Author: Xiyou, ChainCatcher

On October 9, on-chain detective ZachXBT revealed the holding situation of the Meme coin analyst representative Murad's on-chain address, quickly attracting the attention of the crypto community and triggering a narrative of the revival of the old Meme coins, and the layout of low-cap MEME coins is becoming a secret consensus in the crypto community.

In fact, since Binance listed 3 Meme coins (Neiro, Turbo and BabyDoge) in a single day on September 15, and triggered the dispute over the capitalization of Neiro and NEIRO tokens, the Meme coin market has already set off a new round of hype. During the National Day holiday, reports related to Meme projects were all over the place, and the community was full of stories of overnight wealth. V-God sold the gifted MEME coins on the chain twice in a row and publicly expressed his gratitude to the MEME projects, which led to the nearly 100-fold surge of the hippopotamus MOODENG token in a short period of time, attracting a large number of investors to rush in, hoping to catch the birth of the next 100x MEME token.

However, unlike the previous Meme coin hype with no rules and crazy market conditions, this round of Meme coin hype is mainly centered around: the dispute over the capitalization of the name letters, the donation to V-God and the market manipulation by V-God selling coins, and the revival of the Cult (parody culture) MEME coins.

Meme coin hype has evolved from public chain diversion to a dispute over the capitalization of name letters

In this round of Meme coin market, the difference in capitalization of letters has become a unique factor in the hype, and the main reason for this is that Binance simultaneously listed the Neiro spot and NEIRO futures.

The token name NEIRO originally originated from the prototype of Dogecoin. On May 24 this year, the prototype Shiba Inu Kabosu of DOGE passed away, which triggered mourning in the crypto community. In addition to mourning, the owner of Kabosu announced on the X platform that she had adopted a new Shiba Inu, whose English name was translated as 'NEIRO', and then multiple MEME projects with the same name emerged, covering Solana, Ethereum and other public chains, and there were even different MEME projects with capitalization differences on the same chain. However, with the cooling of the MEME market, many NEIRO projects on various public chains have disappeared in the historical tide, and only the top two in market cap are the two capitalized NEIRO and Neiro on the Ethereum chain.

On September 6, Binance announced the launch of the NEIRO futures trading pair, and on September 15, it announced the listing of the NEIRO token. Due to the fact that the token ID in the official announcement was also in uppercase NEIRO, many people mistakenly thought it was the NEIRO project that had already completed the futures listing. After the announcement, the NEIRO token surged by more than 20%, but just as the community was going crazy and a large number of people were buying coins on the chain, a sharp-eyed user found that the contract address of the NEIRO token listed by Binance was not the uppercase NEIRO but the lowercase Neiro token, and the uppercase NEIRO token was then massively sold by community users, with a drop of more than 50% on the same day, while the Neiro token started a surge, from the announcement time of about $15 million market cap to the current $720 million, an increase of nearly 50 times.

The naming strategy of Neiro and NEIRO was originally to distinguish different projects, hoping to use the difference in capitalization to trigger user attention, but Binance's simultaneous listing of NEIRO futures and Neiro spot has made the capitalization dispute of MEME tokens a new hot spot for hype.

The drama of capitalization has been played out on various public chains. Recently, the MEME token MOODENG based on the hippopotamus image of the Pattaya Zoo in Thailand also has a capitalization dispute: Moo Deng and MOODENG. Unlike NEIRO and Neiro, Moo Deng and MOODENG are established on different public chains, with the lowercase Moo Deng first established on Solana on September 10, and the uppercase MOODENG issued on Ethereum on September 15, which is actually a latecomer.

The capitalization difference in the naming of these tokens was originally to distinguish different projects, but now it has become a highlight of MEME token hype, and has even been endowed with different meanings and values in the hype process, such as the uppercase NEIRO being considered as a strong coin, and the lowercase Neiro representing a community project; the Moo Deng on Solana is considered the first dragon due to its earlier launch, and the MOODENG on Ethereum is considered the second dragon due to its later issuance.

