The US presidential election is in the final stretch, with just over 20 days left until the vote. The outcome of this election will have a significant and long-lasting impact on the cryptocurrency industry.

As the election countdown continues, various industry experts are making predictions about altcoins.

Altcoins could surge if regulatory barriers are lifted

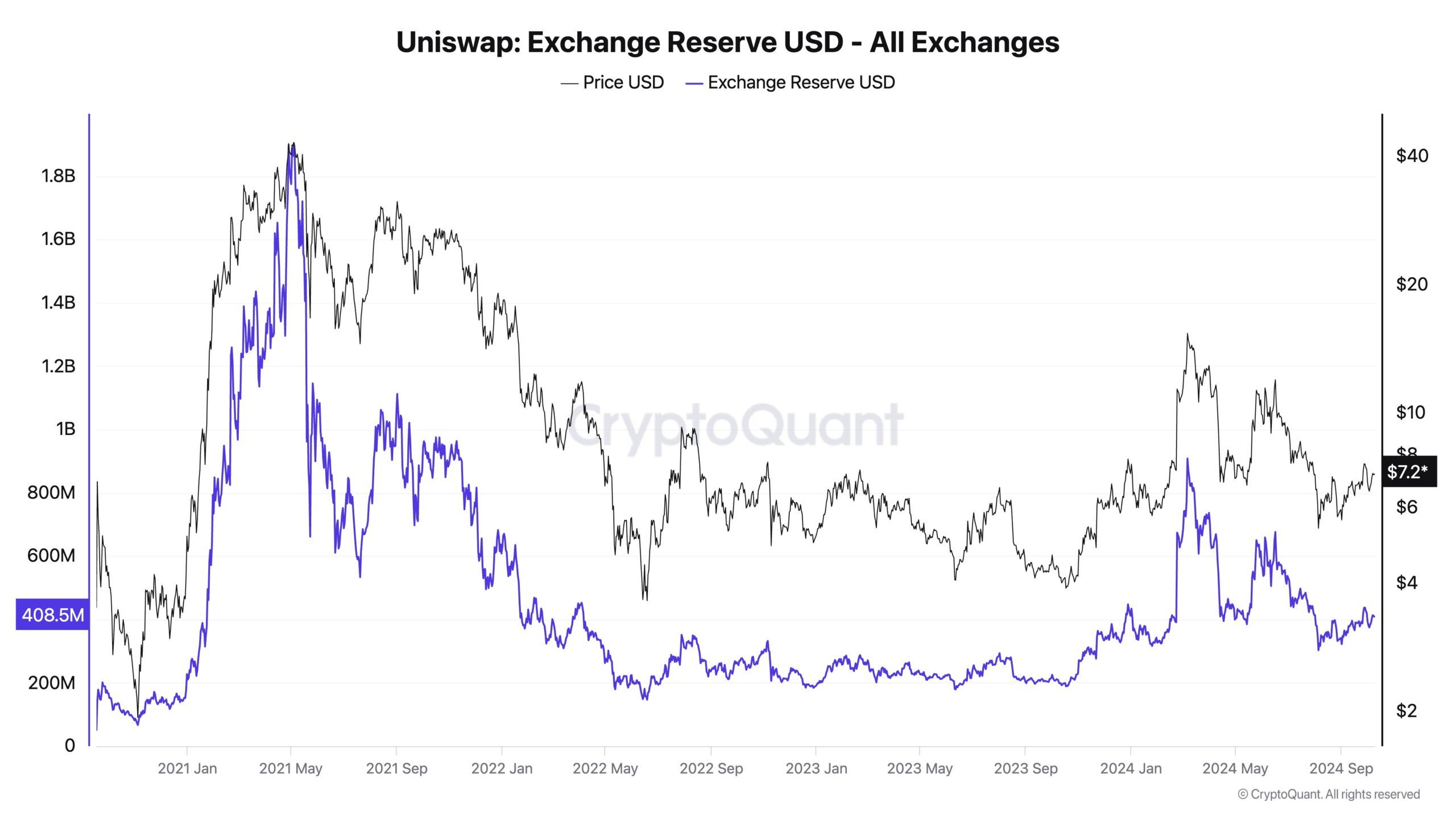

Ki Young Ju, CEO of CryptoQuant, believes that some altcoins have not seen their value increase due to regulatory barriers. To support this claim, he cites the example of Uniswap (UNI).

Since 2022, Uniswap has proposed a fee switch mechanism, which would redistribute protocol fees to UNI token holders. However, Uniswap has expressed concerns that this feature could expose the project to legal risks and that UNI could be classified as a security. In April 2024, the SEC issued a Wells notice to Uniswap, and the project delayed the proposal.

Read more: Uniswap (UNI) Price Prediction 2023/2025/2030

Ki Young Ju suggests that if the fee switch is activated, investors could use the redistributed funds to drive up the price of UNI.

"For example, if Uniswap's fee switch was activated, they could have $314 million in their treasury. There are currently $408 million worth of UNI on centralized exchanges. If the treasury is used for buybacks, the price could surge 10x to 100x depending on the order book depth. (This is not financial advice, and I do not hold UNI.)" Ki Young Ju explained.

He also predicts that if Donald Trump wins the election, new regulations could enable the fee switch, driving up the price of UNI.

Altcoin surge potential based on historical models

Other analysts are predicting an altcoin season towards the end of the year by analyzing past market patterns.

According to CRG's analysis, Bitcoin's current stage is similar to the late 2020 cycle. He observed that after more than 100 weeks since Bitcoin's bottom, its price rises to a new peak, and an altcoin rally starts a week later.

"Compared to the previous cycle, we are tracking exactly on the explosive third year. If we repeat the timing of the last cycle, BTC has 4 weeks left to price discovery, and BTC dominance has 5 weeks left to its multi-month peak," CRG predicted.

Read more: Bitcoin Dominance Chart: What Is It and Why Is It Important?

Currently, Bitcoin's dominance is at 58%, showing no signs of correction. If Bitcoin's dominance decreases, it would indicate that other cryptocurrencies are gaining more market share, which could signal an altcoin season.

Additionally, Michaël van de Poppe believes that the altcoin market capitalization (TOTAL3) suggests an altcoin season could start within the next 15 days.

"The altcoin market cap seems to be preparing for a breakout. The next 1-2 weeks have a high probability of providing that breakout," Michaël van de Poppe predicted.

According to this timeline, altcoins could see a strong surge after the November 5th election. Polymarket currently puts the probability of Trump's victory at 54%. Additionally, other observations suggest that Bitcoin has experienced its best growth during the Trump presidency among the last four presidents.