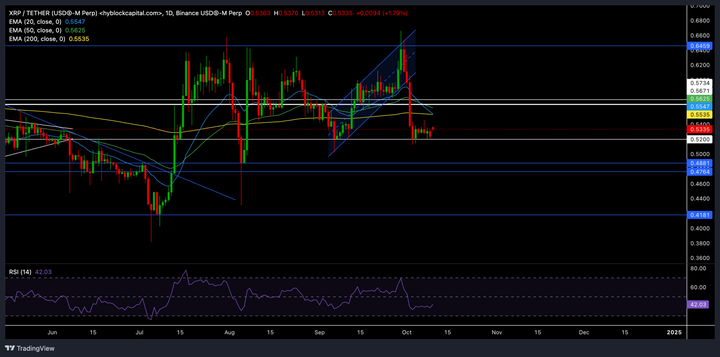

XRP has repeatedly encountered resistance at the $0.60 resistance level over the past three months, leading to continued sideways consolidation. The recent pullback from this level has resulted in a breakout from the ascending channel on the daily chart, highlighting the possibility of a shift in market sentiment.

As of the time of writing, XRP is trading at approximately $0.5328, up 1.66% in the past 24 hours.

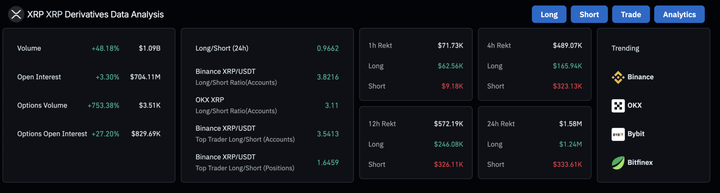

Derivatives data shows

The sentiment in the XRP derivatives market is mixed, but slightly tilted towards a bullish outlook. Currently, the 24-hour long/short ratio is around 0.9662. However, the ratios on Binance and OKX show a strong bullish advantage, at 3.8216 and 3.11, respectively.

Interestingly, XRP's options trading volume has surged by over 753%, indicating an increase in speculative activity. Open interest has also risen by 3.3%, with a significant increase in options open interest (+27.2%), suggesting that traders' interest has reignited despite the recent market weakness. However, the high long liquidation rate indicates profit-taking behavior, as XRP has been unable to maintain its gains above $0.56. Nevertheless, the prominent long positions among top traders suggest that a potential recovery may still be underway.

Can XRP bulls make a comeback?

XRP has been facing resistance at the $0.60 level, leading to prolonged consolidation. The recent decline from this level has triggered a classic breakout from the ascending channel, causing a breach of the 20-day EMA and 50-day EMA, which have now become direct resistance. The downward trend of the 20-day EMA and its potential bearish crossover with the 200-day EMA suggest that bearish forces have been strengthening. If this crossover materializes, XRP may continue to consolidate below the $0.56 resistance, limiting the scope for an immediate rebound.

However, XRP has shown a strong rebound trend from the $0.52 support level. Continued bouncing from this support level may help it reclaim the EMAs, paving the way for a near-term recovery. If the momentum strengthens, it may retest the $0.56 resistance, followed by $0.6. As of the time of writing, the RSI is at 41.79, reflecting a rather pessimistic sentiment.

The recent RSI trend shows a shallower low, while the price action since August has seen higher lows, indicating a mild bullish divergence. This suggests that if the bulls step in, a recovery may emerge, although this largely depends on a broader shift in sentiment. Additionally, from a macroeconomic perspective, XRP's market value to realized value (MVRV) ratio is currently in the opportunity zone. The MVRV ratio, which measures investors' profitability, is at -9.5%, indicating that those who purchased XRP in the past month are experiencing losses. However, historically, this range of -9% to -19% has been viewed as a buying opportunity, as investors tend to stop selling and start accumulating at these low prices. This positioning in the opportunity zone typically leads to a reversal of selling pressure, encouraging accumulation and driving prices higher. With XRP now in this favorable zone, the macroeconomic momentum may turn positive, paving the way for a price rebound.

XRP Price Prediction

XRP price is currently holding above the 38.2% Fibonacci retracement level, around $0.54. If the Altcoin successfully rebounds from this support, it may rally to the next resistance level of $0.55, signaling a bullish trend. If XRP manages to break above $0.55, the technical indicators will point towards further upside. The next target would be the 61.8% Fibonacci line at $0.59. A breakout of this resistance level could potentially push XRP back to $0.60, consolidating its recovery and reversing the recent weakness.

However, if XRP fails to break above the $0.55 resistance, it may ultimately consolidate between $0.52 and $0.55. This would invalidate the bullish outlook and could prolong the recovery process, limiting the upside momentum in the near term.

In summary

The recent downtrend in XRP has triggered a bearish crossover between the 20-day and 50-day EMAs, while the derivatives data is slightly tilted towards the bulls, especially as the Altcoin approaches its recent support level.