Over the past few weeks, the US economy has been a major driver of cryptocurrency investment inflows. However, this situation may change as the US election approaches.

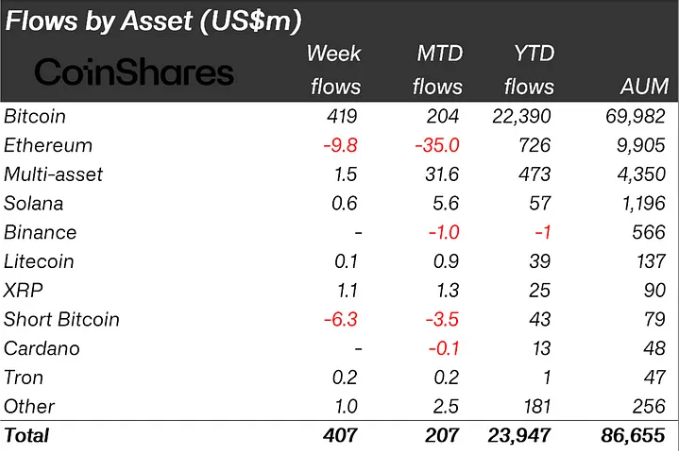

According to a report by UK cryptocurrency asset manager CoinShares, digital asset investment products saw inflows of $407 million last week, surpassing the negative inflows seen in the first week of October.

Crypto Investment Inflows Bounce Back Quickly After Weakness Early in October

In the first week of October, crypto investment outflows had declined significantly, recording a negative $147 million, ending the positive inflow streak that had started on September 9th. During this period, investors focused on the broader US economy, investing in various assets.

However, a new catalyst has emerged — the upcoming US presidential election. This changing narrative is expected to drive crypto inflows. Bit has leveraged this sentiment shift to drive $419 million of inflows into digital asset investment products last week.

"Digital asset investment products saw inflows of $407 million, and investor decisions were likely more influenced by the upcoming US election than monetary policy outlook," the report stated.

Read more: How to Protect Yourself from Inflation Using Cryptocurrency

The report concluded that the stronger-than-expected economic data during the first week of October was not enough to prevent outflows. Despite the non-farm payrolls in September exceeding economists' forecasts, crypto investment inflows were negative.

The continued economic surprises, with unemployment unexpectedly declining, show that the market is reacting to changes in the political landscape. At the same time, the rally in Bit and strong inflows indicate that the market is responding to the shift.

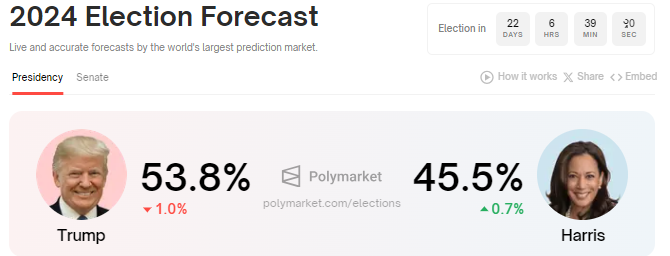

"The recent US Vice Presidential debate and subsequent polls showing a shift towards the Republican party, which is perceived as more favorable to digital assets, has led to immediate inflows and price appreciation," the report added.

Regional crypto investment inflows support the positive outlook, with the US leading the way with $406 million in inflows.

The US Election Could Further Boost Crypto Inflows

If the CoinShares analysts' assumptions hold true, crypto investment could see even stronger inflows in the remaining two weeks of October. The upcoming US election on November 5th is expected to further strengthen the narrative around cryptocurrencies.

As this interest increases, digital asset investment products could benefit significantly, with cryptocurrencies playing a central role in a voter environment where they are becoming increasingly expensive. With the political focus on cryptocurrencies, combined with market factors, digital assets have the potential to grow in investor engagement as we move towards November.

As reported by BeInCrypto, a majority of US voters prefer political leaders who are receptive to cryptocurrencies. This is because cryptocurrencies are becoming a bipartisan issue in the US, with a near-even balance between the Republican and Democratic parties.

A clear and supportive cryptocurrency policy could be a powerful tool for either Donald Trump or Kamala Harris to navigate the narrow path to victory. Polymarket data shows Trump has a nearly 10% lead over Kamala Harris.

Read more: How Can Blockchain Be Used for Voting in 2024?

The shift in sentiment has benefited Bit, with BeInCrypto data showing that BTC has risen nearly 5% since the Monday session open, currently trading at $65,324.