Over the past two days, if you were a crypto trader, the news of the skyrocketing price of NEIRO (NEIROETH) must have been unavoidable.

According to Binance data, as of the time of writing, NEIRO is priced at $0.113, with a 24-hour trading volume soaring to $1.15 billion USDT, and the current contract open interest reaching $50 million USDT, with a market capitalization exceeding $100 million. From October 10th to 12th, the price of NEIROETH has directly surged by over 100%.

Such a surge is enough to make people's jaws drop in the sluggish crypto market conditions of the past few days, and the NEIRO team seems to have skillfully controlled the market sentiment and ignited this rally. High leverage trading, the entry of institutional giants, and carefully planned market promotion, NEIRO has transformed from "not living up to expectations" to "living up to expectations" in just a few days. What secrets are hidden behind this rapid upward trend?

Timeline of NEIRO's Surge: Triple Whammy of Dog Charity, Institutional Buy-the-Dips, and Community Donations

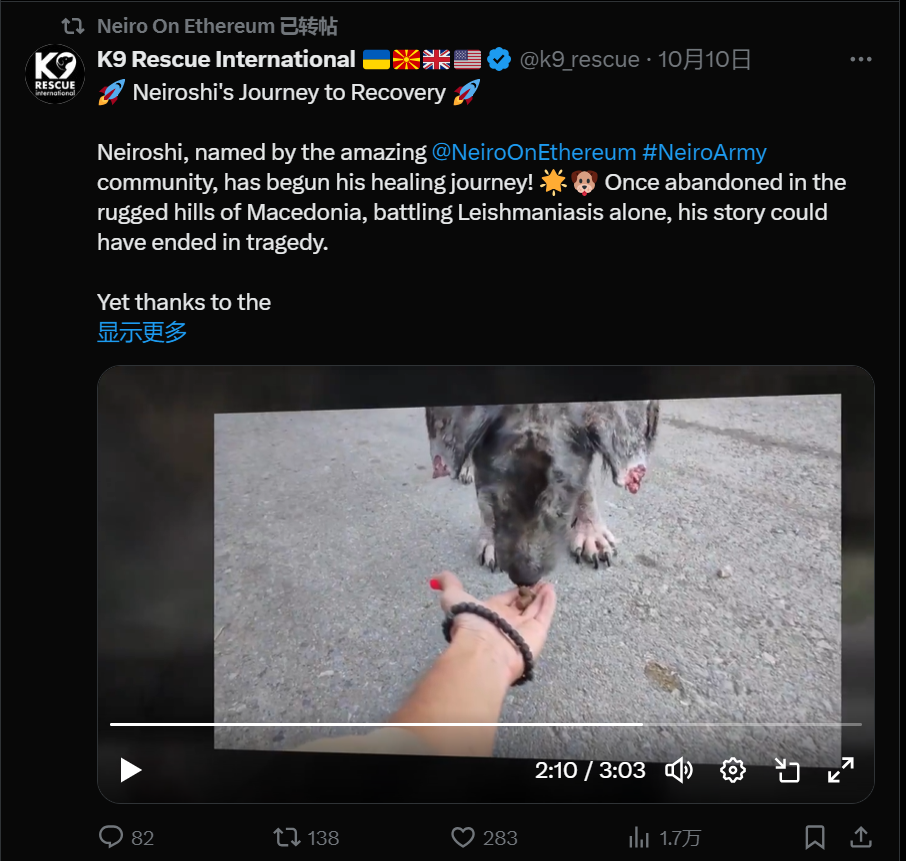

On October 10th, the NEIRO community witnessed an interesting turning point. @k9_rescue on Twitter posted a touching story about "Neiroshi", a small dog who had been struggling with leishmaniasis in the mountains of Macedonia, facing a life-or-death challenge.

However, with the support of NEIRO, Neiroshi received comprehensive medical care and regained the hope of life. This story was enthusiastically shared by the #NeiroArmy community, and the tweet specifically mentioned that NEIROETH provided full funding for the treatment of this little dog, demonstrating the project team's support for public welfare and the cohesion of the community.

This charitable publicity action generated a strong emotional resonance in the market. Neiroshi's story not only warmed the community, but also successfully attracted the attention of a large number of new investors.For many investors, seeing that the project not only has a presence in the market, but also can take concrete actions to help the vulnerable groups, this is undoubtedly a "bonus". This soft promotion has injected warmth into the project and laid the foundation for the subsequent market heat. At the same time, the NEIRO price in the secondary market quickly stabilized after falling to $0.055.

Two months ago, the well-known market maker Wintermute acquired 15 million NEIRO through over-the-counter (OTC) trading, and has since continued to accumulate, currently holding over 45 million NEIRO.As an established first-tier market maker, Wintermute is currently only actively making markets in two meme coins: one is NEIROETH, and the other is Shiba Inu (SHIB). This shows that despite the various rumors of "conspiracy groups" in the market, NEIRO has obviously gained the recognition of top-tier institutions like Wintermute.

