1014 Market Analysis - Bitcoin Breaks $66,000! US Stocks Open and Drive Gains

The crypto market is warming up! This market analysis will take you through the overall market data, including price trends, derivatives markets, macroeconomic factors, and Altcoin gains, all written by researcher Rualigator.

Price Trends

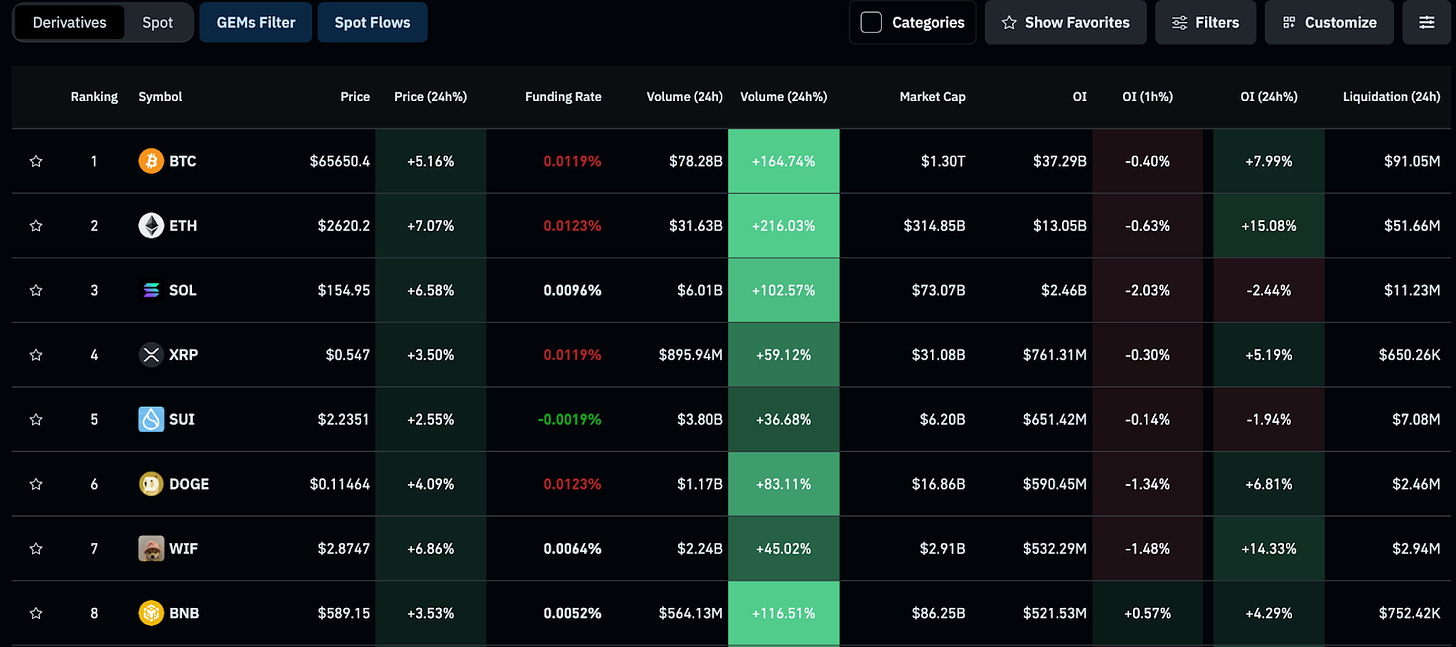

The Top 5 Coins Break Out in the Short Term

The leading coins are seeing explosive trading volume, with short-term trading sentiment increasing

BTC's 24-hour trading volume has grown over 150%, and ETH's even exploded by 200%, significantly increasing the market's activity.