For the capitalization dispute of Meme tokens, the crypto community is more confused, with many users lost in the dilemma of which one to choose, sometimes big, sometimes small, unable to tell the difference, and investors have to carefully discern when choosing to avoid missing opportunities due to capitalization confusion. This differentiation strategy has brought a fresh feel to the market, but also increased the complexity of speculation.

In this regard, some crypto users sighed that previously it was the rise of MEME tokens on different public chains that caused capital diversion, and now it is the capital diversion caused by MEME projects on the same chain and the same name due to different capitalization, which has made the already weak consensus precarious and may lead to further market fragmentation and shrinkage.

Currently, Meme projects are not only the main stronghold on Solana, with the rise of projects like Neiro and MOODENG, Ethereum is still the most anticipated place, and MEME projects on newcomers like Sui are also attracting user attention, such as the recently emerged MEME project HIPPO, which is also inspired by the hippopotamus Moo Deng from the Thai zoo, and its token market cap once exceeded the Moo Deng on Solana.

Donating to V-God to grab attention, using celebrity effect to drive token price

In addition to the capitalization of the name letters, donating to V-God (Vitalik Buterin) has become another hot spot in the Meme coin hype. As the spiritual leader of Ethereum and the crypto world, V-God also often plays an important role in Meme coin projects, with some MEME coin projects donating the funds they have raised to V-God or his related foundations, hoping to enhance the credibility and influence of the project, such as the creator of ShibaInu (SHIB) in 2021 who airdropped 50% of the total supply of SHIB to V-God's wallet address, quickly attracting the attention of the crypto community and triggering a hype of the zoo MEME coin; Neiro has also donated to V-God.

In fact, many Meme projects mainly hope to grab attention by donating to the founder of Ethereum, using the celebrity effect to drive the token price, trying to gain the attention and trust of the community through this connection with the industry leader, which is a big selling point for Meme coins to attract investors, and can effectively attract a large number of investors' attention in the short term, becoming a highlight of the hype.

The Ethereum-based Meme project hippopotamus MOODENG, which attracted much attention during the National Day holiday, also broke out by leveraging the donation to V-God. Since the hippopotamus originally originated on Solana and its market cap quickly exceeded $100 million, becoming well known in the community, while the uppercase hippopotamus MOODENG on Ethereum is a latecomer, and its market cap has not broken through tens of millions of dollars for a long time and has not attracted much user attention.

On October 5, V-God sold Meme tokens on the chain, including MOODENG, and the news was exposed, causing the MOODENG token market cap to surge to $10 million within minutes and then enter a steady upward trend. The MEME projects ITO and KABOSU sold in the same batch also saw significant increases after the sale, with ITO surging over 222% in the short term and KABOSU over 70%.

On October 7, V-God sold MOODENG again, and then donated 260 Ether (about $642,000) from it to the Kanro charity, and publicly wrote an article expressing his gratitude to MOODENG, bringing positive results to the real world.

Some community users believe that this is a rare positive comment from V-God on MEME tokens, and through donation and charity, the worthless tokens in the crypto world are sold, and the value is transferred to solve some real problems, which is a step towards the real world for Crypto.

V-God's coin selling and public thank-you content have generated extremely high interest and attention in the market for the Ethereum hippopotamus MOODENG, and have driven the price of MOODENG to soar, with its market cap quickly breaking through $100 million from the million-dollar level, and its heat has also surpassed the hippopotamus on Solana.

As the narrative of the association between Ethereum Neiro and Moodeng's V-God has gone viral, the MEME project donating directly to V-God's wallet address has become a new trend for hype, and V-God's selling of coins will attract the attention and follow-up of investors, thereby driving the price of the coin up, with MEME coins being transferred to V-God's wallet address every hour.

