Source: Grayscale; Compiled by Wuzhe, Jinse Finance

Abstract

In September 2024, the cryptocurrency market performed well as the Federal Reserve made its first rate cut.

While Bitcoin has outperformed the broader cryptocurrency market so far this year, the gains in September were led by other market segments, particularly the AI-related tokens in the utilities and services cryptocurrency sector.

The regulatory and political backdrop appears to be improving: the U.S. Securities and Exchange Commission (SEC) has approved the listing of spot Bitcoin ETP options, and other institutions are expected to follow suit, while the Bank of New York seems poised to provide cryptocurrency custody services. Meanwhile, former President Trump announced a new DeFi protocol, and Vice President Harris made supportive comments about digital assets and blockchain technology.

The Federal Reserve's rate cuts and various fundamental developments drove the expansion of the cryptocurrency rally in September 2024, with the FTSE/Grayscale Crypto Industry Market Index (CSMI) posting its best monthly return since March (Figure 1).

Figure 1: Digital assets delivered higher returns in September 2024

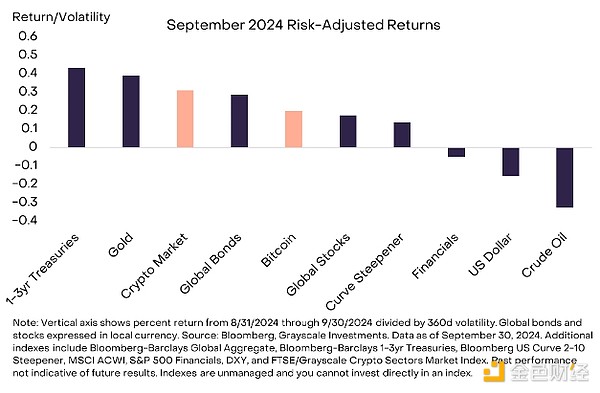

On September 18, the Federal Open Market Committee (FOMC) announced a 50-basis-point (bp) rate cut, exceeding expectations, as inflation showed some improvement and downside risks to the U.S. labor market increased.[1] This triggered a further decline in bond yields (higher returns on short-term Treasuries), a weaker U.S. dollar, and a rise in gold prices (Figure 2). At the same time, stocks in the financial sector, which benefit from higher rates, underperformed the broader market. Later in the month, macroeconomic stimulus measures by Chinese policymakers supported global equity markets. BTC's 8% return was in the middle of the risk-adjusted range, while the CSMI's 18% surge was among the top risk-adjusted performers.

Figure 2: The Federal Reserve's first rate cut was a key driver of the market rally

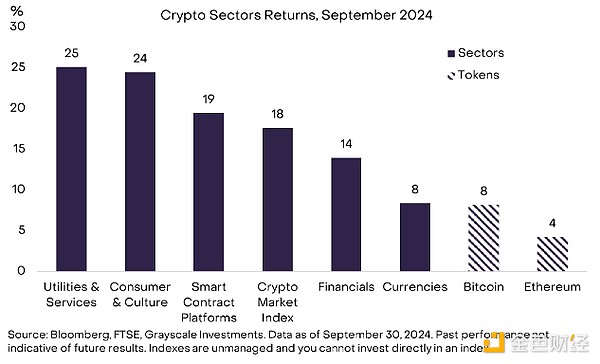

Our cryptocurrency sector framework highlights the breadth of the digital asset market rally in September. BTC and ETH underperformed the FTSE/Grayscale Crypto Sector Index (Figure 3). The best-performing market segment was the utilities and services cryptocurrency sector, which surged 25%. This cryptocurrency sector includes many tokens related to artificial intelligence (AI) technology and benefited from the significant gains in AI-related tokens Fetch.ai and Bittensor.Several assets in the utilities and services cryptocurrency sector also appeared in the latest Grayscale Research Top 20 list, including Chainlink, Bittensor, Helium, Lido DAO, Akash Network, and the UMA protocol.