SOL is up 6.5%, accompanied by a 102% increase in trading volume

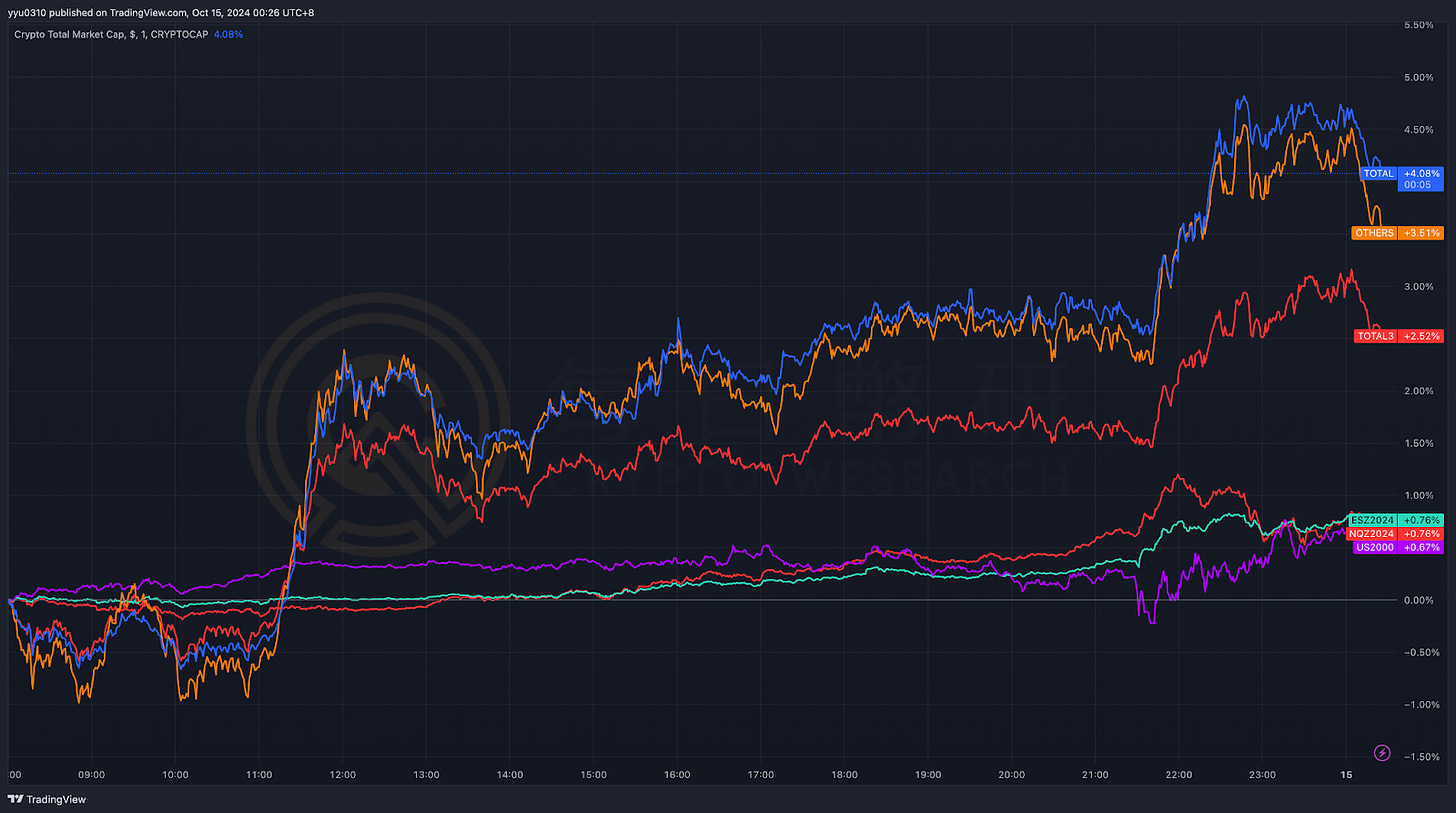

The crypto market has broken away from US stocks, with OTHERS outperforming TOTAL3, indicating that low-cap Altcoins have sufficient momentum to lead the rally.

