Bitcoin (BTC) is moving around the $62,000 level, temporarily balancing between an upward and downward trend. According to the data, Bitcoin is still facing selling pressure from US institutional investors.

This pressure is hindering the upward momentum of Bitcoin in October.

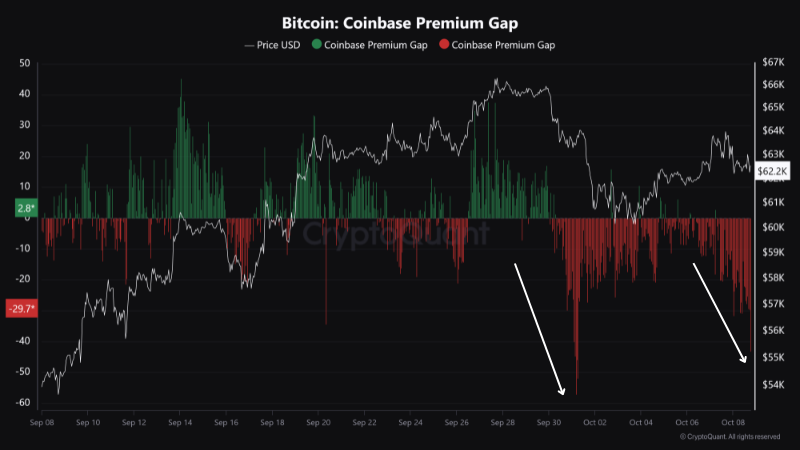

The Coinbase Premium Index remains negative

The Coinbase Premium Index, which tracks the price difference of Bitcoin between Coinbase and Binance, has remained in negative territory throughout October. Coinbase, one of the major cryptocurrency exchanges in the US, is a key platform for institutional investors to trade cryptocurrencies.

Read more: Coinbase vs Coinbase Pro: Which One is Right for You?

The negative index indicates that the Bitcoin price on Coinbase is being maintained lower than on Binance, suggesting strong selling pressure from institutional investors.

"The Coinbase premium falling to -$41 indicates strong selling pressure from US institutions," said on-chain analyst Maartun said

Historically, positive readings in the Coinbase Premium Index have foreshadowed Bitcoin price increases, while negative readings have coincided with price declines. The persistent negative trend in early October is raising concerns about an impending Bitcoin correction.

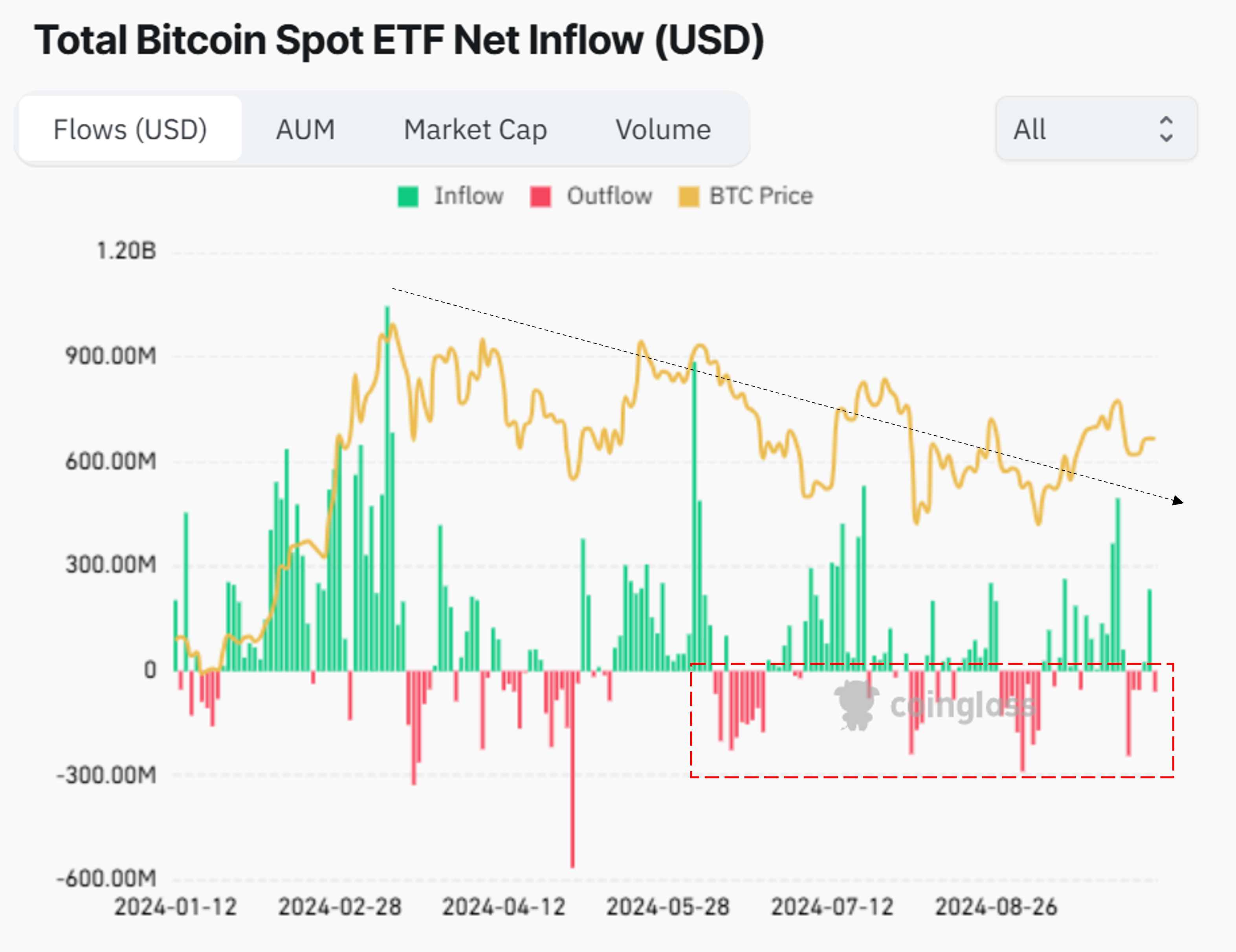

Outflows from Bitcoin ETFs in October

Another data point supporting the claim that US investors are selling is the net outflows from US-based spot Bitcoin ETFs. The chart below shows that the inflows into Bitcoin ETFs have been decreasing recently, and their asset under management (AUM) growth is slowing down.