Figure 3: The utilities and services cryptocurrency sector outperformed other segments

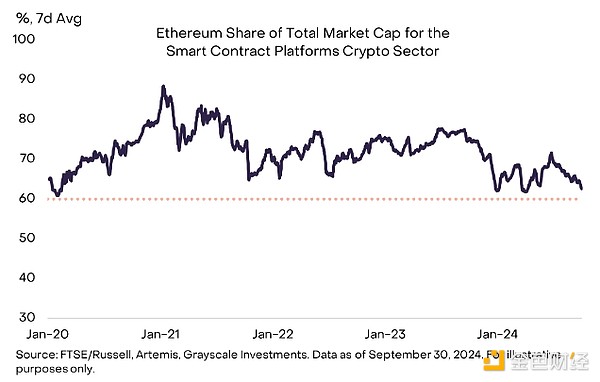

ETH again lagged BTC, with the ETH/BTC price ratio hitting a new cycle low in mid-September. However, ETH remains the leading cryptocurrency in the smart contract platform sector[2], and Grayscale Research believes ETH may outperform competitors for some time for several reasons (see Grayscale Research Insights: Crypto Sector Outlook Q4 2024 for more details). Notably, despite facing new entrants, ETH has maintained at least a 60% share of the total market capitalization of the smart contract platform cryptocurrency sector since 2020 (Figure 4).

Figure 4: ETH still dominates the smart contract platform crypto sector

Net inflows into U.S.-listed spot Bitcoin exchange-traded products (ETPs) rebounded, totaling +$1.3 billion for the month. By our estimate, the cumulative inflows since the launch of these products on January 11, 2024, have reached a new high of +$18.9 billion.

In related news, progress has been made in the ability to trade listed options on spot Bitcoin ETPs. At the end of September, the SEC approved Nasdaq's application - the first step in a multi-stage regulatory approval process. Other applications are expected to be approved subsequently.[3] While the OCC and CFTC still need to provide their own approvals due to their respective jurisdictions over options and Bitcoin, the SEC's preliminary approval represents a positive step forward for the U.S. crypto ETP ecosystem. Similar to the approach taken with spot Bitcoin ETPs themselves, Grayscale Research expects regulators to consider applications from other issuers and factor in competitive dynamics before granting final approval, in order to create a fair competitive environment. In contrast to the positive news on spot Bitcoin ETPs, there were moderate net outflows from spot ETH ETPs, and the SEC delayed decisions on related options products.[4]

Progress was also made last month in institutional adoption of cryptocurrency custody services. Specifically, it was reported that the Bank of New York (BNY) - the oldest bank in the U.S., founded by Alexander Hamilton - will begin providing custody services for spot BTC and ETH ETPs after receiving a "no-objection" letter from the SEC.[5] Traditional financial services firms had previously been prohibited from providing digital asset custody due to SEC Staff Accounting Bulletin (SAB) 121.[6] In a subsequent interview with Bloomberg, SEC Chair Gensler seemed to suggest that BNY will be allowed to custody crypto assets beyond just BTC and ETH, stating: "While the actual negotiations involved two crypto assets, the structure itself does not depend on what the crypto asset is."[7]

The crypto industry also continued to play an important role in the U.S. elections. First, former President Trump announced the launch of World Liberty Financial, a new decentralized finance (DeFi) lending platform based on Aave technology.[8] Second, Vice President Harris stated in a speech to donors that her administration would "encourage innovative technologies like artificial intelligence and digital assets, while protecting our consumers and investors."[9] In a subsequent event, she said she would "recommit to the nation playing a global leadership role in defining the fields of the next century," including "blockchain."[10] While no specific policy proposals were put forth, we view Harris' latest remarks as a step in the right direction.

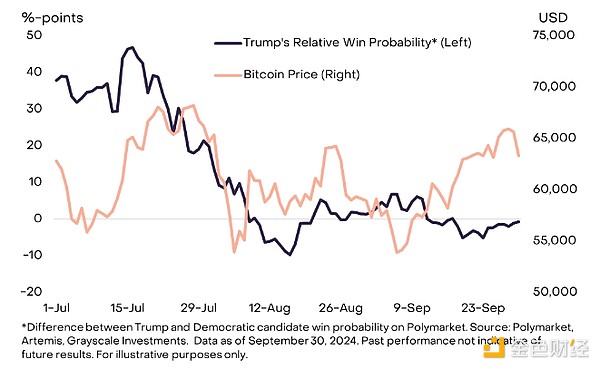

Perhaps due to increased bipartisan support for the industry, the correlation between the BTC price and the probability of Trump winning on Polymarket has recently broken down (Figure 5; see our report Polymarket: Crypto's Election Year Breakthrough Application for background).

Figure 5: The correlation between Trump's winning probability and the BTC price is disappearing