Some crypto users have even designed a set of SOP for the success of the MEME project: MEME project donates to V-God - V-God sells coins (attracts attention) - V-God tweets a thank-you for the donation (drives price increase) - Listing on exchanges.

Cult Meme Culture Meme Coin Revival

Cult Memecoin is a token that combines internet popular culture and cryptocurrency, these coins are often created around a specific community or cultural phenomenon, often with a strong community-driven character, they are often presented in a humorous or satirical way, such as Dogecoin (Dogecoin) was originally created as a joke, Shiba Inu (SHIB) which calls itself the "Dogecoin killer", and the once-popular PepeCoin based on the popular Pepe frog.

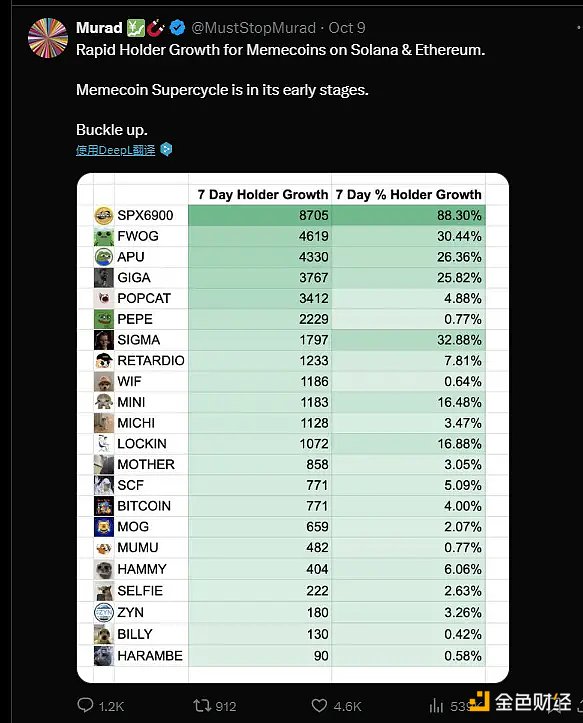

At Token2049, the MEME coin analyst Murad's "MEME Coin Supercycle" article sparked widespread discussion in the crypto community, and the list of MEME tokens he compiled and filtered has been widely circulated in the crypto community, becoming a bible for Meme coin trading at one point.

Murad's criteria for filtering Meme coins is to select those that have been online for at least six months and have experienced a crash, with a market cap between $5 million and $200 million, many of which are built on Solana and Ethereum.

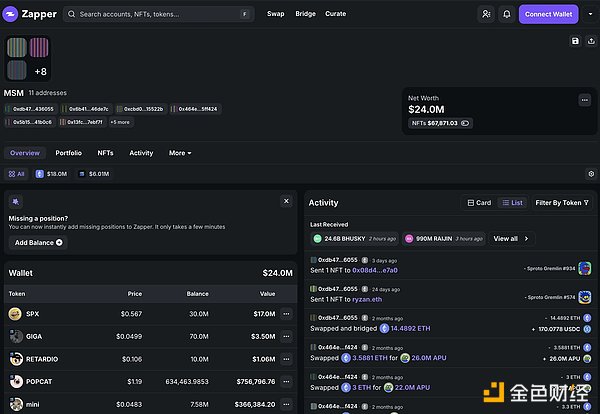

Yesterday, on-chain detective ZachXBT revealed the holdings of Meme coins in Murad's on-chain address, with about $24 million worth of MEME coin assets, the top four being SPX, GIGA, RETARDIO, and POPCAT, with very impressive recent trends.

Among them, the top-ranked abstract index token SPX has risen about 20 times in the past half month, the project is a derivative of the reverse S&P 500 index story, with the narrative of a cute girl saving the crypto world; GIGA is a Meme token on Solana, with a gain of over 200% in the last 7 days, the project was originally a tribute to the legendary figure Ernest Khalimov's original Gigachad, and also a satire of social expectations, triggering discussions about toxic masculinity; the MEME project POPCAT is based on the popular mischievous cat expression on the internet, with a gain of about 90% in the last 7 days; while RETARDIO positions itself as a symbol of courage, rebellion and community cohesion.

