I am often asked a question recently: will memecoins continue to dominate the market? On this topic, I have compiled some thoughts and reviewed the relevant historical background.

First, I believe the main factors driving the dominance of memecoins are as follows:

1. Although the market has a strong demand for new tokens, the industry lacks innovation. (Has cryptocurrency reached the limit of its development without introducing centralized elements?)

2. Intentionally canceling the actual use of tokens, thereby making their valuation unconstrained.

3. Retail investors want to regain control.

4. When memecoins are listed on exchanges, the user registration conversion rate is extremely high, which encourages exchanges to list a large number of low-quality tokens.

Looking back at the innovation process, we can see the technological advancement path of the crypto field:

2016: Basic smart contract functionality, such as DAO and Etherdelta.

2017: Crypto is ubiquitous. For example, various tokens for dentists, taxis, etc.

2021: Combination of finance and Non-Fungible Tokens. Such as lending, automated market makers (AMMs), DeFi, and collectibles.

2023: Infrastructure building, such as Layer 1 networks, cheaper/faster transactions.

2024: Memes

These may seem unrelated on the surface, but they actually have a very clear process of narrowing down. Initially, this technology was like the "Wild West", and everyone felt its possibilities were limitless. However, with each cycle, the application scope of the technology becomes more and more focused, until 2021, when the market felt that the things that could be done in a fully decentralized network had reached their limit.

Since then, the number of innovative dApps has clearly decreased, and the market has begun to focus on improving the infrastructure. Although infrastructure improvements can last for multiple cycles, retail investors' focus is short-term, and when the market can no longer provide other innovations, memes become mainstream, but it is worth noting that memes have always had huge attention. For example, Doge's market capitalization reached $80 billion in 2021, the difference being that now memes have become the most popular trend focus.

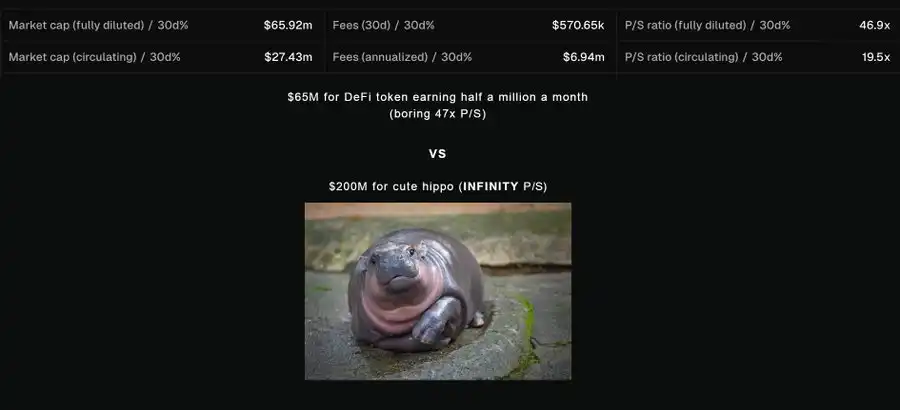

The second factor in the dominance of memecoins is the theoretical valuation. For a long time, there has been a joke in the industry that the most valuable projects never launch a real product, because once they do, the market can immediately quantify their valuation. DeFi in 2024 is a good example: in an efficient market, investors can check the fundamentals of a project in less than five minutes, give it a 20 times price-to-earnings ratio, and conclude that the project should not be worth more. This is the main reason why DeFi cannot see another bull market in the current cycle.

In 2021, we saw some projects create complex token economic designs that made it difficult for most people to see their true returns or whether the project was sustainable. This created some of the most sophisticated Ponzi schemes at the time, but ultimately, as these projects collapsed, the market's interest in opaque token economics also disappeared.

Therefore, the solution for memecoins is very simple: just throw the utility aside, and the project becomes impossible to quantify. Interestingly, the projects in this cycle that have tried to add utility to memecoins have actually damaged their own valuations by doing so.

The most direct reason for the dominance of memecoins in this cycle is, of course, that retail investors want to take power back from venture capital firms and large institutions and transfer it to ordinary investors. But the reality is that this is only a small change in profit distribution, and unfortunately, retail investors still haven't gotten the main gains.

Instead, the profits have shifted from venture capital firms to the "sharks" within the circle (some lean teams), who are very adept at monopolizing token supply, packaging it as "organic" market behavior, and repeating this process over and over again. This phenomenon is ubiquitous in the market, and it no longer needs to point to a specific project.

The key factor that makes this strategy so effective is that the market mistakenly treats market capitalization as a signal of legitimacy, which incentivizes those who artificially inflate valuations through token supply monopolies. Of course, the market is also constantly fighting back, with solutions like Pump Fun being created to limit this opaque supply monopoly behavior. However, this has led to the emergence of even more complex "sniping" and accumulation techniques, and the war continues. But ultimately, the vast majority of the profits from memecoins still end up in the hands of these organized groups, while attracting ordinary retail investors to continue participating in the game through the occasional "organic jackpot".

Finally, let's talk about the token listing mechanism of exchanges, which is rarely discussed, but in fact, exchanges have greatly driven the current memecoin frenzy, which is closely related to their incentive mechanisms. Specifically, the listing teams of exchanges hope to choose tokens that can maximize user registration. That is, how many users a token's listing can get to register and make their first deposit on that exchange. Widely distributed tokens in the new ecosystem perform particularly well in this regard. For example, according to an interview with the CEO of Bybit, the click-to-earn games on TRON brought in hundreds of millions of new users each time they were listed (a staggering number).

Popular memecoins are often widely distributed in small amounts, as they are very easy for ordinary retail investors to understand, which also leads to a higher user registration and deposit conversion rate. However, the underlying incentive mechanism is actually misaligned. For the listing teams, this looks good - a surge in user numbers, meeting their performance goals (OKRs).

But the reality is that many of these new registered users are of poor quality, and this phenomenon often leads exchanges to list some low-quality tokens in order to achieve these numerical targets. In the long run, this is likely to lead to a decline in the quality of listings, which in turn will affect innovation across the entire field.

With this background in mind, do I think the market attention on memecoins will continue? At least in the medium term, I think it will. To make memes lose market attention, we need to see a truly innovative narrative with crypto-native characteristics (i.e., decentralized hybrid technology) and good Ponzi economics (ponzinomics).

However, the regrettable reality is that this is much harder than before. The closest thing to this currently is AI, but in most cases, people will ask why this needs to use crypto technology?