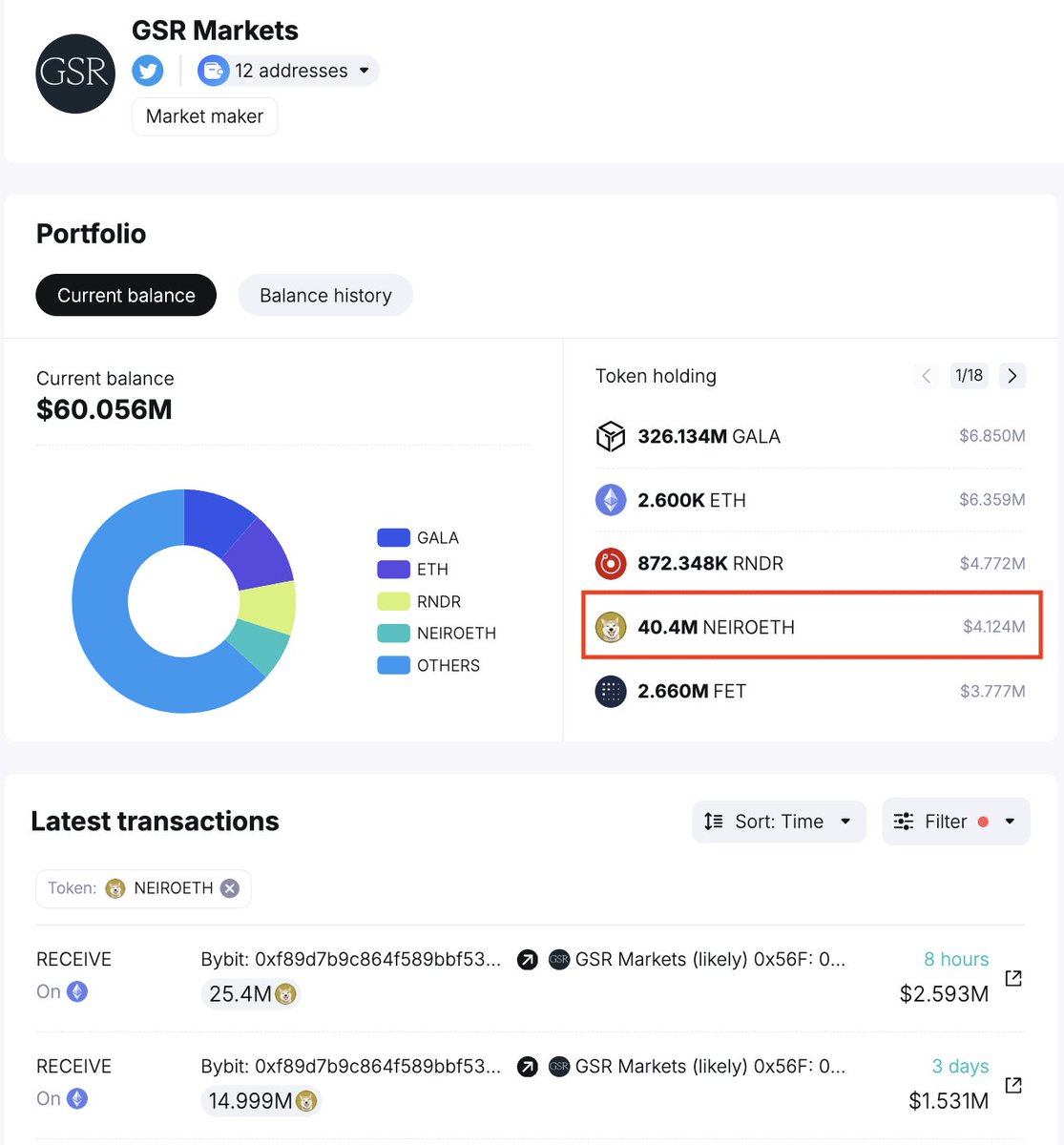

On October 10th, several large institutions including GSR Markets quickly increased their holdings of NEIROETH, injecting strong liquidity into the market.GSR Markets withdrew 25.4 million NEIRO (about $2.41 million) from Bybit 8 hours ago. Over the past 3 days, this market maker has withdrawn 40.4 million NEIRO from Bybit, equivalent to 4.04% of the total supply. This holding has now exceeded Wintermute's 27.63 million NEIRO (worth $2.82 million).

This "buy-the-dips" signal from institutions has generated further bullish expectations in the market, and retail investors have also flocked in.The flow of large capital has undoubtedly provided solid support for the price of NEIRO, and this upward momentum seems to have ignited a fuse, quickly triggering a chain reaction in the market.

