In the early hours of today, the minutes of the September meeting of the Federal Reserve were released, with three key points:

The most critical sentence: Some participants expressed that they would have preferred a 25-basis-point rate cut at this meeting, and the use of the phrase "some participants" by the Federal Reserve suggests that the officials supporting a 25-basis-point rate cut may be slightly less than half, but not a minority. The compromising officials, their future statements will affect the market, because the employment data temporarily confirms that their views are correct.

The second key point: Participants generally agreed that the initial action does not represent a commitment to a specific pace of future rate cuts - emphasizing that large rate cuts will not become the norm.

The third key point: Several participants noted that a 25-basis-point cut would be consistent with a gradual policy normalization path, and this would give policymakers time to assess the extent of policy constraints as the economic situation changes - this statement may become a consensus for the Federal Reserve in the future.

As the minutes were released during a period of low global market activity, and many people are not sensitive to the minutes, the hawkish tone of these minutes will linger for some time.

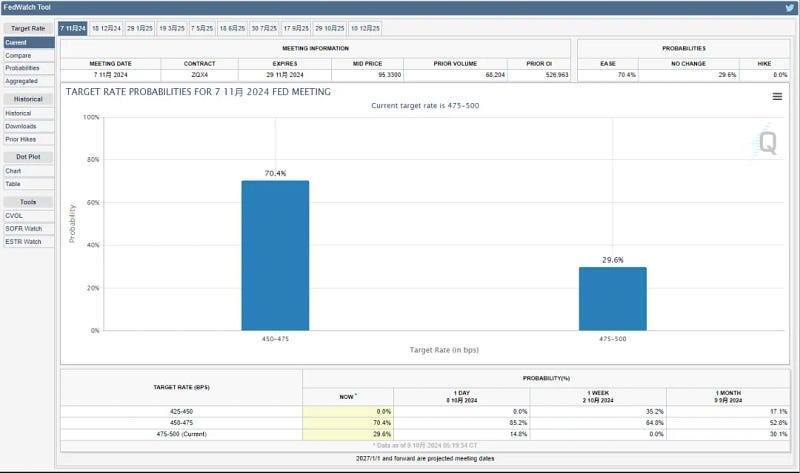

With the release of the Federal Reserve's minutes, the probability of a 25-basis-point rate cut on November 7 is still declining, currently down from the 84.5% cited in the text to 70.4%, and the corresponding probability of no rate cut in November has now reached nearly 30%! Intuitively, it feels like there are hands behind the scenes manipulating market expectations, and at this rate, people will be debating whether to continue cutting rates again in early November...

The important September CPI data will determine whether a large rate cut by the Federal Reserve exists

The US will release the unadjusted September CPI year-on-year and the seasonally adjusted September CPI month-on-month at 8:30 pm tonight. CPI is an important indicator of the price level of consumer goods and services, and its changes have a significant impact on inflation and economic growth. If the CPI data is higher than expected, it may trigger market concerns about inflation, which in turn could have an impact on the financial markets. For the cryptocurrency market, the release of CPI data is also of great significance and may lead to violent market fluctuations.

Market analysis

The market has reached the vicinity of 60,000 again, and ETH hit a low of around 2,350 today. According to the current trend, the percentage decline is actually not large, it is just a tentative correction, and the market has not yet broken through the 60,000 mark. Let's see in the next two days whether the 60,000 whole number mark will be completely broken, and the market will come to the short-term support level of 56-58,000 on the daily chart. The second cake will basically be dragged down to the support level of around 2,260 on the daily chart. The market is in a sluggish state, whether bullish or bearish, it is in a sluggish state. It has been fluctuating in the 62-63 range in the past few days, and after breaking through yesterday, it has come directly to the 60,000 level today, which is a bearish signal.

Highlights for today

BTC

Currently reaching the support level of around 60,000, now just waiting for the 60,000 whole number mark to be broken and come to the 56-58,000 area. The short-term support level on the daily chart is around here, and the resistance level on the intraday level needs to focus on the 61,600-62,000 area. The intraday support point can be observed at 59,000-59,600 after the 60,000 is broken.

ETH

The trend yesterday had a bit of a strong upward rebound, but the downward performance was also very quick. Currently, it is in a downward channel on the 4-hour level. The intraday support point of 2,320 has not been touched yet, waiting for it to be broken below 2,320 and the market will come to the 2,240-2,280 range. The overall focus is still on whether 2,200 can be retested to achieve a perfect breakdown, so that a 1-digit second cake can be seen this month. The resistance level on the intraday level needs to focus on the 2,520 area, and the first support point is 2,360.

The bull market is in the making, and the market is waiting for an opportunity!

The market cannot rise every day, so don't think that just because it has risen in a wave and then corrected, it will crash. If you have this kind of thinking, the market will definitely punish you severely.

With the Federal Reserve's rate cuts, more and more funds are flowing into the financial markets, and these funds are all fuel, accelerating the start of the bull market.

But in this process, it will definitely not be smooth sailing, just like the recent A-shares, you see that it has risen well, and then rush in, this kind of situation will definitely have a correction, because the correction is to make those who chased in afraid, make them dare not enter the market.

Secondly, it will make those who have been trapped in the past few years, finally see a chance to break even, not sell? If they don't sell, I'll correct it, and then rise a little again, you break even again, will you sell? You must sell.

Follow me and let's go through the super bull market together!!!

Create a high-quality circle

Spot trading as the main focus

I will share some content: as per the conditions below:

Total position ≥ $5,000 If you want to join, scan the QR code below!

That's it for the article, I'll do a more detailed analysis in the discussion group, if you want to join my circle, please contact me directly, WeChat below!

Note: If the QR code is invalid, please leave a message in the background