These MEME coins have a common feature, which is that they all have a certain Cult quality, that is, they are wrapped in a layer of absurd, non-mainstream, and abstract elements, usually related to popular internet culture, memes or specific subcultures, known as Cult Memecoin.

It is precisely because of the cultural identity or user base, Cult Memecoin is usually driven by the community, relying on social media and viral marketing to spread.

Some crypto users have pointed out that most of the Cult Memecoins on the market are old projects that have gone through a round of rise and wash, and users should look for the bottom rather than the top when choosing, the community that continuously promotes the token, and the increasing new holders, with elements similar to Cult culture.

Good Meme Needs "Special Narrative and Tone + Strong Spontaneous Community + Strong Backing"

According to data from the Coingecko platform, the total market value of the Meme coin sector has already exceeded $50 billion, with more than 2,000 types of assets recorded, making it the sector with the largest number of cryptocurrencies in the crypto market.

Crypto KOL@ririfish once expressed that the MemeCoin market is growing stronger, and they are no longer just tools for short-term speculation, but represent a new trend of decentralized culture and consensus, the reason why these projects have long-term market resilience is that the community is not just passive investors, but the core force driving the development of the project, the community endows these tokens with lasting vitality through meme propagation, social interaction and participation in project development.

Crypto asset player Vincent@thecryptoskanda has emphasized many times that MemeCoin has already become more than just a crypto track, it has become a "property", which is reflected in the fact that MemeCoin is no longer just about price fluctuations, but is gradually integrated into decentralized culture, representing an identity and market consensus, they embody the unique power of decentralized communities and go beyond the traditional IP-driven model.

Crypto KOL@CXOegg wrote in his latest tweet that a good MEME needs "special narrative + meme's own tone + strong spontaneous community + strong backing", none of which can be missing.

Ririfish also pointed out that the success of MemeCoin does not depend solely on IP support, but on their creation of unique narratives through the community, even projects without strong brand support, such as Shiba Inu and Pepe Coin, have managed to establish a foothold in the crypto market through the power of the community, the growth of these MemeCoin shows that they have built a unique cultural symbol through community interaction, meme propagation and collective creation.

In summary, for a MEME coin to be successful, it first needs an engaging story, the design of the token and the community culture must be unique and attractive in order to resonate and ignite the interest of investors, standing out from the many projects; it also needs a strong spontaneous community, an active and vibrant community is the key to the success of MEME coins, the power of the community can influence market sentiment and investment decisions; in addition, it also needs strong supporters and manipulators behind it to drive the coin price at critical moments.

For example, Neiro had already leaked out photos of grassroots community promotion in Northwest China before listing on Binance, with community members marketing in overseas locations such as Turkey and Vietnam, and the CTO team's donations to charitable organizations; the Ethereum Hippocampus MOODENG project community revealed that they had donated three times to a zoo in Thailand and conducted offline marketing in North America, attracting the attention of Neiro's top whales and Pepe developers and V-God through airdrop donations.

Regarding how to participate in MEME coins, @CXOegg said that there are tens of thousands of new projects appearing in the market every day, with the same narrative but different tickers, the same ticker but competing on different chains, and now even the same ticker on the same chain but with different capitalizations leading to various dramatic events, making it difficult for users to pick a promising project in the early stage.

Currently, there are three strategies to choose from: one is to directly choose the mature and market-tested high-cap old Meme, such as PEPE, WIF, etc.; the second is to buy the mid-cap MEME in the range of a few million to tens of millions, but it requires very strong individual project identification and screening capabilities; the third is to watch for new projects on the chain in the primary market, but the failure rate is very high.