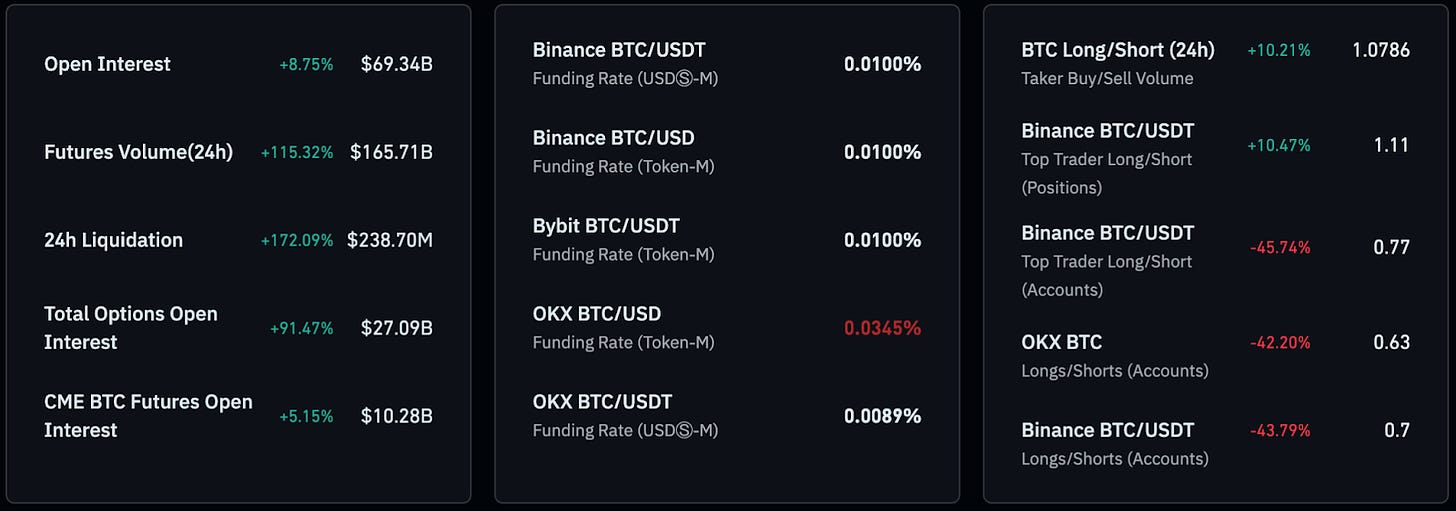

Derivatives Market: Trading Sentiment Doubles, Bullish Sentiment Grows

This influx of capital and high-leverage trading may trigger a violent short-term market movement, but the funding rates have not spiked significantly, indicating that this rally may not continue to the medium-to-long term.

24-Hour Futures Trading Volume Surged +115%

Trading volume reached $165.7 billion, with a large amount of capital flowing into the derivatives market, and investors' attention to short-term market volatility has increased. This type of capital inflow is usually accompanied by strong emotions.

24-Hour Liquidation Amount Surged +172%

Total liquidations reached $238 million, with the market experiencing short-term one-way high volatility, and short positions being massively liquidated, the largest amount since October.

Total Options Open Interest (Options OI) Surged +91%

Reaching $27 billion, indicating that traders are using options to hedge risks or position for a major market move. This significant increase may signal that the market expects an imminent significant price change.

Long/Short Ratio Analysis

BTC's 24-hour L/S Ratio increased +10.2%, reaching 1.0786, indicating strong bullish sentiment in the market.

The top trader's Longing position ratio on Binance increased +10.5%.

Funding Rates Remain Stable with No Significant Changes

The BTC/USDT funding rates on most platforms have remained around 0.0100%, indicating a basic balance between bulls and bears

