Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by 0xjs@Jinse Finance

Bitcoin needs three factors to hit a new all-time high in 2024; another factor may accelerate Bitcoin's development.

I am often asked to predict prices. Sometimes I even give forecasts. For example, at the end of last year, we predicted that Bitcoin would double in 2024, trading above $80,000.

I still believe this is true.

But price forecasts are conditional. They depend on what happens in the world. With that in mind, I believe the following conditions need to be met to achieve my $80,000 Bitcoin price forecast:

The good news is that the conditions are not many.

Conditions for Bitcoin to Reach $80,000

1. Election: As long as the Democrats don't sweep

The US election is of great significance for cryptocurrencies. Most people believe this is a binary outcome: Trump = good, Harris = bad.

Undoubtedly, given the strong support of the Republican Party for cryptocurrencies, a Republican victory would be a good omen for cryptocurrencies. I think the situation on the Democratic side is more nuanced.

The Democrats have very different views on cryptocurrencies, from Senator Elizabeth Warren's (D-MA) "anti-crypto army" to Congressman Ritchie Torres' (D-NY) strong support. The problem over the past four years has been that the Warren faction has controlled policy and agency appointments, creating a hostile environment for the industry.

Bitcoin's prosperity does not require politicians. It just needs them to get out of the way. Unless the Democrats sweep both houses of Congress and the White House, which I doubt they will do, the Democrats will then take a more neutral stance towards the industry.

You can already see the Democrats' surrender to this reality in the comments of House Financial Services Committee Chair Maxine Waters (D-CA), who recently said, "Crypto is inevitable."

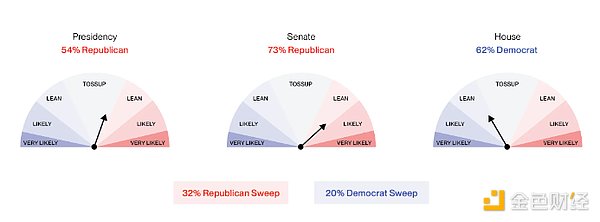

I think this attitude is enough to get us to $80,000 Bitcoin. (It's worth noting that Polymarket currently puts the odds of a Democratic sweep at 20%.)

Polymarket Forecast: Power Balance After 2024 Election

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.

Source: Bitwise Asset Management, data from Polymarket. Data as of October 8, 2024.

2. Economy: Two rate cuts + ongoing global stimulus

The primary reason people are attracted to Bitcoin is simple: you don't trust the government and its currency. This idea, which gave birth to Bitcoin in 2008, is still a powerful driver of cryptocurrencies today. It is widely accepted, even BlackRock uses it in its Bitcoin marketing propaganda.

That's why, despite the US economy growing, the Fed is still cutting rates by 50 basis points, and cryptocurrencies are rallying; and why cryptocurrencies surged after China announced a 2 trillion yuan economic stimulus plan at the end of September.

The market is craving more stimulus. The market currently expects the Fed to further ease policy by another 50 basis points before the end of the year, and China to roll out more fiscal stimulus.

If both happen, I expect we'll see a Q4 rally. If not, I think the disappointment could put pressure on the market.

3. Crypto: No major negative surprises

To achieve a new high of $80,000, the last thing we need to do is ensure a period without major surprises. No major hacks. No major new lawsuits. No previously locked tokens suddenly hitting the market.

Unfortunately, crypto's history is full of countless such surprises. In the past few quarters, Bitcoin previously locked up in the bankrupt exchange Mt. Gox and government vaults has been released, keeping us in a trading range.

If we can get through the end of this year without similar shocks, I expect we'll set a new all-time high and beyond.

What else can help? Altcoins

Some Bitcoin maximalists may hate me for saying this, but I think a broader crypto rally will help achieve this forecast.

The key is to understand: Bitcoin's long-term success does not require Ethereum, Solana, or new Altcoins. In fact, it is often harmed by mischief in the Altcoin space. But if we want to see a broad rally in the short term - say, to $100,000 in just a few months - having some crypto-supportive sentiment sweep the market would be helpful.

I remember the last time Bitcoin had a prolonged trading range, from June 2019 to June 2020, when it traded in a narrow $8,000 to $10,000 range (except for a brief dip during the COVID-19 pandemic). In the late summer of 2020, Bitcoin started to rise and headed straight for $60,000. Much of this was driven by the stimulus measures during the COVID-19 pandemic, but there was also an element of (for lack of a better word) sentiment. Specifically, the "DeFi Summer" of 2020 gave investors reason to get excited about crypto again, and some of that animal spirits spilled over into Bitcoin.

This year, those animal spirits have been largely absent outside of Bitcoin. But I can almost see them rising in areas like stablecoins, where AUM is hitting new highs; in new high-throughput blockchains, where communities are coalescing around projects like Sui, Aptos, and Monad; and in innovative projects like Babylon that are exploring ways for Bitcoin investors to earn yield from staking. The strong and sustained momentum in these areas will amplify the melt-up scenario.

Conclusion

It's worth remembering that Bitcoin has already performed quite well this year. It is one of the best performing assets globally, up 49%, and its news flow has been incredibly strong. We've seen the launch of Bitcoin ETFs, which have been the best-performing ETFs ever. We've seen widespread institutional adoption, with 60% of large hedge funds now holding Bitcoin. We've also seen Bitcoin enter the mainstream political discourse in a way that was unimaginable just a few years ago. Two years ago, FTX was collapsing and Sam Bankman-Fried was making headlines; today, Larry Fink is talking about Bitcoin taking over the world on TV.

All of this suggests that, regardless of how the news unfolds, Bitcoin will reach $80,000 (or more) next year. But if we want to achieve that goal by the end of this year, the script outlined above may help.