In October alone, 4 out of the first 6 days recorded net outflows, with $408 million withdrawn. In contrast, around $260 million has flowed into the ETFs since the beginning of the month. Recently, wallets associated with BlackRock have also recorded significant withdrawals.

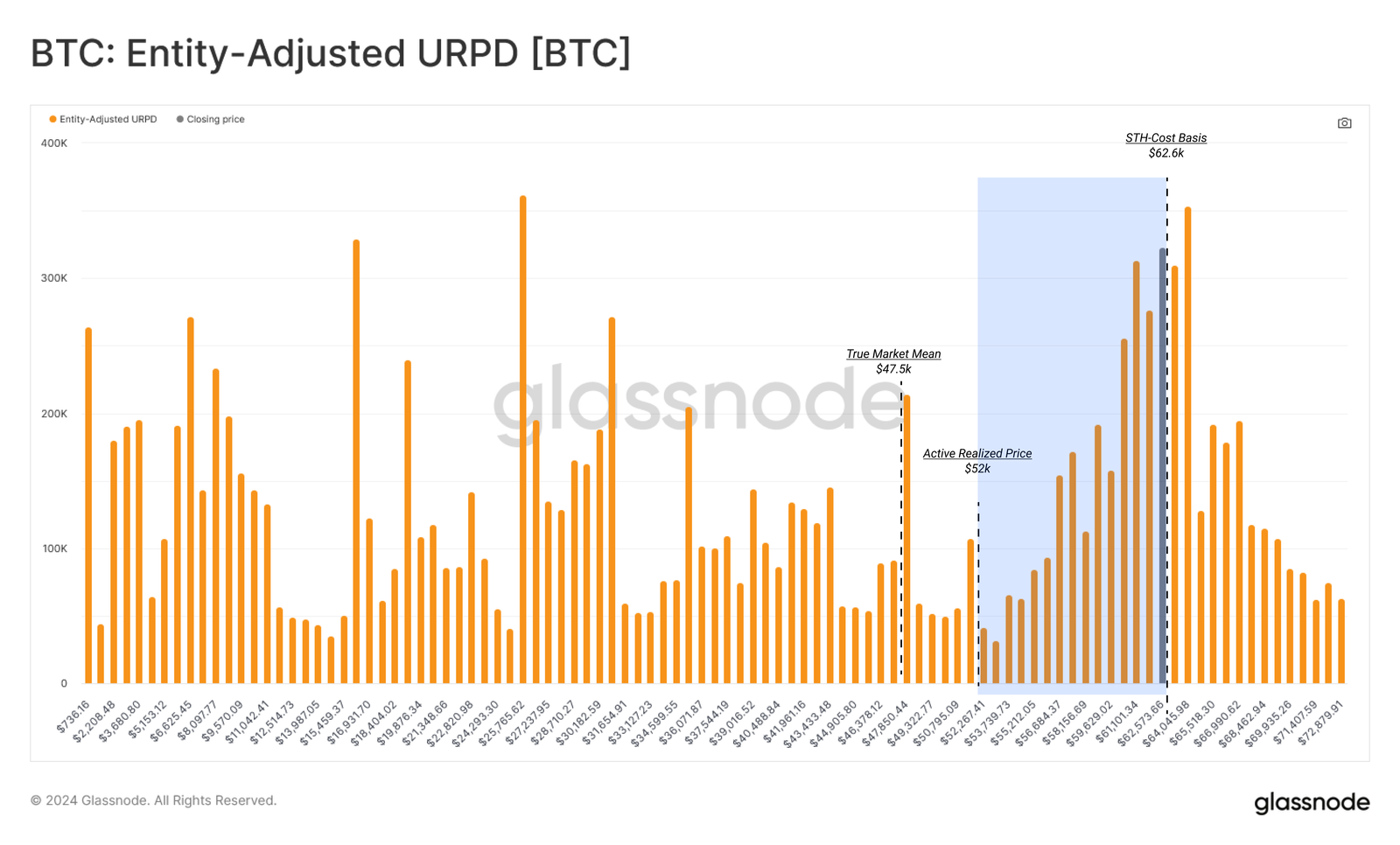

Bitcoin is in a sensitive price range according to URPD data

The UTXO Realized Price Distribution (URPD) tool highlights the sensitive price ranges for Bitcoin by measuring the amount of Bitcoin traded on-chain at various price levels.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

According to data from the cryptocurrency on-chain data analysis platform Glassnode, $62,600 is a key level where significant Bitcoin trading has occurred. Below this price, the support weakens.

If Bitcoin fails to hold around $62,600 and drops below $60,000, it could potentially decline to $52,000. However, if it breaks through the $64,000 resistance level, Bitcoin could quickly surge to $72,000.

"This indicates a sensitive market situation, with a large supply that may be sensitive to the next major market move," Glassnode reported