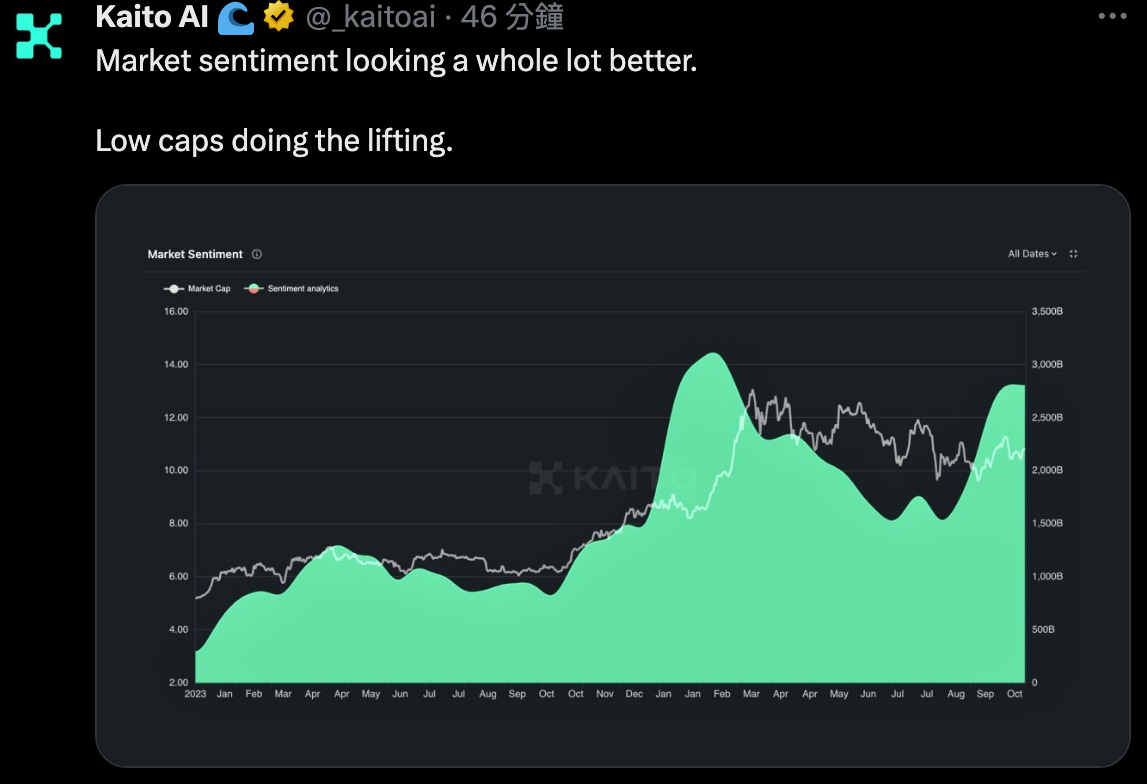

Source: https://x.com/_kaitoai/status/1845753177393508354

According to Kaito's tweet, the market sentiment has returned to the vicinity of the highs seen in Q1 of this year

News: Bullish News Dominates

Capital Market

Fidelity plans to launch its first blockchain-based money market fund, having filed documents with the SEC

Negative news delayed: Mt. Gox will postpone its compensation payments to October 31, 2025, one year later

Altcoin Market

Murad Disclosed His Top 10 Holdings, with the top 3 being $SPX, $GIGA, and $MOG

Kaito reports: The market sentiment has returned, and Altcoin trends can be observed

DeFi Sector

The Ethena community has initiated a proposal to include SOL as collateral for the USDe stablecoin

Midas, backed by BlackRock, has become the first EU-approved RWA project, set to issue the $mBILL US Treasury token and the $mBASIS BTC-ETH basis yield token

Base chain TVL has reached $2.37 billion, surpassing Arbitrum's $2.34 billion for the first time

The Trump DeFi IDO is about to launch: October 15, 20:00 UTC+8, with an estimated valuation of $1.5 billion

Macroeconomic Factors: Key Economic Data This Week

This week, the market's focus is mainly on central bank policies and global consumption data. The European Central Bank's policy direction will directly impact the capital flows in the Eurozone and global markets. US retail sales will provide the latest signals on consumer strength, determining the Federal Reserve's policy direction. Meanwhile, China's GDP growth data will reveal whether its economic recovery is robust, and Japan's inflation data will affect market expectations for the yen and BoJ policy. Around the release of these key data, market volatility is likely to increase significantly.

European Central Bank (ECB) Interest Rate Decision

The Eurozone interest rate decision will partially affect the global capital market, as past data shows that the liquidity released by the US, China, and the EU combined accounts for 75% of the global total.

Release time: October 17, 20:15 (UTC+8)

