A new survey commissioned by financial services giant Charles Schwab shows that U.S. investors are very enthusiastic about investing in cryptocurrency exchange-traded funds (ETFs), with about 45% of respondents saying they plan to invest in crypto through ETFs in the next year.

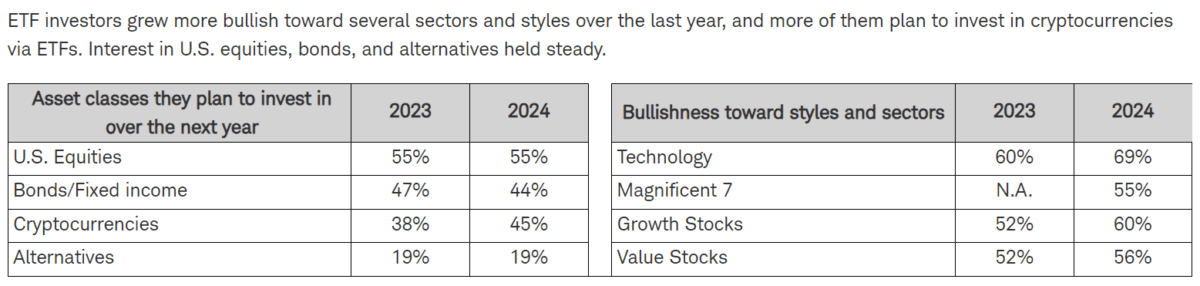

This percentage is higher than the 38% a year ago and exceeds the demand for bonds/fixed income and alternative assets. Only the demand for U.S. stocks is higher, with 55% of respondents planning to invest. Notably, crypto is the only asset class among these four that has seen an increase in the percentage.

However, among Millennial ETF investors, crypto is the most popular asset class, with 62% of respondents saying they plan to allocate to this sector, compared to 48%, 47%, and 46% for U.S. stocks, bonds, and physical assets (such as commodities), respectively.

Baby Boomer ETF investors, on the other hand, have much less interest in digital assets, with only 15% of respondents planning to invest in such ETFs.

Bloomberg Intelligence senior ETF analyst Eric Balchunas expressed "quite shocked" by the high ranking of crypto in the investment plans in the survey.

The survey targeted 2,200 individual investors aged 25 to 75 with at least $25,000 in investments, and its implications could be an encouragement for the emerging and growing crypto ETF category, which is being promoted as a diversification tool for traditional stock and bond portfolios.

According to data, the U.S. BTC spot ETF has attracted about $18.5 billion in net inflows since its launch in January this year, while the Ether spot ETF, which launched in late July, has performed poorly in both relative and absolute terms, with a net outflow of $558 million.