NEIROETH continues to receive the support of market makers, and the "uppercase vs. lowercase" debate in the market is gradually cooling down. After experiencing initial volatility, the price of NEIRO has also gradually stabilized,and its fully diluted market capitalization (FDV) is currently only one-eighth of the lowercase Neiro, while it has only launched contract trading and has not yet been listed on more spot platforms. For investors who are optimistic about the future of NEIRO, this may be an opportunity worth trying.After all, if there is indeed a so-called "conspiracy group", in order to successfully unload at high prices, they must first further raise the price to ensure a smooth exit.

And the NEIRO team has learned how to play the emotional card in this process.

On October 12th, when the market heat reached its peak, they announced a $10,000 donation to the Hurricanes Helene & Milton Emergency Fund to help the affected families and animals in the recent "Hurricane Milton" event in the United States. This charitable act sparked heated discussions in the community, further enhancing the project's public image and credibility. The team has successfully shaped an image of "caring and warmth" through high-leverage trading, market promotion, and community interaction in just a few days. This has not only stabilized the market sentiment, but even some investors who were previously cautious have chosen to enter the market.

The Confrontation between NEIRO and Neiro: Market Manipulation and Binance's Listing Controversy

However, while NEIRO was thriving in the market, the lowercase Neiro (NEIROCTO) was embroiled in public opinion controversy.On October 9th, crypto KOL @kiththeking posted a lengthy tweet on Twitter, directly targeting the "conspiracy operation" of the lowercase Neiro team. He revealed that the "CTO" behind lowercase Neiro is actually a facade, and they secretly controlled more than 80% of the token supply when the token price was low, then used airdrop tactics to win over various KOLs and market makers, and gradually unloaded at high prices, thereby earning huge profits. @kiththeking even described it as a "vampire attack" aimed at draining the funds of retail investors in the market.

This revelation quickly caused a stir in the crypto community, and the market maker Gotbit behind the lowercase Neiro was also thrust into the public spotlight.Gotbit has long been known for manipulating the market, and crypto detective ZachXBT exposed Gotbit's various methods of inflating token prices through fake trading volume more than a year ago, repeatedly warning users to be cautious about projects with Gotbit's involvement. Sure enough, in early October, Gotbit's CEO Aleksei Andriunin was arrested in Portugal, and several other employees also faced legal proceedings.

What really set the market on fire was further revelations from crypto KOL @BlockZeero. He pointed out that Gotbit, as the market maker for lowercase Neiro, helped lowercase Neiro play the "decentralized" role in the market through controlling internal wallets and creating false trading. However, the token supply of lowercase Neiro is severely concentrated in a few wallets, which not only makes the promise of "decentralization" seem hypocritical, but also directly erodes market trust. @BlockZeero further revealed that this is completely at odds with Binance's so-called listing standards - low relative market capitalization and dispersed token holders, but Binance still chose to list lowercase Neiro despite knowing about its manipulation behavior.

Recommended Reading:NEIRO's Ups and Downs: Unraveling the 600x Journey of Binance's New Listing NEIRO

This has made Binance's listing policy a target of criticism. He Yi, the person in charge of Binance's listing, has been criticized by many in the crypto community, as she chose to list the lowercase Neiro with a market cap of $10 million, while the uppercase NEIRO had a much higher market cap and trading volume. This has led many to suspect that Binance may be supporting projects with manipulative behavior, while ignoring the voices of skepticism in the market. Many KOLs have even openly questioned whether Binance has some kind of internal interest exchange, which has allowed this "opaque" project to be listed on a mainstream exchange.

How to view the current meme coin market: short-term speculation or long-term value?

Regarding the turmoil in the meme coin market, opinions within and outside the crypto community vary. The surge of the uppercase NEIRO and the controversy around the lowercase Neiro, on the surface, is a short-term market volatility, but at a deeper level, it reveals the dual nature of the meme coin market - in this highly speculative market, the short-term wealth effect is often accompanied by huge risks.

Looking at the case of the uppercase NEIRO, the coordination between the institution's strategy and the community operation has indeed brought about a short-term price surge, but whether the price is supported by actual value remains to be questioned. High leverage often means high returns, but also high risks. If the market sentiment changes or regulatory pressure increases, the price of NEIRO may experience a violent correction at any time. In such cases, those who buy at high prices are often the retail investors who end up being "harvested".

The controversy over the lowercase Neiro, on the other hand, reveals the dark side of the meme coin market. Market makers like Gotbit have manipulated the market and created false trading volumes to help projects achieve "false prosperity" in a short period of time, but once the project has established a foothold in the market, the manipulators will sell at high prices, leaving the investors with losses. This kind of play may work repeatedly in a bull market, but faced with increasingly strict regulation, it may become increasingly difficult to sustain in the future.

Currently, the SEC and FBI's prosecution of Gotbit clearly indicates that the regulatory authorities have recognized the seriousness of these issues. In the future, as crypto market regulation tightens, those meme coin projects that rely on market manipulation will face greater challenges.At the same time, this also provides opportunities for projects that have real innovative value and are willing to embrace transparency and compliance. Players in the crypto community should remain cautious in the face of such market changes and not be easily misled by short-term market hype.