Expected value: 3.4%

Previous value: 3.65%

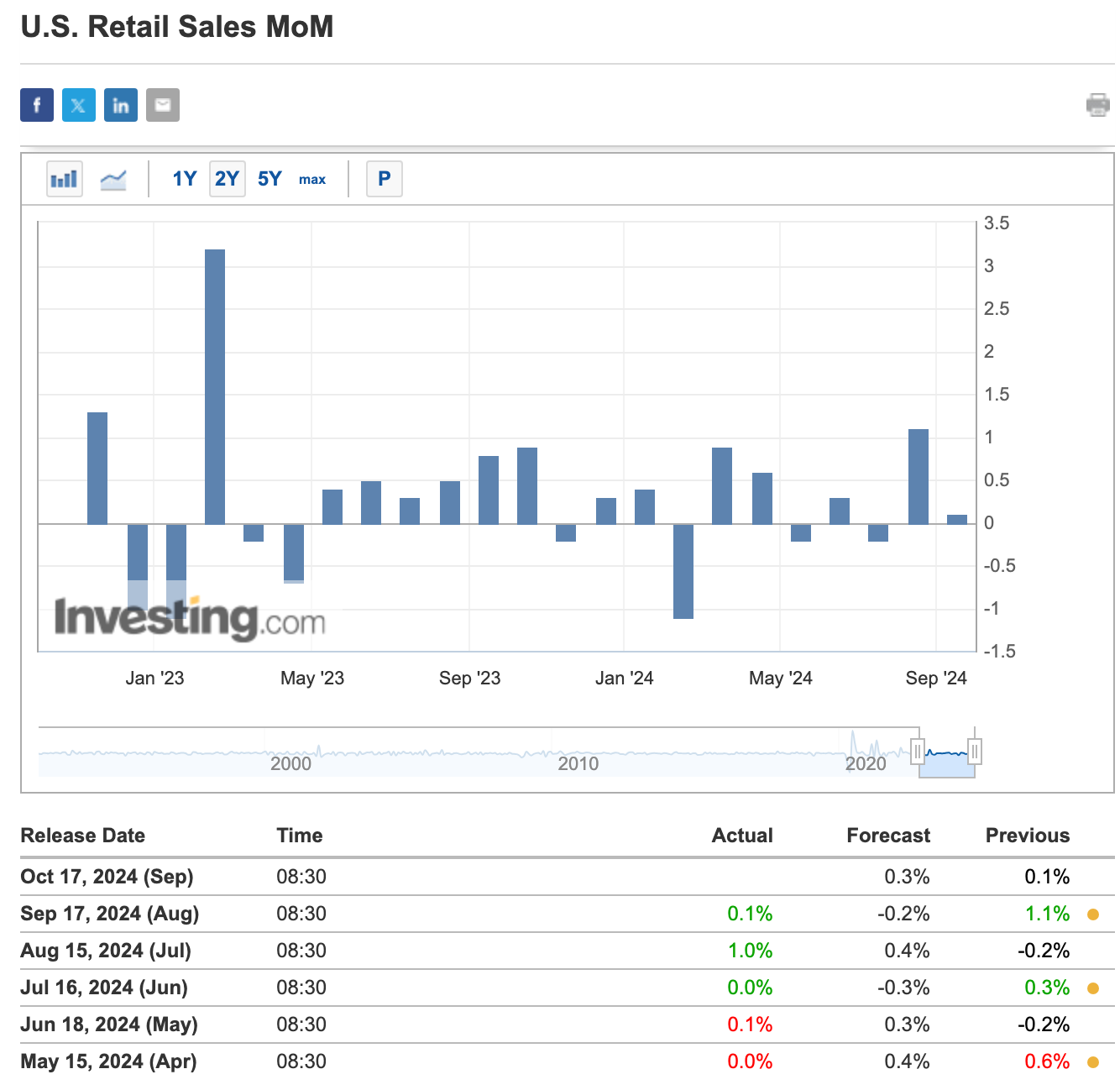

US Retail Sales Month-over-Month (Retail Sales MoM)

Retail data indicates the state of the real economy. The recent employment market and inflation data have shown that the real economy is developing well, and this data will further confirm and verify this.

Release time: October 17, 20:30 (UTC+8)

