to turn to the virtual world to find a sense of belonging and meaning. In this context, meme coins have become their choice. People are not only looking for wealth in meme coins, but also for fun, identity and belonging.

# The power of narrative and culture

Memecoins are essentially a Swiss Army Knife of products that provide identity, culture, escape, reduced loneliness, community, hope, and so much more. I believe religion is losing influence in the world, and brands, experiences, and communities are filling the void. You can already see this in video games, music festivals, yoga, DMT retreats, CrossFit, SoulCycle, the ketogenic diet, and of course, financial assets.

The formation of trends requires narratives to support them. Behind the success of memecoins are stories about people making huge profits through simple means, which continue to spread throughout the industry and social media. For example, Pepe, Bonk and Whiff have become several successful cases in this cycle. These stories have given new life to memecoins and driven the market to continue to develop.

History tells us that assets that do well in the first half of a cryptocurrency cycle tend to continue to do well in the second half. For example, Ethereum surged in 2016 and surged twice in 2017; Verge surged in 2016 and surged again in 2017; and Solana surged in 2020 and rebounded strongly again in 2021. Therefore, I believe that the memecoin boom we experienced in March 2024 was just the first of three waves, followed by two larger surges in 2025.

# Market positioning of memecoin

The success of memecoins is not just due to speculation. They represent a more organic market model that enables ordinary investors to gain wealth by holding tokens. Memecoins have turned investors who would have difficulty making profits in other markets into loyal evangelists, driving the spread of the entire project.

The future of meme coins is that they are not just speculative tools, but a new economic form - a tokenized community. The best meme coins will become long-lasting brands and cultural symbols, representing not only wealth but also identity.

# The Future of MemeCoin

The memecoin supercycle has begun and it will continue to grow. I predict that memecoins will reach a market cap of $1 trillion and that a quarter of the top 20 on CoinMarketCap will be memecoins. Over time, utility tokens and VC-backed Altcoin will continue to underperform, while memecoins will continue to dominate the market.

Memecoins are not only a market phenomenon, they represent a new community economic model. Their simplicity, ease of understanding and high participation make them the most dynamic and growth potential assets in the cryptocurrency industry. If you want to seize the next big opportunity, memecoins are undoubtedly an area worth your attention.

To sum up, memecoins are simpler than tech Altcoin, more liquid than NFTs, more secure than DeFi, they have no inflation, no unlocks, no VCs dumping money on you, your odds are better than sports betting or casinos, more volatility (aka more excitement), it’s a fresher narrative, it gives retail investors a chance to win, and the community is more passionate than any other crypto asset class. The best crypto products don’t need tokens, the best crypto tokens don’t need products. Again, the memecoin cycle is not a prediction, it’s already happening, memecoins dominate on every metric, every metric.

So predictions: memecoins will hit $1 trillion in market cap; you’ll see 2 memecoins with market caps over $100 billion; you’ll see 10 memecoins with market caps over $10 billion; a quarter of the front page of CoinMarketCap will be memecoins; memecoins will have 10% dominance; Utilities and VC-backed Altcoin will continue to underperform; the “fat protocol” theory will slowly die out as it becomes increasingly difficult to build stores of value and casinos (ranked 4th and 5th); VCs will buy blue chip memecoins, as smart VCs have already started to do; traditional finance will buy memecoins, as smart traditional finance has already started to do; you’ll see hyper-memecoinization before hyper-bitcoinization; a lot of people are talking about faith economics, the tokenization of faith, and the new religion of financialization.