Expected value: 0.3%

Previous value: 0.1%

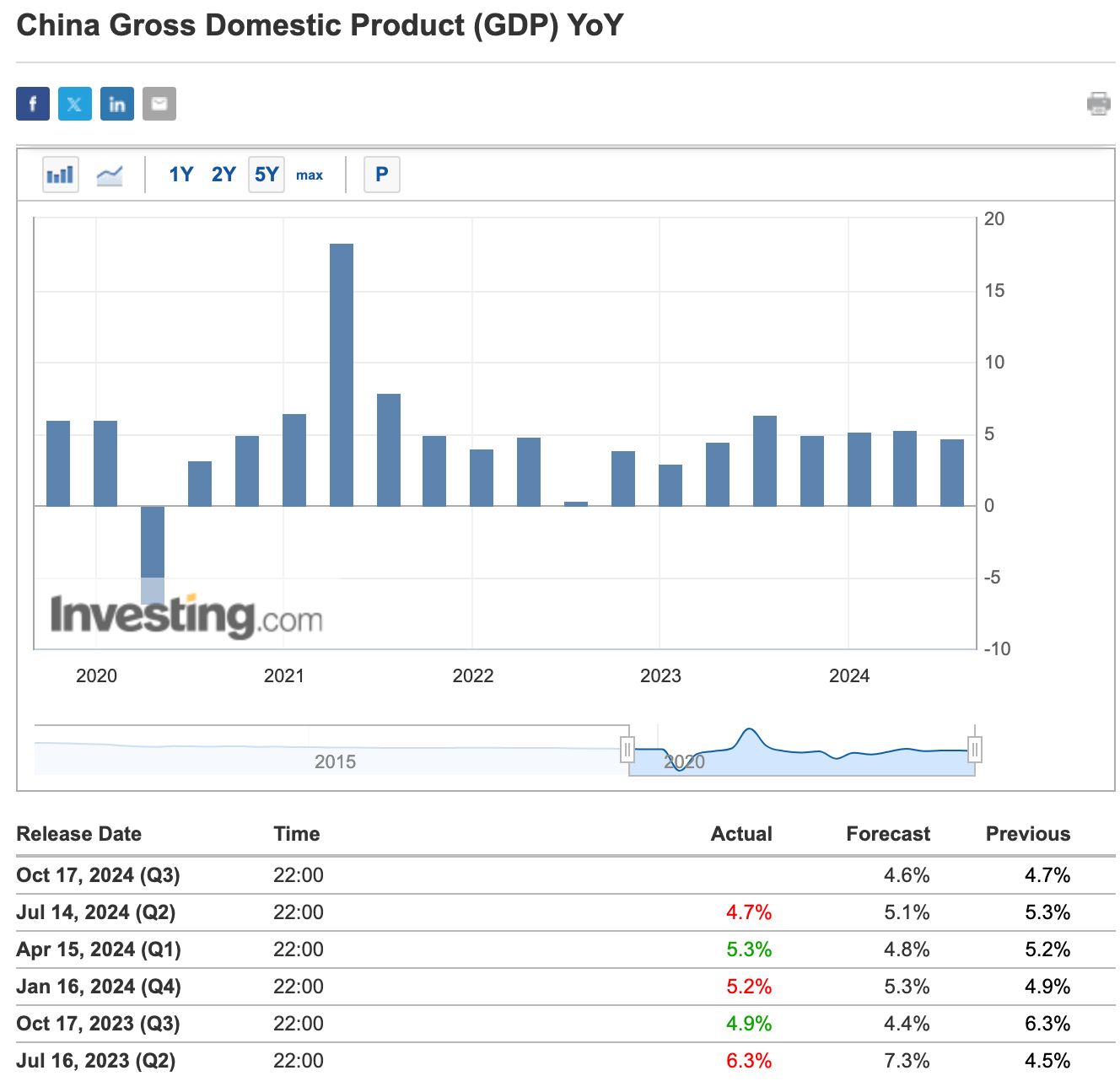

China's GDP Growth Rate YoY

Whether China's GDP weakens will affect whether the market will release liquidity, lower reserve requirements, and cut interest rates in the future. Referring to the situation of the past few weeks and similar to 2015, the Chinese capital market has the ability to boost the A-shares, and may even further squeeze the crypto funds.

Release time: October 18, 10:00 (UTC+8)

Expected value: 4.6%

Previous value: 4.7%

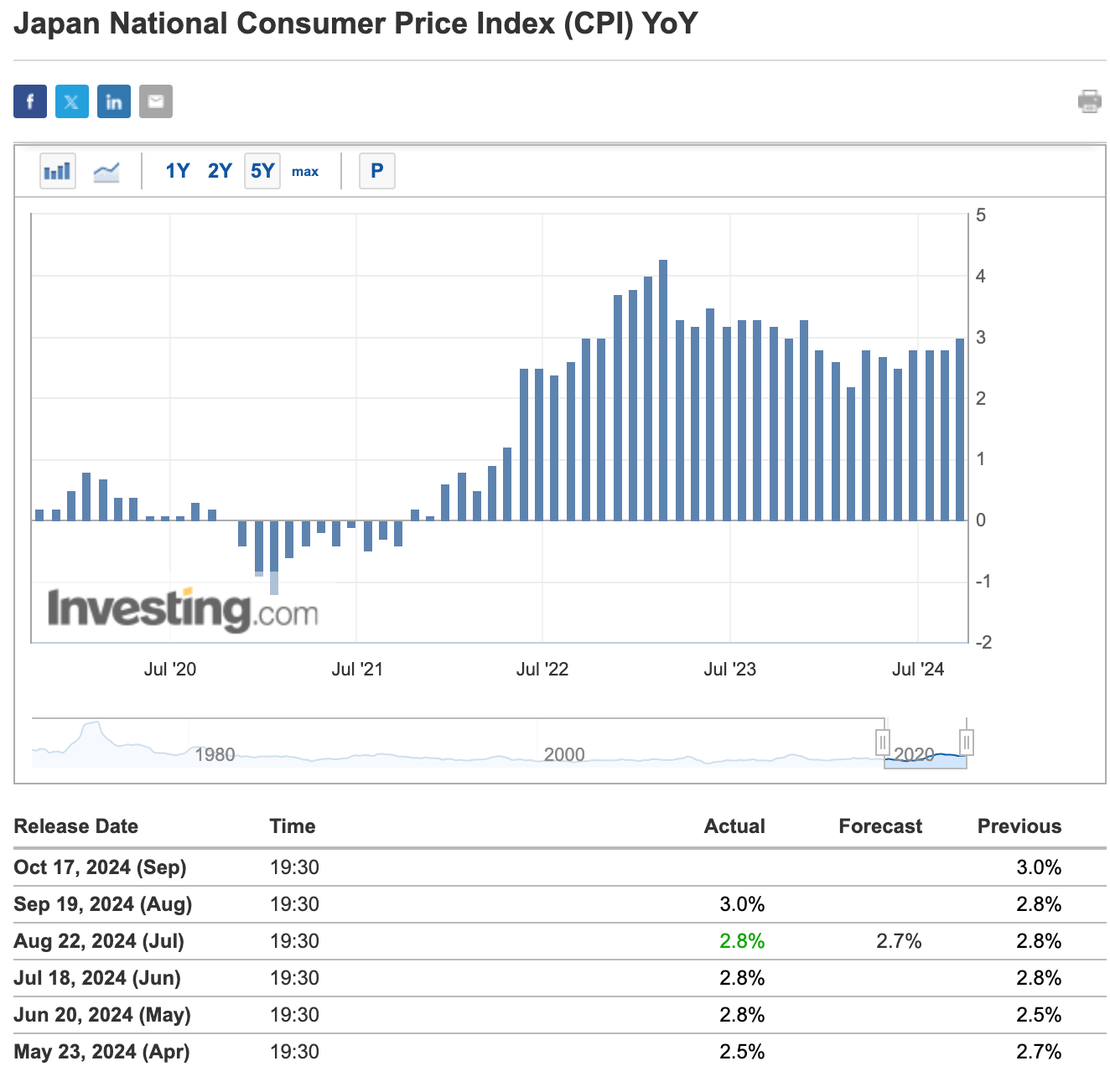

Japan's Inflation Rate YoY

Japan's CPI is currently an important indicator affecting whether the central bank will further raise interest rates. If it rises rapidly, it may trigger a push for rate hikes. Recently, Japan's new prime minister and central bank governor have continued to release a dovish attitude, and analysts point out that Japan may not signal a rate hike until after the October 27 general election.

Release time: October 18, 07:30 (UTC+8)

Expected value: 3%

Previous value: 3%

Top 100 Currencies 24-Hour Gain Ranking - Altcoins led by Meme, DeFi, and AI tracks closely behind

Meme coins: $BRETT, $MOG, $FLOKI

DeFi coins: $ENA, $AERO, $ONDO

AI, DePIN: $WLD, $GRT, $AAVE, $FET

Meme coins: $PEPE, $FLOKI,

DeFi coins: $ENA, $LDO,

AI, DePIN: $WLD

BTC ecosystem: $CORE, $BCH, $RUNE

GameFi: $BEAM, $IMX

Further Reading

For a review of last week's macroeconomic trends and DeFi market, please see the Crypto Research Weekly Report